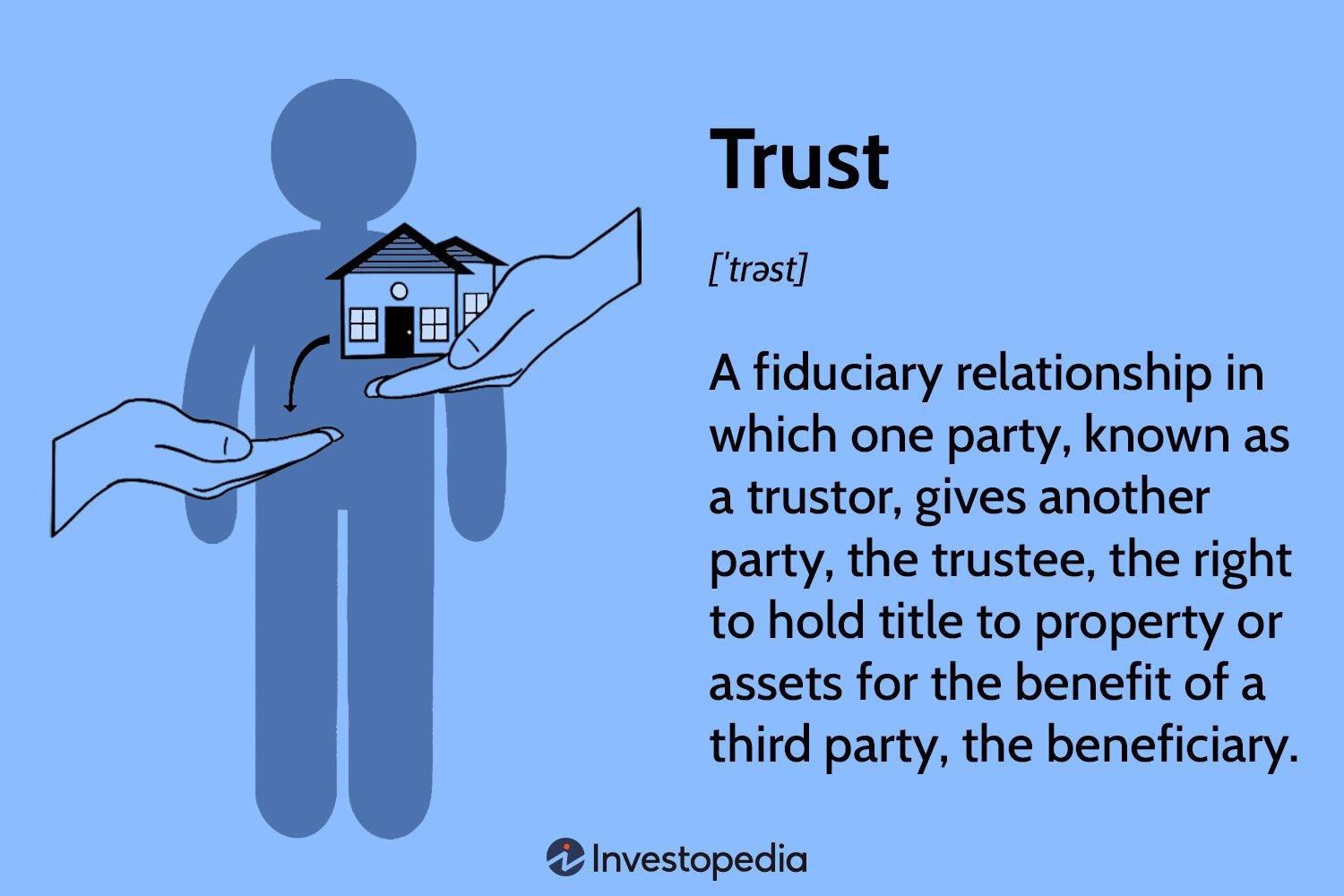

Looking to understand the complexities of trust? You’ve come to the right place! So, what is a trust and its types? A trust is a legal arrangement where one party, the trustee, holds assets on behalf of another party, known as the beneficiary. In simpler terms, it’s a way to safeguard and manage assets for the benefit of someone else. Sounds intriguing, doesn’t it? Well, let’s dive into the fascinating world of trusts and explore the different types that exist.

What is a Trust and its Types

A trust is a legal entity that allows a person, known as the trustee, to hold and manage assets on behalf of another person or a group of people, known as beneficiaries. Trusts are created based on a trust agreement, which outlines the terms and conditions under which the assets are to be managed and distributed.

Trusts serve various purposes and can be an effective tool for estate planning, asset protection, and managing wealth. They provide flexibility and control over how assets are distributed, ensuring that the wishes of the trust creator, also known as the grantor or settlor, are carried out.

Types of Trusts

There are different types of trusts that serve specific purposes and cater to different needs. Let’s explore some of the most common types:

1. Revocable Living Trust

A revocable living trust, also known as an inter vivos trust, is created during the grantor’s lifetime and can be modified or revoked at any time. The grantor maintains control and ownership of the assets placed in the trust and can manage them as they see fit. The trust assets avoid probate upon the grantor’s death, providing privacy and potentially reducing estate taxes.

Benefits of a revocable living trust:

- Flexibility: The trust can be changed or revoked by the grantor during their lifetime.

- Probate avoidance: Assets in the trust do not go through the probate process, saving time and money.

- Privacy: Unlike a will, which becomes a public record, a revocable living trust allows for private distribution of assets.

- Disability planning: The trust can include provisions to manage the grantor’s assets in the event of incapacity.

2. Irrevocable Trust

An irrevocable trust is one that cannot be modified or revoked once it is created, except under certain circumstances. The grantor transfers ownership of the assets to the trust, relinquishing control over them. Irrevocable trusts offer various benefits, including asset protection, tax planning, and charitable gifting.

Benefits of an irrevocable trust:

- Asset protection: Assets in an irrevocable trust may be protected from creditors and lawsuits.

- Estate tax planning: By removing assets from the grantor’s estate, irrevocable trusts can help reduce estate taxes.

- Charitable gifting: Charitable trusts allow grantors to support their favorite causes while potentially receiving tax benefits.

- Medicaid planning: Certain irrevocable trusts can help protect assets while qualifying for Medicaid benefits.

3. Testamentary Trust

A testamentary trust is established through a person’s will and comes into effect upon their death. It allows the grantor to provide for the distribution and management of assets for specific beneficiaries, such as minor children or individuals with special needs. Testamentary trusts offer control over how assets are distributed and can provide ongoing financial support to beneficiaries.

Benefits of a testamentary trust:

- Control over distribution: The grantor can specify how and when assets are distributed to beneficiaries.

- Protection for beneficiaries: Testamentary trusts can protect assets from mismanagement or external influences.

- Special needs planning: The trust can provide for the long-term financial needs of individuals with disabilities without jeopardizing their eligibility for government benefits.

- Minor children’s protection: Assets can be managed and held in trust until a minor child reaches a certain age.

4. Charitable Trust

A charitable trust is established to benefit a charitable organization or a specific cause. It allows the grantor to make a significant impact by providing financial support to their chosen charitable endeavors. Charitable trusts offer tax advantages, including income tax deductions and avoidance of capital gains taxes.

Types of charitable trusts:

- Charitable remainder trust: Provides income to the grantor or other named beneficiaries for a specific period, with the remaining assets donated to charity.

- Charitable lead trust: Provides income to a charitable organization for a set period, after which the remaining assets are distributed to non-charitable beneficiaries.

5. Special Needs Trust

A special needs trust, also known as a supplemental needs trust, is designed to provide for individuals with disabilities without jeopardizing their eligibility for government benefits, such as Medicaid or Supplemental Security Income (SSI). The trust assets supplement, but do not replace, government assistance, ensuring that the beneficiary’s needs are met.

Benefits of a special needs trust:

- Preservation of government benefits: The trust assets do not count as resources for government benefit eligibility.

- Supplemental support: The trust provides additional financial assistance to enhance the beneficiary’s quality of life.

- Careful management: The trust ensures that funds are used to meet the beneficiary’s specific needs.

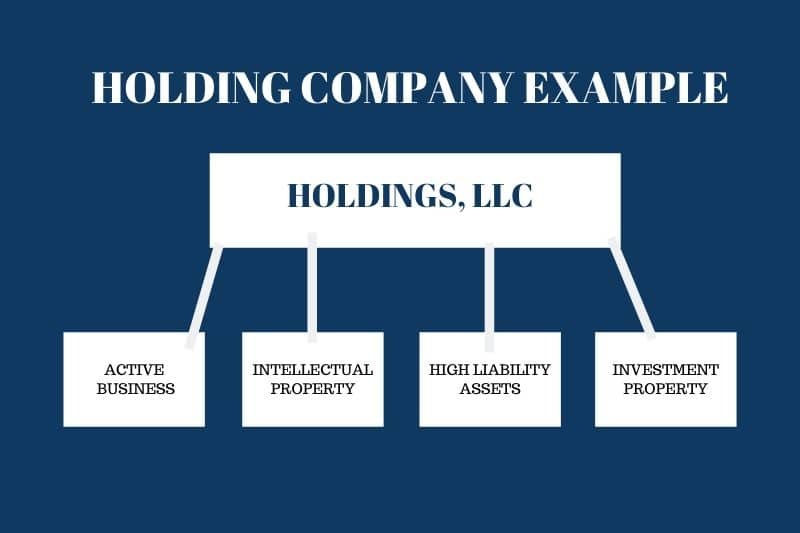

6. Family Trust

A family trust, also known as a living trust or a family living trust, is created to hold and manage assets for the benefit of family members. It can be revocable or irrevocable and allows for the efficient transfer of wealth from one generation to the next, while offering privacy and potential tax benefits.

Benefits of a family trust:

- Estate planning: The trust facilitates the smooth transfer of assets to family members, avoiding probate.

- Asset management: The trustee can manage and distribute assets according to the grantor’s wishes.

- Tax planning: Certain family trusts can help reduce estate taxes or income taxes.

- Privacy: Family trusts offer privacy as they are not subject to public record like a will.

7. Constructive Trust

A constructive trust is a legal arrangement that arises when a person acquires or holds assets that rightfully belong to someone else. It is created by a court to ensure the rightful owner receives the assets. Constructive trusts typically occur in cases of fraud, breach of trust, or unjust enrichment.

Benefits of a constructive trust:

- Asset recovery: The trust helps recover assets that have been wrongfully acquired or held.

- Equitable distribution: The trust ensures fairness by awarding assets to their rightful owners.

Trusts are versatile tools that provide individuals with a range of options for managing their assets and planning for the future. Whether it’s a revocable living trust for probate avoidance, an irrevocable trust for tax planning, or a testamentary trust for minor children, each type of trust serves a unique purpose. It’s essential to consult with an experienced estate planning attorney to determine the most suitable trust structure based on individual needs and goals.

Introduction to Trust law | Different Kinds of Trust | Indian Trust Act 1882 | What is Trust Law

Frequently Asked Questions

Frequently Asked Questions (FAQs)

1. What is a trust and its types?

A trust is a legal arrangement where a person (known as a settlor) transfers assets to another person or entity (known as a trustee) to hold and manage them for the benefit of a third party (known as a beneficiary). There are several types of trusts, including revocable trusts, irrevocable trusts, living trusts, testamentary trusts, charitable trusts, and special needs trusts.

2. How does a revocable trust work?

A revocable trust, also known as a living trust, can be changed or revoked by the settlor during their lifetime. The settlor transfers assets to the trust and maintains control over them. The trust becomes irrevocable upon the settlor’s death, and the assets are distributed according to the trust’s terms.

3. What is an irrevocable trust?

An irrevocable trust is a trust that cannot be modified or revoked by the settlor once it is established. Once assets are transferred to an irrevocable trust, they are no longer considered the settlor’s property, providing potential tax benefits and asset protection.

4. What is a testamentary trust?

A testamentary trust is created through a person’s will and takes effect upon their death. The trust holds and manages assets for the benefit of designated beneficiaries. Unlike revocable trusts, testamentary trusts do not avoid probate and are subject to court supervision.

5. How does a charitable trust work?

A charitable trust is established to support charitable causes or organizations. It allows individuals to contribute assets to a trust, which then distributes income or assets to the designated charities. Charitable trusts may provide tax advantages for donors.

6. What is a special needs trust?

A special needs trust is designed to provide for the financial needs of a person with disabilities without affecting their eligibility for government benefits. The trust holds assets that can be used to enhance the beneficiary’s quality of life while still allowing them to receive essential assistance.

7. Are there any other types of trusts?

Yes, there are various other types of trusts, such as spendthrift trusts, asset protection trusts, family trusts, and constructive trusts. Each type serves specific purposes and can be tailored to meet individual needs and objectives.

8. Can I create a trust on my own?

While it is possible to create a trust without legal assistance, it is highly recommended to consult with an attorney specializing in trust law. Trusts involve complex legal and financial considerations, and professional guidance can ensure your trust is properly structured and legally valid.

Final Thoughts

A trust is a legal arrangement in which a trustee holds and manages assets on behalf of beneficiaries. There are several types of trusts, including revocable trusts, irrevocable trusts, living trusts, testamentary trusts, and special needs trusts. Revocable trusts allow the grantor to retain control and make changes, while irrevocable trusts cannot be altered once created. Living trusts are created during the grantor’s lifetime, while testamentary trusts are established through a will. Special needs trusts are designed to provide for individuals with disabilities. Understanding what is a trust and its types is essential for effective estate planning and asset management.