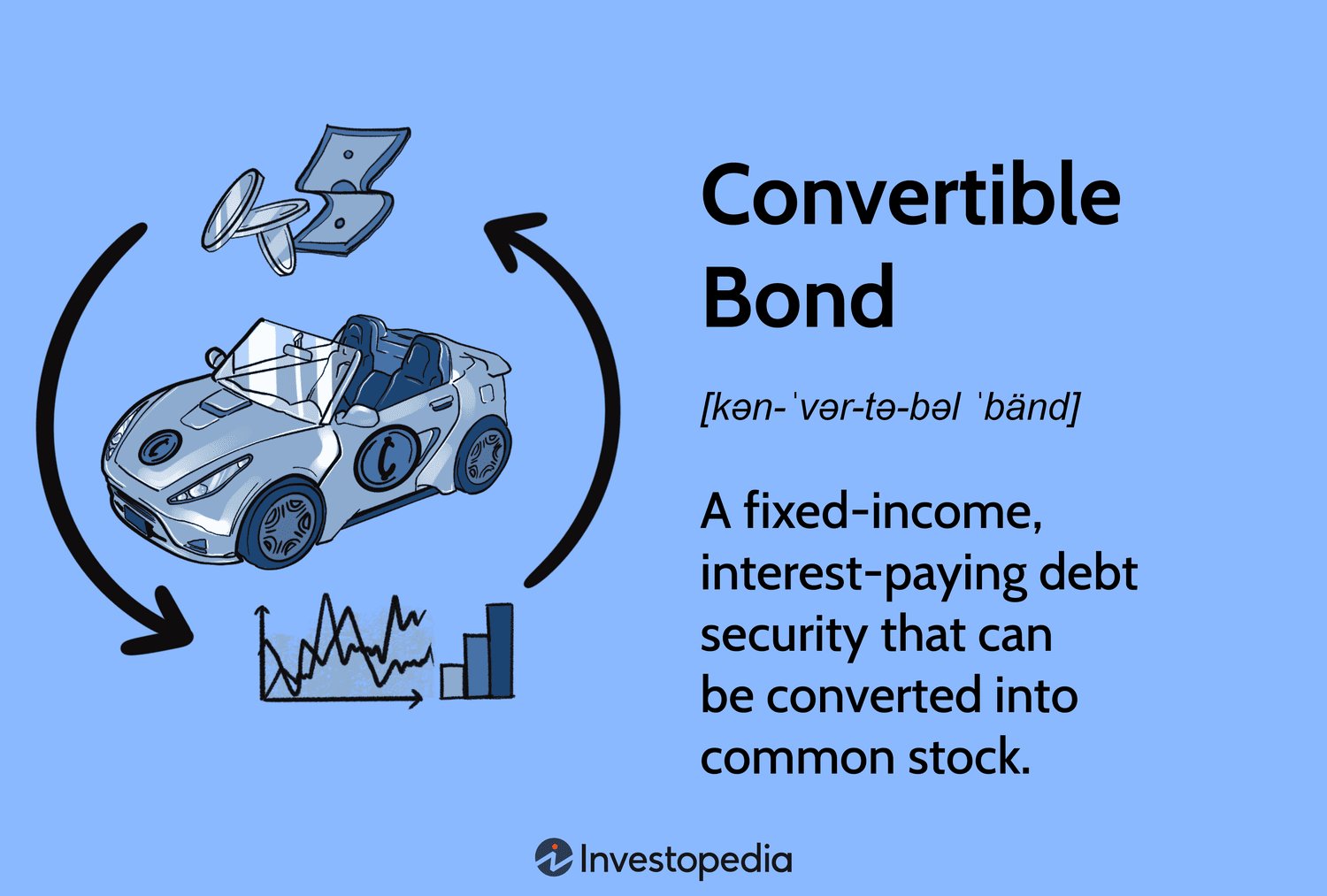

Looking to expand your knowledge of finance? Wondering what a convertible bond is in the world of finance? Well, look no further! A convertible bond is a unique financial instrument that combines the characteristics of a bond and a stock. In simpler terms, it’s a bond that can be converted into shares of the issuing company’s stock. This fascinating investment option has gained popularity among both investors and companies for its potential to offer the best of both worlds. So, let’s dive into the intricacies of convertible bonds in finance and explore their features, benefits, and why they are worth considering.

What is a Convertible Bond in Finance?

A convertible bond is a unique financial instrument that combines the features of both debt and equity. It is a type of bond issued by a corporation or government that provides the bondholder with the option to convert the bond into a predetermined number of the issuing company’s common shares. Essentially, a convertible bond gives investors the opportunity to participate in the growth potential of a company while still receiving a fixed income stream.

Convertible bonds have gained popularity among both issuers and investors due to their flexibility and potential for higher returns. In this article, we will explore the various aspects of convertible bonds, including their structure, advantages, risks, and how they are priced. So, let’s dive in!

Structure of Convertible Bonds

Convertible bonds are structured to provide flexibility to both the issuer and the investor. Here are the key components of a typical convertible bond:

1. Face Value: Like traditional bonds, convertible bonds have a face value, which is the principal amount that the issuer promises to repay to the bondholder at maturity.

2. Coupon Rate: Convertible bonds also pay periodic interest or coupon payments to bondholders, typically semi-annually or annually. The coupon rate is usually lower than that of non-convertible bonds to compensate for the potential equity upside.

3. Conversion Ratio: The conversion ratio determines the number of common shares the bondholder can receive upon conversion. For example, if the conversion ratio is 20, the bondholder can convert each $1,000 bond into 20 common shares.

4. Conversion Price: The conversion price is the price at which the bondholder can convert the bond into common shares. It is calculated by dividing the face value by the conversion ratio. For instance, if the face value is $1,000 and the conversion ratio is 20, the conversion price would be $50 per share.

5. Conversion Period: Convertible bonds have a predetermined period during which the bondholder can exercise the conversion option. This period typically begins after a certain period from the bond’s issuance and ends before the bond’s maturity.

6. Call and Put Features: Some convertible bonds may also have call and put features. A call feature allows the issuer to redeem the bond before maturity, while a put feature empowers the bondholder to sell the bond back to the issuer at a predetermined price.

Advantages of Convertible Bonds

Convertible bonds offer several advantages to both issuers and investors, making them an attractive investment option. Here are some of the key benefits:

1. Access to Capital: For issuers, convertible bonds provide a means to raise capital without immediately diluting existing shareholders. The bonds offer lower coupon payments compared to non-convertible bonds, making them an appealing financing alternative.

2. Increased Flexibility: Convertible bonds offer flexibility for investors. They can choose to hold the bond until maturity, receive regular coupon payments, and enjoy the potential upside if the issuer’s stock price increases.

3. Potential for Capital Appreciation: The conversion feature allows bondholders to participate in the growth potential of the issuing company. If the company’s stock price rises significantly, bondholders can convert their bonds into common shares and benefit from any future appreciation.

4. Risk Mitigation: Convertible bonds provide a level of downside protection with their fixed income feature. Even if the stock price declines, bondholders still have the security of receiving regular interest payments and the return of the principal at maturity.

5. Diversification: Convertible bonds offer diversification opportunities for investors seeking a balanced portfolio. By combining the features of both debt and equity, these bonds bridge the gap between fixed-income securities and equities, allowing investors to have exposure to both asset classes.

Risks of Convertible Bonds

While convertible bonds offer potential advantages, they also come with certain risks that investors should consider. Here are some of the key risks associated with convertible bonds:

1. Equity Risk: The value of convertible bonds is closely tied to the underlying stock price. If the issuer’s stock price declines, the value of the convertible bond may also decrease.

2. Interest Rate Risk: Like traditional bonds, convertible bonds are susceptible to changes in interest rates. If interest rates rise, the value of the bond may decline, as investors may prefer higher-yielding fixed-income securities.

3. Volatility Risk: Convertible bonds are influenced by the volatility of the underlying stock. Higher stock price volatility can increase the value of the conversion feature but also poses risks if the stock price experiences significant declines.

4. Liquidity Risk: Convertible bonds may have lower trading volumes compared to stocks or non-convertible bonds, leading to potential challenges in buying or selling the bonds at desired prices.

5. Credit Risk: As with any bond investment, convertible bonds carry credit risk. If the issuer faces financial difficulties or defaults on its obligations, bondholders may face challenges in receiving interest payments or the return of their principal.

Pricing of Convertible Bonds

The pricing of convertible bonds is a complex process that considers various factors. Key components that influence convertible bond pricing include:

1. Stock Price: The current market value of the underlying stock has a significant impact on the convertible bond’s value. As the stock price increases, the conversion feature becomes more valuable, leading to higher bond prices.

2. Interest Rates: Changes in interest rates affect the present value of the bond’s future cash flows. Lower interest rates generally result in higher convertible bond prices.

3. Volatility: Higher stock price volatility increases the probability of the stock’s future price exceeding the conversion price. This increased potential for equity upside elevates the bond’s price.

4. Time to Maturity: The amount of time remaining until the bond’s maturity affects its price. The longer the time to maturity, the higher the bond’s price as it provides more opportunities for the stock price to increase.

5. Credit Quality: The credit rating of the issuing company also plays a role in convertible bond pricing. Higher-rated issuers generally have lower yields and higher bond prices.

In conclusion, convertible bonds serve as a bridge between debt and equity investments. They offer the potential for capital appreciation while providing downside protection through regular fixed income payments. Convertible bonds benefit issuers by providing access to capital and investors by offering flexibility and diversification. However, investors should be aware of the risks associated with convertible bonds, such as equity and interest rate risks. Understanding the structure, advantages, risks, and pricing of convertible bonds can help investors make informed decisions when considering these unique financial instruments.

CONVERTIBLE BONDS EXPLAINED.

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a convertible bond in finance?

A convertible bond is a type of bond that can be converted into a specified number of shares of the issuing company’s common stock. It combines features of both debt and equity, offering investors the opportunity to benefit from potential stock price appreciation while still receiving fixed interest payments.

How does a convertible bond work?

When an investor purchases a convertible bond, they receive a fixed interest payment at regular intervals until the bond matures. However, they also have the option to convert the bond into a specified number of common shares at a predetermined conversion price during a certain period.

What are the advantages of investing in convertible bonds?

Investing in convertible bonds provides several advantages. Firstly, they offer the potential for higher returns than traditional bonds due to the attached equity option. Secondly, they provide downside protection since the bond’s value is supported by its fixed interest payments. Lastly, they allow investors to participate in the company’s stock price appreciation.

What is the difference between convertible bonds and regular bonds?

The main difference between convertible bonds and regular bonds is the convertible feature. Regular bonds only offer fixed interest payments and repayment of principal at maturity, whereas convertible bonds provide the option to convert into the issuing company’s common shares.

What factors should be considered when investing in convertible bonds?

When investing in convertible bonds, it is important to consider factors such as the issuer’s creditworthiness, the bond’s coupon rate, conversion price, conversion ratio, and the underlying stock’s performance. Additionally, investors should assess the potential for stock price appreciation and evaluate the company’s industry outlook.

What happens if I convert my convertible bond into stock?

If you choose to convert your convertible bond into stock, you will surrender your bond and receive the specified number of common shares. Once converted, you will become a shareholder and can benefit from any potential increase in the stock’s price.

Can convertible bonds be redeemed before maturity?

Yes, some convertible bonds may have a call feature that allows the issuer to redeem the bonds before their scheduled maturity date. This typically happens when the issuer’s stock price exceeds a predetermined level for a specified period, providing an incentive for early redemption.

What are the risks associated with investing in convertible bonds?

While convertible bonds offer potential benefits, they also come with risks. The value of convertible bonds can fluctuate based on changes in interest rates, credit risk of the issuer, and the performance of the underlying stock. Additionally, if the stock price does not rise as expected, the investor may miss out on potential gains.

Final Thoughts

A convertible bond is a financial instrument that allows the bondholder to convert their bond into a predetermined number of common shares. This unique characteristic makes it appealing to investors as it offers the potential for both fixed income through the bond’s coupon payments and equity participation through the conversion feature. Convertible bonds are often issued by companies seeking to raise capital at a lower cost compared to issuing traditional equity. They provide investors with the opportunity to benefit from an increase in the company’s stock price. So, what is a convertible bond in finance? It is a versatile investment tool that combines elements of both debt and equity, offering investors a flexible and potentially advantageous investment option.