A business loan is a financial solution designed to provide the necessary funds for entrepreneurs and business owners to fuel their ventures. It serves as a lifeline for companies seeking to expand, invest in new equipment, or meet working capital requirements. But what exactly is a business loan and what are its requirements? Put simply, a business loan is a borrowing arrangement between a lender and a business entity, allowing the company to access a specific amount of capital. To qualify for a business loan, businesses typically need to meet specific criteria set by the lender, including factors such as creditworthiness, financial stability, and a solid business plan. Let’s delve deeper into the world of business loans and explore their requirements.

What is a Business Loan and Its Requirements

Running a business requires a constant inflow and outflow of funds. Whether you are a small startup or an established company, there are times when you may need financial assistance to fuel your growth, cover expenses, or invest in new opportunities. This is where a business loan can come to your rescue. In this article, we will explore what a business loan is, its various types, and the requirements you need to fulfill to qualify for one.

Understanding Business Loans

A business loan is a form of financial assistance provided by banks, credit unions, or online lenders to entrepreneurs and business owners. It helps them manage their cash flow, expand operations, purchase equipment or inventory, meet payroll, and invest in new projects.

Business loans typically come with a repayment plan, including interest, over a specified period. The terms and conditions vary based on the lender, loan type, and the borrower’s creditworthiness.

Types of Business Loans

There are several types of business loans available, each catering to different business needs. Some common types include:

1. Traditional Term Loans: This is the most common type of business loan where you borrow a lump sum amount and repay it over a fixed term, usually with monthly installments.

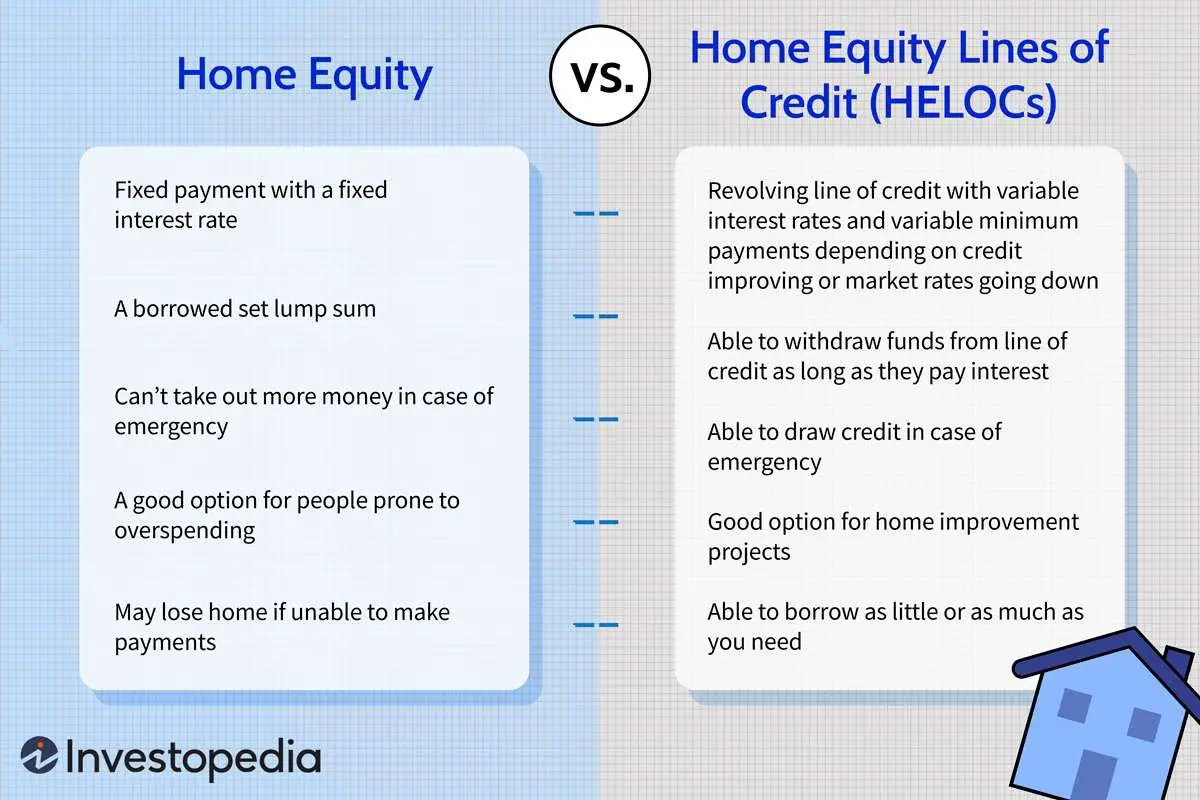

2. Lines of Credit: Similar to a credit card, a line of credit provides a predetermined credit limit that the business owner can access as needed. Interest is charged only on the amount borrowed.

3. Equipment Financing: This loan is specifically designed for purchasing new equipment or machinery for your business. The equipment being purchased itself serves as collateral for the loan.

4. Invoice Financing: Also known as accounts receivable financing, this type of loan allows businesses to borrow against their outstanding invoices. Lenders provide a percentage of the invoice value upfront and collect the full amount from the customer when the invoice is due.

5. Merchant Cash Advances: This is an advance against future credit or debit card sales. The lender provides a lump sum amount, and repayment is made through a percentage of the business’s daily card sales until the loan is fully repaid.

Requirements for Business Loans

While the specific requirements for a business loan may vary depending on the lender and loan type, there are some common prerequisites to consider. Meeting these requirements increases your chances of qualifying for a business loan:

1. Personal and Business Credit Score

Your personal and business credit scores play a crucial role in determining your loan eligibility. Lenders assess your creditworthiness by reviewing your credit history, including any outstanding debts, payment history, and financial stability. A higher credit score typically indicates a lower risk for the lender, increasing your chances of loan approval. While each lender might have different minimum credit score requirements, having a strong credit score is generally advantageous.

2. Business Plan

A well-structured business plan is essential when applying for a business loan. It presents your company’s mission, vision, market analysis, future projections, and how you plan to utilize the loan. Lenders want to see that you have a clear strategy and a realistic plan for using the funds to generate revenue and repay the loan.

Your business plan should include:

– Overview of your business and industry

– Market analysis and target audience

– Competitive analysis

– Financial projections and sales forecasts

– Marketing and growth strategies

– Management team and their qualifications

3. Financial Documents

Lenders require various financial documents to assess the financial health and stability of your business. These documents may include:

– Profit and loss statements

– Balance sheets

– Cash flow statements

– Tax returns

– Bank statements

– Accounts receivable and payable

Having well-organized and up-to-date financial records demonstrates your ability to manage finances and repay the loan.

4. Collateral

Some lenders may require collateral to secure the loan. Collateral can be in the form of property, equipment, inventory, or other valuable assets that the lender can claim in case of default. Providing collateral reduces the lender’s risk, making it easier to secure a loan.

5. Time in Business

The length of time your business has been in operation can impact your eligibility for certain types of loans. Startups or businesses in the early stages may find it more challenging to qualify for larger loans. However, alternative lenders and government-backed loan programs may offer more flexibility for newer businesses.

6. Industry and Business Stability

Lenders consider the stability of your industry and your business when evaluating loan applications. Industries with a high growth potential and stable business models are generally viewed more favorably by lenders. Demonstrating consistent revenue growth and a stable customer base can strengthen your loan application.

7. Debt-to-Income Ratio

Your debt-to-income ratio compares your monthly debt payments to your monthly income. A lower ratio indicates a healthier financial position and increases your chances of loan approval. Lenders want to ensure that your business can comfortably repay the loan without causing financial strain.

Business loans provide much-needed financial support to entrepreneurs and business owners to achieve their goals and navigate through challenges. Understanding the various types of business loans and the requirements to qualify for them is crucial in securing the right loan for your business.

When applying for a business loan, it’s essential to prepare a strong business plan, gather the necessary financial documents, and maintain a healthy credit score. By meeting the requirements and presenting your business in the best light, you increase your chances of obtaining the necessary funds to fuel your growth and success.

How To Get Approved For A Business Loan

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a business loan?

A business loan is a financial product offered by banks, credit unions, or other financial institutions to provide funds for business needs. It is a form of debt that enables businesses to access capital for various purposes, such as expansion, purchasing equipment, or managing cash flow.

What are the requirements for a business loan?

To qualify for a business loan, lenders typically look for the following requirements:

– A well-established and registered business entity

– A good credit history and a strong credit score

– A solid business plan and financial projections

– Sufficient collateral or a personal guarantee

– Proof of stable income and cash flow

– Relevant documents, such as tax returns, bank statements, and legal records

How much can I borrow with a business loan?

The amount you can borrow with a business loan depends on various factors, including your business’s financial health, creditworthiness, and the lender’s policies. Generally, the loan amount can range from a few thousand dollars to millions of dollars.

What are the interest rates for business loans?

Interest rates for business loans can vary depending on factors such as the type of loan, your creditworthiness, market conditions, and the lender’s terms. They can be fixed or variable and typically range from several percentage points above the prime rate.

What are the repayment terms for business loans?

Repayment terms for business loans can vary based on the loan amount, lender’s policies, and the purpose of the loan. Common repayment terms can range from a few months to several years, and the repayment may be structured as monthly installments, quarterly payments, or other agreed-upon terms.

Do I need collateral to get a business loan?

Not all business loans require collateral, but many lenders may require it as security for the loan. Collateral can be in the form of property, equipment, inventory, or even personal assets. The type and value of collateral required may vary depending on the loan amount and the lender’s policy.

How long does it take to get approved for a business loan?

The time it takes to get approved for a business loan can vary based on factors such as your business’s financial health, the complexity of your application, and the lender’s processes. It can range from a few days to several weeks.

What happens if I default on a business loan?

Defaulting on a business loan can have serious consequences. It can negatively impact your credit score, and the lender may take legal action to recover the outstanding balance. Depending on the terms of the loan agreement, they may seize collateral, hire debt collectors, or take other measures to collect the debt. It is important to communicate with the lender if you face difficulties in repaying the loan to explore potential solutions.

Final Thoughts

In conclusion, a business loan is a financial product designed to provide funding for business purposes. It is a loan obtained by a business entity to meet its financial needs, whether it is for starting a new venture, expanding an existing business, or managing day-to-day operations. To qualify for a business loan, certain requirements must be met. These may include a strong credit history, a well-developed business plan, collateral, financial statements, and a positive cash flow. Meeting these requirements demonstrates the borrower’s ability to repay the loan and increases the chances of loan approval. So, understanding what is a business loan and its requirements is crucial for entrepreneurs seeking financial support for their business endeavors.