A simple interest loan is a straightforward borrowing option that offers a solution for those seeking quick and hassle-free financing. In simple terms, it is a loan where interest is calculated only on the principal amount borrowed, without any additional charges or fees. So, what exactly is a simple interest loan? It’s a type of loan that keeps things uncomplicated, ensuring that borrowers can easily understand and manage their repayment obligations. Let’s delve deeper into the concept of simple interest loans and explore how they can benefit individuals in various financial situations.

What is a Simple Interest Loan?

A simple interest loan is a type of loan where the interest is calculated solely on the principal balance. Unlike compound interest loans, which accumulate interest on both the principal and any previously accrued interest, simple interest loans only charge interest on the initial amount borrowed.

Simple interest loans are commonly used for personal loans, auto loans, and other forms of consumer credit. Understanding how they work can help borrowers make informed financial decisions and manage their debt effectively.

How Does a Simple Interest Loan Work?

When you take out a simple interest loan, you agree to repay the principal amount borrowed along with the accumulated interest over a specific period. The interest charged is calculated based on a daily, monthly, or annual rate, and it accrues over the loan term.

Here’s a step-by-step breakdown of how a simple interest loan works:

- You borrow a specific amount of money from a lender, which becomes the principal balance.

- The lender applies an agreed-upon interest rate to the principal balance.

- The interest on the loan is calculated based on the duration of the loan term.

- You make regular payments, typically monthly, to repay the loan.

- Each payment covers a portion of the principal balance and the accrued interest.

- As you make payments, the outstanding balance decreases, resulting in less interest being charged over time.

- Once you have repaid the principal balance and the accumulated interest, the loan is considered fully paid off.

Example:

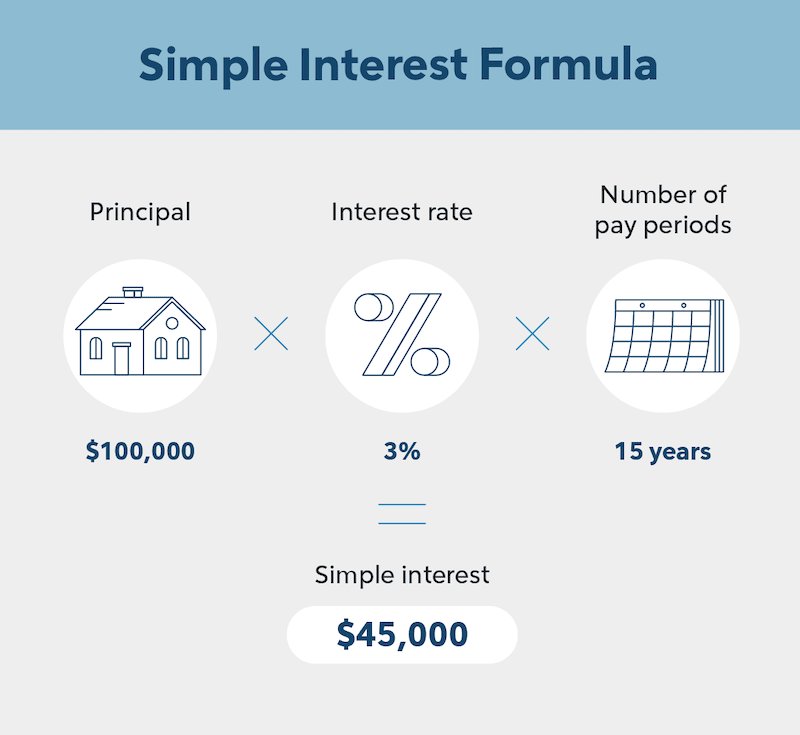

Let’s say you borrow $10,000 at an interest rate of 5% annually for a five-year term. Using the simple interest formula, the total interest to be paid can be calculated as:

Interest = (Principal) x (Interest Rate) x (Time)

Interest = $10,000 x 0.05 x 5 = $2,500

Therefore, over the five-year term, you would pay $12,500 in total, including both the principal and the interest.

Advantages of Simple Interest Loans

Simple interest loans offer several advantages for borrowers:

- Transparency: With simple interest loans, it’s easy to understand how the interest is calculated, making it simpler to budget for loan repayments.

- Lower overall interest costs: Since simple interest loans only charge interest on the principal balance, borrowers can save money on interest compared to compound interest loans.

- Flexible repayment options: Many simple interest loans allow borrowers to make additional payments or pay off the loan early without incurring prepayment penalties.

- Quick repayment: As the principal balance decreases with each payment, the overall interest accrued decreases as well, allowing borrowers to pay off the loan faster.

Disadvantages of Simple Interest Loans

While simple interest loans have their benefits, they also come with a few drawbacks:

- Higher monthly payments: Simple interest loans often require higher monthly payments compared to loans with longer repayment terms, which can put a strain on a borrower’s budget.

- Less time to repay: Due to the higher monthly payments, the loan term for simple interest loans is typically shorter, which may not suit everyone’s financial situation.

- No interest rate reductions: Unlike some other loan types, such as adjustable-rate mortgages, simple interest loans do not offer the opportunity for interest rate reductions over time.

How to Calculate Simple Interest

Calculating the interest on a simple interest loan is straightforward. The formula for calculating simple interest is:

Interest = (Principal) x (Interest Rate) x (Time)

Where:

- Principal: The initial amount borrowed.

- Interest Rate: The annual interest rate expressed as a decimal.

- Time: The duration of the loan in years.

Let’s illustrate this with an example:

You borrow $5,000 at an interest rate of 6% per year for a two-year term. Plugging the values into the formula:

Interest = $5,000 x 0.06 x 2 = $600

In this case, the total interest paid would be $600 over the two-year term.

Simple Interest Loan vs. Compound Interest Loan

Understanding the difference between simple interest loans and compound interest loans is essential when deciding which type of loan is most suitable for your needs.

In a simple interest loan, interest is calculated only on the principal balance, while in a compound interest loan, interest is calculated on both the principal and any previously accrued interest.

Here are some key differences between the two:

| Simple Interest Loan | Compound Interest Loan | |

|---|---|---|

| Interest Calculation | Only on the principal balance | On the principal and previously accrued interest |

| Interest Cost | Lower | Higher |

| Repayment Amount | Principal + Interest | Principal + Accumulated Compound Interest |

| Flexibility | Allows additional payments without penalty | May have prepayment penalties |

| Time to Repay | Shorter loan term | Longer loan term |

When choosing between a simple interest loan and a compound interest loan, consider factors such as your financial goals, repayment ability, and overall interest cost.

A simple interest loan is a straightforward way to borrow money, with interest calculated only on the initial amount borrowed. These loans offer transparency, lower overall interest costs, and flexible repayment options. However, they may come with higher monthly payments and shorter repayment terms. Understanding the differences between simple interest loans and compound interest loans can help borrowers make informed decisions and choose the loan that best suits their needs.

What Is A Simple Interest Loan? | Capital One

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a simple interest loan?

A simple interest loan is a type of loan where interest is calculated on the principal amount only. It does not compound or accrue interest on previously earned interest. The interest on a simple interest loan is calculated based on the original loan amount and the agreed-upon interest rate.

How does a simple interest loan work?

A simple interest loan works by charging interest on the principal amount borrowed. The borrower pays both principal and interest throughout the loan term. As the loan is repaid, the interest portion decreases over time, while the principal amount gradually reduces.

What is the formula for calculating simple interest on a loan?

The formula for calculating simple interest on a loan is: Interest = Principal x Interest Rate x Time. This formula multiplies the principal by the interest rate and the time period to determine the total interest amount payable.

Are simple interest loans better than compound interest loans?

The suitability of a simple interest loan versus a compound interest loan depends on various factors such as the borrower’s financial situation, loan term, and preferences. A simple interest loan may be beneficial for those who prefer a straightforward repayment structure and want to pay less interest over the loan term.

Can I pay off a simple interest loan early?

Yes, you can pay off a simple interest loan early. Since simple interest loans do not have prepayment penalties, you have the flexibility to make additional payments or pay off the loan entirely before the scheduled term ends. Early repayment can help reduce the total interest paid over the loan duration.

Do simple interest loans have fixed interest rates?

Simple interest loans can have either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan term, providing predictability in monthly payments. On the other hand, variable interest rates may change periodically based on market conditions.

What are the advantages of a simple interest loan?

Some advantages of a simple interest loan include:

– Easy calculation of interest charges

– Transparency in repayment structure

– Flexibility for early repayment without penalties

– Potential savings on interest if the loan is repaid early

Are simple interest loans available for mortgages?

Yes, simple interest loans are available for mortgages. Whether it’s a traditional mortgage or a refinanced loan, borrowers can choose between simple interest and compound interest options. However, it’s important to carefully evaluate the terms and conditions of the mortgage to determine the most suitable option for your financial situation.

Can I get a simple interest loan with bad credit?

Getting a simple interest loan with bad credit may be more challenging as lenders typically consider credit history when assessing loan applications. However, some lenders specialize in providing loans to individuals with bad credit. It’s important to explore different options, compare interest rates, and consider improving your credit score before applying for a loan.

Final Thoughts

A simple interest loan is a type of loan where interest is calculated only on the principal amount. It does not compound over time. With a simple interest loan, your monthly payments go towards both the principal and the interest, making it easier to understand and budget for. This type of loan is commonly used for personal loans, car loans, and small business loans. Understanding what a simple interest loan is can help you make better financial decisions and choose the right loan for your needs.