Looking to invest? Curious about private placements? In a nutshell, a private placement in investing refers to the sale of securities directly to a select group of investors, rather than through a public offering. It’s a unique avenue that offers opportunities for both the investor and the issuing company. But what exactly is a private placement in investing, and how does it work? Let’s dive right in and explore this intriguing investment strategy, its benefits, and some key considerations to keep in mind. So, if you’ve been wondering what is a private placement in investing, you’ve come to the right place. Let’s uncover the details together.

What is a Private Placement in Investing?

Private placement in investing refers to the process of offering securities, such as stocks or bonds, to a select group of private investors rather than making a public offering. It provides an alternative method for companies to raise capital outside of traditional public markets, allowing them to access funds from wealthy individuals, institutions, or accredited investors.

Private placements are typically conducted by companies that are not yet ready to go public or do not meet the requirements for a public offering. These offerings are governed by regulations set forth by securities laws, which aim to protect investors and ensure transparency in the process.

Private placements can offer various benefits to both companies and investors. For companies, private placements provide a streamlined and efficient way to raise capital without the extensive regulatory requirements associated with public offerings. For investors, private placements can provide unique investment opportunities, potentially offering higher returns compared to publicly traded securities.

Types of Private Placements

Private placements can take different forms and structures depending on the specific needs and goals of the company and the investors involved. Here are some common types of private placements:

- Equity Placements: Equity placements involve the issuance of company shares in exchange for investment capital. This type of private placement allows investors to acquire ownership stakes in the company. Equity placements are often used by early-stage startups or companies looking to expand and require additional funding.

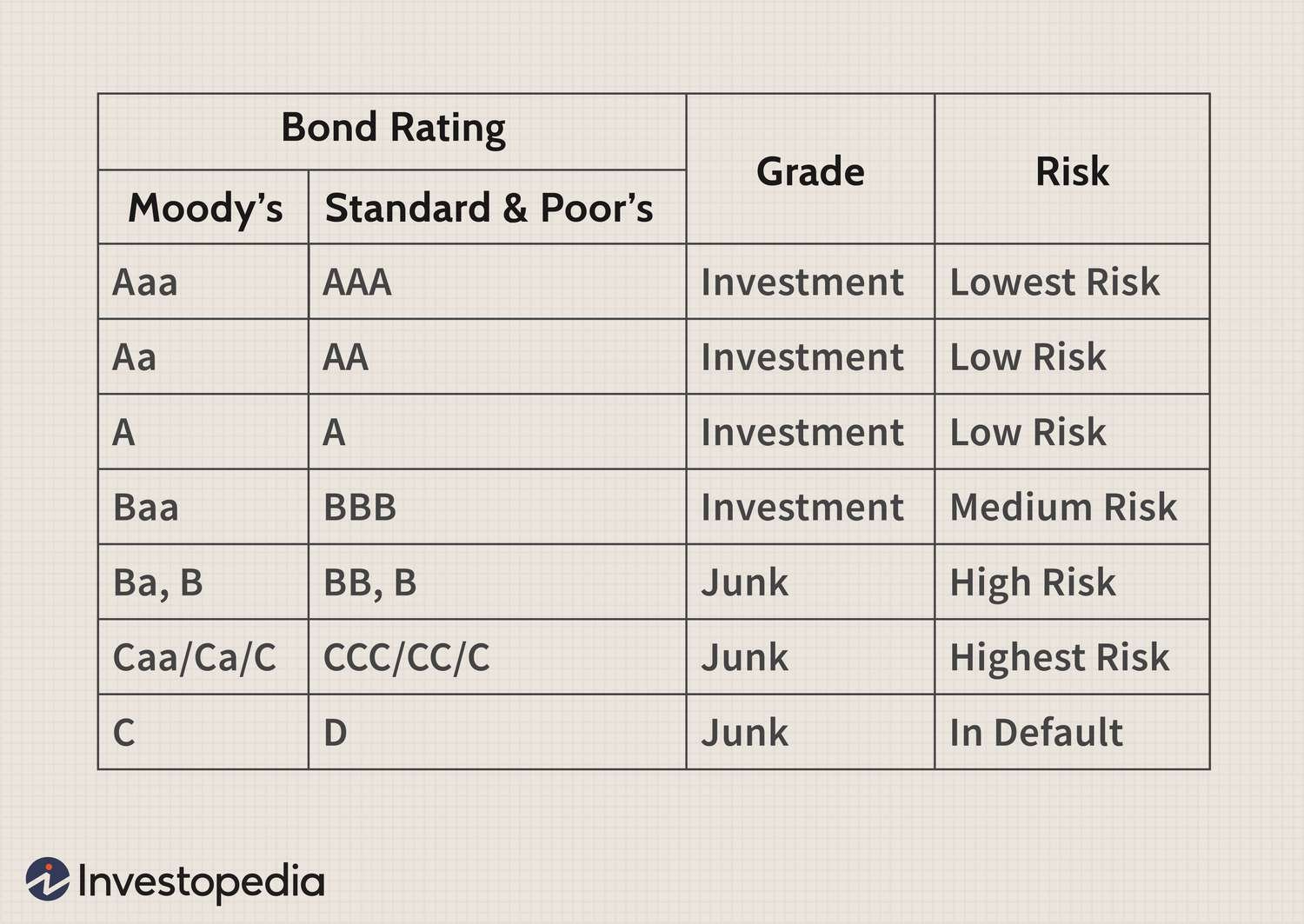

- Debt Placements: Debt placements involve the issuance of debt securities, such as bonds or promissory notes, to investors. Companies in need of funding but prefer not to dilute their ownership may opt for debt placements. Investors receive regular interest payments and the return of their principal at maturity.

- Convertible Placements: Convertible placements combine features of both equity and debt. They involve the issuance of convertible securities, such as convertible notes or preferred stock, which can be converted into equity shares at a later date. This type of private placement provides flexibility for investors to choose between debt or equity investment based on future outcomes.

Advantages of Private Placements

Private placements offer several advantages for both companies and investors. Here are some key benefits:

- Faster Access to Capital: Unlike public offerings that involve complex regulatory requirements, private placements can be completed more quickly, allowing companies to access capital when they need it most.

- Flexibility in Structure: Private placements offer flexibility in structuring deals, allowing companies to negotiate terms directly with investors. This flexibility can be beneficial in tailoring specific investment arrangements to meet the needs of both parties involved.

- Access to Sophisticated Investors: Private placements attract sophisticated and accredited investors who may bring valuable expertise, networks, and resources to the company. These investors often provide more than just capital; they can become strategic partners or advisors.

- Lower Costs: Private placements can be more cost-effective compared to public offerings, as they involve fewer regulatory requirements and do not require extensive marketing or underwriting fees.

- Less Market Volatility: Companies opting for private placements can avoid the market volatility associated with public offerings. This allows them to focus on long-term growth strategies instead of meeting short-term market expectations.

Legal Considerations and Regulatory Requirements

While private placements offer advantages, they are subject to various legal considerations and regulatory requirements to ensure investor protection and market integrity. Here are some key points to consider:

- Accredited Investors: Private placements typically involve accredited investors, who are individuals or entities that meet certain income or net worth criteria. Companies must verify the accreditation of these investors to comply with regulations.

- Private Placement Memorandum (PPM): Companies issuing private placements usually provide a PPM, which contains detailed information about the offering, the company’s financials, risks involved, and other relevant disclosures. Investors should carefully review the PPM before making investment decisions.

- Regulation D and Exemptions: In the United States, private placements are commonly conducted under various exemptions provided by Regulation D of the Securities Act of 1933. These exemptions regulate the offering process, investor qualifications, and restrictions on general solicitation or advertising.

- State Blue Sky Laws: In addition to federal regulations, companies must also comply with state securities laws known as Blue Sky Laws. These laws vary by state and may impose additional requirements or limitations on private placements.

- Ongoing Reporting: Depending on the securities issued and the jurisdiction, companies may be required to file ongoing reports with regulatory authorities, providing updates on financials, business operations, and other material events.

Risks and Considerations for Investors

While private placements can offer unique investment opportunities, it’s important for investors to be aware of the potential risks and considerations involved. Here are some points to consider:

- Limited Liquidity: Private placements are generally illiquid investments, meaning it can be difficult to sell or exit the investment before the agreed-upon term.

- Higher Risk Profile: Private placements often involve early-stage companies or those with limited operating histories, which inherently carry higher risks compared to more established companies.

- Lack of Transparency: Private placements may not have the same level of regulatory oversight or public disclosure requirements as publicly traded securities. Investors should conduct thorough due diligence and seek professional advice to mitigate risks.

- Investment Amounts: Private placements may have minimum investment requirements, which can be higher compared to publicly traded securities. Investors should carefully evaluate their financial situation and risk tolerance before committing significant capital.

- No Secondary Market: Unlike publicly traded securities, private placements generally do not have a secondary market. Investors should be prepared to hold their investments until exit opportunities arise, such as an eventual acquisition or initial public offering (IPO).

In conclusion, private placements provide a valuable avenue for companies to raise capital and for investors to access unique investment opportunities. While they offer advantages such as faster access to capital, flexibility in structure, and access to sophisticated investors, it’s crucial for both companies and investors to navigate the legal and regulatory landscape and carefully evaluate the risks involved. By understanding the nature of private placements and conducting thorough due diligence, investors can make informed investment decisions and potentially benefit from the growth and success of private companies.

the Basics of Private Placements

Frequently Asked Questions

What is a private placement in investing?

A private placement in investing refers to the sale of securities directly to a select group of investors, such as institutions, accredited individuals, or venture capital firms, rather than through a public offering. It is a way for companies to raise capital without going through the traditional public markets.

Who can participate in private placements?

Private placements are typically open to institutional investors, high-net-worth individuals, and venture capital firms. These investors often have access to more capital and are willing to take on higher levels of risk than the general public.

What types of securities are offered in private placements?

Private placements can involve various types of securities, such as stocks, bonds, convertible notes, or warrants. The specific type of security offered depends on the needs and goals of the company raising capital.

What are the advantages of participating in a private placement?

Participating in a private placement can provide investors with the opportunity to invest in companies at an early stage, potentially offering higher returns compared to public investments. Additionally, private placements may offer certain tax advantages and the ability to negotiate favorable terms.

Are there any risks associated with private placements?

Yes, private placements come with certain risks. These investments are typically less liquid, meaning it can be more challenging to sell securities before maturity. Additionally, private companies may present a higher risk of failure compared to established public companies.

How can I find private placement opportunities?

Private placement opportunities can be found through various channels, including investment banks, venture capital firms, private equity networks, and online platforms that connect investors with companies seeking capital.

What should I consider before participating in a private placement?

Before participating in a private placement, it’s important to carefully evaluate the company’s business model, management team, financial projections, and risk factors. Conducting thorough due diligence can help investors make informed decisions.

Is there a minimum investment requirement for private placements?

Private placements often have a minimum investment requirement, which can vary depending on the company and the type of securities being offered. It is essential to review the offering documents and consult with a financial advisor to understand the investment terms.

Can I sell my private placement securities before maturity?

Selling private placement securities before maturity can be challenging due to their limited liquidity. Investors should carefully consider their investment horizon and be prepared to hold the securities until maturity or until there is a secondary market for resale.

Final Thoughts

In conclusion, a private placement in investing refers to the sale of securities to private investors, rather than to the general public. It is a way for companies to raise capital without going through the traditional public offering process. Private placements offer various advantages, such as flexibility in structuring the deal, access to capital from sophisticated investors, and reduced regulatory requirements. However, they also have limitations, such as limited liquidity and the need to comply with securities laws. Overall, understanding what is a private placement in investing is crucial for both companies seeking funding and investors looking for alternative investment opportunities.