Are you prepared for a bear market? If not, don’t worry – this article will guide you through what a bear market is and how to prepare for it. A bear market occurs when stock prices are falling, often leading to a pessimistic market sentiment. But fret not, there are steps you can take to protect your investments and navigate the challenges. From diversifying your portfolio to staying informed about market trends, we’ll delve into the strategies you need to thrive during a bear market. So, let’s dive right in and learn what a bear market is and how to prepare!

What is a Bear Market and How to Prepare

In the world of finance, there are two primary types of market conditions: bull markets and bear markets. While bull markets are characterized by optimism, rising stock prices, and a generally positive outlook, bear markets represent a downturn in the economy, with falling stock prices and a pessimistic sentiment prevailing among investors. Understanding what a bear market is and how to prepare for it is crucial for anyone looking to navigate the ups and downs of the financial markets.

1. Understanding Bear Markets

A bear market is a prolonged period of declining stock prices, typically defined as a drop of 20% or more from recent highs. It is often associated with a weak economy, rising unemployment, and a general pessimism about the future. In a bear market, investors tend to sell off their stocks, leading to further price declines.

There are several key characteristics of a bear market:

- Declining Stock Prices: Bear markets are marked by a sustained decrease in stock prices, with major indices experiencing significant declines.

- Negative Sentiment: Investor sentiment tends to be negative during a bear market, as fears and uncertainties dominate market discussions.

- Increased Volatility: Bear markets are often accompanied by increased market volatility, with sharp price swings becoming more frequent.

- Reduced Trading Activity: As prices decline, trading volumes often decrease, as investors become more hesitant to buy or sell.

2. Factors Contributing to a Bear Market

Several factors can contribute to the onset and severity of a bear market:

- Economic Downturn: A weak economy or recession can trigger a bear market, as companies face declining sales, layoffs, and reduced profits.

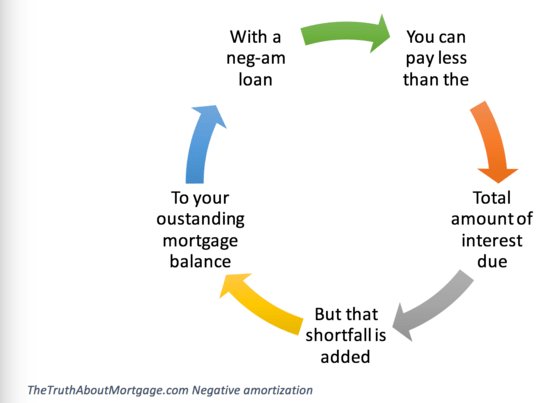

- Interest Rates: Higher interest rates can make borrowing more expensive, negatively impacting consumer spending and business investments.

- Political Uncertainty: Political events such as elections, geopolitical tensions, or policy changes can create uncertainty, leading to market declines.

- Market Valuations: Overvaluation of stocks or sectors can lead to a correction or bear market as prices adjust to more reasonable levels.

3. Preparing for a Bear Market

While it’s impossible to predict precisely when a bear market will occur or how severe it will be, there are steps investors can take to prepare themselves:

3.1 Diversification

Diversifying your investment portfolio is one of the most effective ways to mitigate risk during a bear market. By spreading your investments across different asset classes, sectors, and geographic regions, you reduce your exposure to any single investment’s potential losses. Diversification helps to ensure that a decline in one investment is balanced by the performance of others, maintaining the overall stability of your portfolio.

3.2 Establish an Emergency Fund

Having an emergency fund in place is essential during a bear market. This fund should consist of cash or easily accessible investments that can cover your living expenses for at least six months to a year. It provides a financial cushion, allowing you to meet your basic needs without having to tap into your long-term investments if a bear market leads to job loss or other financial hardships.

3.3 Regularly Review and Rebalance your Portfolio

During a bear market, it’s crucial to regularly review and rebalance your investment portfolio. Reassess your risk tolerance and investment goals, and make any necessary adjustments to align your portfolio with your current financial situation. Rebalancing involves selling assets that have performed well and reinvesting in those that have underperformed. This strategy helps you maintain a balanced portfolio and take advantage of potential opportunities that arise during a downturn.

3.4 Invest for the Long Term

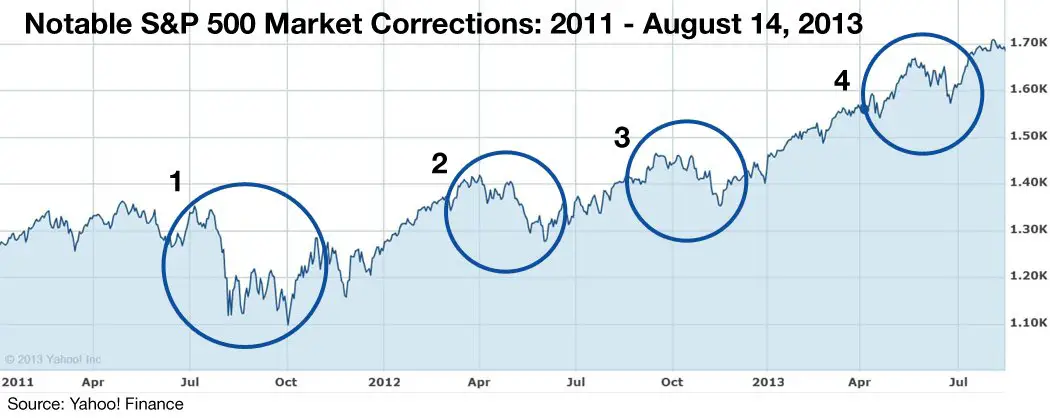

Avoid making knee-jerk reactions to short-term market fluctuations. Investing with a long-term perspective can help you weather bear markets and potentially benefit from eventual market recoveries. Historically, the stock market has shown overall growth over the long run, even after experiencing significant downturns. Stay focused on your long-term financial goals and avoid panic-selling during periods of market volatility.

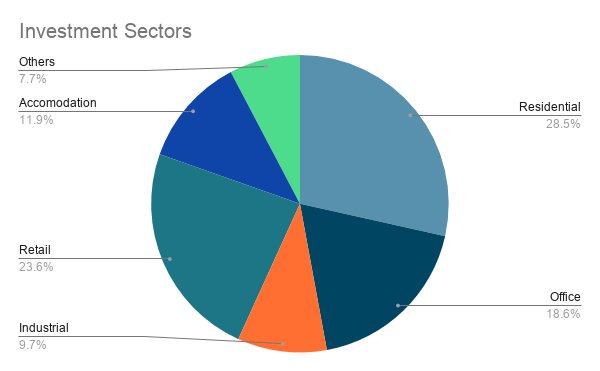

3.5 Consider Alternative Investments

During a bear market, it may be worth considering alternative investments that can provide diversification and potentially generate positive returns. These may include real estate, commodities, or specific hedge funds designed to perform well in challenging market conditions. However, be sure to thoroughly research and understand the risks associated with any alternative investment before allocating a portion of your portfolio to it.

3.6 Stay Informed and Seek Professional Advice

Keeping yourself informed about market trends, economic indicators, and relevant news is vital when preparing for a bear market. Regularly review trusted financial publications, follow reputable investment blogs, and consider seeking advice from a qualified financial advisor. Professional guidance can help you make well-informed decisions and navigate the complexities of the financial markets.

Remember, while it’s essential to be prepared for a bear market, it’s equally important to stay calm and avoid making impulsive decisions based on short-term market fluctuations. By adopting a disciplined approach and implementing a well-thought-out strategy, you can position yourself to withstand the challenges of a bear market and potentially capitalize on the opportunities it presents.

PAST BEAR MARKETS & How To Profit From Them

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a bear market?

A bear market refers to a financial market condition characterized by falling prices and a widespread pessimistic sentiment among investors. It is typically associated with prolonged periods of declining stock prices, with a decrease of at least 20% from recent highs.

How can I prepare for a bear market?

Preparing for a bear market involves taking certain measures to protect your investments and minimize potential losses. Here are some steps you can take:

1. Should I panic and sell all my investments during a bear market?

It is generally not advisable to panic and sell all your investments during a bear market. Timing the market consistently is challenging, and selling at the wrong time could mean missing out on potential gains when the market recovers. It’s important to assess your investment strategy and risk tolerance before making any decisions.

2. What are some strategies to protect my investments during a bear market?

Some strategies to protect your investments during a bear market include diversifying your portfolio, investing in defensive sectors or assets such as bonds or gold, and considering stop-loss orders to limit potential losses. Additionally, regularly reviewing and adjusting your investment strategy based on market conditions and your financial goals can be beneficial.

3. Are there any investment opportunities during a bear market?

Yes, bear markets can present investment opportunities for those who are prepared. Some investors use bear markets as a chance to buy quality stocks at discounted prices, as they believe in the long-term potential of those companies. However, it is essential to conduct thorough research and analysis before making any investment decisions.

4. Should I consider alternative investment options during a bear market?

During a bear market, some investors explore alternative investment options, such as real estate, commodities, or peer-to-peer lending platforms. These alternatives can provide diversification and potentially lower correlation to traditional stock markets. However, it is crucial to carefully evaluate the risks and suitability of such investments for your specific financial situation.

5. How can I stay calm and focused during a bear market?

Staying calm and focused during a bear market can be challenging, but it is important to avoid making emotional or impulsive investment decisions. Some strategies to remain calm include maintaining a long-term perspective, focusing on your investment goals, and regularly reviewing your portfolio with a financial advisor or investment professional.

6. What role does asset allocation play during a bear market?

Asset allocation, the process of diversifying investments across different asset classes, plays a crucial role during a bear market. By having a well-balanced portfolio that includes a mix of stocks, bonds, and other assets, you can potentially mitigate losses and improve the overall risk-return profile of your investment portfolio.

7. When should I consider rebalancing my portfolio during a bear market?

Rebalancing your portfolio during a bear market can be done strategically to maintain your desired asset allocation. Consider rebalancing when your portfolio’s allocation to certain assets deviates significantly from your target allocation. However, it is important to be mindful of transaction costs and tax implications when implementing portfolio rebalancing strategies.

8. What resources can help me navigate a bear market?

Several resources can help you navigate a bear market. Financial news sources, reputable investment websites, and educational materials from financial institutions are valuable sources of information. Additionally, seeking guidance from a qualified financial advisor can provide personalized advice tailored to your specific financial situation and goals.

Final Thoughts

A bear market is a period of declining stock prices, usually accompanied by pessimism and a widespread lack of confidence in the market. To prepare for a bear market, it is essential to take certain steps. Firstly, diversify your investment portfolio by spreading your investments across different asset classes and sectors. This can help reduce the impact of any downturn in a particular market. Secondly, maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Lastly, consider setting up an emergency fund to cover unexpected expenses during a bear market. By understanding what a bear market is and taking appropriate measures, you can better navigate and protect your investments.