Are you familiar with tax liens and how they can impact your financial stability? Understanding what a tax lien is and how to avoid it is crucial in safeguarding your assets and maintaining a healthy financial future. In this article, we will delve into the intricacies of tax liens, shedding light on what they are and providing actionable steps to steer clear of this potential burden. Let’s explore what a tax lien is and how to avoid it, ensuring you are equipped to navigate the complexities of the tax system confidently and proactively.

What is a Tax Lien and How to Avoid It

When it comes to taxes, many people are aware of their responsibility to pay them each year. However, not everyone understands the concept of a tax lien and the potential consequences it can have on their financial well-being. In this comprehensive guide, we will explore what a tax lien is, how it can affect you, and provide valuable tips on how to avoid it. So let’s dive right in!

Understanding Tax Liens

A tax lien is a legal claim placed on your property by the government as a result of unpaid taxes. It serves as a way for the government to secure its interest in your assets until you resolve your tax debt. Tax liens can be imposed by various government entities, such as the Internal Revenue Service (IRS) in the United States or the Canada Revenue Agency (CRA) in Canada.

How Does a Tax Lien Work?

When you fail to pay your taxes on time, the government may initiate the process of placing a tax lien on your property. This lien attaches to your assets, including real estate, vehicles, and financial accounts. Once a tax lien is filed, it becomes a matter of public record, and it can severely impact your financial standing.

A tax lien gives the government a legal claim to your property, making it difficult for you to sell or refinance without first addressing the outstanding tax debt. Additionally, a tax lien can negatively affect your creditworthiness, making it challenging to secure loans or credit in the future.

Types of Tax Liens

There are two main types of tax liens: federal tax liens and state tax liens. Let’s take a closer look at each:

1. Federal Tax Liens

A federal tax lien is imposed by the IRS when you have unpaid federal taxes. It applies to all your property and assets, both current and future, including properties acquired after the lien is filed. Federal tax liens take precedence over most other creditors’ claims and can even survive bankruptcy, making them incredibly powerful tools for the government to collect taxes owed.

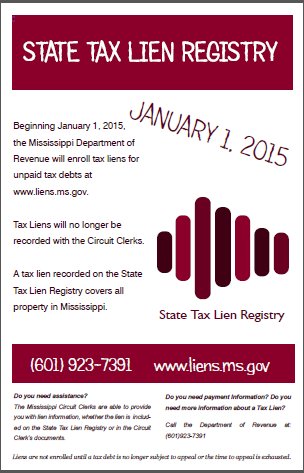

2. State Tax Liens

State tax liens are similar to federal tax liens but are imposed by state tax authorities for unpaid state taxes. These liens can also be filed by local governments and municipalities for unpaid property taxes. State tax liens operate under specific state laws and procedures, which may vary from one jurisdiction to another.

The Consequences of a Tax Lien

Now that we have a better understanding of what a tax lien is, let’s explore the potential consequences that can arise from having one filed against you.

1. Damaged Credit Score

One of the most significant impacts of a tax lien is the damage it can cause to your credit score. Once a lien is filed, it becomes a matter of public record, visible to credit reporting agencies. As a result, your credit score may take a substantial hit, making it harder to secure loans, credit cards, or even rent an apartment.

2. Difficulty Selling or Refinancing Property

If you have a tax lien filed against your property, it can create obstacles when trying to sell or refinance it. Potential buyers or lenders may be hesitant to proceed with the transaction until the lien is resolved, as the government has a legal claim to your property. This can delay the sale process and potentially lead to missed opportunities.

3. Seizure of Assets

If you ignore a tax lien and fail to resolve your tax debt, the government may resort to more aggressive collection actions. This can include seizing and selling your assets to recover the unpaid taxes. Depending on the jurisdiction, the government may sell your property through public auctions or initiate bank levies to collect the owed amount.

4. Legal Troubles

Continuously ignoring a tax lien can lead to legal troubles. The government can take legal action against you, which may result in court proceedings, additional penalties, and in extreme cases, even criminal charges. It is crucial to address a tax lien promptly to avoid such situations.

How to Avoid a Tax Lien

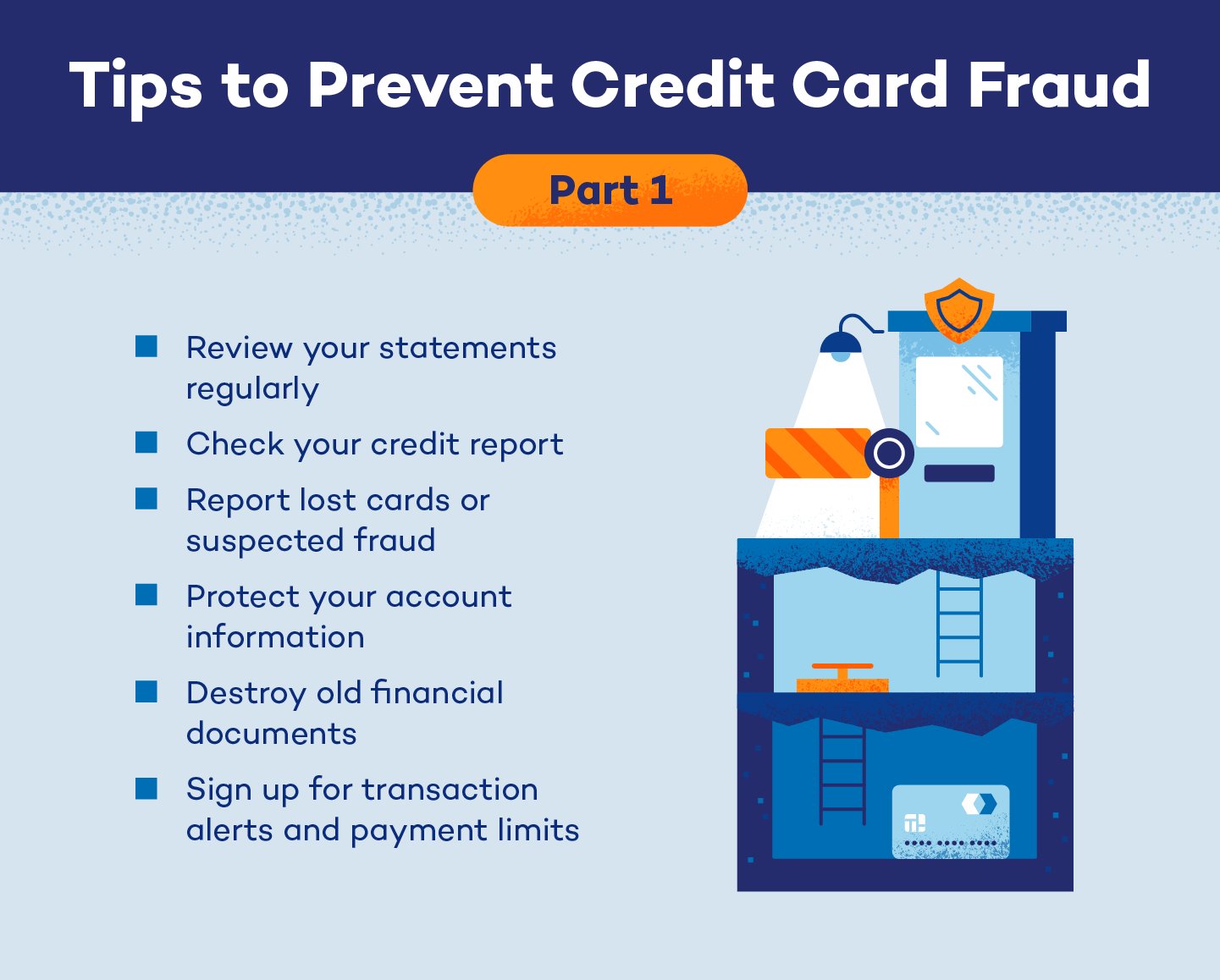

Preventing a tax lien is undoubtedly the best course of action. Here are some effective tips to help you avoid the potential consequences of a tax lien:

1. Pay Taxes on Time

The simplest way to avoid a tax lien is to pay your taxes on time. Ensure you understand your tax obligations, including filing deadlines and payment due dates. By staying organized and meeting your tax responsibilities promptly, you eliminate the risk of accumulating unpaid taxes leading to a tax lien.

2. Set Up a Payment Plan

If you are unable to pay your taxes in full, consider setting up a payment plan with the tax authority. Many government agencies offer installment agreements or other options to help taxpayers fulfill their obligations over time. By proactively addressing your tax debt and keeping up with the agreed-upon payments, you can prevent a tax lien from being filed.

3. Seek Professional Tax Assistance

Navigating the complex world of taxes can be challenging. Consider hiring a professional tax advisor or certified public accountant (CPA) to guide you in meeting your tax obligations. These professionals can help you identify deductions, ensure accurate filings, and proactively address any tax issues, reducing the risk of a tax lien.

4. File for an Offer in Compromise

In certain situations where you are unable to pay your tax debt in full, you may qualify for an Offer in Compromise (OIC). An OIC allows you to settle your tax debt for a lesser amount, based on your financial situation. By successfully negotiating an OIC with the tax authority, you can avoid a tax lien while resolving your tax debt.

5. Keep Tabs on Your Finances

Maintaining good financial management practices and keeping a close eye on your finances can help you avoid unexpected tax problems. Regularly review your income, expenses, and tax withholdings to ensure you are on track. Monitoring your financial situation allows you to identify potential issues early on and take proactive measures to address them.

6. Keep Accurate and Organized Records

Accurate record-keeping is crucial for proper tax management. Keep all relevant tax documents, such as receipts, invoices, and financial statements, in a well-organized manner. This will help you accurately report your income and deductions, reducing the chances of errors that could trigger an audit or additional tax liability.

7. Consult with a Tax Attorney

If you find yourself in a situation where a tax lien has already been filed against you, consulting with a tax attorney can provide valuable guidance. A tax attorney specializes in tax law and can help you understand your rights, navigate complex legal procedures, and negotiate with the government to potentially remove or release the tax lien.

Understanding what a tax lien is and how to avoid it is crucial for maintaining your financial stability and peace of mind. By proactively managing your tax obligations, seeking professional assistance when needed, and staying organized, you can minimize the risk of a tax lien being imposed on your property. Remember, paying your taxes on time and addressing any tax issues promptly are key to avoiding the potential consequences of a tax lien.

FAQs

Please refer to our FAQ section for answers to commonly asked questions about tax liens and how to avoid them.

Beginner Tax Lien Investing (Step By Step)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a tax lien and how can I avoid it?

A tax lien is a claim imposed by the government on a property when the property owner fails to pay their taxes. It is a legal claim that gives the government the right to seize the property if the owner doesn’t settle their tax debt. To avoid a tax lien, you can:

Can I negotiate with the IRS to avoid a tax lien?

Yes, you can negotiate with the IRS to avoid a tax lien. It’s best to communicate with them early and be proactive in finding a solution. You may be able to set up a payment plan or request an offer in compromise to settle your tax debt for less than the full amount owed.

What are some common causes of tax liens?

Some common causes of tax liens include failing to file tax returns, not paying taxes owed, underreporting income, or claiming false deductions. It’s essential to meet your tax obligations on time to prevent a tax lien.

Can a tax lien affect my credit score?

Yes, a tax lien can negatively impact your credit score. It appears on your credit report and can lower your creditworthiness, making it harder to obtain loans, credit cards, or favorable interest rates. Paying off the tax debt and getting the lien released can help improve your credit score.

Should I hire a tax professional to help me avoid a tax lien?

Hiring a tax professional, such as a tax attorney or certified public accountant (CPA), can be beneficial if you are dealing with a potential tax lien. They can provide guidance, help you navigate the complex tax laws, negotiate with the IRS on your behalf, and explore all available options to avoid a tax lien.

What is the difference between a tax lien and a tax levy?

A tax lien is a legal claim on a property due to unpaid taxes, while a tax levy is the actual seizure of the property to satisfy the tax debt. A tax lien is the first step, and if the debt remains unpaid, the IRS may proceed with a tax levy, which involves physically taking possession of the property.

If I can’t pay my taxes in full, what should I do to avoid a tax lien?

If you can’t pay your taxes in full, you should still file your tax returns on time and pay as much as you can. Additionally, consider setting up an installment agreement with the IRS, where you make monthly payments until the debt is fully settled. This can help you avoid a tax lien.

What happens if a tax lien is filed against me?

If a tax lien is filed against you, it becomes public record and attaches to your property. It can affect your ability to sell or refinance the property. The IRS may also seize the property if you fail to pay or resolve the tax debt. It’s crucial to take immediate action to resolve the lien and prevent further consequences.

Final Thoughts

A tax lien can be a significant financial burden for individuals. It is a legal claim imposed by the government on a property when the owner fails to pay their taxes. To avoid a tax lien, it is crucial to stay up to date on tax payments and file tax returns accurately and on time. Keeping meticulous records of your finances and seeking professional advice when needed can also help prevent a tax lien. Additionally, communicating with tax authorities and setting up payment arrangements can provide a solution if you are facing difficulties in settling your tax obligations. By understanding what a tax lien is and taking proactive steps, such as timely payments and open communication, individuals can avoid the potential consequences associated with it.