Are you familiar with dividend reinvestment plans? If not, don’t worry! In this article, we will explore what a dividend reinvestment plan is and how it can benefit you as an investor. A dividend reinvestment plan, also known as DRIP, allows you to automatically reinvest your dividends back into the company’s stock, rather than receiving them as cash. By doing so, you can potentially grow your investment over time through the power of compounding. So, let’s dive right in and uncover the ins and outs of dividend reinvestment plans.

What is a Dividend Reinvestment Plan?

A dividend reinvestment plan (DRIP) is an investment strategy that allows shareholders to reinvest their cash dividends into additional shares of a company’s stock instead of receiving the dividends in cash. This means that instead of receiving a cash payout, shareholders can choose to have their dividends automatically reinvested into more shares of the same stock. DRIPs are typically offered by companies to encourage long-term investment and provide investors with the opportunity to compound their returns over time.

How Does a Dividend Reinvestment Plan Work?

To participate in a dividend reinvestment plan, an investor must first own shares of stock in a company that offers the plan. Once enrolled in the DRIP, any dividends received by the investor are automatically used to purchase additional shares of the same stock. The number of additional shares purchased is determined by the dividend yield and the stock price at the time of reinvestment.

Here’s an example to illustrate how a DRIP works:

Let’s say you own 100 shares of XYZ Company, and the stock price is $50 per share. The company declares a dividend of $2 per share, resulting in a total cash dividend of $200 (100 shares x $2 per share). If you are enrolled in the company’s DRIP, instead of receiving the $200 in cash, it will be reinvested to buy additional XYZ Company shares. Assuming the stock price remains $50 per share, you would be able to purchase 4 additional shares (since $200 / $50 = 4). As a result, your total share ownership in XYZ Company would increase to 104 shares.

Now, when the company pays its next dividend, it would be based on your new ownership of 104 shares, and the process repeats itself. Over time, as more dividends are reinvested, your share ownership in the company can grow significantly.

Advantages of Dividend Reinvestment Plans

Dividend reinvestment plans offer several advantages for investors:

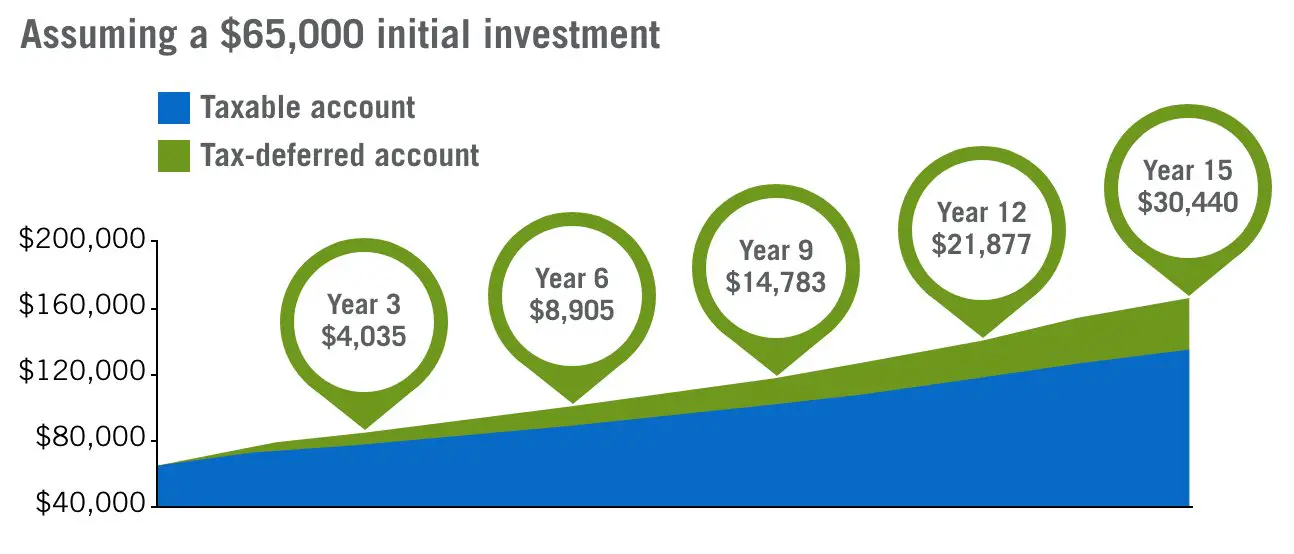

- Compound Returns: By reinvesting dividends, investors benefit from the compounding effect, as future dividends are based on the increased number of shares owned. This can accelerate the growth of an investment over the long term.

- Cost Averaging: DRIPs allow investors to purchase additional shares at regular intervals, regardless of the stock price. This strategy mitigates the impact of volatile market conditions and helps average out the price per share over time.

- No Transaction Costs: Many companies offer DRIPs with no transaction fees, which can be advantageous for investors looking to minimize costs associated with buying and selling stocks.

- Long-Term Focus: By reinvesting dividends, shareholders demonstrate a commitment to long-term investment in a company. This aligns with the objectives of many companies that offer DRIPs, as they prefer shareholders who hold onto their stock for an extended period.

Types of Dividend Reinvestment Plans

There are two main types of dividend reinvestment plans:

- Company-Administered DRIPs: These plans are offered directly by the company to its shareholders. They typically allow for the partial or full reinvestment of dividends and may offer additional features, such as discounted stock purchases or the ability to make additional cash investments.

- Brokerage-Administered DRIPs: These plans are offered by brokerage firms and allow investors to participate in DRIPs across various companies. Brokerage-administered DRIPs offer a more convenient way for investors to manage multiple DRIP investments from a single account.

Investors interested in participating in a DRIP should check with the specific company or brokerage firm to determine if they offer a dividend reinvestment plan and the details of how to enroll.

Considerations for Dividend Reinvestment Plans

While dividend reinvestment plans can be advantageous, there are a few factors to consider before participating:

- Tax Implications: Dividends reinvested through a DRIP are still subject to taxes, even though they are not received as cash. Investors should consult with a tax advisor to understand the tax implications of participating in a dividend reinvestment plan.

- Portfolio Diversification: The decision to reinvest all dividends into a single stock may result in an overconcentration of investments in one company. It’s important to consider the overall diversification of your portfolio and ensure it aligns with your investment goals and risk tolerance.

- Market Volatility: DRIPs can expose investors to the volatility of a single company’s stock. It’s crucial to assess the stability and performance of the company before deciding to reinvest dividends.

- Opportunity Cost: By choosing to reinvest dividends, investors forego the opportunity to use the cash for other purposes, such as paying bills or investing in other assets. It’s essential to evaluate the potential returns from reinvesting dividends compared to alternative uses of the cash.

Dividend Reinvestment Plan | Simple Steps for a Retirement Portfolio Course

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a Dividend Reinvestment Plan?

A Dividend Reinvestment Plan (DRIP) is a program offered by some companies that allows shareholders to automatically reinvest their cash dividends into additional shares of the company’s stock. This means that instead of receiving cash payments, shareholders can choose to acquire more shares, increasing their ownership stake in the company.

How does a Dividend Reinvestment Plan work?

When you participate in a Dividend Reinvestment Plan, your dividends are automatically used to purchase additional shares of the company’s stock. The number of shares you receive is based on the dividend amount and the stock’s market price at the time of reinvestment. The process is usually handled by the company’s transfer agent or a third-party administrator.

What are the benefits of a Dividend Reinvestment Plan?

One of the main benefits of a Dividend Reinvestment Plan is that it allows you to compound your returns over time. By reinvesting your dividends, you can buy more shares and potentially increase your future dividend payments. DRIPs also usually offer cost advantages, such as the ability to purchase shares at a discount or with no transaction fees.

Are all companies eligible for a Dividend Reinvestment Plan?

Not all companies offer Dividend Reinvestment Plans. It is up to each individual company to decide whether to offer this option to its shareholders. Generally, larger, more established companies are more likely to have DRIPs in place, but it’s not a guarantee. You can check with the company’s investor relations department or website to find out if they offer a DRIP.

Can I participate in a Dividend Reinvestment Plan if I don’t own any shares?

In most cases, you need to be a current shareholder of the company’s stock in order to participate in their Dividend Reinvestment Plan. If you don’t already own shares, you would need to purchase them through a brokerage account or another means before you can enroll in the DRIP.

Can I choose to receive cash dividends instead of reinvesting them?

Some Dividend Reinvestment Plans offer an option to receive cash dividends instead of reinvesting them. This is known as a partial dividend reinvestment plan. However, not all companies provide this choice, so it’s important to check the specific terms of the DRIP if you prefer to receive cash.

Is there a minimum investment required for a Dividend Reinvestment Plan?

The minimum investment required to participate in a Dividend Reinvestment Plan varies from company to company. Some may have no minimum requirements, allowing you to start with a small number of shares. Others may have minimum investment thresholds, which could be based on a specific dollar amount or a minimum number of shares.

Can I sell the shares acquired through a Dividend Reinvestment Plan?

Yes, you can sell the shares acquired through a Dividend Reinvestment Plan. Once the shares are purchased and held in your account, they can be sold like any other shares you own. However, it’s important to note that any gains or losses from selling the shares will be subject to capital gains tax rules and other applicable regulations.

Are Dividend Reinvestment Plans a good investment strategy?

Whether a Dividend Reinvestment Plan is a good investment strategy depends on your personal financial goals and circumstances. DRIPs can be a way to accumulate more shares and potentially increase your dividend income over time. They are often favored by long-term investors who are looking to grow their holdings. However, it’s always important to do your own research and consider your individual investment objectives before deciding to participate in a DRIP.

Final Thoughts

A dividend reinvestment plan (DRIP) is a strategy that allows investors to reinvest their dividends into additional shares of a company’s stock. By participating in a DRIP, investors can compound their returns over time and potentially benefit from the power of compounding interest. This plan provides an opportunity to increase the number of shares held, without the need for additional capital. Dividend reinvestment plans are a popular choice for long-term investors seeking to maximize their holdings and take advantage of the potential growth in a company’s stock price. Consider utilizing a dividend reinvestment plan to automatically reinvest your dividends and potentially increase your investment returns.