Hedge funds and their risks are topics that often spark curiosity and concern among investors. So, what exactly is a hedge fund and what are the risks associated with it? A hedge fund can be described as an investment vehicle that pools funds from accredited individuals and institutional investors. These funds are then strategically managed by experienced professionals who aim to generate high returns. However, it’s crucial to understand that with potentially high returns come inherent risks. In this article, we will delve deeper into what a hedge fund really is and explore the risks that investors should be aware of. So, let’s begin our journey into the world of hedge funds and its risks.

What is a Hedge Fund and Its Risks

A hedge fund is a type of investment fund that pools capital from various investors and employs advanced investment strategies to generate high returns. Unlike traditional investment funds, hedge funds have more flexibility in terms of investment options and are often available to accredited or high-net-worth individuals and institutional investors. They aim to achieve positive returns in both rising and falling markets, using a diverse range of investment techniques.

The Structure of a Hedge Fund

Hedge funds are typically structured as limited partnerships, with the fund manager acting as the general partner and the investors as the limited partners. The general partner manages the fund’s investments and makes investment decisions, while the limited partners provide the capital.

Hedge funds are known for their aggressive investment strategies and the potential to generate high returns. These funds often employ complex trading techniques, such as short selling, leverage, derivatives, and arbitrage, to maximize profits. However, along with the potential for high returns, hedge funds also carry various risks that investors should be aware of.

Types of Hedge Funds

Hedge funds can be classified into different types based on their investment strategies. Some common types of hedge funds include:

- Long/Short Equity: These funds take long positions in stocks they expect to increase in value and short positions in stocks they expect to decline.

- Event-Driven: Event-driven hedge funds focus on investing in securities of companies affected by corporate events such as mergers, acquisitions, bankruptcies, or reorganizations.

- Global Macro: Global macro funds invest in various asset classes, including stocks, bonds, currencies, and commodities, based on macroeconomic analysis and predictions.

- Fixed Income: Fixed income hedge funds primarily invest in fixed income securities such as government bonds, corporate bonds, and mortgage-backed securities.

- Quantitative: Quantitative hedge funds use mathematical models and algorithms to identify investment opportunities and execute trades.

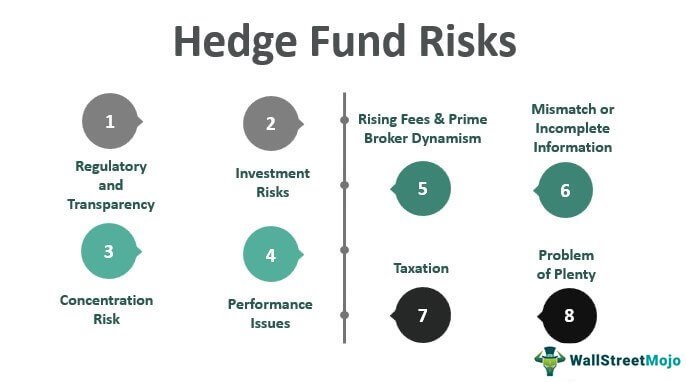

Risks Associated with Hedge Funds

While hedge funds offer potential for high returns, they also come with certain risks that investors should carefully consider before investing:

1. Lack of Regulation

Unlike mutual funds and other regulated investment vehicles, hedge funds operate with fewer regulatory restrictions. This lack of regulation may expose investors to a higher degree of risk, as hedge funds have more flexibility to use complex strategies and invest in riskier assets.

2. High Volatility

Hedge funds often employ aggressive trading strategies that can result in high volatility. The use of leverage and derivatives can amplify both gains and losses, leading to greater fluctuations in the fund’s value.

3. Loss of Capital

Investing in hedge funds carries the risk of losing the entire invested capital. The aggressive investment strategies employed by hedge funds may not always be successful, leading to significant losses.

4. Lack of Transparency

Hedge funds are known for their limited transparency. Unlike mutual funds, hedge funds are not required to disclose their holdings or investment strategies to the public. This lack of transparency makes it challenging for investors to fully understand the fund’s investments and assess associated risks.

5. Illiquidity

Many hedge funds have lock-up periods, during which investors cannot redeem their investments. This illiquidity can be a significant risk, especially during times of financial distress when investors may need immediate access to their funds.

6. Counterparty Risk

Hedge funds often enter into complex derivative contracts and engage with various counterparties. The failure of a counterparty to honor its obligations can pose a significant risk to the fund’s investments and overall performance.

7. Limited Redemption Options

Some hedge funds may have limitations on when and how investors can redeem their investments. This lack of redemption flexibility can restrict investors from accessing their funds when needed, potentially impacting their liquidity.

Due Diligence and Risk Management

To mitigate the risks associated with hedge funds, investors must conduct thorough due diligence and assess the fund’s risk management practices. Here are some key considerations:

1. Track Record and Performance

Review the fund’s historical performance and track record. While past performance does not guarantee future results, it can provide insights into the fund manager’s capabilities and investment strategies.

2. Investment Philosophy

Understand the fund’s investment philosophy and strategy. Assess whether it aligns with your risk tolerance and investment objectives.

3. Risk Management Framework

Examine the fund’s risk management framework. Look for signs of robust risk controls and measures in place to manage potential downside risks.

4. Transparency and Reporting

Evaluate the fund’s transparency and reporting practices. Look for funds that provide regular and comprehensive reporting on their holdings, strategies, and risk exposures.

5. Fund Manager Experience

Assess the experience and expertise of the fund manager and the investment team. Consider their track record, industry reputation, and depth of knowledge in the relevant investment strategies.

6. Fee Structure

Understand the fund’s fee structure, including management fees and performance fees. Consider whether the fees are justified based on the fund’s performance and the value it provides.

7. Exit Options

Review the fund’s redemption terms and exit options. Ensure they align with your liquidity needs and preferences.

Hedge funds offer unique investment opportunities but also come with inherent risks. Investors should carefully assess the risks associated with hedge funds and conduct thorough due diligence before investing. It’s important to understand the fund’s investment strategies, risk management practices, and track record to make informed investment decisions. By being aware of the risks and employing diligent risk management, investors can navigate the hedge fund landscape more effectively.

What Exactly Are Hedge Funds (And Why Are They Always Causing Problems)?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a hedge fund and what are its risks?

A hedge fund is an investment vehicle that pools funds from high-net-worth individuals or institutional investors and employs various strategies to generate returns. These funds aim to maximize profits by utilizing investment techniques such as leveraging, short-selling, and derivatives trading. However, hedge funds also carry certain risks that investors should be aware of.

What are the potential risks associated with investing in hedge funds?

Investing in hedge funds entails several risks, including but not limited to market risk, liquidity risk, leverage risk, counterparty risk, and regulatory risk. These risks can impact the performance and stability of the investment, potentially resulting in financial losses.

How does market risk affect hedge fund investments?

Market risk refers to the possibility of losses arising from changes in market conditions. Hedge funds can be affected by market volatility, economic downturns, geopolitical events, and other factors that can lead to negative returns. It is important to understand that hedge funds are not immune to market risks.

What is liquidity risk in the context of hedge funds?

Liquidity risk refers to the potential difficulty of buying or selling an investment without causing significant price disruptions. Hedge funds often invest in less liquid assets, such as private equity or real estate, which may limit investors’ ability to quickly access their funds. This illiquidity can impact the investor’s ability to meet short-term cash needs.

What is leverage risk, and how does it impact hedge fund investments?

Leverage risk refers to the use of borrowed money to amplify investment returns. While leverage can enhance profits in a favorable market, it also magnifies losses in case investments perform poorly. Hedge funds often employ leverage to increase potential returns, but this strategy can heighten the risks associated with their investments.

What is counterparty risk in hedge fund investing?

Counterparty risk refers to the potential for losses due to the failure of a counterparty to fulfill its contractual obligations. Hedge funds engage in various financial transactions, such as derivative contracts, with counterparties. If a counterparty defaults or cannot honor its obligations, it can have adverse implications for the hedge fund’s investments.

How does regulatory risk affect hedge fund investments?

Regulatory risk encompasses the potential impact of changes in laws, regulations, or government policies on hedge fund investments. Regulatory requirements, reporting obligations, and restrictions can affect the operations and profitability of hedge funds. Investors should stay informed about the regulatory landscape to anticipate and manage such risks.

What steps can investors take to mitigate hedge fund risks?

To mitigate hedge fund risks, investors are advised to conduct thorough due diligence, carefully assess the fund’s investment strategy, track record, and risk management practices. Diversifying investments, setting realistic return expectations, and monitoring the fund’s performance are also essential risk management measures. Seeking professional advice from financial advisors can help investors make informed decisions.

Are hedge funds suitable for all types of investors?

Hedge funds are generally suitable for sophisticated and accredited investors who have a higher risk tolerance and a thorough understanding of the complexities associated with these investments. Regulatory requirements often restrict hedge fund participation to certain categories of investors, such as institutions, high-net-worth individuals, or qualified purchasers.

Final Thoughts

In conclusion, understanding what a hedge fund is and the associated risks is crucial for investors. Hedge funds are privately managed investment funds that aim to generate high returns through various strategies. However, they also entail certain risks, such as market volatility, leverage, lack of transparency, and potential legal and regulatory issues. Therefore, it is important for investors to carefully consider these risks before investing in hedge funds. By being aware of the potential risks, individuals can make informed investment decisions and mitigate any potential losses.