Looking for a convenient way to make a purchase without breaking the bank? Enter the layaway plan! Wondering what exactly a layaway plan is and what its pros and cons are? Well, you’re in luck! In this article, we’ll dive into the ins and outs of what a layaway plan entails and explore its advantages and disadvantages. So, whether you’re planning to buy that must-have item or simply curious about alternative payment options, keep reading to uncover the fascinating world of layaway plans and all they have to offer.

What is a Layaway Plan and Its Pros and Cons

Are you considering purchasing a product but don’t have the immediate funds to pay for it in full? A layaway plan could be the solution you’re looking for. In this article, we’ll delve into the concept of layaway plans, how they work, and explore the pros and cons associated with this payment option.

Understanding Layaway Plans

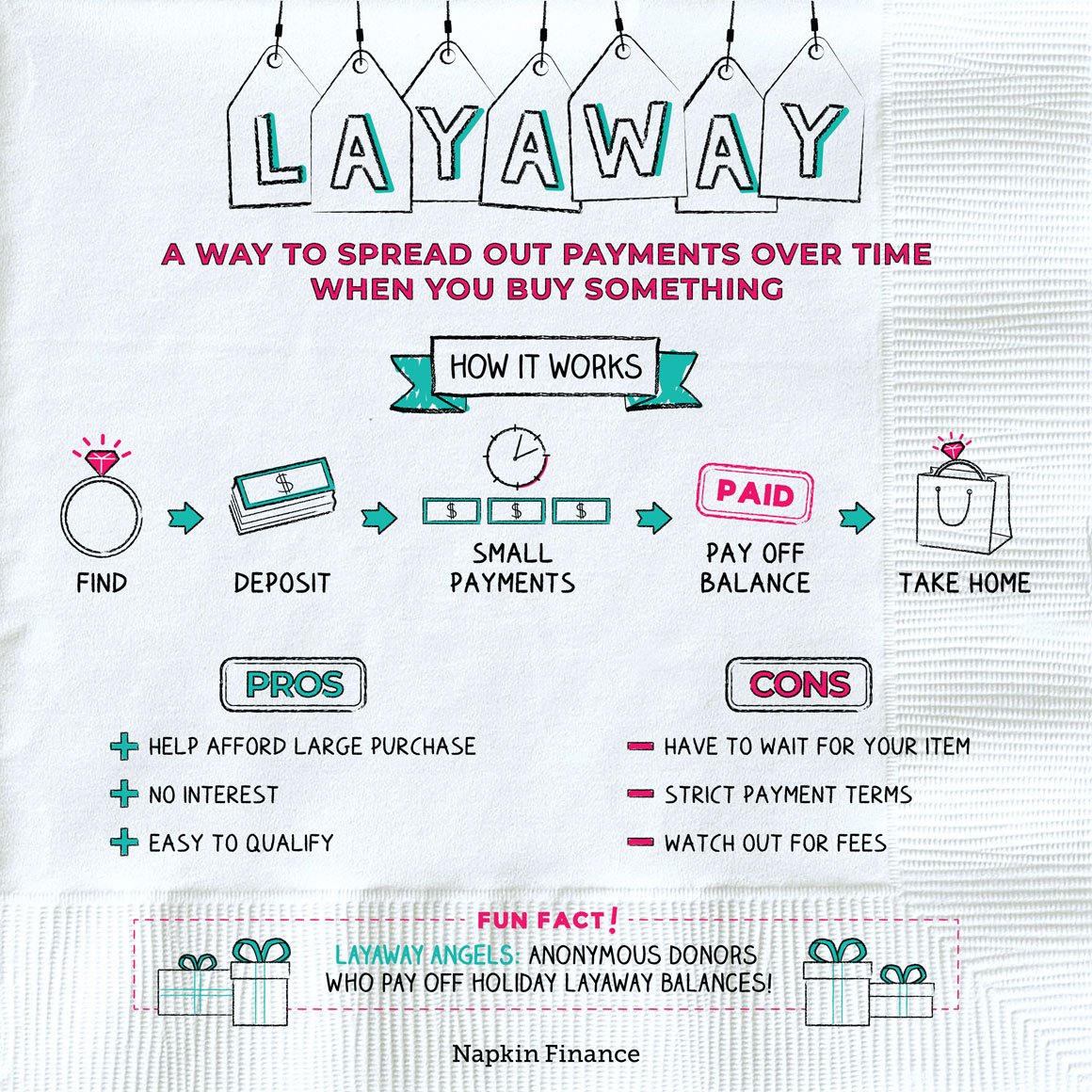

A layaway plan, also known as layby in some countries, is a payment option offered by retailers that allows customers to purchase products by making a series of installment payments. With a layaway plan, customers can reserve an item and pay for it over a specified period of time, usually without accruing any interest charges.

The process begins by selecting the desired product and putting down a deposit, typically a percentage of the item’s total cost. The customer then agrees to make regular payments towards the remaining balance until it is paid in full. Once all payments have been made, the customer can collect the item they’ve reserved.

The Pros of Layaway Plans

While layaway plans may not be suitable for everyone, they do offer several advantages that can make them an attractive option for certain individuals. Let’s explore some of the pros of using a layaway plan:

- No interest charges: Unlike credit cards or loans, layaway plans typically do not charge any interest. This means you can spread out your payments without incurring any additional costs.

- Financial discipline: Layaway plans can help individuals with limited self-control in managing their finances. By committing to regular payments, customers can develop a sense of financial discipline and avoid the temptation of impulse buying.

- Guaranteed availability: Have you ever come across a limited edition item that you absolutely must-have? With layaway plans, you can secure the item by making a deposit, ensuring that it will be available for you when you complete your payments.

- Avoid credit card debt: If you’re concerned about accumulating credit card debt, especially during seasonal shopping sprees, layaway plans provide an alternative payment method that allows you to avoid using credit cards altogether.

- Fee-free cancellation: In some cases, if you change your mind or encounter unexpected financial difficulties, you can cancel your layaway agreement without incurring any fees. This allows for greater flexibility compared to other payment options.

The Cons of Layaway Plans

While layaway plans offer several advantages, it’s important to consider the potential drawbacks before deciding if they are the right choice for you. Here are some cons associated with layaway plans:

- Product availability: While layaway plans guarantee availability for the reserved item, the limited inventory may mean forfeiting the opportunity to purchase the same item from another retailer who has it in stock.

- Restrictions on payment terms: Layaway plans often have specific payment terms, such as requiring a minimum deposit or a fixed payment frequency. These limitations may not align with your financial situation or preferred payment schedule.

- No immediate possession: Unlike cash purchases or credit transactions, you won’t have immediate access to the product until the final payment has been made. This can be inconvenient if you need the item urgently.

- Potential loss of funds: If you are unable to make the required payments or decide to cancel the plan, you may lose the initial deposit or incur cancellation fees. It’s crucial to understand the retailer’s policies before entering into a layaway agreement.

- No price protection: Prices of products can fluctuate over time, and with layaway plans, there is no guarantee that the price you initially agreed upon will remain the same until you complete your payments. You may end up paying a higher price if the cost of the item increases.

Is Layaway Right for You?

Deciding whether or not to use a layaway plan ultimately depends on your individual circumstances and financial goals. Here are a few factors to consider:

- Financial stability: If you have a stable income and can comfortably make the required payments without impacting your overall financial well-being, a layaway plan can be a feasible option.

- Product necessity: If the desired item is a necessity or will significantly enhance your quality of life, a layaway plan can help you acquire it without the need for immediate full payment.

- Opportunity cost: Assess whether waiting and saving up for the item or exploring other financing options would be more beneficial in the long run. Consider potential discounts, interest rates, or alternative methods of acquiring the product.

- Flexibility: Review the terms and conditions of the layaway plan to ensure they align with your specific needs and preferences. Evaluate factors such as the payment schedule, cancellation policy, and any associated fees.

By carefully considering these factors, you can determine if a layaway plan is the right choice for you.

Layaway Pros and Cons

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a layaway plan?

A layaway plan is a purchasing option where customers can pay for goods or services in installments over a period of time. The item is set aside for the customer and they can take it home once the full payment has been made.

What are the pros of using a layaway plan?

Using a layaway plan offers several benefits, including:

– Budgeting: It allows you to make smaller payments over time, helping you stay within your budget.

– No credit check: Layaway plans often do not require a credit check, making it accessible to individuals with low credit scores.

– Avoiding debt: By paying in installments, you can avoid incurring debt on credit cards or loans.

– Securing popular items: Layaway plans allow you to reserve popular items, ensuring you can get them before they sell out.

Are there any cons to using a layaway plan?

While layaway plans can be advantageous, there are a few considerations to keep in mind:

– Fees: Some layaway plans may charge fees for the service, impacting the overall cost of the item.

– No immediate possession: You won’t have immediate possession of the item until the full payment is made.

– Limited return policies: Depending on the store’s policies, returning or canceling layaway items may have restrictions or fees attached.

How does a layaway plan work?

When utilizing a layaway plan, you typically select the desired item and make a down payment. The retailer then holds the item for you and you continue to make regular payments until the full amount is paid. Once the final payment is made, you can take the item home.

What happens if I miss a payment on a layaway plan?

If you miss a payment on a layaway plan, the specific consequences will depend on the terms and conditions set by the retailer. Commonly, you may face late fees or your layaway contract may be cancelled, resulting in the loss of the item and any payments made.

Can I cancel a layaway plan?

Yes, generally you can cancel a layaway plan. However, there may be cancellation fees or restrictions on receiving a full refund. It’s important to review the retailer’s policies regarding layaway cancellations before making a decision.

Are all items eligible for layaway?

Not all items are eligible for layaway. Retailers typically have specific criteria for eligible items, which can vary. It’s best to check with the retailer or review their layaway terms and conditions to determine which items qualify.

Can I pay off a layaway plan early?

In most cases, you can pay off a layaway plan early. This can be advantageous as it allows you to take possession of the item sooner. However, it’s important to review the retailer’s policies to ensure there are no penalties or restrictions for early payment.

Final Thoughts

A layaway plan is a payment option that allows customers to reserve a product by paying for it in installments over a set period of time. This enables individuals to make purchases without incurring credit card debt or paying interest. One of the main advantages of a layaway plan is the ability to budget and pay for items gradually, making it a suitable choice for those on a tight budget. However, there are some downsides to consider. Layaway plans often come with fees and penalties if the customer fails to make timely payments or cancels the agreement. Additionally, the desired item may not be available by the time the final payment is made. Overall, a layaway plan can be a helpful option for disciplined buyers looking to manage their finances and avoid credit card debt.