A revolving credit account is a financial tool that allows you to borrow funds up to a predetermined credit limit, repay the borrowed amount, and then borrow again. It offers flexibility and convenience, making it a popular choice for many individuals and businesses. With a revolving credit account, you have the freedom to use the funds whenever you need them, without having to apply for a new loan each time. In this article, we will delve deeper into what a revolving credit account entails and explore its benefits and considerations. So, let’s get started and demystify the concept of a revolving credit account!

What is a Revolving Credit Account?

A revolving credit account is a type of credit account that allows you to borrow money up to a predetermined credit limit. Unlike installment loans where you receive a lump sum of money and make fixed monthly payments, revolving credit accounts give you the flexibility to borrow and repay as needed, within the credit limit. This type of credit account is commonly associated with credit cards, lines of credit, and home equity lines of credit (HELOCs).

How Does a Revolving Credit Account Work?

When you open a revolving credit account, the lender assigns you a credit limit, which is the maximum amount you can borrow. You can make purchases or cash advances up to this limit, and the available credit replenishes as you repay the borrowed amount. With a revolving credit account, you have the flexibility to borrow and repay repeatedly, as long as you stay within your credit limit.

Each month, the lender will provide you with a statement that lists your purchases, payments made, and the outstanding balance. If you make a minimum payment, the remaining balance carries over to the next billing cycle. However, if you pay your balance in full, you won’t be charged interest on the borrowed amount.

Unlike installment loans, revolving credit accounts don’t have a fixed repayment term. You can take as long as you want to repay the borrowed amount, but keep in mind that interest will accrue on the outstanding balance until it is fully paid off.

Types of Revolving Credit Accounts

Revolving credit accounts come in various forms, each with its own features and benefits. Here are some common types:

Credit Cards:

Credit cards are a popular form of revolving credit. They allow you to make purchases up to your credit limit, and you can choose to pay the balance in full or make minimum payments. Credit cards often come with additional perks such as rewards programs, cash back, or travel benefits.

Lines of Credit:

A line of credit is a flexible borrowing option offered by lenders, such as banks or credit unions. It gives you access to a predetermined amount of money that can be used for various purposes. You can withdraw funds from the line of credit as needed, and you’ll only pay interest on the amount borrowed.

Home Equity Lines of Credit (HELOCs):

HELOCs are revolving credit accounts secured by your home’s equity. They allow you to borrow against the value of your home and use the funds for any purpose. Similar to other revolving credit accounts, you can repeatedly borrow and repay within the credit limit. The interest rates for HELOCs are typically lower compared to other forms of credit.

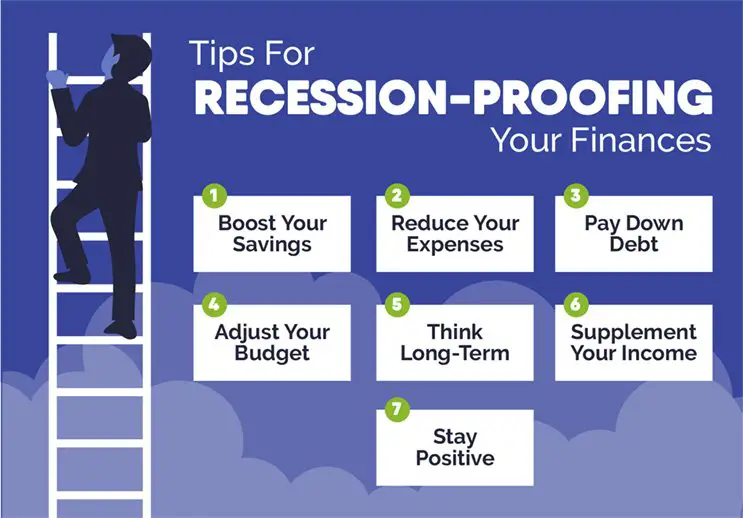

Advantages of Revolving Credit Accounts

Revolving credit accounts offer several advantages that make them a popular choice among borrowers. Here are some benefits:

Flexibility:

- Revolving credit accounts provide flexibility in terms of borrowing and repayment. You can borrow and repay repeatedly within your credit limit, allowing you to address changing financial needs.

- Unlike installment loans that require fixed payments over a specific period, revolving credit accounts give you control over your payment amounts as long as you make at least the minimum payment.

Convenience:

- With a credit card or line of credit, you have access to funds whenever you need them. This convenience can be especially helpful in emergencies or when unexpected expenses arise.

- Revolving credit accounts often come with online and mobile banking features, making it easy to track your spending, make payments, and manage your account.

Build Credit:

Using a revolving credit account responsibly and making timely payments can help you build a positive credit history. Lenders report your account activity to credit bureaus, and a good credit history can improve your credit score over time.

Disadvantages of Revolving Credit Accounts

While revolving credit accounts offer flexibility, they also come with some disadvantages. Here are a few drawbacks to consider:

High-Interest Rates:

Revolving credit accounts often have higher interest rates compared to installment loans or other forms of credit. If you carry a balance from month to month, the interest charges can accumulate quickly, potentially leading to significant debt.

Temptation to Overspend:

Having access to revolving credit can make it easy to overspend and accumulate debt. The flexibility to borrow repeatedly without immediate consequences may lead to impulsive buying decisions and financial stress in the long run.

Credit Score Impact:

Excessive borrowing or late payments on revolving credit accounts can negatively impact your credit score. A high credit utilization ratio, which is the percentage of your available credit that you’re using, can lower your credit score and make it harder to qualify for future credit.

Revolving credit accounts offer flexibility and convenience for borrowers, allowing them to borrow and repay repeatedly within a credit limit. Whether it’s a credit card, line of credit, or a home equity line of credit, understanding how these accounts work can help you make informed financial decisions. While they offer advantages such as flexibility and convenience, it’s important to use them responsibly to avoid excessive debt and maintain a positive credit history.

What Is a Revolving Credit Account? | Experian Credit 101 Express

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a revolving credit account?

A revolving credit account is a type of credit arrangement that allows borrowers to borrow money up to a specific credit limit. Once the borrowed amount is repaid, the credit becomes available again, enabling borrowers to use it repeatedly.

How does a revolving credit account work?

A revolving credit account works by providing borrowers with a predetermined credit limit, which they can access as needed. Borrowers can make purchases or withdraw cash up to this limit. The account holder must make regular payments to reduce the outstanding balance, and any repaid amount becomes available credit for future use.

What are the advantages of a revolving credit account?

– Flexibility: With a revolving credit account, borrowers have the freedom to access funds when they need them.

– Convenience: Borrowers can use the account for various expenses without needing to reapply for credit each time.

– Interest on the used amount: Interest is only charged on the amount borrowed, not on the entire credit limit.

– Build credit history: Consistently repaying the revolving credit account can help improve an individual’s credit score.

Are there any drawbacks to having a revolving credit account?

While revolving credit accounts offer flexibility, there are a few drawbacks to consider:

– High-interest rates: If not managed properly, the interest rates on revolving credit accounts can be relatively high compared to other forms of credit.

– Temptation to overspend: The availability of credit may lead some individuals to spend beyond their means.

– Minimum payment trap: Making only the minimum required payment each month can result in long-term debt and increased interest charges.

How is a revolving credit account different from a traditional loan?

Unlike a traditional loan, a revolving credit account does not have a fixed term or monthly repayment amount. Borrowers have the freedom to borrow and repay multiple times within the credit limit, while a traditional loan provides a lump sum amount with a fixed repayment schedule.

Can anyone qualify for a revolving credit account?

Qualification criteria for a revolving credit account may vary among lenders. Factors such as credit history, income, and existing debt are typically taken into account when determining eligibility. It is advisable to check with the specific lender for their qualification requirements.

How does a revolving credit account affect credit score?

A revolving credit account can impact credit score positively or negatively depending on its management. Making timely payments and keeping credit utilization low can help improve or maintain a good credit score. On the other hand, late payments, high balances, or maxing out the credit limit can have a negative impact.

Can a revolving credit account be closed?

Yes, a revolving credit account can be closed. The closure may impact the credit score since it reduces the overall available credit limit. It is important to repay any outstanding balance and inform the lender about the intention to close the account.

Final Thoughts

A revolving credit account is a versatile financial tool that allows individuals to borrow and repay funds flexibly within a predetermined credit limit. With this type of account, borrowers have the freedom to use funds, repay them, and borrow again, as long as they stay within their credit limit. This can be a useful option for managing ongoing expenses, unexpected costs, or as a means to build credit history. By understanding what a revolving credit account is and how it works, individuals can make informed financial decisions that suit their needs and goals.