Wondering what a capital gain distribution in mutual funds is? Look no further! In simple terms, it refers to the distribution of profits made by a mutual fund when it sells securities at a higher price than when it originally bought them. These gains are then passed on to the fund’s shareholders, and they are generally taxable. So, if you’re investing in mutual funds or considering it, understanding capital gain distributions is essential. Let’s explore this topic further and demystify the ins and outs of capital gain distributions in mutual funds.

What is a Capital Gain Distribution in Mutual Funds

Introduction

Investing in mutual funds can be a great way to grow your wealth and achieve your financial goals. Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. One crucial aspect of investing in mutual funds is understanding how capital gain distributions work.

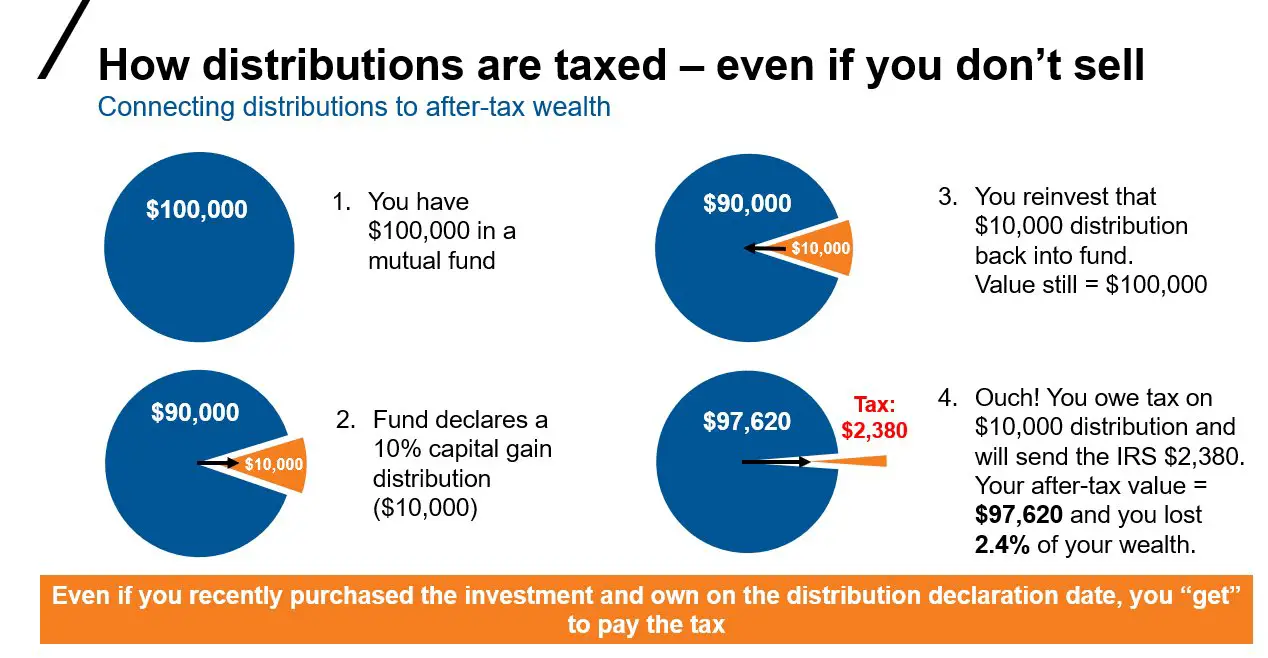

A capital gain distribution is a payment made by a mutual fund to its shareholders when the fund sells securities within its portfolio at a profit. This distribution represents the capital gains realized by the fund and is typically made annually or semi-annually, depending on the fund’s investment strategy and the securities it holds.

How Capital Gain Distributions are Generated

Capital gains for mutual funds are generated when the fund’s portfolio manager sells securities held by the fund that have appreciated in value. The profits from these sales are then distributed to the fund’s shareholders. Here’s a breakdown of how capital gain distributions are generated:

1. Portfolio Management: The fund’s portfolio manager makes decisions on buying and selling securities within the fund’s portfolio based on the fund’s investment objective and strategy.

2. Securities Appreciation: Over time, some of the securities held by the fund may increase in value due to various market factors like economic growth, increased demand, or positive company performance.

3. Sell Off: When the portfolio manager decides to sell a security that has appreciated in value, a capital gain is realized. The gain is calculated as the difference between the selling price and the original purchase price of the security.

4. Capital Gain Distribution: Once the capital gain is realized, the mutual fund is required by law to distribute the gains to its shareholders in the form of capital gain distributions.

Types of Capital Gain Distributions

There are two main types of capital gain distributions that a mutual fund may make:

1. Short-term Capital Gains: These are gains generated from the sale of securities that the fund held for one year or less. Short-term capital gains are typically subject to higher tax rates than long-term capital gains.

2. Long-term Capital Gains: These are gains generated from the sale of securities that the fund held for more than one year. Long-term capital gains are usually taxed at a lower rate than short-term gains.

It’s essential for investors to consider the tax implications of capital gain distributions. Depending on your tax bracket and the type of account in which you hold the mutual fund investment, the distributions may be subject to different tax rates.

Tax Considerations for Capital Gain Distributions

When it comes to capital gain distributions, there are several tax considerations to keep in mind:

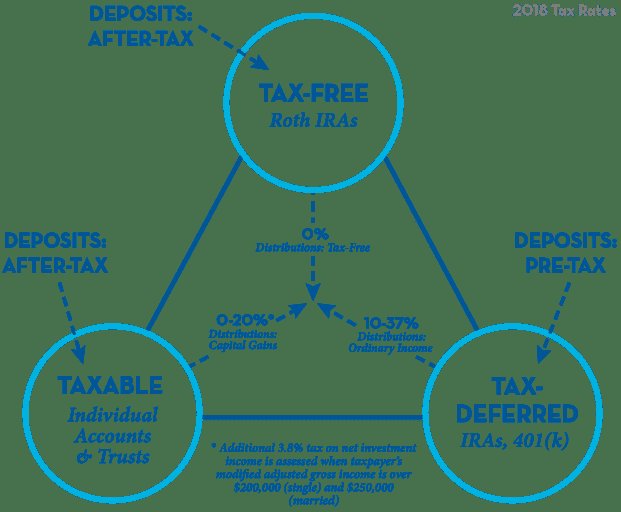

1. Taxable Accounts: If you hold mutual fund investments in a taxable account (such as an individual brokerage account), you may be liable to pay taxes on the capital gain distributions. The tax rates will depend on whether the gains are short-term or long-term.

2. Tax-Advantaged Accounts: Investments held in tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k) plans may defer taxes on capital gain distributions until withdrawals are made. However, depending on the type of account, there may still be tax implications.

3. Net Asset Value (NAV) Impact: Capital gain distributions can impact the net asset value (NAV) of the mutual fund. When a distribution is made, the NAV of the fund decreases by the amount distributed, which may affect the fund’s overall return.

4. Reinvestment Options: Investors usually have the option to reinvest capital gain distributions back into the mutual fund or receive them as cash. Reinvesting can be beneficial for compounding returns over time.

It’s important to consult with a tax advisor or financial professional to understand the specific tax implications of capital gain distributions based on your individual circumstances.

Minimizing the Impact of Capital Gain Distributions

While capital gain distributions are a normal part of investing in mutual funds, some investors may prefer to minimize their impact. Here are a few strategies to consider:

1. Tax-Managed Funds: Some mutual funds are specifically designed to minimize capital gain distributions and their associated tax liabilities. These funds employ strategies such as tax-efficient trading and prioritizing long-term holdings.

2. Index Funds and ETFs: Passively managed funds, such as index funds and exchange-traded funds (ETFs), tend to generate fewer capital gain distributions compared to actively managed funds. This is because they generally have lower portfolio turnover.

3. Timing Investments: Investors can also consider the timing of their investments to minimize the impact of capital gain distributions. By investing in a mutual fund just before its distribution date, you may be able to avoid receiving the distribution for that year.

4. Tax-Loss Harvesting: Investors with taxable accounts can offset capital gains by strategically selling other investments that have experienced losses. This can help to minimize the tax impact of capital gain distributions.

It’s worth noting that while minimizing capital gain distributions can be advantageous from a tax perspective, it should not be the sole factor driving your investment decisions. It’s crucial to consider other factors such as fund performance, risk, and alignment with your investment goals.

Understanding capital gain distributions is essential for investors in mutual funds. These distributions represent the realized gains from the sale of securities within a fund’s portfolio. It’s important to be aware of the tax implications associated with capital gain distributions and to consider strategies to minimize their impact, such as investing in tax-efficient funds or timing your investments strategically. Consulting with a financial advisor or tax professional can provide valuable guidance tailored to your specific circumstances. By being informed and proactive, investors can navigate the complexities of capital gain distributions and make sound investment decisions.

What are mutual fund capital gain distributions?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a capital gain distribution in mutual funds?

A capital gain distribution in mutual funds refers to the distribution of profits made by the fund from the sale of its investments. These profits are generated by selling securities, such as stocks or bonds, at a higher price than they were originally bought for. When these capital gains are distributed to mutual fund investors, they are subject to taxation.

How are capital gain distributions taxed?

Capital gain distributions are taxed based on the type of capital gains realized by the mutual fund. If the fund holds securities for more than one year before selling them, the capital gains are considered long-term and taxed at a lower rate. Conversely, if the securities are held for one year or less, the capital gains are considered short-term and taxed at the investor’s ordinary income tax rate.

Are capital gain distributions reinvested automatically?

Whether or not capital gain distributions are reinvested automatically depends on the individual investor’s preferences. Some investors choose to automatically reinvest their capital gains back into the mutual fund, while others may opt to receive the distributions in cash.

How often are capital gain distributions made by mutual funds?

Mutual funds typically make capital gain distributions to their shareholders annually, although it can vary depending on the fund’s specific policies. The exact timing of the distribution is usually determined by the fund manager and is communicated to the investors in advance.

Can capital gain distributions be avoided?

Capital gain distributions cannot be entirely avoided as they are a natural consequence of a mutual fund’s investment activities. However, investors can minimize the impact of capital gain distributions by investing in tax-efficient mutual funds, such as index funds or exchange-traded funds (ETFs), which generally have lower turnover and thus generate fewer capital gains.

Are capital gain distributions taxable if I reinvest them?

Yes, capital gain distributions are still taxable even if they are reinvested. The reinvested capital gains are treated as if they were received in cash, and the investor is liable for the associated taxes. It’s important to report and include reinvested capital gains as part of your taxable income when filing your tax return.

What are the implications of capital gain distributions for tax planning?

Capital gain distributions can have implications for tax planning as they can increase an investor’s taxable income for the year in which they are received. It is important to consider the tax implications of capital gain distributions when planning your overall investment and tax strategy, especially if you anticipate being in a higher tax bracket.

Are there any strategies to reduce the impact of capital gain distributions?

One strategy to reduce the impact of capital gain distributions is tax-loss harvesting. This involves selling investments that have experienced a loss to offset the capital gains realized from other investments. By strategically harvesting losses, investors can reduce their overall tax liability and potentially offset the impact of capital gain distributions. However, it’s important to consider the specific circumstances and consult with a tax professional before implementing such strategies.

Final Thoughts

A capital gain distribution in mutual funds refers to the distribution of profits made from the sale of securities within the fund’s portfolio. This distribution is made to the investors of the mutual fund in proportion to their holdings. By investing in mutual funds, individuals can participate in the gains made by the fund through capital gain distributions. These distributions are usually made annually or semi-annually and can be reinvested or received as cash. Understanding capital gain distributions is important for investors as it affects their tax liability and overall returns from the mutual fund investment. Overall, capital gain distributions in mutual funds are a way for investors to share in the fund’s profits and enhance their investment returns.