Are you familiar with the concept of a family limited partnership in estate planning? If not, you’ve come to the right place! A family limited partnership, in the context of estate planning, is a valuable tool that can provide numerous benefits to families seeking to protect their assets and efficiently transfer wealth to the next generation. In simple terms, it allows family members to pool their resources and create a partnership that can be used to manage and distribute assets, while also providing certain legal protections. So, let’s delve into the intricacies of what a family limited partnership in estate planning entails and how it can be advantageous for you and your loved ones.

What is a Family Limited Partnership in Estate Planning?

Estate planning is a crucial aspect of managing one’s assets and ensuring their smooth transition to future generations. One popular tool that individuals and families use in estate planning is a Family Limited Partnership (FLP). A Family Limited Partnership is a legal structure that allows family members to pool their resources, control assets, and minimize taxes in a strategic and efficient manner.

An FLP is formed when family members decide to create a partnership entity to manage their assets collectively. The partnership consists of two types of partners: general partners and limited partners. General partners have full control and management authority over the partnership, while limited partners have a more passive role and mainly contribute capital.

The primary purpose of establishing an FLP is to provide a framework for efficient asset management and protection. By consolidating family assets under a single entity, FLPs offer several advantages in estate planning, including:

1. Asset Protection

One key benefit of an FLP is the protection it offers against potential creditors. When family assets are held within the partnership, they become less vulnerable to outside claims. Creditors typically cannot go after specific assets held in the FLP; they can only reach the general partner’s interest. This feature can be particularly valuable in safeguarding family wealth and protecting it from lawsuits, business liabilities, or other financial obligations.

2. Estate and Gift Tax Planning

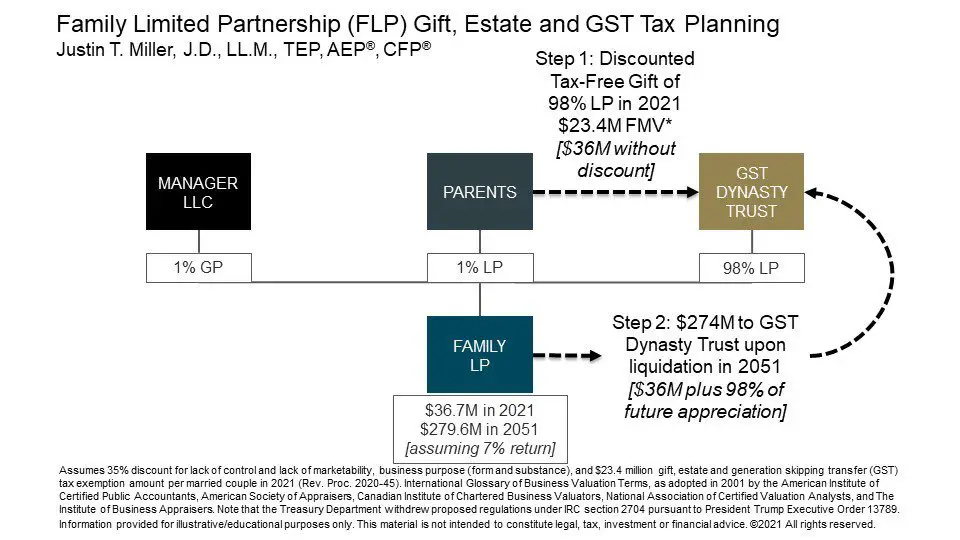

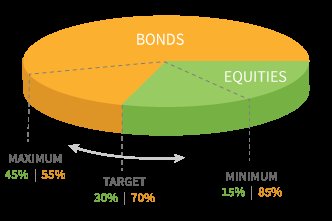

FLPs also provide effective strategies for minimizing estate and gift taxes. When you establish an FLP, you can transfer assets to the partnership and then gift or sell limited partnership interests to other family members. This process allows you to leverage various tax advantages, such as utilizing annual gift tax exclusions and applying discounts to the value of the limited partnership interests.

By leveraging these techniques, you can gradually transfer wealth to your heirs while reducing the potential tax burden. The ability to discount the value of the limited partnership interests is one of the most powerful tax planning tools offered by FLPs. Valuation discounts typically result from restrictions on the marketability and control of the limited partnership interests, making them an attractive feature for estate planning purposes.

3. Succession Planning

Succession planning is a critical consideration for many families when engaging in estate planning. Through an FLP, families can establish a clear framework for the orderly transfer of partnership interests to the next generation. This allows for a smoother transition of assets while maintaining control and preserving family wealth.

By setting up the FLP with specific provisions for succession and management, families can ensure that their wishes are effectively carried out. Succession planning within an FLP can help minimize disputes among family members and provide a clear roadmap for the future.

4. Centralized Management and Consistency

Another advantage of utilizing an FLP in estate planning is the centralized management it offers. By consolidating assets within the partnership, you can streamline decision-making processes and enjoy greater consistency in asset management. This can be particularly beneficial for families with diverse asset portfolios, such as real estate, investments, or businesses.

Having a centralized management structure helps prevent conflicts and ensures that all family members’ interests are considered. It also simplifies the administration of assets, as the FLP acts as a single legal entity responsible for managing and distributing resources according to the partnership agreement.

5. Flexibility and Control

FLPs offer tremendous flexibility and control in estate planning. As the general partner, you retain control over the management and decision-making of the partnership assets. This allows you to retain influence over the distribution and allocation of resources, even as you transfer limited partnership interests to other family members.

The partnership agreement can be customized to suit your specific needs and objectives. You have the freedom to determine how income, profits, and losses are allocated among partners. This flexibility empowers you to tailor the FLP structure to your family’s unique circumstances and long-term goals.

In conclusion, a Family Limited Partnership is a versatile and powerful tool in estate planning. By establishing an FLP, you can protect assets, minimize taxes, facilitate succession planning, streamline management, and maintain control over family resources. Working with a qualified estate planning attorney or financial advisor can help you navigate the complexities of FLPs and create a comprehensive plan that aligns with your specific objectives.

FLLC – Family Limited Liability Company for Estate Planning: Advanced LLCs Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a family limited partnership in estate planning?

A family limited partnership (FLP) is a legal entity created by family members to manage and protect their assets for estate planning purposes. It is designed to help families maintain control over their assets while minimizing estate taxes and facilitating the transfer of wealth to future generations.

How does a family limited partnership work?

In a family limited partnership, the family members pool their assets into the partnership, with one or more individuals acting as general partners who manage the partnership’s affairs. Limited partners are typically family members who hold ownership interests in the partnership but have limited control and liability. The general partners make decisions regarding investments, distributions, and other matters, while limited partners enjoy benefits such as asset protection and reduced estate taxes.

What are the benefits of using a family limited partnership in estate planning?

Using a family limited partnership in estate planning offers several benefits. Firstly, it allows for centralized management and control of assets, ensuring that they are managed in a unified manner. Additionally, FLPs can provide asset protection by separating personal and business assets, which can shield them from potential creditors. Moreover, FLPs can help minimize estate taxes by taking advantage of valuation discounts and allowing for the gifting of limited partnership interests to future generations at reduced tax costs.

Who can be a part of a family limited partnership?

Family limited partnerships typically include family members such as parents, children, and grandchildren. However, other individuals or entities, like trusts, can also be partners in the family limited partnership. It is essential to consult with an attorney specializing in estate planning to determine the most suitable structure for your specific needs.

What assets can be transferred into a family limited partnership?

A wide range of assets can be transferred into a family limited partnership, including real estate, investment accounts, business interests, and other valuable properties. However, it is recommended to consult with a professional to evaluate the specific assets and their implications before transferring them into the partnership.

Are there any restrictions on the transfer of assets in a family limited partnership?

While there are generally no limitations on the types of assets that can be transferred into a family limited partnership, it is crucial to comply with certain legal and tax requirements. The transfer of assets must be done in accordance with the partnership agreement, and it is advisable to consult with legal and tax professionals to ensure compliance.

Can a family limited partnership be dissolved or terminated?

Yes, a family limited partnership can be dissolved or terminated if the partners decide to do so. The partnership agreement should outline the process for dissolution and may include provisions for events such as the death of a partner or the desire to close the partnership. It is essential to follow the legal requirements and consult with professionals to properly dissolve a family limited partnership.

What are the potential risks or drawbacks of using a family limited partnership?

While family limited partnerships offer various benefits, they also involve certain risks and drawbacks. These may include challenges in maintaining family harmony and decision-making, the possibility of disputes among family members, and the need for ongoing management and compliance. It is essential to carefully consider these factors and consult with professionals to determine if a family limited partnership is suitable for your estate planning goals.

Final Thoughts

A family limited partnership in estate planning is a powerful tool that allows families to protect and pass on their wealth efficiently. By forming a partnership, family members can pool their assets and divide ownership shares, while retaining control through the general partner. This structure provides several benefits, such as asset protection, reducing estate taxes, and facilitating the transfer of assets to future generations. Additionally, a family limited partnership offers flexibility and can be customized to meet the specific needs of each family. Incorporating a family limited partnership into an estate plan can provide significant advantages in preserving wealth for future generations.