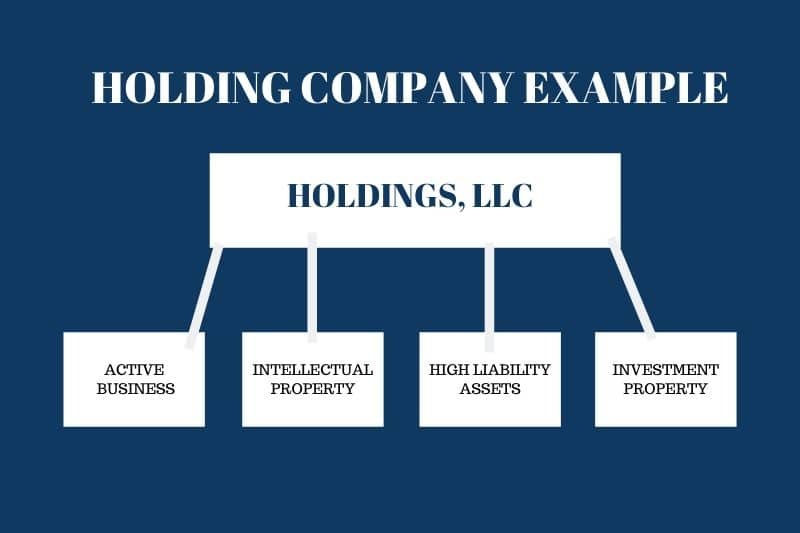

A holding company structure is a key element in business that many find puzzling. What exactly does it entail? Simply put, a holding company structure is a business arrangement where a corporation or individual owns the majority or all of the shares of other companies, known as subsidiaries. These subsidiaries can be in various industries, providing a diverse portfolio of assets for the holding company. In this article, we will delve into the world of holding company structures, exploring their purpose, benefits, and how they operate in the business landscape. So, if you’ve ever wondered what a holding company structure is and how it works, you’ve come to the right place.

The first section will focus on the definition and purpose of a holding company structure. Understanding the fundamental concepts and objectives behind this business arrangement is essential to grasp its significance in the corporate world.

Next, we’ll dive into the benefits of a holding company structure. From risk management and tax advantages to improved financial flexibility and simplified management, we’ll explore the advantages that make this structure an attractive option for businesses.

In the following section, we’ll shed light on the inner workings of a holding company structure. We’ll take a closer look at the relationships between the holding company and its subsidiaries, as well as the control and influence the holding company exercises over its businesses.

Furthermore, we’ll explore different types of holding company structures, such as vertical and horizontal structures, to showcase the versatility and adaptability of this business model.

To enhance your understanding, we’ll also discuss real-world examples of well-known holding companies and how they have utilized this structure to their advantage.

By the end of this article, you will have a comprehensive understanding of what a holding company structure is, why it matters, and how it operates in the business world. Whether you’re a budding entrepreneur, a business professional, or simply curious about the intricacies of corporate structures, this article will provide the insights you seek. So, let’s delve into the fascinating realm of holding company structures and unlock the secrets behind their success.

What is a Holding Company Structure?

A holding company structure is a form of business organization that involves the ownership and control of multiple subsidiary companies. In this structure, the holding company, also known as a parent company, owns a significant portion of the shares or assets of the subsidiary companies, giving it the power to control their operations and decision-making processes.

The primary purpose of a holding company is to create a centralized entity that exercises control over its subsidiaries while maintaining separate legal and operational identities for each individual company. This structure offers several advantages, such as risk diversification, tax efficiencies, and improved corporate governance. Let’s delve deeper into the various aspects of a holding company structure to gain a comprehensive understanding.

Types of Holding Companies

There are different types of holding companies, each with its specific characteristics and purposes. These include:

1. Pure Holding Companies: Also known as investment holding companies, pure holding companies exist solely to hold assets, such as stocks, bonds, and other investments, without engaging in any operational activities. They generate income through dividends, interest, and capital gains derived from their investments.

2. Parent Companies: Parent companies are entities that own the majority of shares in one or more subsidiary companies, giving them the power to control and influence the strategic decisions made by these subsidiaries. Parent companies often provide financial, operational, and managerial support to their subsidiaries.

3. Subsidiary Holding Companies: Subsidiary holding companies are holding companies that are themselves owned by another holding company. This nested structure allows for greater control and strategic management of multiple layers of subsidiaries.

Advantages of a Holding Company Structure

A holding company structure offers several benefits to businesses and their stakeholders. Here are some of the key advantages:

1. Risk Diversification: Holding companies provide risk diversification by spreading investments across multiple subsidiaries and industries. This reduces the exposure to risks associated with a single business and enhances overall stability.

2. Tax Efficiencies: Holding companies can take advantage of tax planning strategies, such as tax consolidation, profit shifting, and utilizing tax havens, to optimize their overall tax liabilities. Such strategies can lead to significant tax savings and increased profitability.

3. Asset Protection: By separating assets and liabilities among different subsidiaries, a holding company can protect its core assets from the potential risks and liabilities associated with specific businesses. This can safeguard the overall wealth of the organization and its shareholders.

4. Centralized Control: With a holding company structure, the parent company can exercise centralized control and strategic decision-making for its subsidiaries. This allows for better coordination, synergy, and alignment of business objectives across the entire group.

5. Financing Flexibility: Holding companies can facilitate financing for their subsidiaries by leveraging their overall financial strength and creditworthiness. This can lead to improved access to capital markets, lower borrowing costs, and enhanced financial stability for subsidiary companies.

Key Considerations in Setting Up a Holding Company Structure

When establishing a holding company structure, certain important factors need to be taken into consideration. These include:

1. Legal and Regulatory Requirements: It is crucial to understand the legal and regulatory frameworks in the jurisdictions where the holding company and its subsidiaries operate. Compliance with company laws, tax regulations, and reporting requirements is essential for ensuring the legal validity of the structure.

2. Ownership and Control: Determining the ownership and control structure is a critical step. The holding company must acquire a sufficient percentage of shares or assets in the subsidiary companies to exercise control while maintaining separate legal identities.

3. Corporate Governance: Establishing effective corporate governance practices is vital for ensuring transparency, accountability, and ethical conduct within the holding company and its subsidiaries. This includes defining roles and responsibilities, implementing robust internal controls, and promoting fair business practices.

4. Financial and Tax Planning: Conducting thorough financial and tax planning is essential to optimize the benefits of the holding company structure. This involves assessing tax implications, cash flow management, dividend policies, and transfer pricing strategies.

5. Operational Integration: To achieve synergy and operational efficiencies, the holding company should carefully consider the integration of the subsidiaries. This may involve streamlining processes, sharing resources, and implementing centralized management systems where appropriate.

Case Study: Berkshire Hathaway

One prominent example of a holding company structure is Berkshire Hathaway, led by renowned investor Warren Buffett. Berkshire Hathaway is composed of a diversified portfolio of businesses, including insurance, manufacturing, utilities, and retail.

As a holding company, Berkshire Hathaway operates by acquiring controlling interests in various subsidiary companies, allowing Buffett and his team to provide strategic guidance and governance. Some of the well-known subsidiaries of Berkshire Hathaway include GEICO, Duracell, Fruit of the Loom, and BNSF Railway.

This structure has enabled Berkshire Hathaway to capitalize on the strength and profitability of its subsidiaries, resulting in a robust and successful conglomerate. The holding company’s ownership and management approach have made it one of the most valuable companies globally.

In conclusion, a holding company structure is a powerful and flexible business model that provides numerous benefits to organizations operating in diverse industries. By establishing a centralized entity to control subsidiary companies, a holding company can tap into risk diversification, tax efficiencies, and centralized decision-making. However, setting up and managing a holding company requires careful consideration of legal, financial, and operational aspects. With proper planning and execution, a well-structured holding company can unlock significant value and contribute to the long-term success of the entire group.

How My Holding Company Works

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a holding company structure?

A holding company structure refers to a type of business organization that controls and owns other companies, known as subsidiaries. Instead of engaging in day-to-day operations, a holding company’s primary purpose is to own and manage the shares or assets of the subsidiaries.

How does a holding company structure work?

In a holding company structure, the holding company owns a majority stake in its subsidiaries, usually by holding their shares. This allows the holding company to have control over the subsidiaries’ strategic decisions and financial matters without directly participating in their operational activities.

What are the advantages of a holding company structure?

A holding company structure offers several advantages, including:

1. Diversification: Holding companies can invest in various industries, reducing risks associated with dependence on a single business.

2. Risk Management: If one subsidiary encounters financial difficulties, the holding company’s other subsidiaries can provide financial support.

3. Tax Benefits: Holding companies may benefit from tax advantages, such as deducting expenses across multiple subsidiaries.

4. Asset Protection: Holding companies can separate assets and liabilities, safeguarding the overall group from legal and financial risks.

Are there any disadvantages to a holding company structure?

While a holding company structure has its advantages, some potential disadvantages include:

1. Complex Structure: Maintaining a holding company structure requires careful management, accounting, and legal considerations.

2. Limited Control: Holding companies have control over strategic decisions but may have limited control over day-to-day operations of the subsidiaries.

3. Capital Requirement: Establishing a holding company often requires a significant amount of capital to acquire or invest in subsidiaries.

What types of businesses commonly use a holding company structure?

Holding company structures are often used by conglomerates, family-owned businesses, or large corporations that operate in multiple industries. Additionally, investors seeking to diversify their portfolios may also use a holding company structure.

Can a holding company structure be used for tax optimization?

Yes, a holding company structure can be used for tax optimization. By having subsidiaries in jurisdictions with favorable tax laws or utilizing tax planning strategies, holding companies can potentially reduce their overall tax liabilities.

What is the difference between a holding company and a subsidiary?

A holding company is a separate entity that owns and controls other companies, known as subsidiaries. The holding company does not participate in the day-to-day operations of the subsidiaries but manages their shares or assets. Subsidiaries, on the other hand, are companies that are owned and controlled by the holding company.

Are holding companies regulated by any specific laws or regulations?

The regulation of holding companies varies depending on the jurisdiction. Some countries have specific laws and regulations that apply to holding companies, while others may regulate them as any other type of business entity. It is essential for holding companies to comply with the legal and regulatory requirements of the jurisdictions in which they operate.

Final Thoughts

A holding company structure is a business arrangement where one company, known as the holding company, owns a controlling interest in other companies, known as subsidiaries. This structure allows the holding company to exercise control and influence over the subsidiaries’ strategic decisions, yet each subsidiary operates as a separate legal entity. The main purpose of a holding company structure is to facilitate diversification, risk management, and centralized control over various business operations. By consolidating ownership and control, holding companies can achieve economies of scale and enhance efficiency within the group. In conclusion, a holding company structure is a strategic framework that enables companies to manage multiple subsidiaries under a single entity, leading to improved control, coordination, and growth opportunities.