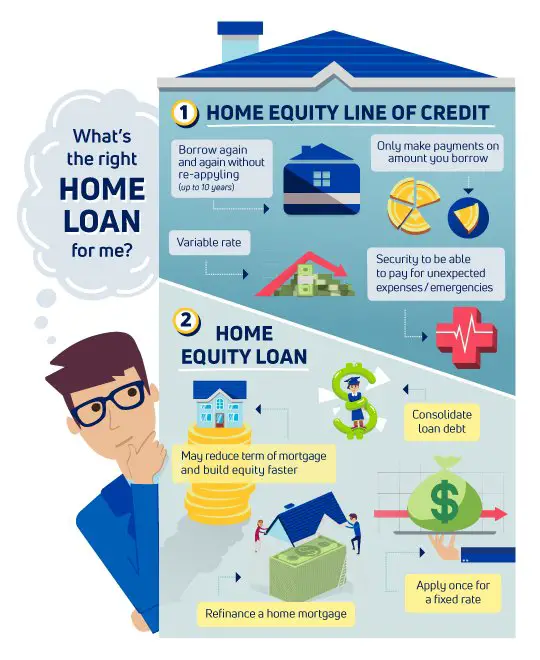

If you’ve ever wondered what a home equity line of credit is, you’re in the right place. A home equity line of credit, or HELOC for short, is a flexible borrowing option that allows homeowners to tap into the equity they’ve built in their homes. It’s a bit like having a credit card with a spending limit tied to your home’s value. With a HELOC, you can access funds as needed, giving you the freedom to use the money for various purposes, like home improvements, debt consolidation, or unexpected expenses. Let’s dive deeper into this financial tool and explore how it can work for you.

# What is a Home Equity Line of Credit?

A home equity line of credit (HELOC) is a flexible form of borrowing that allows homeowners to tap into the equity they have built up in their property. It is a revolving line of credit, similar to a credit card, that is secured against the value of your home. With a HELOC, you can borrow funds as needed, up to a certain limit, and repay them over time.

## How Does a Home Equity Line of Credit Work?

To understand how a home equity line of credit works, let’s break it down into a few key components:

### 1. Equity

Equity is the difference between the current market value of your home and the outstanding balance on your mortgage. As you make mortgage payments and the value of your property appreciates, your equity increases. A home equity line of credit allows you to borrow against this equity.

### 2. Credit Limit

When you apply for a HELOC, the lender will determine the maximum amount of money you can borrow based on factors such as your credit history, income, and the appraised value of your home. This amount is known as the credit limit.

### 3. Draw Period

The draw period is the time during which you can access funds from your home equity line of credit. This period typically lasts for 5 to 10 years, during which you can borrow funds up to your credit limit. Interest is charged only on the amount you actually borrow.

### 4. Repayment Period

After the draw period ends, the repayment period begins. During this phase, you can no longer borrow funds from your HELOC and must start repaying the outstanding balance. The repayment period usually ranges from 10 to 20 years and requires you to make monthly payments of principal and interest.

### 5. Variable Interest Rates

HELOCs often come with variable interest rates, meaning the interest rate can fluctuate over time. The interest rate is typically based on a benchmark, such as the prime rate, plus a margin determined by the lender. It’s important to note that changes in interest rates can impact your monthly payments.

## Advantages of a Home Equity Line of Credit

Now that we understand the basics of a home equity line of credit, let’s explore some of the advantages it offers:

### 1. Flexibility

One of the main benefits of a HELOC is its flexibility. Unlike a traditional loan where you receive a lump sum upfront, a home equity line of credit allows you to borrow funds as needed. This flexibility can be especially useful for ongoing expenses, such as home renovations, education costs, or medical bills.

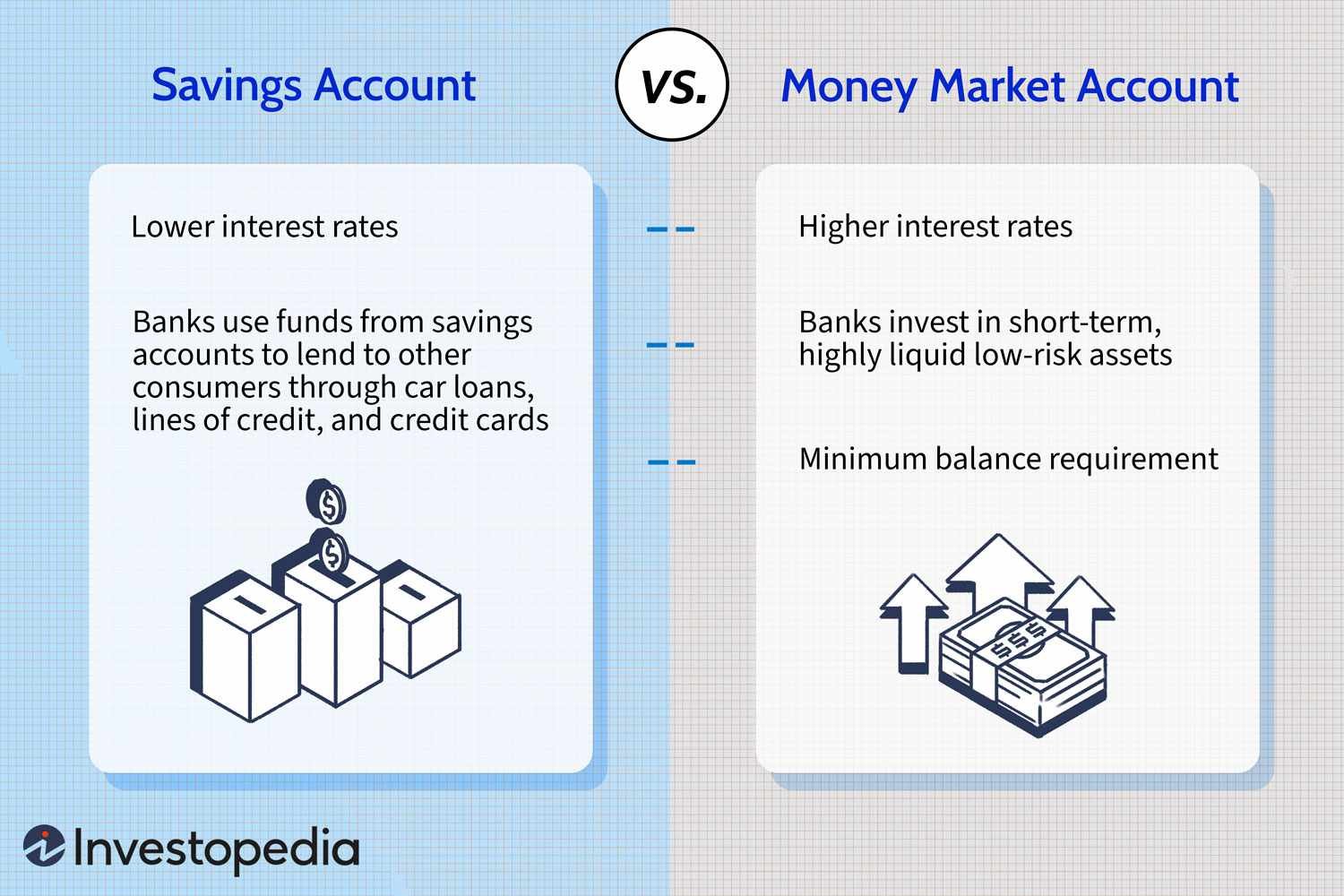

### 2. Lower Interest Rates

Compared to other forms of borrowing, such as personal loans or credit cards, HELOCs often come with lower interest rates. This is because the loan is secured by your home, which reduces the lender’s risk. Taking advantage of a lower interest rate can save you money on interest payments over time.

### 3. Potential Tax Benefits

In some cases, the interest paid on a home equity line of credit may be tax-deductible. However, it’s important to consult with a tax professional or financial advisor to understand the specific tax implications based on your individual circumstances.

### 4. Access to Emergency Funds

Having a home equity line of credit in place can provide a safety net in case of unexpected expenses or emergencies. Instead of resorting to high-interest credit cards or personal loans, you can tap into your HELOC to cover immediate financial needs.

## Considerations and Potential Risks

While a home equity line of credit can offer numerous benefits, it’s crucial to be aware of the potential risks and considerations involved:

### 1. Risk of Foreclosure

A HELOC is secured by your home, which means if you fail to make your scheduled payments, the lender has the right to initiate foreclosure proceedings. It’s essential to make timely payments to avoid putting your home at risk.

### 2. Variable Interest Rates

As mentioned earlier, HELOCs often come with variable interest rates. This means that if interest rates rise, your monthly payments could increase, potentially impacting your budget. It’s important to budget for potential changes in interest rates when considering a home equity line of credit.

### 3. Responsible Borrowing

A home equity line of credit should be used responsibly. It’s essential to borrow only what you need and can comfortably repay. Using a HELOC for unnecessary expenses or non-essential items can lead to financial strain and debt accumulation.

### 4. Closing Costs and Fees

When opening a home equity line of credit, there may be closing costs and fees involved, such as appraisal fees, credit check fees, or origination fees. It’s important to factor in these costs when considering a HELOC.

## Is a Home Equity Line of Credit Right for You?

Deciding whether a home equity line of credit is right for you depends on your individual financial situation and goals. Here are a few factors to consider:

### 1. Purpose of Borrowing

Are you planning to use the funds for a specific purpose, such as home improvements or debt consolidation? Assessing your borrowing needs and goals can help determine if a HELOC aligns with your plans.

### 2. Financial Stability

Consider your current financial stability and ability to make monthly payments. Make sure you have a reliable source of income to cover the repayment obligations associated with a home equity line of credit.

### 3. Alternative Options

Explore other borrowing options available to you. Compare the terms, interest rates, and repayment structures of HELOCs with other types of loans to ensure you choose the best option for your needs.

### 4. Future Expectations

Assess your future expectations, including potential changes in income, housing plans, and interest rate trends. Understanding how these factors may affect your ability to repay the loan can help you make an informed decision.

## Conclusion

A home equity line of credit can be a valuable tool for homeowners looking to leverage the equity in their property. By understanding how a HELOC works and considering the benefits and risks, you can determine if it aligns with your financial goals. Remember, it’s important to consult with a financial advisor or mortgage professional to fully comprehend the implications of a home equity line of credit and make an educated decision.

How a Home Equity Line of Credit Works! (HELOC EXPLAINED & How To Get a HELOC)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a Home Equity Line of Credit?

A Home Equity Line of Credit (HELOC) is a type of loan that allows homeowners to borrow money using the equity they have built up in their homes. It acts as a revolving line of credit, similar to a credit card, where homeowners can borrow against the equity in their homes and repay the borrowed amount over a specific period of time.

How does a Home Equity Line of Credit work?

A Home Equity Line of Credit works by using the equity in your home as collateral. The lender determines the amount you can borrow based on the appraised value of your home, your credit history, and other factors. Once approved, you can access funds from your HELOC as needed and only pay interest on the amount you borrow.

What can I use a Home Equity Line of Credit for?

A Home Equity Line of Credit can be used for various purposes such as home improvements, debt consolidation, funding education expenses, or covering unexpected expenses. However, it’s essential to use the funds responsibly and within your means.

How is a Home Equity Line of Credit different from a Home Equity Loan?

A Home Equity Line of Credit differs from a Home Equity Loan in that it operates as a revolving line of credit, while a Home Equity Loan provides a lump sum of money upfront. With a HELOC, you can borrow, repay, and borrow again, whereas with a Home Equity Loan, you receive a fixed amount in a one-time disbursement and make fixed monthly payments.

What factors determine the amount I can borrow with a Home Equity Line of Credit?

The amount you can borrow with a Home Equity Line of Credit depends on factors such as the appraised value of your home, the amount of equity you have, your credit score, your income, and your debt-to-income ratio. Lenders typically allow homeowners to borrow up to a certain percentage of their home’s appraised value.

What are the advantages of a Home Equity Line of Credit?

Some advantages of a Home Equity Line of Credit include flexibility in borrowing money as needed, potentially lower interest rates compared to other types of loans, and the possibility of tax-deductible interest payments. However, it’s important to carefully consider the risks and ensure you can manage the repayments before taking out a HELOC.

What are the risks of a Home Equity Line of Credit?

The risks of a Home Equity Line of Credit include the potential to accumulate more debt if not used responsibly, the possibility of fluctuating interest rates, the risk of foreclosure if you fail to make payments, and the potential impact on your credit score if you default on the loan.

How can I qualify for a Home Equity Line of Credit?

To qualify for a Home Equity Line of Credit, you typically need to have a good credit score (usually 620 or higher), a low debt-to-income ratio, a stable income, and a sufficient amount of equity in your home. Lenders also consider other factors, including your employment history and financial stability.

Final Thoughts

A home equity line of credit (HELOC) is a convenient financial tool that allows homeowners to access funds based on the equity in their property. It functions like a credit card, where you can borrow against a predetermined credit limit and only pay interest on the amount you use. With a HELOC, you can tap into your home’s equity for various purposes, such as home improvements, debt consolidation, or covering unexpected expenses. By understanding what a home equity line of credit is and its potential benefits, homeowners can make informed decisions about their financial options.