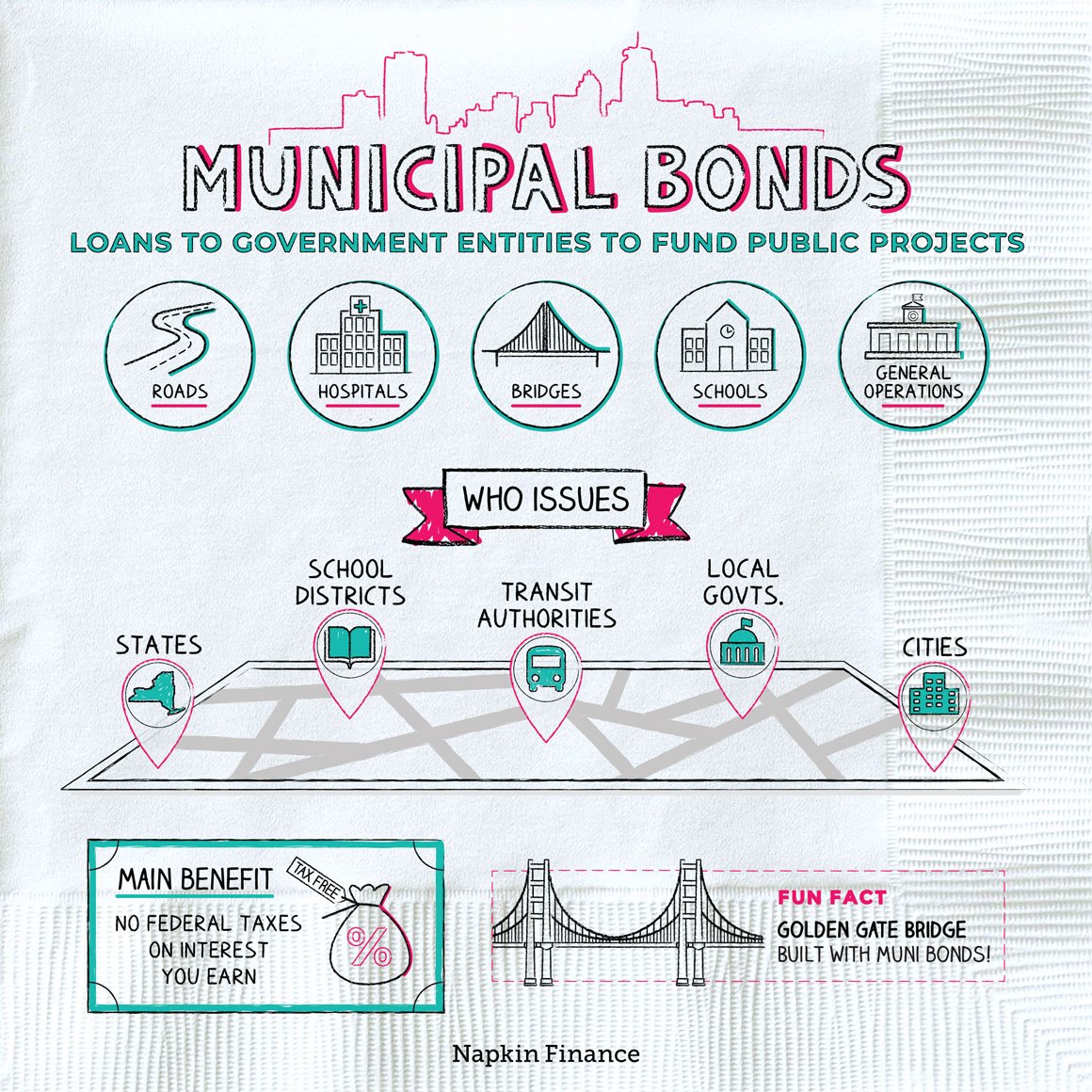

Are you wondering what a municipal bond is and how it can benefit you? Well, look no further! In this article, we will delve into the world of municipal bonds and uncover their numerous advantages. Municipal bonds, also known as munis, are debt securities issued by state and local governments to raise capital for public projects. These bonds offer attractive tax advantages and provide investors with a steady stream of income. So, if you are interested in mastering the art of municipal bonds and harnessing their potential, read on to discover why they might be just what you need to elevate your investment portfolio.

What is a Municipal Bond and Its Benefits

Municipal bonds, also known as munis, are debt securities issued by local governments, such as cities, counties, and states, as well as their agencies and authorities. These bonds are used to finance public projects such as building schools, improving infrastructure, and funding public utilities. Municipal bonds offer several benefits for both investors and the communities they serve. In this article, we will explore what municipal bonds are, how they work, and the advantages they offer.

Understanding Municipal Bonds

Municipal bonds are essentially loans made by investors to local governments. When investors purchase municipal bonds, they are lending money to the issuing entity, which agrees to pay them back with regular interest payments over a specified period of time. The interest payments are typically tax-exempt, making them an attractive investment option for individuals seeking tax advantages.

There are two main types of municipal bonds: general obligation (GO) bonds and revenue bonds.

- General Obligation (GO) Bonds: GO bonds are backed by the full faith and credit of the issuing government entity. This means that the government pledges to use its taxing powers to repay bondholders. In case of default, the government may raise taxes to honor its debt obligations. Due to the higher level of security, GO bonds tend to have lower interest rates.

- Revenue Bonds: Revenue bonds are secured by the revenue generated from specific projects funded by the bond issuance. This could include income from toll roads, bridges, airports, or utilities. The issuer pledges to use the revenue from these projects to repay the bondholders. Revenue bonds may offer higher interest rates compared to GO bonds, but they also carry a higher level of risk.

Benefits of Municipal Bonds

Municipal bonds offer several advantages for both investors and the communities they serve. Let’s take a closer look at the benefits of investing in municipal bonds:

1. Tax Advantages

One of the primary benefits of municipal bonds is their tax-exempt status. The interest income earned from most municipal bonds is generally exempt from federal income taxes. In addition, if you purchase bonds issued by the state in which you reside, the interest may also be exempt from state and local taxes. This tax advantage can make municipal bonds particularly attractive for high-net-worth individuals in higher tax brackets.

2. Diversification

Investing in municipal bonds can help diversify your investment portfolio. Municipal bonds are considered relatively low-risk investments compared to stocks and other higher-yielding securities. The stability and regular income provided by municipal bonds can help offset the volatility of other investments, potentially reducing overall portfolio risk.

3. Regular Income

Municipal bonds are known for their regular interest payments, which are typically made semi-annually or annually. This regular income stream can be particularly appealing for retirees or income-focused investors who rely on steady cash flow. The predictable nature of municipal bond income can help to meet ongoing financial obligations.

4. Capital Preservation

While no investment is entirely risk-free, municipal bonds are generally considered to be a relatively safe investment. The credit quality of municipal bonds is assessed by independent rating agencies, providing investors with insight into the issuer’s ability to meet its debt obligations. Municipal bonds with higher credit ratings are less likely to default, offering a measure of capital preservation.

5. Support Local Communities

Investing in municipal bonds allows individuals to contribute directly to the development and growth of their local communities. Municipal bonds fund vital infrastructure projects, such as roads, bridges, schools, and hospitals, which benefit the entire community. By investing in these bonds, individuals can help improve their local area while potentially earning a return on their investment.

6. Socially Responsible Investing

For individuals interested in socially responsible investing, municipal bonds can align with their values. Many municipal bonds finance projects focused on sustainability, renewable energy, affordable housing, or other socially beneficial initiatives. By investing in these bonds, individuals can support projects that have a positive impact on the environment and society.

7. Potential for Yield

Although municipal bonds are generally considered lower-risk investments, they can still offer attractive yields compared to other fixed-income options. The yield on municipal bonds is influenced by various factors, including the issuer’s creditworthiness, prevailing interest rates, and the length of the bond’s maturity. Investors willing to take on slightly more risk with revenue bonds may find higher yields compared to GO bonds.

Risks Associated with Municipal Bonds

While municipal bonds offer numerous benefits, it’s important to be aware of the potential risks involved. These risks include:

1. Credit Risk

There is always a risk that the issuing government entity may default on its debt obligations. Factors such as economic downturns, mismanagement, or poor fiscal policies can impact the issuer’s ability to repay bondholders. It’s crucial to research and assess the creditworthiness of the issuer before investing in municipal bonds.

2. Interest Rate Risk

Municipal bonds are sensitive to changes in interest rates. When interest rates rise, the market value of existing bonds generally declines. This is because newly issued bonds with higher interest rates become more attractive to investors, reducing the demand for existing lower-yielding bonds. Investors who sell their bonds before maturity may experience capital losses if they sell at a time when interest rates have increased.

3. Market Liquidity Risk

Municipal bonds can have lower trading volumes compared to more liquid investments such as stocks or corporate bonds. If an investor needs to sell their municipal bonds before maturity, they may face challenges finding buyers, especially for less popular or lower-rated bonds. This illiquidity can potentially impact the market value of the bonds and limit an investor’s ability to access their invested capital.

4. Legislative and Regulatory Risk

Changes in tax laws or regulations can impact the tax-exempt status of municipal bonds. Although relatively uncommon, there is a risk that future legislation or tax reforms could affect the tax advantages associated with municipal bonds. It’s essential to stay informed about any potential regulatory changes that could impact the after-tax return on investments.

Municipal bonds play a crucial role in financing the development and improvement of local communities. They offer investors an opportunity to generate income while contributing to the growth of their own neighborhoods. The tax advantages, diversification benefits, regular income, and potential for yield make municipal bonds an attractive investment option for individuals seeking stability, tax efficiency, and the chance to support their local area. However, investors should carefully consider the risks associated with municipal bonds and conduct thorough research before making any investment decisions.

The Tax Benefits of Municipal Bonds

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a municipal bond?

A municipal bond, often referred to as a muni bond, is a type of debt security issued by a state, city, or local government to finance public projects such as schools, roads, or hospitals. When investors purchase municipal bonds, they are essentially lending money to the government entity in return for regular interest payments and the return of the principal amount at maturity.

What are the benefits of investing in municipal bonds?

Investing in municipal bonds offers several benefits, including:

– Tax advantages: The interest earned from most municipal bonds is exempt from federal taxes. Additionally, if you invest in bonds issued by your own state or municipality, the interest may also be exempt from state and local taxes.

– Lower risk: Municipal bonds are generally considered less risky compared to other types of bonds due to the reliability of government entities in meeting their debt obligations.

– Regular income: Municipal bonds provide a steady stream of income through regular interest payments, which can be particularly attractive to income-focused investors.

– Diversification: Adding municipal bonds to your investment portfolio can help diversify your holdings and reduce overall risk.

Can individuals buy municipal bonds?

Yes, individual investors can buy municipal bonds. They are widely available for purchase through brokerage accounts, financial advisors, or directly from the issuing government entities.

Are municipal bonds suitable for all investors?

While municipal bonds offer several benefits, they may not be suitable for all investors. It is important to consider factors such as your investment goals, risk tolerance, and tax situation before investing in municipal bonds. Consulting with a financial advisor can help determine if they align with your overall investment strategy.

Are municipal bonds risk-free investments?

No, municipal bonds, like any investment, carry a certain level of risk. While they are generally considered lower-risk compared to other types of bonds, there are still risks involved, such as the possibility of default by the issuing government entity or changes in interest rates that could affect bond prices. It is important to thoroughly research and evaluate the creditworthiness of the issuer before investing.

How can I assess the creditworthiness of a municipal bond?

Creditworthiness of a municipal bond can be evaluated by reviewing credit ratings assigned by credit rating agencies such as Standard & Poor’s, Moody’s, or Fitch. These agencies assess the likelihood of timely interest and principal payments based on the issuer’s financial health, revenue sources, and economic conditions. Higher-rated bonds are generally considered less risky.

What is the minimum investment required for municipal bonds?

The minimum investment required for municipal bonds can vary depending on the specific bond and the issuer. Some bonds may have minimum denominations as low as $1,000, while others may require larger minimum investments. It is important to check the bond’s prospectus or consult with a financial advisor to determine the minimum investment requirement.

Can I sell my municipal bonds before maturity?

Yes, you can sell your municipal bonds before their maturity date. However, the market value of the bond may fluctuate depending on various factors such as changes in interest rates, credit quality, and overall market conditions. Selling before maturity may result in a gain or loss compared to the initial investment.

Final Thoughts

In conclusion, a municipal bond is a debt security issued by a local government to fund public projects such as infrastructure, schools, and hospitals. Municipal bonds offer several benefits. Firstly, they are generally exempt from federal taxes, making them attractive to investors seeking tax advantages. Additionally, municipal bonds often provide stable income streams with regular interest payments. They are also widely considered as relatively low-risk investments. By investing in municipal bonds, individuals can support their local communities while potentially earning attractive returns. So, what is a municipal bond and its benefits? Municipal bonds are an investment option that offers tax advantages, stable income, and the opportunity to contribute to local development.