Financial audits play a critical role in ensuring the accuracy and integrity of a company’s financial statements. But what exactly is a financial audit and why is it so important? A financial audit is a comprehensive examination of a company’s financial records, conducted by an independent auditor. Its primary objective is to assess whether the financial statements are presented fairly and in accordance with the applicable accounting standards. By scrutinizing the company’s financial records, verifying transactions, and assessing internal controls, a financial audit provides assurance to shareholders, investors, and other stakeholders about the reliability of the company’s financial information. In this article, we will delve into the intricacies of financial audits and highlight their importance in today’s business landscape. So, let’s get started!

What is a Financial Audit and its Importance

Introduction

A financial audit is a systematic examination of an organization’s financial records, statements, and processes by an independent auditor. It involves assessing and evaluating the accuracy, completeness, and transparency of financial information to ensure compliance with accounting principles and regulations. The importance of financial audits cannot be overstated, as they play a crucial role in maintaining the integrity and reliability of financial reporting. In this article, we will delve deeper into the concept of financial audits and explore their significance in today’s business world.

The Purpose of Financial Audits

The primary purpose of a financial audit is to provide assurance to stakeholders, including investors, shareholders, creditors, and regulatory bodies, that the financial statements of an organization present a true and fair view of its financial position. Here are some specific objectives that financial audits aim to achieve:

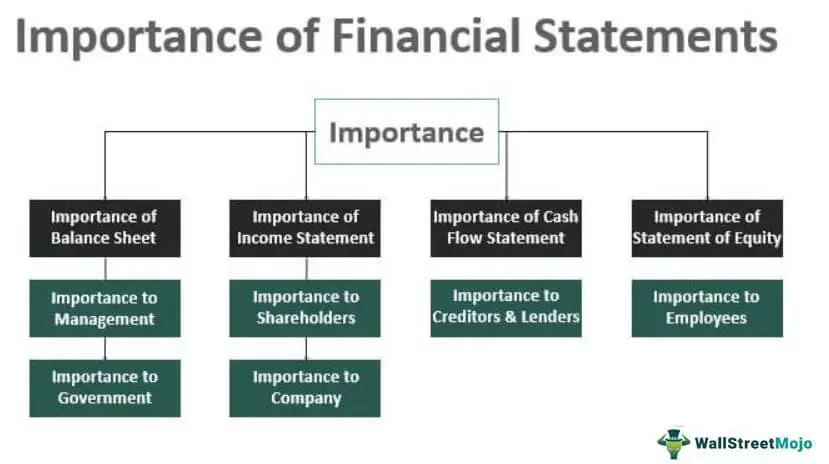

- Verifying Financial Statements: Auditors examine financial statements, including the balance sheet, income statement, and cash flow statement, to verify that they accurately represent the organization’s financial position, performance, and cash flows.

- Ensuring Compliance: Audits ensure that an organization complies with relevant accounting standards, laws, and regulations. This helps maintain transparency and trust between the organization and its stakeholders.

- Detecting Errors and Fraud: Auditors assess the risk of material misstatement due to error or fraud and perform procedures to uncover any instances of financial irregularities, such as fraudulent transactions or misappropriation of funds.

- Assessing Internal Controls: Audits evaluate the effectiveness of an organization’s internal controls, which are the processes and procedures in place to safeguard assets, ensure reliable financial reporting, and prevent fraud.

- Providing Insight and Recommendations: Auditors provide valuable insights and recommendations to help organizations improve their financial reporting, internal controls, and overall business operations.

The Audit Process

The financial audit process typically involves several stages, each with its own set of activities and objectives. Here’s an overview of the key steps in the audit process:

1. Planning

The planning stage is crucial as it lays the foundation for the entire audit process. During this phase, the auditor gathers essential information about the organization, such as its business operations, accounting policies, and key risks. They also determine the scope and objectives of the audit, identify material accounts, and plan the audit approach.

2. Risk Assessment

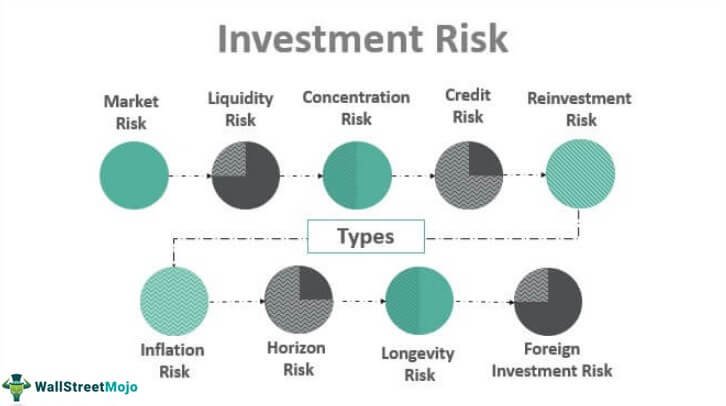

In this phase, auditors assess the risks that could impact the reliability of the financial statements. They identify and prioritize these risks, considering factors such as the organization’s industry, internal controls, and previous audit findings. This assessment helps auditors plan their procedures and allocate resources effectively.

3. Testing and Evaluation

During the testing and evaluation stage, auditors perform detailed procedures to obtain audit evidence and evaluate the financial information. This involves testing transactions, examining documentation, reconciling balances, and assessing the reasonableness of estimates. Auditors may employ various techniques, such as analytical procedures, substantive testing, and sampling, to gather sufficient and appropriate evidence.

4. Reporting

After completing the necessary procedures, the auditor prepares a comprehensive audit report. This report presents the findings, conclusions, and recommendations resulting from the audit. It includes an opinion on the fairness of the financial statements and discloses any significant issues or deficiencies identified during the audit. The audit report is shared with the organization’s management, board of directors, and other stakeholders.

The Importance of Financial Audits

Financial audits hold immense importance for businesses and other organizations. Let’s explore why they are essential:

1. Enhancing Financial Credibility and Transparency

Financial audits provide an independent and expert opinion on the accuracy and reliability of an organization’s financial statements. This reassures stakeholders that the information presented is trustworthy, boosting their confidence in the organization. The transparent and credible financial reporting facilitated by audits helps attract investors, secure loans, and foster trust with clients and suppliers.

2. Detecting Errors and Fraudulent Activities

Audits play a vital role in identifying errors, irregularities, and fraudulent activities within an organization’s financial records. Through rigorous testing and evaluation, auditors can detect misstatements, intentional or unintentional, and bring them to management’s attention. This helps prevent financial loss, protects the organization’s reputation, and ensures compliance with legal and regulatory requirements.

3. Strengthening Internal Controls

The audit process provides an opportunity to assess and enhance an organization’s internal controls. Auditors evaluate the effectiveness of existing controls and recommend improvements to mitigate risks, streamline processes, and prevent fraud. This helps organizations establish robust and reliable systems that safeguard assets, mitigate risks, and ensure the accuracy and integrity of financial information.

4. Compliance with Legal and Regulatory Requirements

Financial audits ensure that organizations comply with accounting standards, laws, and regulations specific to their industry. By examining the financial statements and assessing internal controls, auditors can determine whether the organization follows the prescribed guidelines. This compliance is especially crucial for publicly traded companies, as they are subject to additional scrutiny from regulatory bodies.

5. Facilitating Stakeholder Decision-making

The outcomes of financial audits provide stakeholders with vital information for making informed decisions. Investors can use audit reports to assess the financial health and performance of an organization before making investment decisions. Creditors rely on audits to evaluate creditworthiness and assess the risks associated with lending funds. Therefore, financial audits significantly contribute to the overall efficiency and effectiveness of the financial market.

In conclusion, financial audits are indispensable for organizations and their stakeholders. They offer assurance regarding the accuracy and reliability of financial statements, help mitigate risks, detect errors and fraud, strengthen internal controls, ensure compliance, and facilitate informed decision-making. By undergoing regular financial audits, organizations can demonstrate their commitment to transparency, accountability, and sound financial management.

What is Audit?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a financial audit and why is it important?

A financial audit is a systematic examination of an organization’s financial records, statements, and transactions to ensure accuracy, legality, and compliance with regulations. It is important because it provides external stakeholders, such as investors, creditors, and regulators, with confidence in the organization’s financial health and integrity.

Who conducts financial audits?

Financial audits are typically conducted by certified public accountants (CPAs) or audit firms that specialize in assurance services. They are independent third parties who are trained and experienced in evaluating financial information and providing an unbiased opinion on its reliability.

What is the purpose of a financial audit?

The main purpose of a financial audit is to assess and verify the fairness and accuracy of an organization’s financial statements. It ensures that the financial information presented to stakeholders is reliable, transparent, and in compliance with accounting standards and regulations.

What are the benefits of a financial audit?

A financial audit offers several benefits, including:

- Enhancing the credibility and integrity of financial statements

- Providing assurance to stakeholders regarding the accuracy of financial information

- Identifying financial risks and weaknesses in internal control systems

- Helping in the detection and prevention of fraud and irregularities

- Ensuring compliance with laws, regulations, and accounting standards

How often should a financial audit be conducted?

The frequency of financial audits depends on various factors, including the size and nature of the organization, industry regulations, and stakeholder requirements. Generally, audits are conducted annually, but some organizations may opt for more frequent audits, especially if they operate in highly regulated industries.

What is the difference between an internal and external financial audit?

An internal financial audit is conducted by the organization’s own internal audit department or an outsourced internal audit firm. It focuses on evaluating internal control systems, risk management, and compliance with internal policies and procedures.

On the other hand, an external financial audit is conducted by independent auditors who are not part of the organization. It provides an unbiased opinion on the fairness and accuracy of financial statements and ensures compliance with external laws, regulations, and accounting standards.

What are the key steps involved in a financial audit?

The key steps in a financial audit typically include:

- Planning the audit, including understanding the organization’s business and assessing risks

- Gathering and analyzing financial data, such as records, statements, and transactions

- Evaluating internal control systems and testing their effectiveness

- Performing substantive procedures to verify the accuracy of financial information

- Formulating an opinion on the fairness of financial statements and issuing an audit report

Can a financial audit uncover fraud?

Yes, a financial audit can uncover fraud or irregularities within an organization. Auditors are trained to identify possible indicators of fraud during the audit process and perform additional procedures if they suspect any fraudulent activities. However, it’s important to note that audits are not designed solely to detect fraud, and not all instances of fraud may be detected during an audit.

Final Thoughts

A financial audit is a comprehensive review of an organization’s financial records, transactions, and processes to ensure accuracy, compliance, and transparency. It plays a crucial role in assessing the financial health and credibility of a business. By verifying financial statements, internal controls, and adherence to regulatory requirements, audits provide valuable insights into an organization’s financial position, helping stakeholders make informed decisions. Financial audits also help identify and prevent fraud, errors, and misappropriation of funds, ensuring the integrity and reliability of financial information. In conclusion, financial audits are vital for maintaining trust, maximizing accountability, and ensuring the soundness of financial systems. They are an essential tool for businesses and organizations of all sizes to safeguard their financial interests and navigate complex economic landscapes.