If you’ve ever wondered “what is a credit score and how is it calculated,” you’re not alone. Understanding this important financial indicator is key to managing your personal finances and making informed decisions. A credit score is a numerical representation of your creditworthiness, a measure of how likely you are to repay loans and debts. So, how is it calculated? Well, it involves analyzing various factors such as your payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. In this article, we’ll delve into the fascinating world of credit scoring and demystify the calculation process for you. Ready to gain a deeper understanding? Let’s dive in!

What is a Credit Score and How is it Calculated?

Introduction

A credit score is a three-digit number that reflects an individual’s creditworthiness. It is a crucial factor considered by lenders when deciding whether to approve a loan or credit application. Understanding what a credit score is and how it is calculated is essential for anyone seeking financial stability and access to affordable credit.

What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness. It provides a snapshot of their credit history, indicating how likely they are to repay their debts. Lenders, such as banks, credit card companies, and mortgage providers, use credit scores to assess the potential risk of lending money to borrowers.

The most commonly used credit scoring models in the United States are the FICO Score and VantageScore. These models range from 300 to 850, with higher scores indicating lower credit risk. While the specific calculations may vary between models, the underlying factors influencing credit scores remain relatively consistent.

Factors that Influence Credit Scores

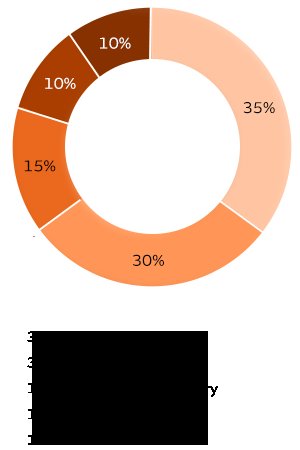

Several factors contribute to the calculation of a credit score, including:

1. Payment History: This is the most important factor and accounts for about 35% of the credit score. It reflects whether you have made past payments on time and if any accounts have gone into collections or experienced bankruptcy.

2. Credit Utilization: This factor accounts for about 30% of the credit score. It considers how much of your available credit you are using. Keeping credit utilization below 30% is generally recommended to maintain a healthy credit score.

3. Length of Credit History: This factor accounts for about 15% of the credit score. It takes into account how long you have been using credit and the average age of your credit accounts. A longer credit history generally results in a higher credit score.

4. Credit Mix: This factor accounts for about 10% of the credit score. It considers the variety of credit accounts you have, such as credit cards, loans, and mortgages. Having a diverse mix of credit types can positively impact your credit score.

5. New Credit Applications: This factor accounts for about 10% of the credit score. It looks at how frequently you apply for new credit. Multiple credit applications within a short period may indicate financial distress and can lower your credit score.

The Importance of a Good Credit Score

Having a good credit score is crucial for several reasons:

1. Loan Approvals: Lenders rely on credit scores to assess the likelihood of loan repayments. A good credit score increases your chances of being approved for loans, mortgages, and credit cards. It may also result in lower interest rates and better loan terms.

2. Rental Applications: Landlords often use credit scores to evaluate prospective tenants. A good credit score can make it easier to secure a rental property.

3. Utility Services: Utility companies may check credit scores when determining whether to provide services. A good credit score can help streamline the process and avoid additional deposits or fees.

4. Employment Opportunities: Some employers conduct credit checks as part of the hiring process, especially for financially sensitive positions. A good credit score can positively impact your employability.

How is a Credit Score Calculated?

While the exact algorithms used to calculate credit scores are proprietary information, the general methodology is known. Both the FICO Score and VantageScore utilize similar principles when assessing creditworthiness.

FICO Score Calculation

The FICO Score calculation is based on the following factors:

1. Payment History (35%): This factor evaluates the consistency of your payment history, including any late payments, delinquencies, or defaults.

2. Amounts Owed (30%): This factor considers the amount of debt you currently owe on different credit accounts and your credit utilization.

3. Length of Credit History (15%): This factor takes into account the age of your oldest and newest credit accounts, along with the average age of all your accounts.

4. Credit Mix (10%): This factor assesses the variety of credit accounts you have, such as credit cards, loans, and mortgages.

5. New Credit (10%): This factor looks at any recent credit inquiries and new accounts you have opened.

VantageScore Calculation

The VantageScore calculation is based on the following factors:

1. Payment History (40%): This factor evaluates your track record of making timely payments and any negative events like delinquencies or charge-offs.

2. Credit Utilization (20%): This factor assesses your credit card balances compared to your credit limits and overall credit utilization.

3. Credit Balances (20%): This factor considers the total amount of debt you owe across all credit accounts.

4. Depth of Credit (10%): This factor looks at the length of your credit history and the different types of credit you have, such as credit cards, loans, and mortgages.

5. Recent Credit (10%): This factor considers the number of new credit accounts or credit inquiries on your report.

How to Improve Your Credit Score

Improving your credit score is possible with time and effort. While there are no shortcuts or quick fixes, the following strategies can help you improve your creditworthiness:

1. Make Timely Payments

Paying your bills on time is one of the most effective ways to improve your credit score. Set up reminders or automatic payments to avoid missing due dates.

2. Reduce Credit Card Balances

Lowering your credit card balances can significantly improve your credit utilization ratio. Aim to keep your balances below 30% of your credit limits.

3. Avoid Opening Unnecessary Credit Accounts

Applying for multiple credit accounts within a short period can negatively impact your credit score. Only open new accounts when necessary.

4. Regularly Check Your Credit Report

Reviewing your credit report allows you to identify any errors or fraudulent activity that could be dragging down your credit score. Disputing inaccuracies can help improve your score.

5. Maintain a Diverse Credit Mix

Having a mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. However, avoid opening new accounts solely for the purpose of diversification.

Understanding what a credit score is and how it is calculated is essential for anyone seeking financial stability and affordable credit. Factors such as payment history, credit utilization, length of credit history, credit mix, and new credit applications all influence credit scores. By actively managing these factors and adopting healthy credit habits, individuals can improve their creditworthiness and gain access to better financial opportunities. Remember, building a good credit score takes time and consistent effort, but the benefits are well worth it.

How Are Credit Scores Calculated?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a credit score and how is it calculated?

A credit score is a numerical representation of an individual’s creditworthiness. It is calculated using various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries.

How important is a credit score?

A credit score is very important as it plays a crucial role in determining your eligibility for loans, credit cards, and other financial opportunities. Lenders use credit scores to assess the risk associated with lending money to an individual.

What is the range of credit scores?

Credit scores typically range from 300 to 850. A higher score indicates a lower credit risk, while a lower score suggests a higher credit risk.

How can I check my credit score?

You can check your credit score through various credit reporting agencies or financial institutions. Many of them provide online platforms or mobile apps where you can easily access and monitor your credit score.

What factors can negatively impact my credit score?

Several factors can negatively impact your credit score, including late payments, high credit card balances, bankruptcy, foreclosure, collection accounts, and numerous credit inquiries within a short period.

Can I improve my credit score?

Yes, it is possible to improve your credit score. By consistently making on-time payments, reducing credit card balances, avoiding new credit inquiries, and maintaining a good credit utilization ratio, you can gradually improve your score.

How long does it take to improve a credit score?

The time it takes to improve a credit score varies depending on individual circumstances. It can take several months or even years of responsible credit behavior to see significant improvements in your credit score.

Will checking my credit score affect it negatively?

No, checking your own credit score does not impact it negatively. This type of inquiry is called a “soft inquiry” and has no effect on your credit score. However, “hard inquiries” made by lenders when you apply for credit can have a temporary negative impact.

Final Thoughts

A credit score is a numerical representation of an individual’s creditworthiness. It is calculated based on various factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. These factors are analyzed by credit reporting agencies to generate a credit score. A higher credit score indicates a lower risk of defaulting on credit obligations, while a lower score suggests a higher risk. It is essential to understand the importance of maintaining a good credit score as it impacts the ability to secure loans, obtain favorable interest rates, and access various financial opportunities. By being aware of what a credit score is and how it is calculated, individuals can take necessary steps to improve and maintain their creditworthiness.