A sinking fund provision in bonds is an important feature that benefits both bond issuers and investors. So, what is a sinking fund provision in bonds? It is a mechanism that requires the issuer to set aside money regularly to repay a portion of the bond debt before the maturity date. This provision ensures that the issuer gradually pays off the debt, reducing the overall risk for investors. By incorporating a sinking fund provision, bond issuers demonstrate their commitment to honoring their financial obligations and provide investors with a reliable and secure investment opportunity. Let’s delve deeper into the details of this fascinating financial instrument.

What is a Sinking Fund Provision in Bonds?

A sinking fund provision is a feature commonly found in bond agreements that requires the issuer to set aside funds periodically to retire a portion of the bond’s principal. It acts as a safeguard for bondholders, providing a measure of security by ensuring that the issuer will have the necessary funds to meet their repayment obligations. In this article, we will delve deeper into the concept of sinking fund provisions in bonds, exploring how they work, their benefits, and the implications for both issuers and investors.

Understanding Sinking Fund Provisions

A sinking fund provision specifies the terms under which an issuer is obligated to retire a portion of the bond’s principal before its maturity date. This provision typically outlines the amount and frequency of the payments to be made into the sinking fund. The funds are used to buy back a predetermined number of bonds on the open market or through a lottery system.

The Purpose of Sinking Fund Provisions

The main purpose of a sinking fund provision is to reduce the risk for bondholders. By requiring the issuer to set aside funds regularly, the provision ensures that there will be money available to repay the bonds when they come due. This increases the creditworthiness of the issuer and provides investors with an added layer of security.

Benefits for Bondholders

Sinking fund provisions offer several benefits for bondholders:

- Reduced default risk: The presence of a sinking fund provision lowers the risk of default as it forces the issuer to set aside funds for repayment.

- Enhanced liquidity: The provision promotes liquidity in the bond market as the issuer regularly buys back a portion of the bonds through the sinking fund.

- Potential for price appreciation: The act of buying back bonds can lead to increased demand, potentially driving up bond prices and providing investors with a capital gain.

- Increased creditworthiness: Bondholders benefit from the enhanced creditworthiness of the issuer, which can lead to lower borrowing costs in the future.

Implications for Issuers

While sinking fund provisions bring benefits for bondholders, they also impose certain obligations on issuers:

- Contractual obligation: The issuer is contractually obligated to make regular payments into the sinking fund, which can strain cash flow.

- Opportunity cost: Setting aside funds for the sinking fund limits the issuer’s ability to invest in other projects or initiatives that could potentially generate higher returns.

- Early retirement risk: If interest rates decline after the issuance of the bonds, the issuer may be forced to retire them early at a premium, resulting in increased costs.

Variations of Sinking Fund Provisions

Sinking fund provisions can vary in their structure and terms. Some common variations include:

Optional Sinking Fund

An optional sinking fund provision gives the issuer the discretion to repurchase bonds on a voluntary basis. The issuer can choose to retire bonds ahead of schedule or not, depending on market conditions and their financial situation. This flexibility allows the issuer to take advantage of favorable market conditions or postpone repurchase in times of financial strain.

Mandatory Sinking Fund

In contrast to an optional sinking fund, a mandatory sinking fund provision requires the issuer to retire a specified amount of bonds at predetermined intervals. This structure provides more certainty for bondholders as it guarantees regular repayment of the bond principal.

Serial Bonds

Serial bonds incorporate a sinking fund provision by design, with the issuer retiring specified amounts of the bond principal on predetermined dates. This gradual repayment structure ensures that the issuer can systematically retire the outstanding bonds, reducing the risk associated with a single large repayment upon maturity.

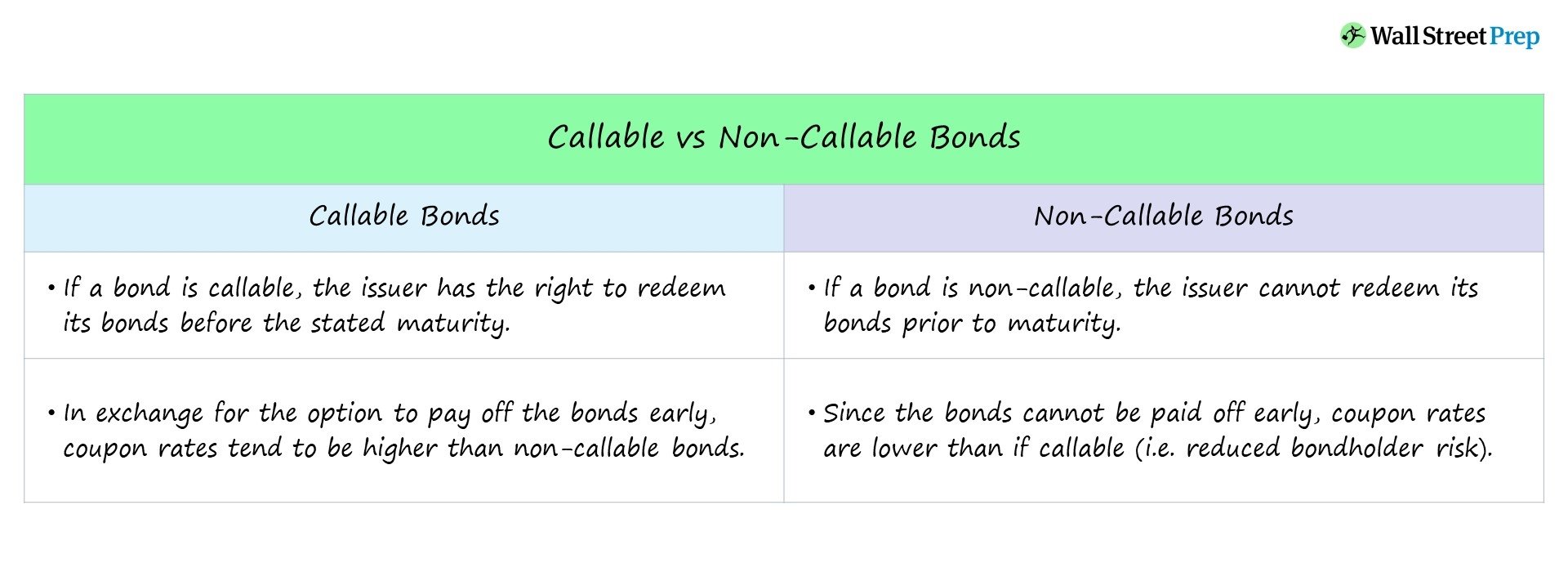

Sinking Fund vs. Call Provision

While sinking fund provisions and call provisions serve somewhat similar purposes, they differ in their mechanisms. A call provision allows the issuer to redeem the bonds before maturity at a specified price. On the other hand, a sinking fund provision requires the issuer to retire a portion of the bonds at regular intervals, reducing the outstanding principal over time.

- A call provision provides the issuer with more flexibility, as they can choose when to retire the bonds and at what price.

- A sinking fund provision offers more security to bondholders, as it guarantees a gradual retirement of the bond principal on predetermined dates.

- Both provisions aim to reduce risk and improve creditworthiness, but they do so in different ways.

In Conclusion

Sinking fund provisions in bonds play a crucial role in mitigating risk for bondholders and enhancing the creditworthiness of issuers. By requiring the issuer to set aside funds regularly, they ensure that there will be money available for repayment when the bonds mature. While sinking fund provisions impose obligations on issuers, they offer various benefits for bondholders, including reduced default risk and enhanced liquidity. Understanding the variations of sinking fund provisions and their implications can help investors make informed decisions when considering bond investments.

Remember, when investing in bonds, always consult with a financial advisor to assess your specific circumstances and risk tolerance.

Investopedia Video : Sinking Fund

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a sinking fund provision in bonds?

A sinking fund provision in bonds is a contractual provision that requires the issuer of the bond to set aside funds periodically to repay a portion of the bond principal before the maturity date.

How does a sinking fund provision work?

Under a sinking fund provision, the bond issuer will make regular deposits into a separate sinking fund account, which accumulates over time. These funds are then used to repurchase a predetermined amount of the bond principal at specified intervals.

Why do issuers include sinking fund provisions in bonds?

Issuers include sinking fund provisions in bonds to reduce the risk of default and ensure timely repayment of the bond. It provides the issuer with a method to retire the bond gradually instead of making a lump sum payment at maturity.

What are the benefits of a sinking fund provision for investors?

Investors benefit from a sinking fund provision as it increases the likelihood of timely repayment and reduces credit risk. It provides additional security and enhances the marketability of the bond.

Can a sinking fund provision be optional?

Yes, a sinking fund provision can be either mandatory or optional. In a mandatory sinking fund provision, the issuer is obligated to make regular payments into the fund. In contrast, an optional sinking fund provision gives the issuer the choice to make payments depending on market conditions.

What happens if an issuer fails to meet its sinking fund obligation?

If an issuer fails to meet its sinking fund obligation, it can be considered a default. The bondholders may then have the right to take legal action against the issuer and demand immediate repayment of the outstanding principal.

How does a sinking fund provision affect the yield of the bond?

A sinking fund provision can impact the yield of a bond. As the issuer repurchases a portion of the bond principal over time, the remaining outstanding principal decreases. This reduces the overall risk for the investor and, therefore, may lower the yield of the bond.

Are sinking fund provisions common in all types of bonds?

Sinking fund provisions are more commonly found in corporate bonds, municipal bonds, and government bonds. However, not all bonds include sinking fund provisions, and their presence depends on the terms negotiated between the issuer and the bondholders.

Final Thoughts

A sinking fund provision in bonds is a contractual agreement that requires the issuer to set aside funds periodically to repay the bondholders. This provision helps to ensure that the issuer will have enough money available to fulfill its obligation to repay the bondholders at maturity. The purpose of a sinking fund provision is to reduce the risk for bondholders and provide them with a greater level of security. By setting aside funds in a sinking fund, the issuer can demonstrate its commitment to honoring its debt obligations. Overall, a sinking fund provision in bonds is a valuable safeguard that adds an extra layer of protection for bondholders.