Have you ever wondered what a sinking fund is in personal finance? Well, let me tell you. A sinking fund is a smart and practical way to save money for future expenses or financial goals, without relying on credit or loans. It’s like having your own personal safety net, allowing you to proactively set aside funds for things like emergencies, vacations, a new car, or even a down payment on a house. By setting up a sinking fund, you’ll have peace of mind knowing that you’re prepared for the unexpected or ready to tackle those bigger financial goals. So, let’s dive deeper into what a sinking fund is all about and how it can benefit your personal financial journey.

What is a Sinking Fund in Personal Finance?

Introduction to Sinking Funds

When it comes to personal finance, having a clear understanding of different savings strategies can significantly impact your financial well-being. One such strategy is the concept of a sinking fund. A sinking fund is essentially a way to set aside money over time for a specific purpose or expense, ensuring that you are financially prepared when the time comes. It provides a structured approach to saving, allowing you to meet your goals without incurring debt or financial stress.

How Does a Sinking Fund Work?

A sinking fund operates on the principle of setting aside small amounts of money regularly, typically on a monthly basis, to accumulate a specific sum over time. This fund is separate from your emergency fund and is dedicated to non-emergency financial goals or upcoming expenses. By breaking down a larger expense into smaller, manageable contributions, a sinking fund makes it easier to achieve financial targets without straining your budget.

Benefits of a Sinking Fund

Having a sinking fund can provide several advantages that contribute to your overall financial stability and peace of mind:

- Eliminate Debt: By saving in advance for planned expenses, you can avoid relying on credit cards or loans, reducing or eliminating the need for debt.

- Financial Preparedness: By setting aside money over time, you can be prepared for future expenses and avoid last-minute financial burdens.

- Reduce Stress: With a sinking fund in place, you can feel more confident and less stressed about your financial obligations, knowing you have funds available for specific purposes.

- Improved Budgeting: By allocating a portion of your income towards sinking funds, you establish clear savings goals and incorporate them into your monthly budget, helping you stay on track.

Common Uses for Sinking Funds

Sinking funds can be tailored to suit various financial goals and expenses. Here are some common uses for sinking funds:

- Annual Insurance Premiums: Many insurance policies require annual payments. By saving each month in a sinking fund, you can be prepared when the premium becomes due.

- Vehicle Maintenance and Repairs: Cars require regular maintenance and can occasionally face unexpected repairs. A sinking fund can ensure you have money set aside specifically for these expenses.

- Home Repairs and Renovations: Whether it’s fixing a leaking roof or upgrading your kitchen, home repairs and renovations can be costly. A sinking fund can help you plan and save for these projects in advance.

- Vacations or Travel: If you have travel aspirations, saving regularly with a sinking fund allows you to enjoy your vacations without creating a financial burden.

- Taxes and Other Annual Expenses: Taxes, professional licenses, or other yearly expenses are often overlooked. By setting up a sinking fund, you can be prepared when these financial obligations arise.

- Higher Education: Saving for your child’s education is a long-term goal that can be achieved with a sinking fund. By starting early and consistently contributing, you can alleviate the strain of tuition fees in the future.

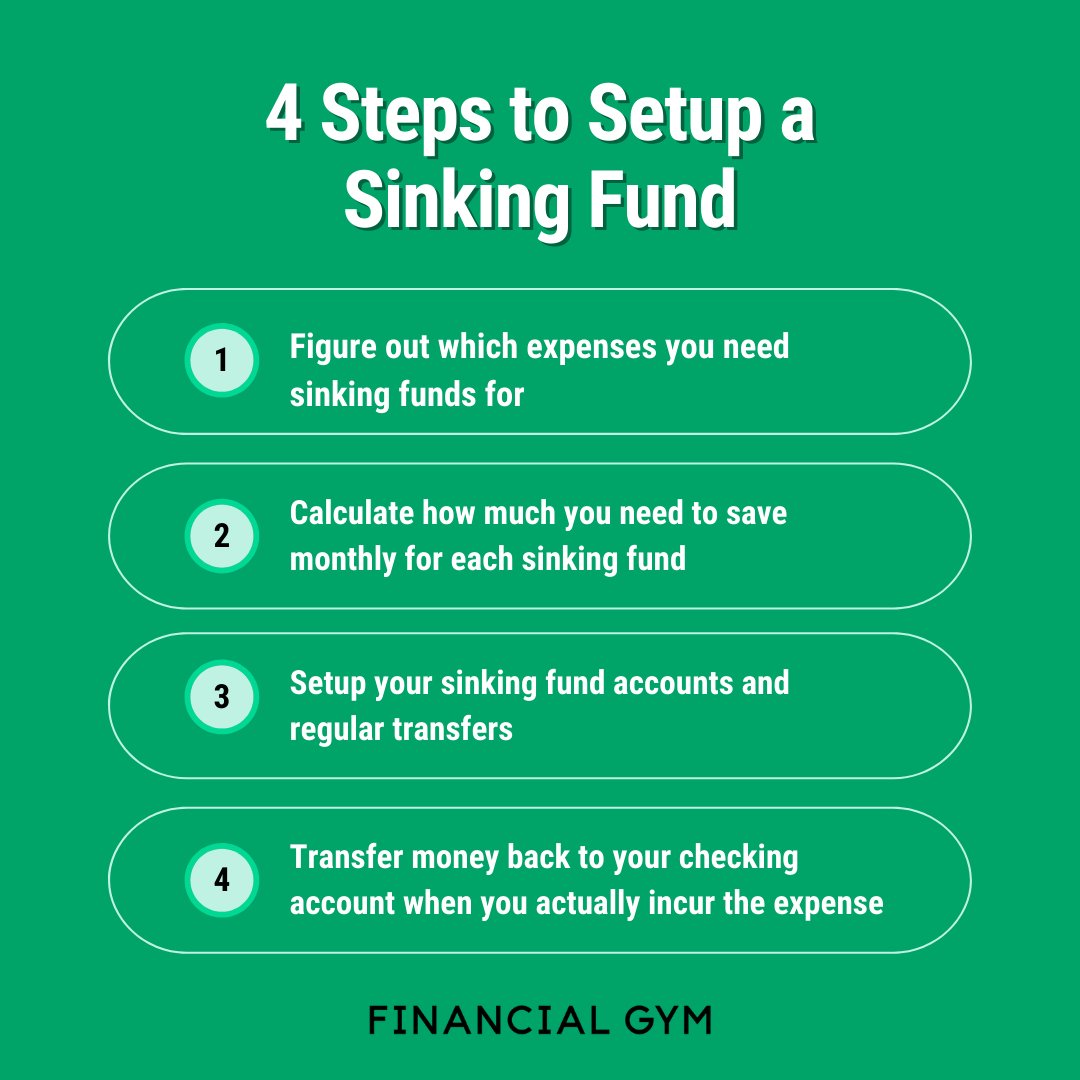

Setting Up and Managing a Sinking Fund

Identify Your Financial Goals and Expenses

To set up a sinking fund effectively, it is important to identify your financial goals and recurring expenses. Consider both short-term and long-term goals, such as saving for a vacation or a down payment on a house. By identifying these goals, you can determine the amount and frequency of contributions to your sinking fund.

Determine Contribution Amount and Frequency

Once you have identified your financial goals, it’s time to determine the amount of money you can contribute to your sinking fund regularly. Review your budget to understand your income and expenses, and decide on a realistic contribution amount. Ideally, this should be a sum that does not strain your overall financial situation.

Create a Separate Sinking Fund Account

To keep your sinking fund organized and easily trackable, create a separate account dedicated solely to your sinking fund. This account should be easily accessible while maintaining some separation from your regular checking or savings accounts. Many financial institutions offer specific accounts designed for sinking funds, often with no or minimal fees.

Automate Contributions

To ensure consistency and discipline, consider automating your sinking fund contributions. Set up automatic transfers between your main account and your sinking fund account on a recurring basis, aligning with your chosen contribution frequency. This eliminates the risk of forgetting or skipping contributions, keeping you on track towards your financial goals.

Regularly Monitor and Adjust

As life circumstances change, it’s important to regularly review and adjust your sinking fund strategy. Track your progress towards your financial goals and make any necessary modifications to your contributions. If you find that you are consistently saving more than required, you may consider redirecting the excess amount towards other financial objectives or investments.

A sinking fund is a powerful tool that can provide financial stability and peace of mind. By setting aside money regularly for specific goals and expenses, you can avoid debt, reduce stress, and achieve a better handle on your personal finances. Whether it’s saving for home repairs, a dream vacation, or unexpected expenses, a sinking fund allows you to take control of your financial future. Start today and witness the positive impact a sinking fund can have on your financial well-being.

How to Save for Future Expenses with a Sinking Fund

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a sinking fund in personal finance?

A sinking fund is a dedicated savings account set up to accumulate funds over time for a specific future expense or financial goal. It allows individuals to plan ahead and save systematically towards anticipated expenses, such as a down payment on a house, a large purchase, or even annual vacations.

How does a sinking fund work?

A sinking fund works by setting aside a certain amount of money regularly until the target amount is reached. This can be achieved by automating savings, where a fixed amount is deducted from your paycheck or transferred from your main account into the sinking fund account. Over time, the fund grows, allowing you to cover the future expense without relying on credit or disrupting your regular budget.

Why should I consider using a sinking fund?

Using a sinking fund can help you avoid accumulating debt or depleting your emergency savings when unexpected expenses arise. By planning ahead and saving systematically, you can have the necessary funds readily available when the time comes, reducing financial stress and allowing you to maintain your overall financial stability.

What are the advantages of having a sinking fund?

Having a sinking fund offers several advantages, such as providing a sense of financial security, enabling you to achieve your financial goals without debt, and allowing you to take advantage of opportunities that require upfront payments. Additionally, a sinking fund helps you develop disciplined saving habits and gives you greater control over your finances.

How do I determine the amount to save in a sinking fund?

To determine the amount to save in a sinking fund, you need to consider the future expense or financial goal and divide it by the number of months or years you have until you need the funds. This calculation will help you establish a monthly or periodic savings target to ensure you accumulate the required amount within the desired timeframe.

Can a sinking fund be used for emergencies?

While a sinking fund is primarily intended for planned expenses, it can also be utilized for unexpected emergencies. However, it’s generally recommended to maintain a separate emergency fund to cover unforeseen financial needs. By having both a sinking fund and an emergency fund, you can effectively manage both anticipated and unforeseen expenses.

Where should I keep my sinking fund?

It is advisable to keep your sinking fund in a separate savings account that is easily accessible but not directly linked to your everyday spending account. Look for a savings account with no or minimal fees and a competitive interest rate to maximize the growth of your sinking fund over time.

What happens if I don’t use all the funds in my sinking fund?

If you don’t end up using all the funds in your sinking fund for the intended purpose, you have several options. You can either leave the excess funds in the sinking fund for future use, allocate them towards another financial goal, or consider investing the surplus in other financial instruments to potentially earn higher returns. It’s important to regularly review and adjust your sinking fund as necessary to align with your evolving financial needs.

Final Thoughts

In personal finance, a sinking fund is a strategic savings account that helps individuals set aside money for specific future expenses. It is a proactive approach to financial planning, allowing individuals to anticipate and prepare for larger expenses without going into debt or disrupting their regular budget. By consistently contributing to a sinking fund over time, individuals can build up a sufficient amount to cover expenses such as car repairs, home renovations, or vacations. This helps to avoid relying on credit or dipping into emergency savings. So, what is a sinking fund in personal finance? It is a smart and practical tool for achieving financial security and peace of mind.