A stop-loss order in stock trading is a powerful tool that every investor should understand and utilize. It acts as a safety net, protecting your investment from excessive losses. When the market takes an unexpected turn, a stop-loss order automatically sells your shares once they reach a predetermined price, limiting potential damage. But wait, there’s more to it than a simple price trigger! Let’s delve into the intricacies of what a stop-loss order truly entails and how it can safeguard your portfolio in the ever-fluctuating world of stocks.

What is a Stop-Loss Order in Stock Trading?

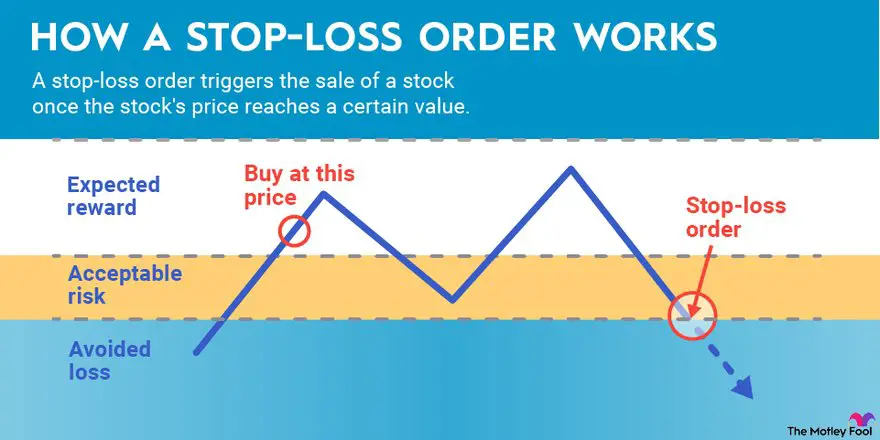

When it comes to stock trading, it’s essential to have a plan in place to manage your risk and protect your investments. One powerful tool that traders use to achieve this is a stop-loss order. A stop-loss order is an instruction given to a broker or a trading platform to automatically sell a security if its price falls below a certain predetermined level. This order acts as a safety net, protecting traders from potential losses and allowing them to manage their risk effectively.

A stop-loss order is commonly used in stock trading and is particularly important for active traders who are constantly monitoring their positions. By setting a stop-loss order, traders can define their maximum acceptable loss on a trade and let the order execute automatically when that level is reached. This automatic execution eliminates emotional decision-making and ensures that traders stick to their predetermined strategies.

How Does a Stop-Loss Order Work?

To understand how a stop-loss order works, let’s consider an example. Imagine you purchase 100 shares of ABC Company at $50 per share. You decide to set a stop-loss order at $45, which means that if the price of the stock drops to or below $45, your broker will automatically sell your shares to limit your potential losses.

Once the stop-loss order is in place, it functions as an automated trigger. If the price of ABC Company’s stock falls to $45 or lower, your order will be executed, and your shares will be sold at the prevailing market price. This ensures that you exit the trade at the predetermined stop-loss level, even if you are not actively monitoring the market.

It’s important to note that stop-loss orders do not guarantee the execution price. Market conditions, such as high volatility or gaps in trading, can result in a stop-loss order executing at a price different from the specified stop price. This occurrence is known as slippage.

Types of Stop-Loss Orders

There are different types of stop-loss orders that traders can utilize based on their preferences and trading strategies. Let’s explore some of the most commonly used types:

1. Market Stop-Loss Order

A market stop-loss order is the simplest type of stop-loss order. With this order, your shares will be sold at the prevailing market price once the stop-loss level is reached. The advantage of a market stop-loss order is that it guarantees execution when the price hits the stop level. However, it does not guarantee the execution price, which means you may experience slippage.

2. Limit Stop-Loss Order

A limit stop-loss order allows traders to set a specific price at which they want their shares to be sold. This order ensures that the shares are sold at the specified price or better. However, the disadvantage is that there is no guarantee of execution if the market price does not reach the specified limit price before the stock continues to decline.

3. Trailing Stop-Loss Order

A trailing stop-loss order is a dynamic order that adjusts the stop price as the stock price moves in a favorable direction. This order type is particularly useful in capturing potential gains while still protecting against downside risk. The trailing stop-loss order is set as a percentage or a dollar amount below the highest price reached since the order was placed. If the stock price starts to decline, the stop price remains unchanged. However, if the stock price increases, the stop price is adjusted based on the trailing amount specified.

Benefits of Using Stop-Loss Orders

Using stop-loss orders in stock trading can offer several benefits to traders. Here are some of the key advantages:

1. Risk Management

– Stop-loss orders provide traders with a defined exit strategy and help manage risk by limiting potential losses.

– They prevent emotional decision-making by automating the execution of trades based on predetermined levels.

– Traders can protect their trading capital and avoid significant portfolio drawdowns.

2. Peace of Mind

– Knowing that a stop-loss order is in place provides traders with peace of mind, allowing them to focus on other aspects of their trading strategies.

– They can participate in the market without constant monitoring, knowing they are protected if the trade turns against them.

3. Protection Against Volatility

– Stop-loss orders protect traders from sudden market fluctuations and volatile trading conditions.

– They help prevent losses in cases where prices rapidly decline, such as during market crashes or unexpected news events.

Considerations and Limitations

While stop-loss orders are valuable risk management tools, it’s important to be aware of their limitations and consider additional factors when using them:

1. Market Volatility

– During periods of high volatility, such as during earnings releases or economic announcements, stop-loss orders can be more susceptible to slippage.

– Significant price gaps can occur, causing the execution price to deviate from the specified stop price.

2. False Price Movements

– In some cases, stock prices can experience temporary fluctuations that do not reflect the true market sentiment.

– Stop-loss orders triggered by these false movements can result in unnecessary selling and potential missed opportunities.

3. Overreliance on Stop-Loss Orders

– Relying solely on stop-loss orders without considering other fundamental or technical factors can limit a trader’s ability to react to changing market conditions.

– It’s essential to incorporate a comprehensive trading strategy that combines different indicators and analysis techniques.

In the fast-paced world of stock trading, managing risk is crucial for successful and profitable trading. Stop-loss orders provide traders with a powerful tool to protect their investments and manage their risk effectively. By implementing stop-loss orders, traders can define their maximum acceptable loss, automate trade executions, and trade with the peace of mind that they have a safety net in place.

Remember, always consider your individual risk tolerance, trading strategy, and market conditions when utilizing stop-loss orders. They are not foolproof and should be used in conjunction with other risk management techniques and analysis tools. Happy trading!

Trading Up-Close: Stop and Stop-Limit Orders

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a stop-loss order in stock trading?

A stop-loss order is a type of order placed by investors to minimize potential losses in stock trading. It sets a predetermined price at which a stock should be automatically sold or bought, depending on the nature of the order, in order to limit further losses for the investor.

How does a stop-loss order work?

When a stop-loss order is placed, it remains inactive until the stock price reaches the specified stop price. Once the stop price is reached, the order is triggered and converts into a market order, instructing the broker to execute the trade at the best available price. This helps protect investors from significant losses during volatile market conditions.

What are the different types of stop-loss orders?

There are three common types of stop-loss orders:

1. Market Order: This order is triggered when the stock price reaches the specified stop price and is executed at the best available price.

2. Limit Order: This order is triggered when the stock price reaches the specified stop price but is executed only at or above a specified limit price.

3. Trailing Stop Order: This order is set at a certain percentage or dollar amount below the market price and adjusts automatically as the stock price fluctuates. It helps protect gains by allowing investors to capture the upside potential while limiting downside risk.

Why should I use a stop-loss order in stock trading?

Using a stop-loss order can help investors limit their losses and protect their investments. It offers a proactive approach to risk management by automatically executing the order when the stock price reaches the specified stop price, reducing potential losses during market downturns.

Are there any drawbacks to using a stop-loss order?

While stop-loss orders can be beneficial, there are a few drawbacks to consider:

1. Triggering due to market volatility: In a highly volatile market, stop-loss orders may be triggered by temporary price fluctuations, leading to unnecessary selling or buying of stocks.

2. Gaps in execution: Stop-loss orders may not always execute at the specified stop price if the market experiences a gap in trading, resulting in a different execution price.

3. Overlooking long-term potential: Depending solely on stop-loss orders can sometimes cause investors to miss out on long-term gains if the stock price eventually recovers after a temporary decline.

Is it possible to cancel or modify a stop-loss order?

Yes, it’s possible to cancel or modify a stop-loss order before it is triggered. Investors can contact their broker and provide the relevant details of the order to make any necessary changes.

Can stop-loss orders be used in conjunction with other trading strategies?

Absolutely! Stop-loss orders can be combined with other trading strategies to enhance risk management and maximize returns. For example, investors can use stop-loss orders in conjunction with trailing stops or take-profit orders to lock in profits and limit potential losses simultaneously.

Is using a stop-loss order foolproof?

While stop-loss orders are a valuable tool in risk management, they are not foolproof. Sudden market movements, gaps in execution, and other factors can still result in unexpected losses. It’s important for investors to stay informed, diversify their portfolios, and regularly monitor their investments alongside the use of stop-loss orders.

Final Thoughts

A stop-loss order in stock trading is a tool that helps investors manage their risk by automatically selling a stock when it reaches a specific price. It serves as a safety net, preventing further losses and protecting profits. By setting a predetermined stop price, investors can limit their potential losses and make rational decisions without being driven by emotions. Implementing a stop-loss order is a prudent strategy for investors to safeguard their capital and optimize their trading outcomes.