Are you curious about what exactly a negative amortization loan is? If so, you’re in the right place! In this blog article, we’ll dive into the ins and outs of this type of loan and help you understand how it works. Negative amortization loans, also known as deferred interest loans, can be a bit complex to grasp, but fear not – we’re here to unravel the mystery for you. So, let’s jump right in and explore what a negative amortization loan truly means for borrowers like yourself.

What is a Negative Amortization Loan?

A negative amortization loan, also known as a deferred interest loan or an Option ARM (Adjustable Rate Mortgage), is a type of mortgage where the borrower has the option to make minimum monthly payments that are lower than the actual interest charged on the loan. This means that the loan balance could increase over time rather than decrease. Negative amortization loans were popular during the housing boom of the early 2000s but fell out of favor after the financial crisis.

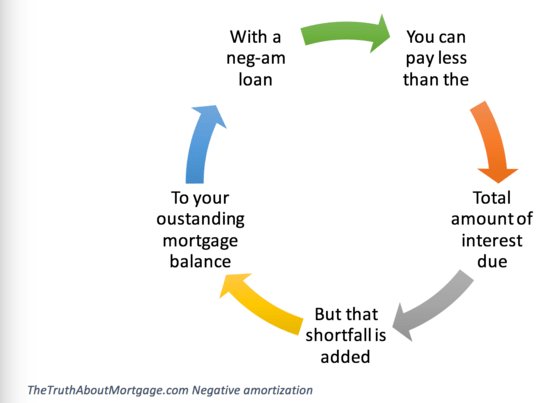

Negative amortization occurs when the monthly payment made by the borrower is insufficient to cover the interest accrued on the loan. The unpaid interest is then added to the principal balance, resulting in an increase in the overall loan amount. This can lead to a situation where the borrower owes more on the loan than they originally borrowed.

How Negative Amortization Loans Work

Negative amortization loans typically have a fixed period, during which the borrower can choose to make minimum payments that don’t cover the full interest due. These minimum payments are usually set artificially low to make them more affordable in the short term. However, they can result in a substantial increase in the loan balance over time.

After the initial fixed period, the loan typically transitions to an adjustable-rate mortgage, where the interest rate can fluctuate based on market conditions. At this point, the borrower may be required to make fully amortizing payments that cover both the principal and the interest. The transition to the adjustable-rate period often triggers higher monthly payments, as the interest rate may increase and any deferred interest is added to the loan balance.

The Pros and Cons of Negative Amortization Loans

Like any financial product, negative amortization loans have their advantages and disadvantages. It’s essential for borrowers to understand these pros and cons before considering this type of loan.

Pros of Negative Amortization Loans

- Lower initial payments: The minimum payments during the fixed period can be significantly lower than the payments required for a fully amortizing loan. This can make it more affordable for borrowers, especially if they anticipate an increase in income in the future.

- Cash flow flexibility: Negative amortization loans can provide borrowers with increased cash flow in the short term, allowing them to allocate funds to other financial goals or investments.

- Lower credit requirements: Some negative amortization loans may have more lenient credit requirements, making them accessible to borrowers who may not qualify for traditional mortgages.

Cons of Negative Amortization Loans

- Increasing loan balance: One of the significant drawbacks of negative amortization loans is that the loan balance can grow over time. This means borrowers could end up owing more than they initially borrowed, which can significantly impact their equity and ability to refinance or sell the property.

- Higher future payments: Once the loan transitions to the adjustable-rate period, borrowers may face significantly higher monthly payments as deferred interest is added to the loan balance and the interest rate potentially increases.

- Potential financial strain: If the borrower’s income does not increase as anticipated, the higher payments during the adjustable-rate period can put a strain on their financial situation.

- Limited loan options: Negative amortization loans have become less common in the aftermath of the financial crisis. As a result, borrowers may find it more challenging to obtain this type of loan compared to traditional fixed-rate or adjustable-rate mortgages.

When to Consider a Negative Amortization Loan

Negative amortization loans may be suitable for certain borrowers in specific situations. However, they require careful consideration and should not be taken lightly. Here are some scenarios in which a negative amortization loan might be worth considering:

Low initial payment requirements

If you’re confident that your income will increase in the future or your financial situation is temporary, the low initial payments of a negative amortization loan can provide short-term relief.

Short-term investment opportunities

If you have access to short-term investment opportunities with high potential returns, you may prefer to use your available cash flow for those investments instead of making larger mortgage payments.

Short-term cash flow constraints

If you’re experiencing temporary cash flow constraints, such as starting a new business or going back to school, a negative amortization loan could help you manage your finances until your situation improves.

It’s crucial to consult with a trusted financial advisor or mortgage professional before deciding if a negative amortization loan is the right choice for your specific circumstances. They can help you evaluate the risks and benefits and determine if there are alternative mortgage options that better suit your needs.

In conclusion, a negative amortization loan is a type of mortgage where borrowers have the option to make minimum monthly payments that don’t cover the full interest due. This can result in an increasing loan balance over time. While negative amortization loans can provide short-term affordability and cash flow flexibility, they come with risks, such as a higher future payment obligation and potential strain on your financial situation. It’s essential to carefully evaluate your circumstances and consult with a financial professional before considering this type of mortgage.

What is a Negative Amortization Loan?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a negative amortization loan?

A negative amortization loan is a type of loan where the monthly payments are not enough to cover the interest due. As a result, the unpaid interest is added to the loan balance, leading to an increase in the overall loan amount over time.

How does a negative amortization loan work?

In a negative amortization loan, the borrower pays less than the interest accrued each month. The unpaid interest is then added to the outstanding loan balance. As a result, the loan balance grows over time instead of decreasing.

What are the advantages of a negative amortization loan?

Negative amortization loans may initially offer lower monthly payments, making them more affordable for some borrowers. They can be useful for individuals facing temporary financial difficulties or those with irregular income.

What are the risks of a negative amortization loan?

Negative amortization loans come with significant risks. As the loan balance increases, borrowers may face considerable challenges in repaying the loan, especially if the property’s value decreases. Additionally, the loan balance may eventually reach a preset limit, triggering a payment increase or even leading to foreclosure.

Who benefits from a negative amortization loan?

Negative amortization loans may benefit borrowers who expect their income to increase substantially in the future or those who plan to sell or refinance the property before the loan balance becomes unmanageable. However, it is crucial to carefully consider the risks and consult with a financial advisor before opting for this type of loan.

How can I avoid negative amortization?

To avoid negative amortization, it is best to make payments that cover the full interest due each month. If possible, paying more than the minimum amount required can help reduce the loan balance and prevent negative amortization.

Can negative amortization loans be refinanced?

In some cases, negative amortization loans can be refinanced to convert them into traditional loans with fixed monthly payments. Refinancing may be a viable option if the borrower’s financial situation improves or if market conditions are favorable.

Are negative amortization loans common?

Negative amortization loans were more prevalent before the financial crisis of 2008. Since then, regulations have tightened, and these loans are less common. However, it’s essential to stay informed about the loan terms before signing any agreements with lenders.

Final Thoughts

A negative amortization loan refers to a type of loan where the borrower’s monthly payments are not sufficient to cover the interest charges, resulting in the unpaid interest being added to the loan balance. This can lead to a growing balance over time rather than a reduction. Negative amortization loans can be risky for borrowers as they may end up owing more than they initially borrowed. It is crucial for borrowers to fully understand the implications and potential risks associated with negative amortization loans.