Have you ever wondered what a credit report is and how to read it? Understanding this crucial financial document can be a game-changer when it comes to managing your credit and making informed financial decisions. In this article, we’ll delve into the nitty-gritty of what a credit report entails and break it down into simple steps on how to interpret it. So, if you’ve been scratching your head trying to make sense of your credit report, look no further! Let’s explore what is a credit report and how to read it, demystifying this important aspect of personal finance.

What is a Credit Report and How to Read It

A credit report is a financial document that provides a detailed record of an individual’s credit history. It contains information about their borrowing and repayment activities, including credit cards, mortgages, loans, and other financial obligations. Lenders, such as banks and financial institutions, use credit reports to assess an individual’s creditworthiness and determine their ability to repay loans.

Understanding how to read a credit report is important for managing your personal finances and improving your creditworthiness. In this article, we will explore the various sections of a credit report and provide insights on how to interpret the information it contains.

1. Personal Information

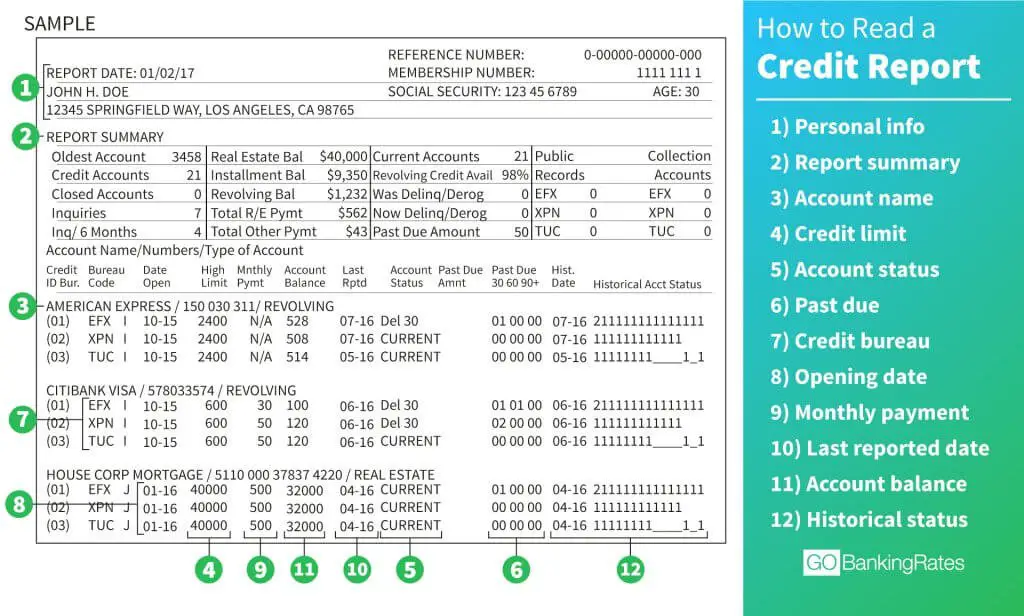

The first section of a credit report typically contains personal information, including your full name, date of birth, social security number, current and previous addresses, and employment history. It is essential to review this section carefully to ensure accuracy. Any errors or discrepancies could impact your creditworthiness and lead to potential issues in the future.

2. Credit Summary

The credit summary section provides an overview of your credit accounts. It includes information about the total number of accounts, the number of open and closed accounts, as well as the total outstanding debt. This section also highlights any accounts that are currently delinquent or have been sent to collections.

Types of Credit

Within the credit summary section, you will find a breakdown of the different types of credit accounts you have. This could include:

- Credit cards

- Auto loans

- Mortgages

- Student loans

- Personal loans

Understanding the mix of credit types in your report is important, as it can impact your credit score. Having a diverse range of credit accounts demonstrates responsible credit management.

Account Status

The account status section provides information on the current status of each credit account. This can include:

- Open accounts: These are active accounts with an ongoing balance or credit limit.

- Closed accounts: These are accounts that have been closed by you or the lender.

- Delinquent accounts: These are accounts with late or missed payments.

- Accounts in collections: These are accounts that have been sent to a collection agency due to non-payment.

Reviewing the account status section helps you understand your payment history and identify any accounts that may require immediate attention.

Credit Limits and Balances

This subsection provides details about your credit limits and outstanding balances for each account. It is crucial to monitor this information, as it directly affects your credit utilization ratio. A high credit utilization ratio, where your outstanding balances are close to or exceed your credit limits, can negatively impact your credit score.

3. Payment History

The payment history section is one of the most critical parts of a credit report. It tracks your payment behavior for each credit account over time. This includes information on whether payments were made on time, any late or missed payments, and any accounts that have been sent to collections.

Maintaining a positive payment history is crucial for a good credit score. Late or missed payments can significantly impact your creditworthiness and make it difficult to obtain credit in the future. It’s important to review this section carefully and address any potential issues or inaccuracies.

4. Credit Inquiries

Credit inquiries refer to the instances when someone, typically a lender, requests a copy of your credit report. There are two types of credit inquiries:

- Hard inquiries: These occur when you apply for new credit, such as a loan or credit card. They can have a temporary negative impact on your credit score.

- Soft inquiries: These occur when a person or company checks your credit report for informational purposes, such as a background check or pre-approved credit offers. Soft inquiries do not affect your credit score.

Reviewing the credit inquiries section allows you to see who has accessed your credit report and for what purpose. It’s important to monitor this section for any unauthorized or suspicious inquiries that could indicate potential identity theft.

5. Public Records

The public records section contains information regarding any bankruptcies, tax liens, judgments, or other legal actions related to your financial history. These records can have a significant negative impact on your creditworthiness and may remain on your credit report for several years.

Reviewing the public records section is crucial for spotting any inaccuracies or outdated information that may be affecting your credit report negatively.

6. Dispute Process

If you find any errors or discrepancies in your credit report, it is essential to take the necessary steps to correct them. The credit report should provide information on how to dispute inaccurate information. Typically, you will need to contact the credit reporting agency directly and provide documentation supporting your claim. The agency will investigate the dispute and make the necessary corrections if warranted.

It is crucial to periodically review your credit report and ensure its accuracy. By monitoring your credit report, you can identify potential issues early on and take the necessary actions to improve your creditworthiness.

Remember, a good credit report is the key to unlocking financial opportunities such as obtaining favorable loan terms, securing lower interest rates, and improving your overall financial well-being.

How to Read a Credit Report ????

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a credit report and how to read it?

A credit report is a detailed record of an individual’s credit history maintained by credit bureaus. It includes information about the credit accounts they have, payment history, outstanding balances, and any negative items such as defaults or bankruptcies. To read a credit report, follow these steps:

1. Obtain a Copy: Obtain a free copy of your credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion.

2. Review Personal Information: Check that all your personal details, such as name, address, and social security number, are correct.

3. Examine Accounts: Analyze each credit account listed in the report, including credit cards, loans, and mortgages. Note the type of account, the creditor’s name, the credit limit, and the current balance.

4. Check Payment History: Look for any late payments, missed payments, or defaults. Timely payments positively affect your credit score, whereas delinquencies can have a negative impact.

5. Assess Account Status: Determine whether each account is open, closed, or in collections. Closed accounts should show a zero balance.

6. Verify Credit Inquiries: Check for any credit inquiries made by lenders when you applied for credit. Multiple inquiries can temporarily lower your credit score.

7. Review Public Records: Look for bankruptcies, tax liens, or court judgments, as they can severely impact your creditworthiness.

8. Identify Errors: If you spot any errors or discrepancies on your credit report, contact the credit bureaus and dispute the inaccuracies.

What is the importance of a credit report?

A credit report is crucial because it provides lenders, landlords, and other entities with an overview of your credit history. It helps them assess your financial responsibility and decide whether to approve your credit applications, such as loans or credit cards. Additionally, employers may also check credit reports to evaluate an individual’s financial stability and trustworthiness for certain job positions.

How often should I check my credit report?

It is advisable to check your credit report at least once a year. Regularly monitoring your credit report helps you identify any errors, fraudulent activity, or signs of identity theft. If you are planning to apply for credit or a loan, it is recommended to check your report a few months in advance to allow time for corrections or improvements if needed.

Can I access my credit report for free?

Yes, you can access your credit report for free once every 12 months from each of the three major credit bureaus (Experian, Equifax, and TransUnion). To obtain your free report, visit annualcreditreport.com, the official website authorized by the Federal Trade Commission. You can also request your report by mail or phone.

Does checking my credit report impact my credit score?

No, checking your own credit report does not affect your credit score. This type of inquiry is considered a “soft inquiry” and has no impact on your creditworthiness. However, if a lender or creditor checks your credit report in response to a credit application, it may result in a “hard inquiry” which can slightly lower your credit score temporarily.

How long does information stay on my credit report?

Most information on your credit report remains for a specific period:

– Late payments, defaults, and other negative items: Usually remain on your report for seven years.

– Bankruptcies: Can stay on your report for up to ten years, depending on the type (Chapter 7 or Chapter 13).

– Credit inquiries: Generally stay on your report for two years.

– Positive accounts: These typically remain on your report for ten years or more, depending on the account’s history.

What should I do if I find an error on my credit report?

If you find an error on your credit report, you should promptly dispute it by contacting the credit bureau that provided the report. Gather any supporting documentation and clearly state why you believe the information is inaccurate. The credit bureau will investigate the dispute and make any necessary corrections. Regularly monitoring your credit report can help identify these errors and ensure your creditworthiness is accurately portrayed.

How can I improve my credit score?

Improving your credit score requires consistent effort over time. Here are some steps you can take:

– Pay your bills on time: Late payments can lower your score, so always strive to make timely payments.

– Reduce credit card balances: High credit card balances compared to your credit limit can negatively impact your score. Aim to keep your credit utilization below 30%.

– Limit credit applications: Applying for credit frequently can have a negative impact. Only apply for credit when necessary.

– Build a positive credit history: Maintain active credit accounts, make regular payments, and avoid closing old accounts, as they contribute to your credit history length.

– Regularly check your credit report: Keeping an eye on your credit report allows you to identify and address any issues promptly.

Final Thoughts

In conclusion, understanding what a credit report is and how to read it is crucial for financial well-being. A credit report is a detailed record of an individual’s credit history and includes information such as accounts, payment history, and credit inquiries. By regularly reviewing your credit report, you can ensure its accuracy, identify any errors, and take steps to improve your credit score. To read a credit report effectively, focus on sections like personal information, account history, and credit inquiries. By familiarizing yourself with the contents of your credit report, you can make informed financial decisions and maintain a healthy credit profile.