A tax-deferred account is an excellent tool for optimizing your finances and maximizing your savings. So, what exactly is a tax-deferred account and its benefits? Essentially, it is an investment account that allows you to postpone paying taxes on your contributions and any investment gains until you withdraw the funds in the future. This means more money stays in your account to grow over time, thanks to the power of compounding. By taking advantage of a tax-deferred account, you can potentially lower your overall tax liability, build a robust retirement nest egg, and pursue your financial goals with greater ease and flexibility. Let’s dive deeper into the benefits of this smart financial strategy.

What is a Tax-Deferred Account and Its Benefits

In the realm of personal finance, tax planning is an essential aspect of optimizing your financial strategy. One popular tax planning tool is a tax-deferred account. This type of account allows individuals to put off paying taxes on their investments’ earnings until a later date. Tax-deferred accounts come in various forms, such as individual retirement accounts (IRAs), 401(k)s, and annuities. They offer several benefits, including potential tax savings and the opportunity for growth over time. Let’s delve deeper into the world of tax-deferred accounts and explore their advantages.

The Basics of Tax-Deferred Accounts

Tax-deferred accounts are investment vehicles designed to assist individuals in saving for retirement while minimizing their tax liability. The concept behind tax deferral is relatively straightforward: instead of paying taxes on the earnings of your investments as they occur, you postpone those tax payments until a later date, typically during retirement.

When you contribute to a tax-deferred account, the money you invest grows tax-free until you decide to withdraw it. This tax advantage allows your investments to compound over time, potentially resulting in substantial growth. However, keep in mind that when you eventually withdraw the funds from your tax-deferred account, you will be liable for applicable taxes.

The Benefits of Tax-Deferred Accounts

Tax-deferred accounts offer several advantages that make them an attractive option for retirement planning and wealth accumulation. Let’s explore some of the key benefits:

1. Potential Tax Savings

One of the primary benefits of tax-deferred accounts is the potential for tax savings. By deferring taxes on your investments until retirement, you may be able to take advantage of lower tax rates. During your working years, you may fall into a higher tax bracket due to your income. However, in retirement, your income may decrease, potentially placing you in a lower tax bracket. By deferring taxes, you can reduce your overall tax liability and keep more of your hard-earned money.

2. Compound Growth

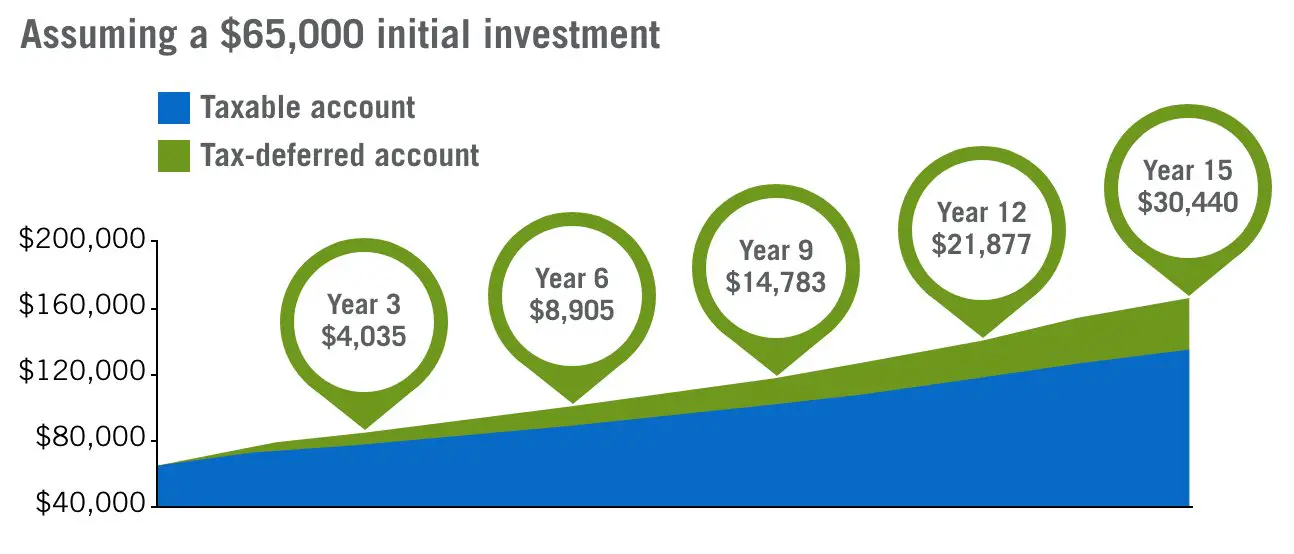

Tax-deferred accounts allow your investments to grow on a tax-free basis. This compounding growth potential can significantly increase the value of your investments over time. The longer your investments remain in the account, the greater the potential for compound growth. This is especially advantageous for long-term retirement planning, where the power of compounding can make a significant difference in your financial well-being.

3. Diversification of Investment Options

Tax-deferred accounts offer a wide array of investment options, including stocks, bonds, mutual funds, and more. This diversity allows you to tailor your investment strategy to match your risk tolerance and financial goals. By diversifying your investments, you can spread the risk and potentially enhance your returns. It is essential to choose a mix of investments that align with your long-term objectives and risk profile.

4. Employer Contributions

Certain tax-deferred accounts, such as 401(k)s, often come with the added benefit of employer contributions. Employers may match a portion of your contributions or make a predetermined contribution on your behalf. These employer contributions serve as additional funds for your retirement savings, helping you accelerate your wealth accumulation. It is crucial to take full advantage of any employer match programs to maximize your retirement savings.

5. Flexibility in Contributions

Tax-deferred accounts generally provide flexibility in terms of contribution amounts. While there are annual contribution limits set by the IRS, you have the freedom to choose how much you contribute within those limits. This flexibility allows you to adjust your contributions based on your financial situation and retirement goals. It is advisable to contribute as much as you can afford to maximize the tax benefits and potential growth.

6. Lower Taxable Income

Contributing to a tax-deferred account can lower your taxable income for the year. When you contribute pre-tax dollars to these accounts, your taxable income decreases accordingly. This reduction in taxable income can potentially place you in a lower tax bracket, resulting in overall tax savings. It is vital to consult with a tax professional to understand the specific tax advantages and contribution limits associated with your chosen tax-deferred account.

Types of Tax-Deferred Accounts

There are various types of tax-deferred accounts available, each with its own rules and benefits. Here are three common types:

1. Individual Retirement Accounts (IRAs)

IRAs are individual retirement accounts that offer tax advantages for retirement savings. There are two main types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs allow you to make tax-deductible contributions, and your investments grow tax-deferred until withdrawal, at which point you pay taxes on the distributions. Roth IRAs, on the other hand, are funded with after-tax contributions, and qualified withdrawals are tax-free. Both types of IRAs have contribution limits and other eligibility requirements.

2. 401(k)s

A 401(k) is a tax-deferred retirement savings plan offered by many employers. With a 401(k), eligible employees can contribute a portion of their salary to the account, usually through automatic payroll deductions. These contributions are made on a pre-tax basis, reducing your taxable income for the year. Many employers also provide a matching contribution, up to a certain percentage of your salary. 401(k) contributions grow tax-deferred until withdrawal during retirement, at which point they are subject to taxes.

3. Annuities

Annuities are another type of tax-deferred account that individuals can use for retirement savings. Annuities are insurance products that provide regular income payments over a specified period. With a deferred annuity, your contributions grow tax-deferred until you begin receiving distributions. Annuities offer the advantage of guaranteeing a steady stream of income in retirement, making them an appealing option for those seeking financial security.

Considerations and Conclusion

While tax-deferred accounts offer numerous benefits, it’s important to consider certain factors before deciding whether they are the right fit for your financial goals. Here are a few considerations:

- Withdrawal Penalties: Tax-deferred accounts typically impose penalties for early withdrawals before the age of 59½. It’s crucial to understand the withdrawal rules and any potential penalties associated with your chosen account.

- Tax Diversification: Depending solely on tax-deferred accounts for retirement savings may result in a significant tax liability during retirement. Consider diversifying your retirement savings with a mix of taxable and tax-advantaged accounts to provide flexibility in managing your taxes in retirement.

- Future Tax Rates: Tax rates can fluctuate over time, and it’s challenging to predict what tax rates will be in the future. Assessing your current tax situation and making informed projections can help you determine whether tax-deferred accounts align with your long-term goals.

In conclusion, tax-deferred accounts provide a valuable tool for retirement planning and tax optimization. They offer the benefits of potential tax savings, compound growth, investment diversification, and flexibility in contributions. Understanding the various types of tax-deferred accounts available, such as IRAs, 401(k)s, and annuities, will help you make informed decisions about your financial future. Remember to consult with a qualified financial advisor or tax professional to assess your individual circumstances and maximize the benefits of tax deferment. Start exploring the possibilities of tax-deferred accounts today and take a step closer to a financially secure retirement.

Benefits of tax deferral

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a tax-deferred account?

A tax-deferred account is a type of investment account where you can contribute pre-tax income, and the earnings on the investments are not taxed until you withdraw the money. Examples of tax-deferred accounts include Individual Retirement Accounts (IRAs) and 401(k) plans.

What are the benefits of a tax-deferred account?

Investing in a tax-deferred account offers several benefits, including:

How does a tax-deferred account work?

When you contribute to a tax-deferred account, the money is deducted from your taxable income for that year. The investments in the account then grow tax-free until you begin making withdrawals during retirement. At that time, the withdrawals are taxed as ordinary income.

Can anyone open a tax-deferred account?

Most tax-deferred accounts have eligibility requirements. For example, to open an IRA, you need to have earned income, while 401(k) plans are typically offered by employers to their employees.

Are there contribution limits for tax-deferred accounts?

Yes, tax-deferred accounts have contribution limits set by the government. These limits may vary depending on the type of account and can change from year to year. It is important to stay updated on the current contribution limits to maximize your tax advantages.

What happens if I withdraw money from a tax-deferred account before retirement?

Withdrawing money from a tax-deferred account before reaching retirement age may result in penalties and taxes. Generally, an early withdrawal from an IRA or 401(k) may be subject to income tax and an additional early withdrawal penalty of 10%.

Are there any exceptions to early withdrawal penalties?

Yes, there are certain circumstances where you may be exempt from early withdrawal penalties, such as using the funds for qualified education expenses or a first-time home purchase. However, income taxes may still apply.

Can I have multiple tax-deferred accounts?

Yes, you can have multiple tax-deferred accounts. For example, you can contribute to both an IRA and a 401(k) plan, as long as you meet the eligibility requirements and stay within the contribution limits for each account.

Final Thoughts

A tax-deferred account is an investment account where participants can contribute pre-tax income, allowing them to reduce their taxable income for the year. These accounts, such as 401(k)s and Traditional IRAs, offer numerous benefits. Firstly, they provide tax advantages, with contributions and investment earnings growing tax-free until withdrawal. Secondly, they promote long-term savings by encouraging individuals to save for retirement, as early withdrawals often incur penalties. Lastly, these accounts offer potential employer contributions, helping individuals grow their retirement savings faster. In summary, tax-deferred accounts offer tax advantages, promote long-term savings, and often come with employer contributions, making them an attractive option for individuals planning for retirement.