Private equity funds are investment vehicles that pool capital from high-net-worth individuals and institutional investors to acquire equity stakes in private companies. Essentially, they serve as a way for investors to participate in the growth and success of these companies. The structure of a private equity fund typically includes a general partner (GP) who manages the fund’s operations and limited partners (LPs) who provide the capital. With a clear understanding of what a private equity fund is and its structure, let’s delve into the intricacies that make it an appealing investment option.

What is a Private Equity Fund and Its Structure

Private equity funds have become increasingly popular in recent years as a way for investors to access high-growth companies and potentially earn substantial returns. In this article, we will explore what a private equity fund is, how it is structured, and the key components that make up its framework.

Definition of a Private Equity Fund

A private equity fund is an investment vehicle that pools money from various investors to acquire ownership stakes in private companies or take control of publicly traded companies and convert them into private ones. These funds are typically managed by private equity firms, which are specialized investment firms with expertise in identifying, evaluating, and managing investments in private companies.

Objective of a Private Equity Fund

The primary objective of a private equity fund is to generate attractive returns for its investors. This is achieved by investing in companies that have the potential for significant growth or by acquiring undervalued companies and implementing strategic initiatives to enhance their value. Private equity funds often adopt a long-term investment approach, allowing them to work closely with portfolio companies and actively participate in their management and operations.

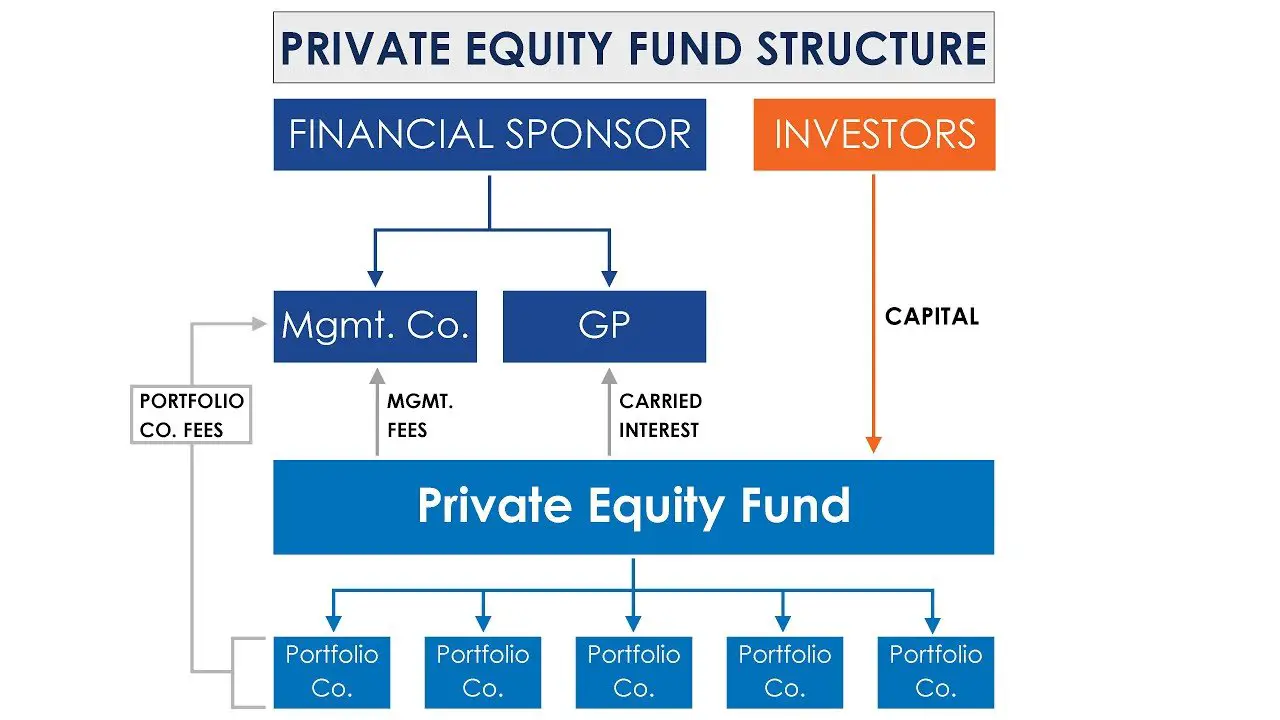

Structure of a Private Equity Fund

To understand the structure of a private equity fund, let’s break it down into its key components:

Limited Partners (LPs)

Limited partners are the investors in a private equity fund. They include institutional investors such as pension funds, endowments, and insurance companies, as well as high-net-worth individuals. Limited partners provide the majority of the capital for the fund and have limited liability, meaning their losses are typically limited to the amount they have invested.

General Partners (GPs)

General partners are the fund managers and are responsible for sourcing investment opportunities, making investment decisions, and managing the day-to-day operations of the fund. They also contribute a certain percentage of the fund’s capital, known as the general partner commitment, which aligns their interests with the limited partners. General partners typically receive a management fee based on the total value of the fund’s assets and a share of the profits, known as carried interest, once investors have received their initial capital back.

Fund Structure

Private equity funds operate under a limited partnership structure. The fund is set up as a legal entity, typically a limited partnership or a limited liability company (LLC), with the general partner serving as the fund’s manager. Limited partners enter into a partnership agreement or an operating agreement with the general partner, which outlines the terms and conditions of their investment in the fund.

Investment Period

Private equity funds have a defined investment period during which they actively deploy capital into investments. This period is typically around three to five years but varies depending on the fund’s strategy and industry focus. During the investment period, the general partner identifies investment opportunities, conducts due diligence, negotiates deal terms, and makes investments on behalf of the fund.

Portfolio Companies

The capital raised by a private equity fund is used to acquire ownership stakes in portfolio companies. These are often companies with significant growth potential, distressed companies that need restructuring, or publicly traded companies that can be taken private. The general partner focuses on identifying companies that align with the fund’s investment strategy and have the potential to generate attractive returns.

Value Creation

Private equity funds actively work with their portfolio companies to create value. This involves implementing operational improvements, strategic initiatives, and financial restructuring to enhance the company’s performance and increase its value. The general partner often appoints a team of professionals, including industry experts and operational specialists, to work closely with the portfolio companies and execute value-creation strategies.

Exit Strategy

Private equity funds typically have a targeted holding period for their investments, typically ranging from three to seven years. Once the portfolio company has achieved its growth targets or reached a point where it can be sold at a substantial profit, the fund will exit its investment. Common exit strategies include selling the company to a strategic buyer, conducting an initial public offering (IPO), or merging it with another company.

In conclusion, a private equity fund is an investment vehicle that allows investors to access high-growth companies and potentially earn substantial returns. Its structure includes limited partners who provide capital, general partners who manage the fund, a legal entity as the fund’s structure, an investment period for deploying capital, portfolio companies where investments are made, value creation through active management, and an exit strategy to realize profits. Private equity funds have become an integral part of the investment landscape, attracting investors seeking the potential for superior returns through strategic investments in private companies.

Private Equity Fund Structure

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a private equity fund and how is it structured?

A private equity fund is a type of investment fund that pools money from investors to make private equity investments in various companies. The fund is structured as a limited partnership, with a general partner (GP) and limited partners (LPs). The GP manages the fund’s investments, while the LPs provide the capital.

How does a private equity fund raise capital?

A private equity fund raises capital by soliciting investments from various institutional investors, such as pension funds, endowments, and high-net-worth individuals. The fund’s GP typically sets a target amount to raise and presents the investment opportunity to potential LPs, who then commit capital to the fund.

What are the different stages of a private equity fund’s life cycle?

A private equity fund typically goes through four stages in its life cycle: fundraising, investment, management, and exit. During the fundraising stage, the fund raises capital from LPs. In the investment stage, the fund deploys the capital by acquiring equity stakes in companies. The management stage involves actively managing the portfolio companies to improve their performance and ultimately generate returns. The exit stage involves selling the fund’s investments and distributing profits to the LPs.

What is the role of the general partner (GP) in a private equity fund?

The general partner (GP) is responsible for managing the private equity fund’s investments and operations. They identify potential investment opportunities, conduct due diligence, negotiate deals, and provide strategic guidance to the portfolio companies. The GP also acts as the liaison between the fund and the limited partners (LPs).

How do limited partners (LPs) benefit from investing in a private equity fund?

Limited partners (LPs) benefit from investing in a private equity fund through the potential for high returns. Private equity investments often outperform traditional public market investments over the long term. Additionally, LPs gain access to a diversified portfolio of private companies that may not be available to individual investors.

What types of companies do private equity funds invest in?

Private equity funds invest in a wide range of companies across various industries and stages of development. They may target startups, growth-stage companies, or mature businesses in need of restructuring or expansion. Private equity funds typically focus on companies with significant growth potential and the potential for increased profitability.

How are private equity fund managers compensated?

Private equity fund managers are typically compensated through a combination of management fees and carried interest. The management fees are a percentage of the fund’s committed capital and cover the operating expenses of the fund. Carried interest is a share of the profits generated by the fund’s investments and is distributed to the GP once the LPs have received their initial capital and a predetermined rate of return.

What risks are associated with investing in private equity funds?

Investing in private equity funds carries certain risks. These include the illiquidity of investments, as the capital is typically locked up for a specified period. There is also the risk of the fund’s investments not performing as expected, resulting in lower returns or even losses. Additionally, private equity investments are subject to market and economic risks, as well as regulatory and legal risks.

Final Thoughts

A private equity fund is an investment vehicle that pools money from various investors to acquire ownership stakes in private companies. It operates by raising capital from limited partners and then using that capital to make investments in companies with growth potential. These funds are typically managed by private equity firms, who play a crucial role in sourcing and evaluating investment opportunities, managing portfolio companies, and ultimately generating returns for their investors. Private equity funds have a hierarchical structure that includes general partners, limited partners, and portfolio companies. General partners are responsible for investment decision-making, while limited partners provide the majority of the capital. Portfolio companies are the actual businesses in which the fund invests. Overall, private equity funds offer a unique investment strategy for investors looking to actively participate in the growth and success of private companies.