Are you wondering what a tax lien is and how you can resolve it? Well, you’ve come to the right place! A tax lien is a legal claim by the government on your property due to unpaid taxes. It can cause a lot of stress and financial burden, but fear not – there are steps you can take to resolve it. In this article, we will guide you through the process of understanding what a tax lien is and provide you with practical solutions to tackle it head-on. So, let’s dive in and explore how you can resolve a tax lien effectively.

What is a Tax Lien and How to Resolve It

A tax lien is a legal claim imposed by the government on a property or asset when an individual or business fails to pay their taxes. It is a mechanism used by tax authorities to ensure that they receive the funds owed to them. When a tax lien is placed on a property, it becomes a public record and can affect the owner’s ability to sell or refinance the property.

Resolving a tax lien is crucial to protect your assets, credit rating, and financial well-being. In this article, we will explore what a tax lien is, how it affects you, and the steps you can take to resolve it.

Understanding Tax Liens

Tax liens are a tool used by tax authorities, such as the Internal Revenue Service (IRS) in the United States, to collect unpaid taxes. When individuals or businesses fail to pay their taxes on time, tax authorities have the authority to place a lien on their property or assets.

A tax lien is typically filed with the county or state where the property is located. Once filed, it becomes a public record and can be found through a title search or by contacting the relevant government agency. The lien secures the government’s interest in the property, making it difficult for the owner to sell or refinance without addressing the outstanding tax debt.

How Tax Liens Affect You

A tax lien can have serious consequences for individuals and businesses. Here are some ways a tax lien can affect you:

1. Impact on Credit Score: A tax lien can significantly damage your credit score, making it difficult to qualify for loans or favorable interest rates in the future.

2. Property Ownership: A tax lien gives the government a legal claim on your property or assets. It can hinder your ability to sell or transfer ownership until the lien is resolved.

3. Difficulty in Obtaining Financing: Lenders may hesitate to provide financing or approve a loan application if a tax lien exists. This can affect your ability to secure mortgages, car loans, or business loans.

4. Increased Debt: Tax authorities can take additional collection actions, such as garnishing wages or levying bank accounts, to recover the unpaid taxes. This can lead to additional financial strain and increase the amount owed.

Resolving a Tax Lien

Resolving a tax lien is essential to regain control of your financial situation. While the process may seem daunting, taking action is crucial. Here are the steps you can follow to resolve a tax lien:

Step 1: Understand the Tax Debt

The first step towards resolving a tax lien is to fully understand the amount owed and the specific tax obligations. This information can be obtained by reviewing tax returns, notices, and contacting the tax authority that filed the lien. Understanding the details of the tax debt will help you formulate a plan for resolution.

Step 2: Contact the Tax Authority

Once you have a clear understanding of the tax debt, it is essential to contact the tax authority that filed the lien. This could be the IRS or a state/local tax agency, depending on the type of taxes owed. Contacting the tax authority will allow you to discuss your options and potentially negotiate a resolution.

Step 3: Explore Payment Options

When dealing with a tax lien, there are several payment options to consider. These include:

- Full Payment: If possible, paying the full amount owed can quickly resolve the tax lien. This includes the outstanding tax debt, any interest, and penalties.

- Installment Agreement: If paying the full amount is not feasible, you may be able to negotiate an installment agreement with the tax authority. This allows you to make monthly payments over an extended period until the debt is fully paid.

- Offer in Compromise: In some cases, the tax authority may accept an offer in compromise. This involves negotiating a settlement for less than the total amount owed if you can prove financial hardship or doubt about the tax liability.

- Innocent Spouse Relief: If the tax debt is the result of a spouse’s actions or omissions, you may qualify for innocent spouse relief. This relieves you of the responsibility for the tax debt.

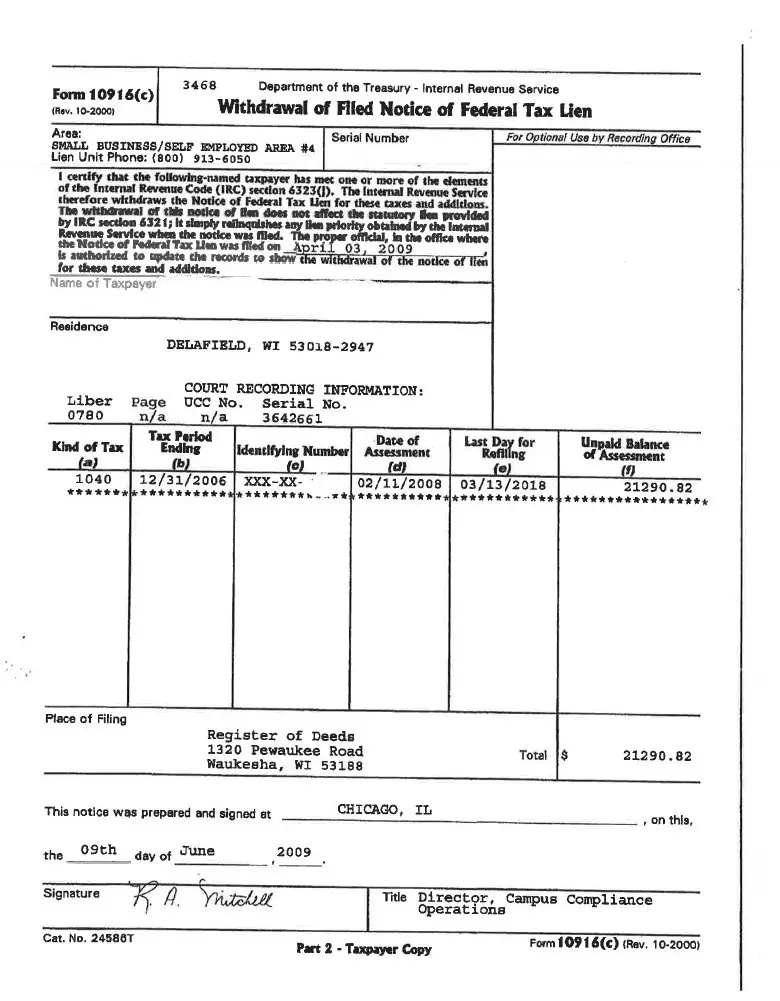

Step 4: Request a Lien Discharge or Subordination

Once you have resolved the tax debt or established a payment plan, you can request a lien discharge or subordination. A lien discharge removes the tax lien from the property altogether, while a lien subordination allows you to refinance or sell the property while the lien remains in place. These requests are typically submitted to the tax authority in writing, along with any required documentation.

Step 5: Maintain Compliance

To prevent future tax liens and maintain your financial stability, it is crucial to remain compliant with your tax obligations. This includes filing tax returns on time, paying taxes as required, and keeping accurate records. Staying organized and proactive will help you avoid further tax issues in the future.

Seek Professional Assistance

Resolving a tax lien can be a complex and challenging process. It is often beneficial to seek professional assistance from tax attorneys, certified public accountants (CPAs), or enrolled agents. These professionals have the knowledge and experience to guide you through the process, negotiate with tax authorities on your behalf, and ensure the best outcome.

Remember, resolving a tax lien requires patience and persistence. By taking the appropriate steps and seeking professional assistance when needed, you can successfully navigate the process and regain control of your financial situation.

Beginner Tax Lien Investing (Step By Step)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a tax lien and how to resolve it?

A tax lien is a legal claim imposed by the government on a property when the property owner fails to pay their taxes. Resolving a tax lien involves taking steps to pay off the outstanding tax debt and remove the lien from the property.

How does a tax lien affect me?

A tax lien can have serious implications on your financial well-being. It can negatively impact your credit score, making it difficult to obtain loans or credit cards. Additionally, a tax lien can result in the government seizing your property or garnishing your wages to satisfy the unpaid taxes.

Can I sell my property with a tax lien?

While it is possible to sell a property with a tax lien, it can be challenging. The tax lien will need to be addressed before the sale can proceed. Typically, the proceeds from the sale will be used to pay off the lien.

How can I find out if there is a tax lien on my property?

To determine if there is a tax lien on your property, you can contact the county or city treasurer’s office where the property is located. They will be able to provide information on any outstanding liens.

What are my options for resolving a tax lien?

There are several options for resolving a tax lien. You can pay off the debt in full, set up a payment plan with the government, or explore the possibility of an offer in compromise, which allows you to settle the debt for less than the full amount owed.

Can I negotiate with the government to reduce the amount of the tax lien?

Yes, it is possible to negotiate with the government to reduce the amount of the tax lien. This process is known as an offer in compromise. However, the government will only approve an offer in compromise if they believe it is in their best interest and if you can demonstrate that you are unable to pay the full amount owed.

What happens if I cannot pay off the tax lien?

If you are unable to pay off the tax lien, the government can pursue further collection actions. This may include seizing your property, garnishing your wages, or placing a levy on your bank accounts.

How long does a tax lien stay on my credit report?

A tax lien can stay on your credit report for up to seven years from the date it was paid or released. However, if the lien remains unpaid, it can stay on your report indefinitely, negatively impacting your creditworthiness.

Please note that the information provided here is for general informational purposes only and should not be considered as legal or financial advice. It is always recommended to consult with a qualified professional regarding your specific situation.

Final Thoughts

In conclusion, understanding what a tax lien is and knowing how to resolve it is crucial for individuals facing this financial challenge. A tax lien is a legal claim placed by the government on a property or assets of a taxpayer who owes unpaid taxes. To resolve a tax lien, the taxpayer has several options, including paying the amount owed in full, negotiating a payment plan with the tax authorities, or seeking professional assistance to navigate the complex process. Taking proactive steps and timely action can help alleviate the burden of a tax lien and ensure a path towards financial recovery.