Curious about what a target-date fund is and how it works? Look no further! In this article, we will dive into the world of target-date funds and unravel the mystery behind their functionality. A target-date fund is a type of investment vehicle that automatically adjusts its asset allocation based on an investor’s anticipated retirement date. By harnessing the power of time, these funds aim to strike a balance between risk and growth. But how exactly do they do it? Let’s explore the inner workings of target-date funds and understand how they can help you achieve your long-term financial goals.

What is a Target-Date Fund and How Does it Work?

Investing can sometimes be a complex and daunting task, especially when it comes to planning for retirement. With so many options and strategies available, it can be challenging to know which approach is best suited for your financial goals. One strategy that has gained popularity in recent years is investing in target-date funds.

Understanding Target-Date Funds

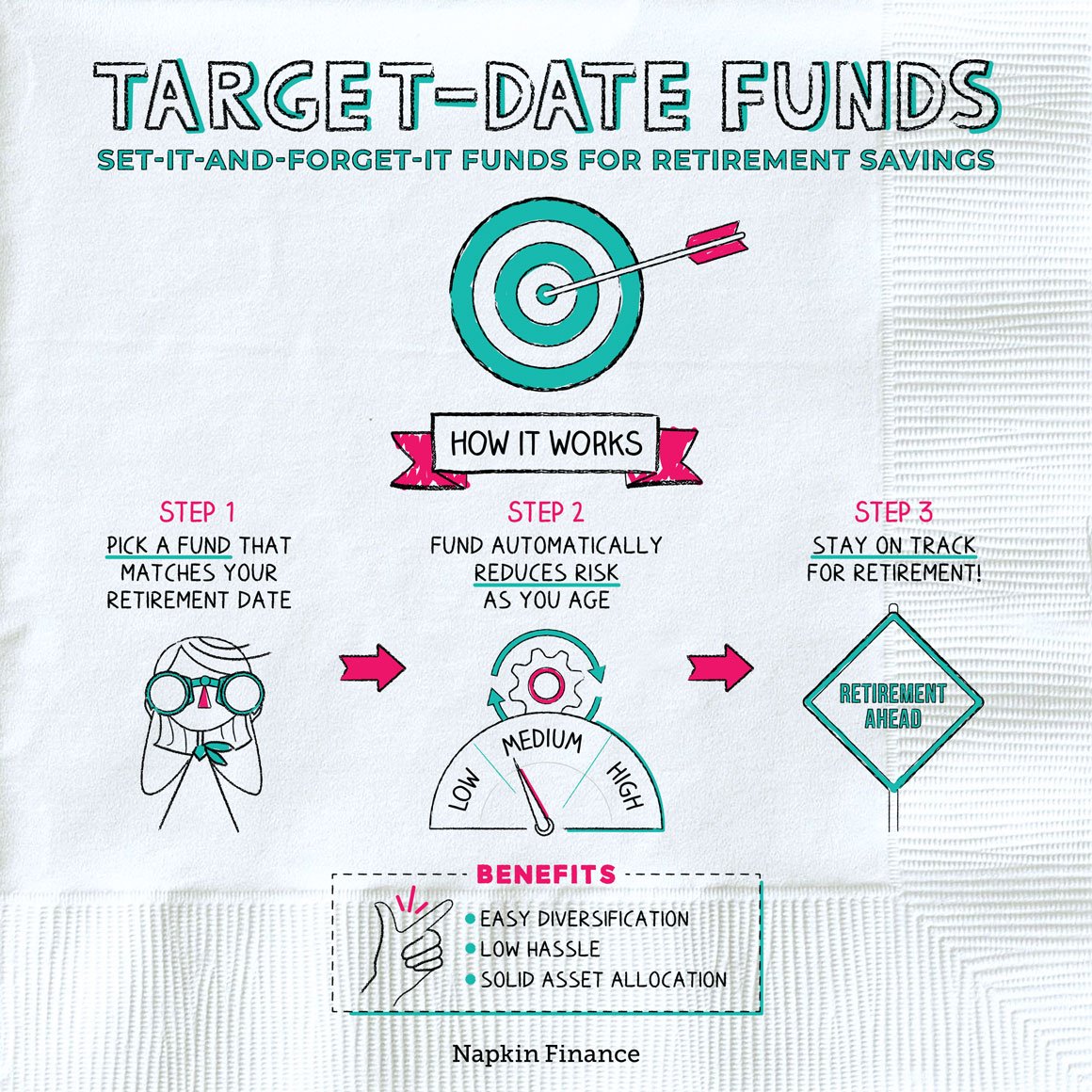

A target-date fund, also known as a lifecycle fund or age-based fund, is a type of mutual fund that provides investors with a diversified portfolio based on their expected retirement date. These funds are designed to automatically adjust the asset allocation mix over time, gradually becoming more conservative as the target date approaches. The concept behind target-date funds is to simplify the investment process by offering a “set it and forget it” approach.

Here’s an example to help illustrate how target-date funds work:

- Let’s say you plan to retire in 2050.

- You invest in a target-date fund with a target date of 2050.

- Initially, the fund’s asset allocation might be heavily weighted towards stocks.

- As the years go by and you get closer to your target date, the fund automatically adjusts its allocation, gradually reducing the percentage allocated to stocks and increasing the percentage allocated to bonds or other more conservative investments.

- By the time you reach your target date, the fund’s allocation will have shifted to be more conservative, aiming to preserve capital and reduce volatility.

This gradual adjustment of the asset allocation is known as the fund’s glide path. Each target-date fund has a different glide path, which determines how quickly or slowly the allocation changes over time.

The Benefits of Target-Date Funds

Target-date funds offer several benefits that make them an appealing option for individual investors:

- Simplicity: One of the main advantages of target-date funds is their simplicity. They eliminate the need for investors to actively manage their portfolio or make frequent adjustments. With a target-date fund, you can set it up and let the fund do the work for you.

- Diversification: Target-date funds typically consist of a mix of different asset classes, such as stocks, bonds, and cash. This diversification helps reduce the risk associated with investing in a single asset class, as losses in one area may be offset by gains in another.

- Automatic Rebalancing: Maintaining a balanced portfolio can be challenging, especially during market fluctuations. Target-date funds automatically rebalance the portfolio, ensuring that the asset allocation stays on track. This feature helps investors avoid the temptation to make emotional investment decisions based on short-term market movements.

- Long-Term Focus: Target-date funds are designed for long-term investing, particularly for retirement planning. By gradually shifting to a more conservative allocation as the target date approaches, these funds aim to reduce volatility and protect capital.

- Professional Management: Target-date funds are managed by professional investment teams who have expertise in managing diversified portfolios. This can be particularly beneficial for individuals who do not have the time, knowledge, or desire to manage their investments actively.

Factors to Consider when Investing in Target-Date Funds

While target-date funds offer many benefits, it’s essential to consider a few factors before investing:

- Expense Ratios: Target-date funds, like other mutual funds, charge expense ratios. These fees can vary between funds, so it’s important to compare expense ratios to ensure you choose a fund with reasonable fees that align with your investment goals.

- Glide Path: Different target-date funds have different glide paths, meaning they adjust their asset allocation at different rates. It’s crucial to understand the glide path of a fund to ensure it aligns with your risk tolerance and investment objectives.

- Asset Allocation: While target-date funds are designed to be well-diversified, it’s crucial to understand the specific asset allocation of a fund. Some funds might be weighted more towards domestic stocks, while others might have a more international focus. Assessing the asset allocation can help you determine if it aligns with your investment preferences.

- Other Investments: It’s important to consider your overall investment strategy when deciding to invest in a target-date fund. If you have other investment accounts or specific investment preferences, you may need to factor those into your decision-making process.

The Role of Target-Date Funds in Retirement Planning

Target-date funds can play a significant role in retirement planning by providing individuals with a simplified and effective investment option. Here are a few reasons why target-date funds are often recommended for retirement planning:

- Time Horizon: Retirement planning typically involves a long-term outlook. Target-date funds cater to this time horizon by gradually adjusting the asset allocation to a more conservative stance as the target date approaches.

- Risk Management: As retirement nears, individuals may have less tolerance for risk. Target-date funds aim to mitigate risk by reducing exposure to potentially volatile asset classes like stocks.

- Rebalancing: Maintaining a balanced portfolio can be challenging, but target-date funds automatically rebalance the portfolio to keep it aligned with the target allocation. This ensures that the investor’s asset allocation stays on track without requiring any action on their part.

- Set-and-Forget: Target-date funds offer simplicity and convenience. Once an individual selects a target-date fund based on their expected retirement date, they can generally leave it alone and let the fund handle the asset allocation adjustments, removing the need for constant monitoring and adjustment.

It’s important to note that while target-date funds can be a valuable option for retirement planning, they may not be suitable for everyone. Individual circumstances, risk tolerance, and investment goals should always be taken into consideration when making investment decisions.

Target-date funds provide individuals with a simplified and automated approach to investing for retirement. By gradually adjusting the asset allocation over time, these funds aim to manage risk and preserve capital as the target date approaches. While they offer numerous benefits, it’s crucial to consider factors such as expense ratios, glide path, asset allocation, and personal investment preferences before investing in a target-date fund. By understanding the role of target-date funds in retirement planning and making informed decisions, individuals can take a step closer to achieving their financial goals.

What You Need to Know About Target Date Retirement Funds

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a target-date fund and how does it work?

A target-date fund is a type of mutual fund that automatically adjusts its asset allocation based on an investor’s desired retirement date. It is designed to provide a diversified investment approach that becomes more conservative as the target date approaches. The fund manager regularly rebalances the portfolio, shifting investments from higher-risk assets to lower-risk assets. This simplifies investing for individuals by offering a set-it-and-forget-it approach.

How does the target-date fund determine the asset allocation?

The target-date fund determines the asset allocation based on the investor’s retirement date. The further the retirement date, the more aggressive the fund’s investment strategy will be, with a higher allocation to stocks. As the retirement date approaches, the allocation to stocks gradually decreases while the allocation to bonds and other fixed-income investments increases.

What are the benefits of investing in a target-date fund?

Target-date funds offer several benefits. They provide a diversified investment approach, reducing the risk associated with investing in a single asset class. They are designed to automatically rebalance the portfolio, ensuring the asset allocation aligns with the investor’s retirement date. Additionally, target-date funds are convenient for investors who prefer a hands-off approach to investing.

Can I make changes to the target-date fund’s asset allocation?

Yes, you can make changes to the target-date fund’s asset allocation. However, it is important to note that target-date funds are designed to be a set-it-and-forget-it investment option. Making frequent changes to the asset allocation may undermine the fund’s purpose of providing a long-term investment strategy. It is recommended to consult with a financial advisor before making any significant changes.

Are target-date funds suitable for every investor?

Target-date funds can be suitable for many investors, especially those who prefer a simplified and hands-off approach to retirement investing. However, it is important to consider individual financial goals, risk tolerance, and investment time horizon before investing in a target-date fund. Some investors may prefer a more customized investment strategy or may have specific investment preferences that are better served through other investment options.

Can I invest in multiple target-date funds?

Yes, you have the option to invest in multiple target-date funds. This may be suitable for investors who have different retirement goals or different risk tolerances for different accounts. However, it is important to evaluate the overall asset allocation and diversification across all investment accounts to avoid overlapping or conflicting investment strategies.

What are the costs associated with target-date funds?

Target-date funds, like any mutual fund, have expense ratios associated with them. These expenses cover the fund management fees, administrative costs, and other operational expenses. It is important to consider the expense ratios when comparing different target-date funds. Some funds may have higher expenses than others, which can impact overall investment returns over time.

Are target-date funds guaranteed to provide a certain level of returns?

No, target-date funds do not guarantee a certain level of returns. Like any investment, target-date funds are subject to market fluctuations and risks. The performance of the fund will depend on the performance of the underlying assets and market conditions. It is important to understand that investing in target-date funds involves risks, including the potential loss of principal.

Final Thoughts

A target-date fund is an investment strategy that automatically adjusts the allocation of assets over time based on the investor’s anticipated retirement date. These funds are designed to simplify the retirement planning process by offering a diversified portfolio that becomes more conservative as the target date approaches. They typically include a blend of stocks, bonds, and cash equivalents, with the allocation gradually shifting towards less risky investments. Target-date funds aim to provide long-term growth potential while minimizing risk as retirement nears. By investing in a target-date fund, investors can benefit from a professionally managed portfolio based on their retirement goals and time horizon. Understanding what a target-date fund is and how it works can help individuals make informed decisions about their retirement savings strategy.