If you’re struggling to keep up with multiple debts and finding it overwhelming, a debt consolidation loan could be the solution you’ve been searching for. So, what is a debt consolidation loan? It’s a financial tool that allows you to combine all your debts into a single loan with one manageable monthly payment. Imagine the relief of no longer juggling various due dates and interest rates. With a debt consolidation loan, you can regain control of your finances and simplify your repayment process. Let’s dive deeper into how it works and explore its potential benefits.

What is a Debt Consolidation Loan?

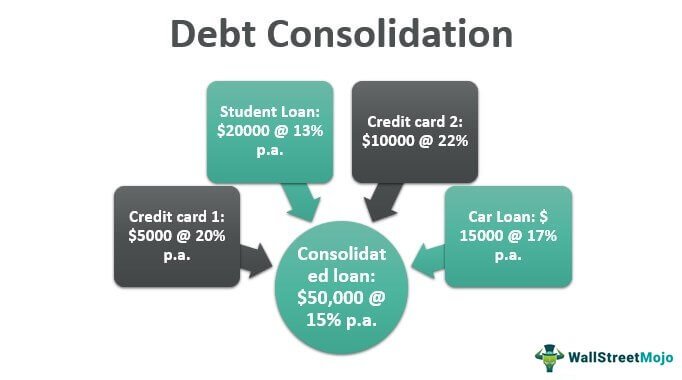

Debt consolidation loans are a powerful financial tool that can help individuals manage their multiple debts more effectively. These loans allow borrowers to consolidate all their outstanding debts into a single loan, resulting in a more streamlined repayment process. This type of loan can be particularly beneficial for individuals struggling with high-interest credit card debt, personal loans, or medical bills.

When you opt for a debt consolidation loan, you essentially take out a new loan to pay off your existing debts. By doing so, you can simplify your finances by having just one monthly payment to make, rather than juggling multiple payments with different due dates and interest rates. Debt consolidation loans often come with more favorable terms, such as lower interest rates or longer repayment periods, which can make it easier for borrowers to manage their debt and potentially save money in the long run.

How Does a Debt Consolidation Loan Work?

Debt consolidation loans work by combining all your existing debts into a single loan. Here’s a step-by-step breakdown of how the process typically works:

1. Assessing your debt: The first step is to evaluate your current debts, including credit card balances, outstanding personal loans, medical bills, or any other debts you may have. This assessment will help you determine the total amount you need to consolidate.

2. Researching lenders: Once you have a clear understanding of your debt situation, it’s time to start researching lenders that offer debt consolidation loans. Look for reputable lenders who offer competitive interest rates and favorable terms.

3. Applying for the loan: After selecting a lender, you’ll need to complete a loan application. This typically involves providing personal information, details about your existing debts, and your financial situation. The lender will then review your application and assess your creditworthiness.

4. Loan approval and disbursement: If your application is approved, the lender will provide you with the loan amount you need to consolidate your debts. The funds will be disbursed directly to your creditors, paying off your existing debts.

5. Repayment: With your debts consolidated into a single loan, you’ll now have one monthly payment to make to your lender. Make sure to pay this amount on time each month to avoid any negative consequences and to work towards eliminating your debt.

The Benefits of a Debt Consolidation Loan

Debt consolidation loans offer several advantages that can help borrowers regain control of their finances. Here are some key benefits:

1. Simplified repayment: Managing multiple debts with different interest rates and due dates can be overwhelming and lead to missed payments. With a debt consolidation loan, you have only one payment to make each month, simplifying your financial obligations.

2. Lower interest rates: One of the significant advantages of debt consolidation loans is the potential for lower interest rates compared to your existing debts. By securing a loan with a lower interest rate, you can reduce the overall cost of your debt and potentially save money.

3. Extended repayment period: Debt consolidation loans often come with longer repayment periods, allowing borrowers to spread out their payments over a more manageable timeframe. This can help lower monthly payment amounts, making it easier to meet financial obligations.

4. Improved credit score: When you consolidate your debts into a single loan, it can positively impact your credit score. As long as you make timely payments on your debt consolidation loan, it demonstrates responsible financial behavior, which can help improve your creditworthiness over time.

5. Debt management assistance: Some lenders offer additional benefits, such as financial counseling or debt management programs, to help borrowers better manage their finances and avoid future debt problems.

Is Debt Consolidation Right for You?

While debt consolidation loans can be an effective tool for managing debt, they may not be suitable for everyone. It’s important to consider your individual financial situation and goals before deciding if a debt consolidation loan is right for you. Here are a few factors to weigh:

1. Total debt amount: Debt consolidation loans are typically most beneficial for individuals with a significant amount of debt. If you have only a small amount of debt, it may be more manageable to pay it off individually rather than going through the consolidation process.

2. Interest rates: Assess the interest rates on your current debts and compare them to the rates offered by potential lenders. If you can secure a consolidation loan with a lower interest rate, it may be a viable option for saving money on interest payments.

3. Repayment ability: Consider your ability to make the monthly payments on a debt consolidation loan. If the new loan’s repayment terms are favorable and fit within your budget, it can be an effective way to regain control of your finances. However, if the monthly payments are too high, it may not be the right solution for you.

4. Financial discipline: Debt consolidation loans are only effective if you commit to responsible financial habits. Evaluate whether you have the discipline to avoid incurring new debts and make timely payments on your consolidation loan.

Alternatives to Debt Consolidation Loans

If a debt consolidation loan doesn’t seem like the right option for you, there are alternative strategies to explore. These alternatives may offer similar benefits or provide a tailored approach to address your specific financial needs. Here are a few alternatives to consider:

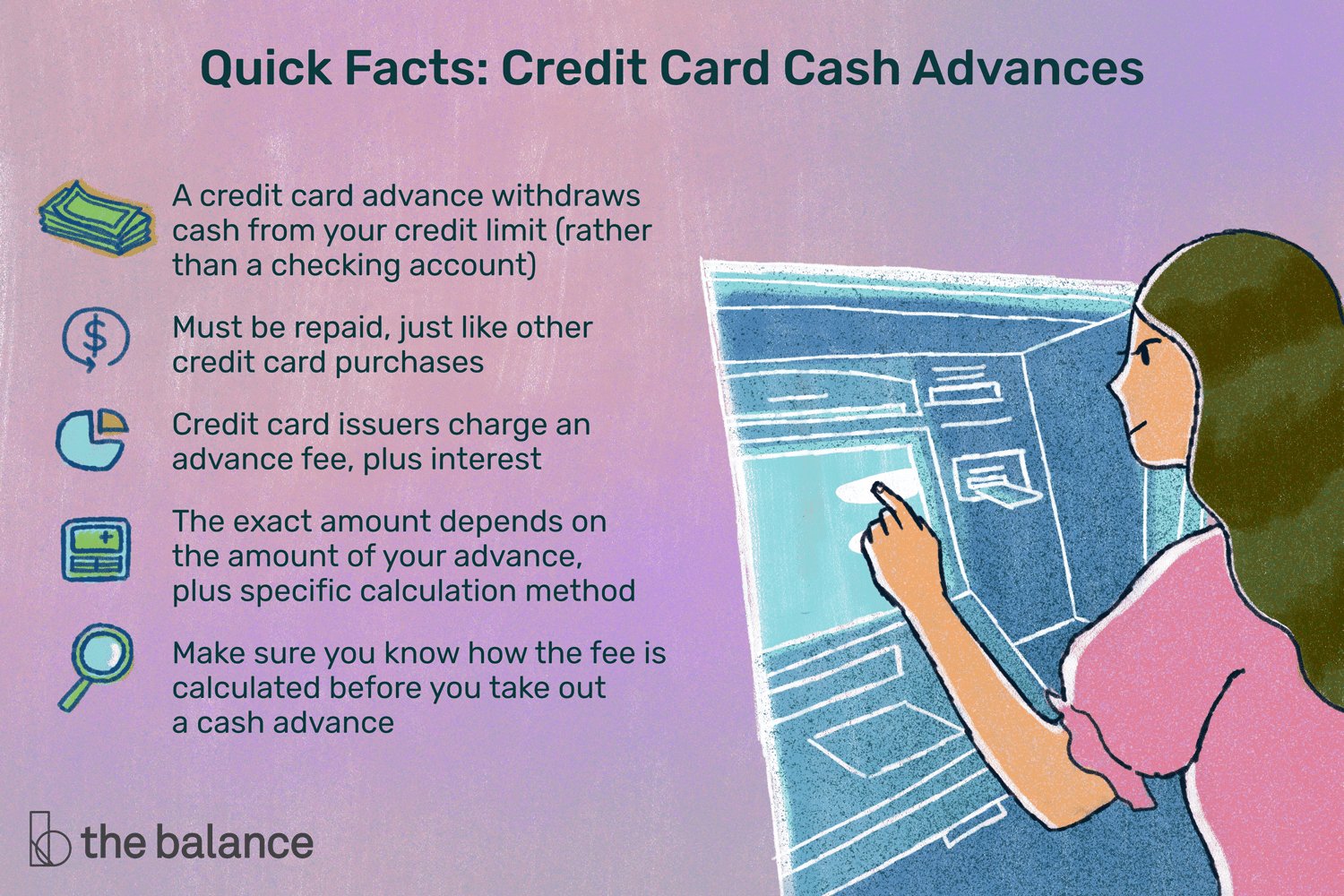

1. Balance transfer credit card: Some credit card companies offer balance transfer promotions with low or zero interest rates for a limited period. Transferring your high-interest credit card debt to a balance transfer card can help reduce interest charges during the promotional period.

2. Debt management plan: A debt management plan involves working with a credit counseling agency to negotiate lower interest rates with your creditors. This can make your debt more manageable, as you’ll make a single monthly payment to the credit counseling agency, which will distribute the funds to your creditors.

3. Personal loan: A personal loan can be used to consolidate debts similar to a debt consolidation loan. However, personal loans may have higher interest rates compared to specialized debt consolidation loans. It’s essential to carefully compare interest rates and terms before selecting this option.

4. Self-directed repayment: If you have a manageable number of debts and can afford the monthly payments, you may choose to tackle your debts individually. By prioritizing your debt payments and applying any extra funds towards the highest-interest debts first, you can gradually eliminate your debts over time.

Remember, it’s essential to research and fully understand the terms and implications of any alternative options before proceeding. Each strategy has its own advantages and disadvantages, and what works best for one person may not be the ideal solution for another.

Debt consolidation loans can be a valuable tool for individuals looking to simplify their debt repayment and regain control of their finances. By consolidating multiple debts into a single loan, borrowers can potentially save money on interest, reduce their monthly payments, and streamline their financial obligations. However, it’s crucial to carefully assess your financial situation and consider alternative options before deciding if a debt consolidation loan is the right choice for you. Remember, responsible financial habits and commitment to timely payments are key to successfully managing debt and improving your overall financial well-being.

Does Debt Consolidation Really Do Anything?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a debt consolidation loan?

A debt consolidation loan is a type of loan that allows you to combine multiple debts into a single loan. It is used to pay off existing debts, such as credit card balances, medical bills, or personal loans, by taking out a new loan with better terms and interest rates.

How does a debt consolidation loan work?

When you apply for a debt consolidation loan, the lender will review your financial situation and assess your ability to repay the loan. If approved, you will receive a new loan with a fixed interest rate and a set repayment plan. You can then use the loan proceeds to pay off your existing debts. This way, you only have to make one monthly payment to the new lender instead of multiple payments to different creditors.

What are the benefits of a debt consolidation loan?

Debt consolidation loans offer several benefits, including:

- Simplifying your finances by combining multiple debts into one

- Potentially lowering your monthly payments

- Reducing the overall interest rate on your debts

- Providing a clear repayment plan

- Helping you save money in the long run

Is a debt consolidation loan right for me?

Whether a debt consolidation loan is right for you depends on your individual financial situation. It can be a good option if you have multiple high-interest debts and want to simplify your payments. However, it’s important to consider the terms of the loan, including the interest rate and any fees, to ensure that it will actually save you money in the long term.

Can I consolidate all types of debts with a debt consolidation loan?

Debt consolidation loans can typically be used to consolidate various types of debts, such as credit card debts, personal loans, medical bills, and even certain types of student loans. However, it’s important to check with the lender to see which types of debts are eligible for consolidation.

Will getting a debt consolidation loan affect my credit score?

Applying for a debt consolidation loan may temporarily lower your credit score, as it involves a hard inquiry on your credit report. However, if you use the loan to pay off your existing debts responsibly and make your payments on time, it can ultimately have a positive impact on your credit score by reducing your overall debt and improving your payment history.

What are the alternatives to a debt consolidation loan?

If a debt consolidation loan doesn’t seem like the right option for you, there are alternatives to consider. These include debt management plans, debt settlement, balance transfer credit cards, and seeking credit counseling. Each option has its own advantages and disadvantages, so it’s important to carefully research and consider which one aligns best with your financial goals.

Where can I apply for a debt consolidation loan?

You can apply for a debt consolidation loan through various financial institutions, such as banks, credit unions, and online lenders. It’s recommended to compare offers from different lenders and consider factors such as interest rates, fees, repayment terms, and customer reviews before making a decision.

Final Thoughts

In conclusion, a debt consolidation loan is a financial tool that allows individuals to combine multiple debts into a single loan. By doing so, it simplifies repayment and often results in lower interest rates and monthly payments. Debt consolidation loans can be an effective way to manage debt and regain control of your finances. By consolidating your debts into one loan, you can potentially save money and reduce stress. If you are struggling with multiple debts, a debt consolidation loan might be a viable option to consider.