A statement of cash flows in accounting is a vital tool that helps businesses understand their financial health and make informed decisions. So, what exactly is a statement of cash flows? Put simply, it is a financial document that provides a detailed summary of a company’s cash inflows and outflows during a specific period. By analyzing this statement, businesses can gain insights into their cash position, identify trends, and evaluate their ability to meet short-term obligations. In this blog article, we will delve into the intricacies of a statement of cash flows, explore its components, and highlight its significance in financial reporting. So, let’s embark on this journey of understanding the fascinating world of cash flows!

What is a Statement of Cash Flows in Accounting?

A statement of cash flows is a financial statement that provides information about the cash inflows and outflows of a company over a specific period of time. It is an essential tool in financial accounting that helps stakeholders understand how a company generates and uses its cash.

The statement of cash flows is part of a company’s financial statements along with the balance sheet and income statement. Together, these three statements provide a comprehensive view of a company’s financial health and performance.

Purpose of a Statement of Cash Flows

The primary purpose of a statement of cash flows is to provide information about the cash flow activities of a company. It helps users, such as investors, creditors, and management, to assess the company’s ability to generate future cash flows, its liquidity, and its overall financial stability.

The statement of cash flows can answer the following questions:

- Where did the company’s cash come from during the period?

- How was the cash used by the company?

- What was the change in the company’s cash balance?

Operating Activities

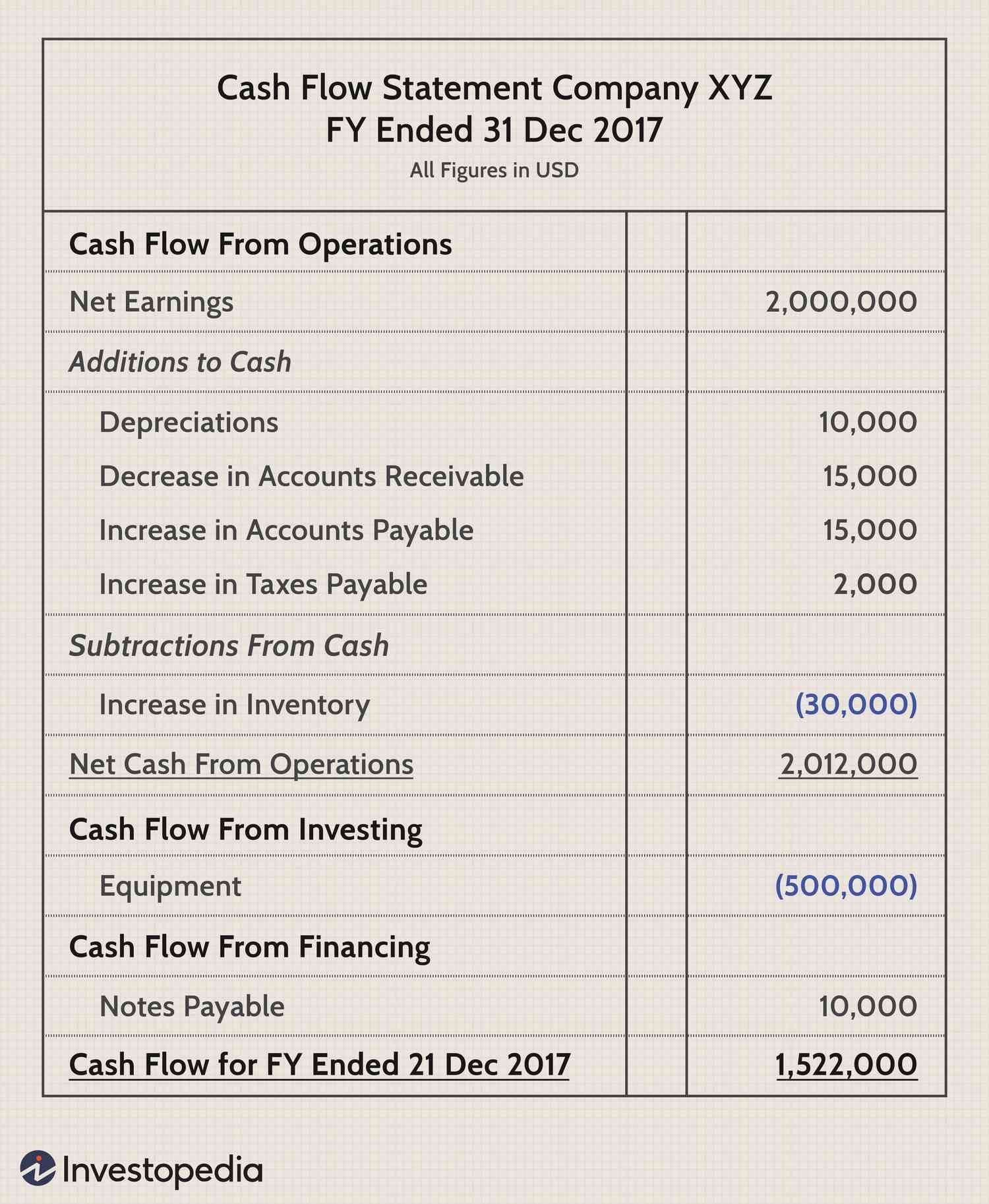

The first section of the statement of cash flows focuses on the company’s operating activities. It shows the cash inflows and outflows directly related to the core business operations. This section helps users understand the company’s ability to generate cash from its primary activities.

The operating activities section includes items such as:

- Cash received from customers for the sale of goods or services

- Cash paid to suppliers and vendors for inventory or operating expenses

- Cash paid to employees for wages and salaries

- Cash received or paid for interest and income taxes

Investing Activities

The investing activities section of the statement of cash flows provides information about the cash flows related to a company’s investments in long-term assets and other entities. It shows how the company is using its cash to expand its business or make strategic investments.

Examples of cash flows from investing activities include:

- Cash paid for the purchase of property, plant, and equipment

- Cash received from the sale of investments or long-term assets

- Cash paid for acquisitions or investments in other companies

- Cash received from the sale of subsidiary or investment

Financing Activities

The financing activities section focuses on the cash flows related to a company’s financing and capital structure. It shows how the company raises and repays capital, including debt and equity financing, dividends, and other financing arrangements.

Examples of cash flows from financing activities include:

- Cash received from issuing new shares or borrowing

- Cash paid for repurchasing shares or paying dividends

- Cash received from loans or other long-term borrowings

- Cash paid for the repayment of debt or interest

Direct vs. Indirect Method

There are two methods for preparing the statement of cash flows: the direct method and the indirect method. The direct method presents the actual cash inflows and outflows from operating activities, while the indirect method adjusts net income to arrive at the cash flow from operations.

The direct method provides more detailed information about the company’s cash flows but requires more effort and resources to prepare. The indirect method is more commonly used as it starts with net income from the income statement and adjusts for non-cash items and changes in working capital.

Significance of a Statement of Cash Flows

The statement of cash flows is significant for various reasons:

- Assessing liquidity: It helps stakeholders evaluate a company’s ability to meet its short-term obligations and maintain sufficient cash reserves.

- Identifying cash flow problems: It reveals any potential cash flow issues that a company may face, such as a negative cash flow from operating activities or excessive cash used in investing or financing activities.

- Evaluating financial performance: By analyzing the statement of cash flows alongside the income statement and balance sheet, stakeholders can gain a more comprehensive understanding of a company’s financial performance.

- Making informed investment decisions: Investors can use the statement of cash flows to assess the stability and growth potential of a company before making investment decisions.

In conclusion, a statement of cash flows is a crucial financial statement that provides insights into a company’s cash inflows and outflows. It helps stakeholders understand how a company generates and utilizes its cash, assess its liquidity, and evaluate its overall financial health. By analyzing the statement of cash flows, users can make informed decisions about investing, lending, and other financial matters.

The CASH FLOW STATEMENT for BEGINNERS

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a statement of cash flows in accounting?

A statement of cash flows is a financial statement that summarizes the cash inflows and outflows of a company during a specific period of time. It provides insights into the operating, investing, and financing activities of the business and helps assess its overall financial health.

How does a statement of cash flows differ from other financial statements?

While the income statement and balance sheet show a company’s profitability and financial position at a specific point in time, the statement of cash flows focuses solely on the cash movements. It tracks the actual cash generated or used by a business and offers a different perspective on its financial performance.

What are the main sections of a statement of cash flows?

A statement of cash flows typically consists of three main sections: operating activities, investing activities, and financing activities. Operating activities include cash flows from day-to-day business operations, such as revenue from sales and payments to suppliers. Investing activities involve cash flows from the purchase or sale of long-term assets, such as property or equipment. Financing activities include cash flows related to the company’s capital structure, such as borrowing or repaying loans.

Why is the statement of cash flows important?

The statement of cash flows is important because it helps assess the liquidity and cash-generating ability of a company. It provides valuable information to investors, creditors, and other stakeholders about the sources and uses of cash within the business. It also helps identify any potential cash flow issues and allows for better financial planning and decision-making.

How does the statement of cash flows help in financial analysis?

The statement of cash flows helps in financial analysis by providing insights into a company’s cash flow patterns. It allows analysts to assess the company’s ability to generate cash from operations, its investment decisions, and its financing activities. By analyzing the changes in cash flows over time, analysts can evaluate the company’s cash management practices, identify trends, and make informed investment or credit decisions.

What are the key components of the operating activities section?

The operating activities section of a statement of cash flows includes cash flows from the core business operations of a company. It typically includes cash received from customers, cash payments to suppliers and employees, and other operating cash receipts or payments. It helps measure the cash generated or used by the company in its day-to-day operations.

What types of activities are included in the investing activities section?

The investing activities section of the statement of cash flows includes cash flows resulting from the purchase or sale of long-term assets. It includes cash spent on acquiring property, plant, and equipment, as well as cash received from selling such assets. It also includes investments in securities or other businesses.

What does the financing activities section of the statement of cash flows include?

The financing activities section of the statement of cash flows includes cash flows related to the company’s capital structure. It includes cash received from issuing stocks or bonds, as well as cash payments for dividends to shareholders and repayment of debt. It helps assess how a company raises capital and manages its financial obligations.

Can a company have a negative cash flow in any section of the statement?

Yes, a company can have negative cash flows in any section of the statement of cash flows. Negative cash flows from operating activities may indicate that the company is spending more on day-to-day operations than it is generating from sales. Negative cash flows from investing activities may result from significant investments in long-term assets. Negative cash flows from financing activities may indicate repayments of debt or dividend payments exceeding the cash raised from issuing stocks or bonds.

Final Thoughts

The statement of cash flows in accounting provides a detailed understanding of a company’s cash inflows and outflows over a specific period. It outlines the sources and uses of cash, including operating activities, investing activities, and financing activities. By analyzing this statement, stakeholders can evaluate a company’s liquidity, operating performance, and financial health. This crucial financial document helps in making informed decisions and assessing the company’s ability to generate cash in the long run. Understanding what is a statement of cash flows in accounting is essential for any investor, creditor, or manager seeking to evaluate the cash flow position of a company.