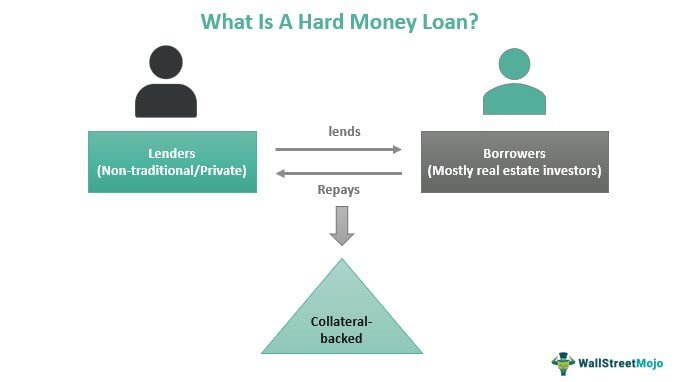

Have you ever wondered what a hard money loan in real estate is? Well, in simple terms, it’s a type of short-term loan that is secured by real estate. Unlike traditional bank loans, hard money loans are typically offered by private lenders and investors who focus on the property’s value rather than the borrower’s creditworthiness. This means that even if you have less-than-perfect credit or a limited track record, you may still be able to qualify for a hard money loan. In this article, we’ll delve deeper into the world of hard money loans in real estate and explore why they have become a popular financing option for many investors. So, let’s get started!

What is a Hard Money Loan in Real Estate?

Real estate investing often requires substantial amounts of capital, which can be a significant barrier for many individuals or businesses. Traditional lenders, such as banks, have stringent qualification criteria and lengthy approval processes, making it challenging for some borrowers to obtain financing. This is where hard money loans come into play.

A hard money loan, also known as a private money loan, is a type of short-term loan primarily used in real estate transactions. Unlike traditional loans from banks, hard money lenders base their lending decisions on the collateral property’s value rather than the borrower’s creditworthiness or financial history. This makes hard money loans an attractive option for borrowers seeking quick funding or who may not meet the strict criteria set by conventional lenders.

Hard money loans are typically secured by real estate properties, such as residential or commercial properties. The property serves as collateral, offering security to the lender in case the borrower fails to repay the loan. These loans are often used by real estate investors, house flippers, and individuals needing financing for property rehabilitation or construction projects.

How Do Hard Money Loans Work?

Hard money loans operate differently from traditional loans offered by banks or credit unions. Here’s a step-by-step breakdown of how hard money loans work:

1. Application Process: When applying for a hard money loan, borrowers submit their loan request to a hard money lender or a private lending company. The lender evaluates the borrower’s project and the collateral property’s value to determine the loan amount they are willing to offer.

2. Loan Terms and Conditions: Once the lender approves the loan, they provide the borrower with a loan term sheet or letter of intent. This document outlines the loan amount, interest rate, loan duration, repayment terms, and any additional fees associated with the loan.

3. Property Valuation: Before finalizing the loan, the lender conducts a property valuation or appraisal to determine its market value. This valuation helps the lender ascertain the loan-to-value (LTV) ratio, which is the loan amount as a percentage of the property’s value.

4. Loan Approval and Funding: If the property valuation meets the lender’s criteria, they proceed with finalizing the loan. Once the borrower accepts the loan terms and conditions, the lender disburses the funds. Funding for hard money loans often happens faster than traditional loans, with some lenders able to provide financing within days.

5. Repayment Period: Hard money loans typically have shorter repayment periods compared to traditional loans. They are typically repaid within six months to one year, although some lenders may offer longer terms. During the loan term, borrowers make monthly interest payments or sometimes interest-only payments. The principal is repaid at the end of the loan term or through a balloon payment.

Advantages of Hard Money Loans

Hard money loans offer several advantages to borrowers, making them a popular choice in the real estate industry. Here are some key benefits:

1. Quick Approval and Funding: Unlike traditional loans that require extensive documentation and underwriting processes, hard money loans can be approved and funded rapidly. This is particularly advantageous for time-sensitive real estate transactions, such as purchasing foreclosed properties at auctions.

2. Flexible Qualification Criteria: Hard money lenders primarily focus on the collateral property’s value. This means borrowers with less-than-perfect credit scores or financial histories can still qualify for a hard money loan. As long as the property value justifies the loan amount, borrowers have higher chances of approval.

3. Asset-Based Lending: Hard money loans are asset-based, meaning the property itself secures the loan. This offers peace of mind to lenders, as they have a tangible asset to recover their investment in case of borrower default. Additionally, the property’s value helps determine the loan amount, which can be higher than what traditional lenders offer.

4. Negotiable Loan Terms: Hard money loans often have more flexible terms compared to traditional loans. Borrowers can negotiate interest rates, repayment schedules, and other loan conditions with their lender. This flexibility allows borrowers to customize the loan to suit their specific investment needs.

5. Opportunities for Fix and Flip Projects: Real estate investors looking to purchase distressed properties, renovate them, and sell them at a profit often rely on hard money loans. The quick approval and funding process enables investors to seize time-sensitive opportunities, increasing their chances of success in fix and flip projects.

Disadvantages of Hard Money Loans

While hard money loans have numerous advantages, it’s essential to consider their potential drawbacks before pursuing this financing option. Here are some disadvantages to keep in mind:

1. Higher Interest Rates: Hard money loans often come with higher interest rates compared to traditional loans. This is because hard money lenders take on more significant risks by providing loans to borrowers with lower creditworthiness or unconventional projects. Borrowers should carefully assess the interest rate and calculate the impact on their overall project costs.

2. Shorter Loan Terms: Hard money loans typically have shorter repayment periods, ranging from six months to one year. While this may work well for short-term projects, borrowers need to have a solid plan to repay the loan within the given time frame. Failing to do so can result in additional fees or the risk of foreclosure.

3. Additional Costs and Fees: Hard money loans often involve additional costs beyond the interest rate. Borrowers may be required to pay origination fees, closing costs, and other charges associated with loan processing and administration. These additional expenses should be factored into the overall project budget.

When to Consider a Hard Money Loan

Hard money loans can be a viable option in certain real estate scenarios. Here are some situations where borrowers may consider obtaining a hard money loan:

1. Time-Sensitive Purchases: When a real estate opportunity requires quick action, such as purchasing a property at a foreclosure auction, hard money loans offer fast approval and funding, allowing borrowers to secure the property promptly.

2. Poor Credit History: Borrowers with less-than-perfect credit scores or financial histories may find it challenging to secure financing from traditional lenders. Hard money lenders primarily focus on the collateral property’s value, making it easier for borrowers with imperfect credit to obtain funding.

3. Fix and Flip Projects: Real estate investors specializing in buying distressed properties, renovating them, and selling at a profit often rely on hard money loans. The short-term nature of these loans aligns well with the quick turnaround time required for fix and flip projects.

4. Property Rehabilitation or Construction: Hard money loans can be an option for borrowers needing funds to rehabilitate or construct a property. When traditional lenders are hesitant due to the property’s condition or incomplete construction, hard money lenders may be more willing to provide financing based on the property’s potential.

In conclusion, hard money loans offer alternative financing options for real estate investors and individuals seeking quick funding for property-related projects. While they come with higher interest rates and shorter repayment periods, hard money loans provide flexibility, faster approval and funding, and the opportunity to take advantage of time-sensitive real estate opportunities. By understanding the advantages, disadvantages, and suitable scenarios for hard money loans, borrowers can make informed decisions when considering this financing option.

Hard Money Lenders Explained – How To Properly Find & Utilize Them

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a hard money loan in real estate?

A hard money loan in real estate is a type of loan that is secured by a real asset, typically a property. Unlike traditional bank loans, hard money loans are often funded by private investors or companies and are based on the value of the property rather than the borrower’s creditworthiness.

How does a hard money loan work?

When obtaining a hard money loan, the borrower uses the property as collateral for the loan. The lender evaluates the property’s value and potential for profit, rather than focusing primarily on the borrower’s financial qualifications. These loans are usually short-term and may have higher interest rates compared to traditional bank loans.

When should I consider a hard money loan?

Hard money loans can be a viable option for real estate investors who need quick financing or have difficulty qualifying for traditional bank loans. They are often used for fix-and-flip projects, property renovations, or when quick access to funds is crucial.

What are the benefits of using a hard money loan?

Some benefits of using hard money loans include faster approvals and funding compared to traditional bank loans, flexibility in terms and repayment options, and the ability to secure financing even with poor credit history or short business track record.

Who typically provides hard money loans?

Hard money loans are commonly provided by private investors, companies, or specialized lending institutions that focus on real estate investments. These lenders understand the unique needs of real estate investors and are experienced in evaluating property values and potential returns.

What are the typical interest rates for hard money loans?

Interest rates for hard money loans can vary depending on factors such as the lender, location, property type, and the borrower’s creditworthiness. Generally, they tend to be higher than traditional bank loans, often ranging from 8% to 15%.

What are the loan-to-value (LTV) ratios for hard money loans?

Hard money lenders typically offer loan-to-value ratios ranging from 60% to 75%. This means they may lend up to 60-75% of the appraised value of the property being used as collateral. The actual LTV ratio depends on various factors such as the property type and the borrower’s experience.

What is the repayment term for a hard money loan?

Hard money loans are typically short-term loans, with repayment terms ranging from six months to a few years. The duration of the loan depends on the project and the borrower’s requirements. It is important to have a clear repayment plan in place before obtaining a hard money loan.

Can I get a hard money loan for a primary residence?

Hard money loans are primarily designed for real estate investment purposes rather than for purchasing primary residences. These loans are commonly used for non-owner occupied properties such as fix-and-flip projects, commercial properties, or rental properties. Traditional mortgage loans are more suitable for primary residences.

Final Thoughts

A hard money loan in real estate refers to a type of short-term, asset-based loan that is secured by the property itself. These loans are typically provided by private investors or companies, and they are primarily used by real estate investors who need quick access to funding. Unlike traditional bank loans, hard money loans are based on the value of the property rather than the borrower’s creditworthiness. They are often utilized for housing flips, land development, or emergency financing. With a hard money loan, investors can secure the necessary funds for their real estate projects without the lengthy approval process of traditional loans.