Donor-advised funds have become increasingly popular for individuals looking to streamline their charitable giving. But what exactly is a donor-advised fund and what benefits does it offer? Essentially, a donor-advised fund is a philanthropic vehicle that allows donors to contribute to a fund, receive an immediate tax deduction, and then recommend grants to charitable organizations over time. In essence, it’s like having your own personal charitable foundation without the administrative hassle. This article will delve into the ins and outs of donor-advised funds, exploring their benefits and how they can help you make a lasting impact in the world of philanthropy. So if you’re curious about what a donor-advised fund is and how it can benefit you, keep reading.

What is a Donor-Advised Fund and Its Benefits

A donor-advised fund (DAF) is a philanthropic vehicle that allows individuals, families, and businesses to contribute to a fund, receive an immediate tax deduction, and then recommend grants from the fund to nonprofit organizations over time. DAFs have gained popularity in recent years due to their flexibility and ease of use. In this article, we will delve into the details of what a donor-advised fund is and explore the numerous benefits it offers to donors and the nonprofit sector.

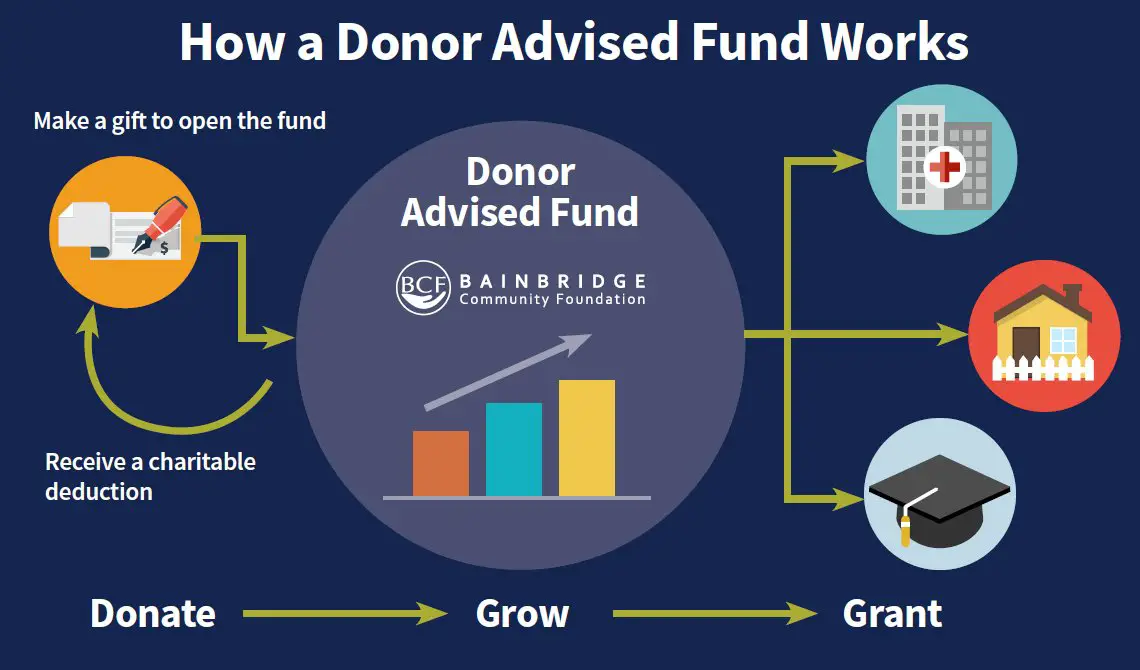

How Does a Donor-Advised Fund Work?

A donor-advised fund operates in a relatively straightforward manner. Here’s a step-by-step breakdown of how it works:

- A donor makes a contribution to a donor-advised fund sponsor, which is typically a public charity or a financial institution.

- The donor receives an immediate tax deduction for the full amount of the contribution. This deduction can be up to 60% of the donor’s adjusted gross income for cash contributions and up to 30% for appreciated assets.

- Once the funds are contributed, they are invested and have the potential to grow tax-free, allowing donors to maximize their charitable impact.

- The donor can then recommend grants from the fund to qualified nonprofit organizations. The DAF sponsor conducts due diligence to ensure the organizations meet the necessary criteria.

- The DAF sponsor distributes the grants to the recommended organizations on behalf of the donor, often providing the option to remain anonymous if desired.

- The donor can continue to contribute to the fund and recommend grants over time, establishing a long-term philanthropic strategy.

This streamlined process simplifies charitable giving, allowing donors to focus on supporting causes they care about without the administrative burden of managing individual grants.

The Benefits of Donor-Advised Funds

Donor-advised funds offer a range of benefits to both donors and the nonprofit sector. Let’s explore some of these advantages in detail:

1. Tax Advantages

One of the primary benefits of contributing to a donor-advised fund is the potential tax advantages it offers. Here’s how DAFs can provide tax benefits:

- Immediate tax deduction: Donors can claim an immediate tax deduction for the full value of their contribution, even if the funds are not immediately distributed to nonprofits. This allows donors to optimize their deductions in a given tax year.

- Capital gains tax avoidance: By contributing appreciated assets such as stocks or real estate to a DAF, donors can avoid paying capital gains tax on the appreciation of those assets. This can lead to significant tax savings.

- Reduced administrative burden: Donors can consolidate their giving into a single tax receipt, which simplifies record-keeping and eases the hassle of tracking multiple donations throughout the year.

2. Flexibility

A donor-advised fund offers remarkable flexibility and control over charitable giving. Here’s how it provides donors with enhanced flexibility:

- Timing of grants: Donors can contribute to the fund when it is most financially advantageous for them, but they have the flexibility to recommend grants to nonprofits at any time in the future. This allows donors to respond to immediate needs or time their giving strategically.

- Investment growth: While the funds are waiting to be distributed, they can be invested and have the potential to grow tax-free. This growth enables donors to increase the impact of their giving over time.

- Choice of organizations: Donors have the freedom to recommend grants to the nonprofit organizations of their choice, including local, national, and international causes. This empowers donors to align their giving with their personal passions and values.

3. Philanthropic Strategy

A donor-advised fund allows individuals and families to establish a long-term philanthropic strategy. Here’s how it helps donors develop and execute their giving plan:

- Strategic giving: Donors can take the time to research and identify organizations that closely align with their charitable goals and make informed decisions about where their grants will have the most impact.

- Family involvement: DAFs offer the opportunity for multiple generations of a family to participate in philanthropy. Families can engage in meaningful discussions about their values, support causes together, and create a lasting legacy of giving.

- Continuity and permanence: Donor-advised funds can provide ongoing support for nonprofit organizations. By establishing a DAF, donors ensure that their charitable giving continues beyond their lifetimes, creating a lasting impact.

By leveraging the benefits of a donor-advised fund, donors can optimize their contributions and make a meaningful difference in their communities.

Impact on the Nonprofit Sector

Donor-advised funds have a significant impact on the nonprofit sector. Here are some ways in which DAFs benefit nonprofit organizations:

1. Stability and Predictability

Nonprofit organizations rely on a steady stream of funding to carry out their missions effectively. Donor-advised funds provide stability and predictability for nonprofits by offering consistent support over time. This allows organizations to plan their programs and services more effectively, knowing they have a reliable source of funding.

2. Administrative Efficiency

Managing multiple individual donors can be resource-intensive for nonprofit organizations. However, when donations come from a donor-advised fund, the administrative burden is significantly reduced. DAF sponsors handle the due diligence, paperwork, and grant distribution, saving nonprofits time and resources that can be redirected towards their core work.

3. Engaging New Donors

The accessibility and ease of use associated with donor-advised funds make them an attractive option for donors of all backgrounds. This inclusiveness enables nonprofits to engage new donors who may not have considered philanthropy previously. By offering a streamlined giving process, nonprofits can expand their donor base and build lasting relationships with individuals and families.

4. Long-Term Partnerships

Donor-advised funds facilitate long-term partnerships between nonprofits and donors. As donors contribute to and recommend grants from their DAFs, they develop an ongoing relationship with the organizations they support. This connection can lead to deeper engagement, increased communication, and collaboration on achieving shared goals.

Overall, donor-advised funds play a crucial role in supporting the nonprofit sector by providing stability, efficiency, and fostering lasting philanthropic partnerships.

What Are Donor Advised Funds And Why Do They Hurt Charitable Causes? | Defined | Forbes

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a donor-advised fund?

A donor-advised fund is a charitable giving vehicle that allows individuals, families, or organizations to make contributions to a fund, receive an immediate tax deduction, and then recommend grants to qualified charitable organizations over time.

How does a donor-advised fund work?

When you establish a donor-advised fund, you contribute assets to the fund and receive an immediate tax deduction. The funds in the account can be invested for potential growth, and you can recommend grants to eligible charities from the fund.

What are the benefits of a donor-advised fund?

– Tax advantages: Contributions to a donor-advised fund are tax-deductible in the year they are made, providing immediate tax benefits.

– Simplicity: Donor-advised funds offer an easy and efficient way to manage charitable giving, with administrative tasks handled by the fund sponsor.

– Flexibility: Donor-advised funds allow you to make contributions at any time and recommend grants to multiple charities over time.

Can I contribute various types of assets to a donor-advised fund?

Yes, you can contribute a variety of assets to a donor-advised fund, including cash, appreciated securities, publicly traded stock, and even some non-cash assets like real estate or privately held stock.

Are there any restrictions on the grants I can recommend from a donor-advised fund?

You can recommend grants to most qualified public charities that meet the IRS guidelines. However, certain grants, such as those for political campaigns or private foundations, are generally not allowed.

What are the administrative fees associated with a donor-advised fund?

Donor-advised funds typically charge administrative fees, which may vary among different fund sponsors. These fees cover the costs of managing the fund, providing investment options, and processing grants.

Can I involve my family or others in my donor-advised fund?

Yes, you can involve your family or others in your donor-advised fund. Many funds allow for joint or successor advisors, which means you can designate family members or trusted individuals to continue granting from the fund after you’re no longer able to.

Is there a required minimum contribution to establish a donor-advised fund?

The minimum contribution required to establish a donor-advised fund varies depending on the fund sponsor. Some funds may require a minimum initial contribution, while others have no minimum requirement.

How long can a donor-advised fund last?

Donor-advised funds can last indefinitely. The funds can continue to grow tax-free, allowing for ongoing charitable giving and the ability to involve future generations in philanthropic activities.

Final Thoughts

A donor-advised fund is a charitable giving tool that allows individuals to make contributions to a dedicated fund, which can then be donated to various nonprofits over time. This flexible approach allows donors to have greater control over their giving, while also benefiting from potential tax advantages. Donor-advised funds provide an efficient and convenient way to organize and manage charitable contributions, allowing donors to support multiple causes and make a lasting impact. By utilizing a donor-advised fund, individuals can simplify their giving process and maximize the impact of their donations, all while receiving tax benefits and supporting the causes they care about. Whether you are looking to support local organizations or address global issues, a donor-advised fund offers a valuable tool for strategic giving.