Are you curious about the inner workings of the financial world? Wondering what exactly a financial market is and what types exist? Well, you’ve come to the right place! A financial market refers to a platform where buyers and sellers engage in the trade of various financial assets such as stocks, bonds, currencies, and commodities. Understanding the different types of financial markets is essential for anyone looking to navigate the complex world of investments and finance. In this article, we will delve into what a financial market is and explore its various types. So, let’s dive right in!

What is a Financial Market and its Types?

A financial market refers to a marketplace where various entities, such as individuals, governments, and corporations, engage in financial transactions involving assets. These assets can include stocks, bonds, currencies, commodities, and derivatives. Financial markets play a vital role in facilitating the flow of funds between borrowers and investors, providing a platform for buying, selling, and trading financial instruments.

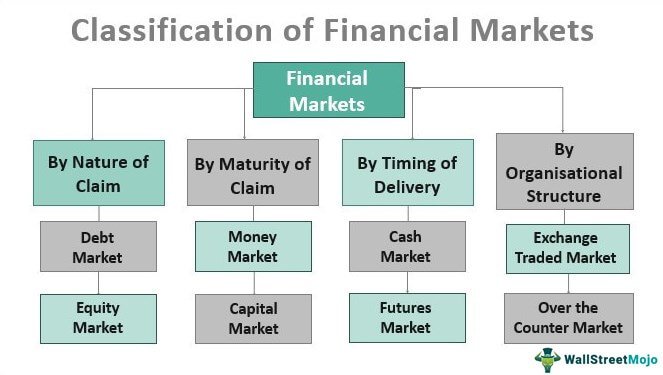

Financial markets can be categorized into different types based on various factors such as the nature of the market participants, the type of financial instruments traded, and the location of the market. In this article, we will explore the major types of financial markets and how they function.

1. Capital Markets

Capital markets are one of the most well-known types of financial markets. They serve as a platform for buying and selling long-term financial instruments known as securities. Securities include stocks and bonds, which are issued by companies, governments, and other entities to raise capital.

In capital markets, individuals and institutions can invest their money in securities, providing funds to businesses or governments. The most prominent capital market is the stock market, where shares of publicly traded companies are bought and sold. Additionally, the bond market allows investors to purchase and trade debt instruments issued by governments and corporations.

a. Stock Market

The stock market is a segment of the capital market where stocks and shares of companies are traded. Investors can become partial owners of a company by purchasing its stocks, which represent a share of its ownership. The stock market provides a platform for companies to raise capital by selling shares to investors. It also offers individuals the opportunity to invest in various companies and potentially earn returns through dividends and capital appreciation.

Major stock exchanges around the world include the New York Stock Exchange (NYSE), NASDAQ, London Stock Exchange (LSE), and Tokyo Stock Exchange (TSE). These exchanges facilitate the buying and selling of stocks among market participants, ensuring liquidity and fair prices.

b. Bond Market

The bond market, also known as the debt market or the fixed-income market, is another segment of the capital market. In the bond market, investors buy and sell debt securities issued by governments, municipalities, and corporations. Bonds represent loans made by investors to these entities, who promise to repay the principal amount along with periodic interest payments.

Bond markets play a crucial role in enabling organizations to raise funds for various purposes, such as infrastructure development or expansion. They provide investors with fixed income opportunities and a relatively lower level of risk compared to stock investments. Government bonds, corporate bonds, municipal bonds, and treasury bonds are common types of bonds traded in the bond market.

2. Money Market

The money market is a segment of the financial market where short-term debt instruments with high liquidity and low risk are traded. Money market instruments typically have a maturity period of one year or less, making them attractive to investors seeking secure parking for their short-term funds.

The primary participants in the money market are banks, corporations, and governments. They engage in transactions involving instruments such as Treasury bills, certificates of deposit (CDs), commercial paper, and repurchase agreements (repos). These instruments serve various purposes, including meeting short-term financing needs, managing cash flows, and maintaining liquidity.

Transactions in the money market are usually conducted over-the-counter (OTC) rather than through a centralized exchange. This market plays a crucial role in the overall financial system by providing short-term funding and ensuring stability in the banking sector.

3. Foreign Exchange Market

The foreign exchange market, commonly known as the forex market, is the global marketplace for trading different currencies. It is the largest and most liquid financial market in the world, with daily trading volumes exceeding trillions of dollars.

The forex market facilitates the conversion of one currency into another and enables businesses and individuals to conduct international trade and investment. Market participants in the forex market include banks, central banks, corporations, governments, and individual traders.

Currency exchange rates fluctuate constantly in response to various factors such as economic indicators, geopolitical events, and market sentiment. Forex traders aim to profit from these exchange rate movements by buying and selling currencies at opportune times.

4. Derivatives Market

The derivatives market involves trading financial instruments whose value derives from an underlying asset or benchmark. Derivatives are contracts between two or more parties that derive their value based on an underlying asset’s price or an agreed-upon reference point.

Derivatives are used for various purposes, including hedging against price fluctuations, speculation, and arbitrage. The most common types of derivatives are futures contracts, options contracts, and swaps.

Futures contracts obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price and date in the future. Options contracts provide the buyer with the right, but not the obligation, to buy or sell an asset at a specified price within a certain time frame. Swaps involve the exchange of cash flows or liabilities between two parties.

The derivatives market helps manage risk and provides opportunities for investors to leverage their positions or diversify their portfolios.

5. Commodities Market

The commodities market is where commodities such as gold, oil, natural gas, agricultural products, and metals are traded. It enables producers and consumers of commodities to hedge against price fluctuations and provides investors with opportunities for speculation and diversification.

Commodities can be traded through various channels, including spot markets, futures exchanges, and over-the-counter markets. The commodities market plays a vital role in global trade and ensures a stable supply of essential resources.

In conclusion, financial markets are crucial components of the global economy, facilitating the flow of funds, promoting investment, and managing risk. Capital markets, money markets, foreign exchange markets, derivatives markets, and commodities markets are the major types of financial markets, each serving unique purposes and catering to specific financial instruments. Understanding the functioning and characteristics of these markets is essential for individuals, investors, and businesses looking to participate and make informed financial decisions.

What is Financial Market? definition, features, functions and classification

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a financial market and its types?

A financial market is a platform where buyers and sellers come together to trade financial assets such as stocks, bonds, currencies, and commodities. There are several types of financial markets, including stock markets, bond markets, foreign exchange markets, and commodity markets.

What is a stock market?

A stock market is a type of financial market where shares of publicly traded companies are bought and sold. It provides a platform for investors to trade stocks and other securities, allowing companies to raise capital and investors to profit from buying and selling shares.

What is a bond market?

A bond market is a financial market where investors buy and sell debt securities known as bonds. Bonds are issued by governments, municipalities, and corporations as a means to raise funds. Bond markets allow investors to earn interest on their investments and provide a source of long-term financing.

What is a foreign exchange market?

A foreign exchange market, often referred to as the forex market, is where currencies are traded. It is a decentralized market where participants can buy, sell, exchange, and speculate on different currencies. The forex market plays a crucial role in facilitating international trade and investment.

What is a commodity market?

A commodity market is a financial market where primary goods or raw materials, such as gold, oil, agricultural products, and metals, are bought and sold. Commodities are traded on exchanges and allow investors to speculate on price movements or hedge against potential risks.

What is the role of financial markets?

Financial markets play a vital role in the economy by facilitating the flow of funds between savers and borrowers. They provide a platform for raising capital, setting prices, allocating resources, and managing risks. Financial markets also contribute to economic growth and stability.

What are the benefits of participating in financial markets?

Participating in financial markets offers several benefits, including the opportunity to earn returns on investments, diversify portfolios, hedge against risks, and access capital for businesses. Financial markets provide liquidity, transparency, and price discovery, making them essential for investors and businesses alike.

How do financial markets affect the economy?

Financial markets have a significant impact on the economy. They influence interest rates, borrowing costs, and investment levels. Efficient financial markets contribute to economic stability, facilitate capital formation, and support businesses’ growth. However, poorly functioning markets can lead to financial crises and economic downturns.

What factors affect financial markets?

Several factors influence financial markets, including economic indicators, geopolitical events, government policies, interest rates, inflation, and investor sentiment. Changes in these factors can cause fluctuations in market prices, volatility, and shifts in investment strategies.

Note: The information provided is for general knowledge purposes only and should not be considered as financial advice. It is important to consult with a professional financial advisor before making any investment decisions.

Final Thoughts

A financial market is a platform where buyers and sellers interact to trade financial assets such as stocks, bonds, currencies, and commodities. There are several types of financial markets, including stock markets, bond markets, currency markets, and commodity markets. Stock markets enable trading in shares of public companies, while bond markets facilitate the buying and selling of debt securities. Currency markets deal with the exchange of different currencies, and commodity markets involve trading in raw materials like gold, oil, and agricultural products. Understanding the concept of a financial market and its various types is essential for anyone interested in investing and managing their finances effectively.