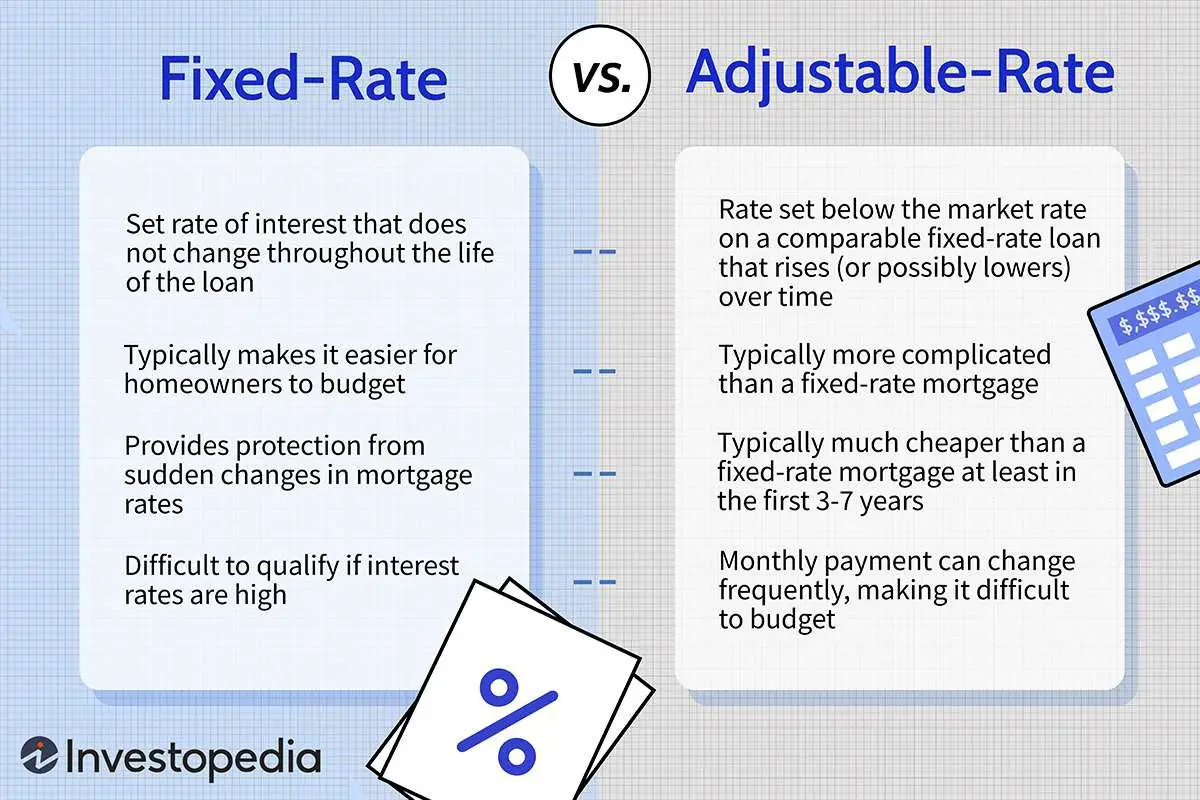

An adjustable-rate mortgage, commonly known as an ARM, is a type of home loan that offers a variable interest rate. If you’re wondering what is an adjustable-rate mortgage, let’s dive right into it. Unlike a fixed-rate mortgage, where the interest rate remains the same throughout the loan term, an ARM has rates that can fluctuate over time. This means that your monthly mortgage payments may change periodically. But don’t worry, an adjustable-rate mortgage comes with its own set of benefits and considerations. Let’s explore them together in this article.

What is an Adjustable-Rate Mortgage?

An adjustable-rate mortgage (ARM) is a type of home loan where the interest rate can fluctuate over time. Unlike a fixed-rate mortgage, where the interest rate remains the same throughout the loan term, an ARM offers a variable interest rate that adjusts periodically. This adjustment is usually based on a financial index, such as the U.S. Treasury bill rate or the London Interbank Offered Rate (LIBOR). The adjustment frequency may vary, typically occurring every 1, 3, 5, 7, or 10 years, depending on the loan terms.

ARMs are appealing to homebuyers who want to take advantage of potentially lower interest rates in the future or those planning to sell or refinance their homes before the adjustment period begins. However, they also carry some degree of risk, as the interest rate can rise, leading to increased mortgage payments. In this article, we will delve deeper into the world of adjustable-rate mortgages, exploring their benefits, drawbacks, and different types available.

Understanding How Adjustable-Rate Mortgages Work

To truly grasp the concept of an adjustable-rate mortgage, it’s essential to understand how they work and the factors that influence their interest rates. Here’s a closer look at the key elements of an ARM:

1. Initial Fixed-rate Period

Most adjustable-rate mortgages begin with an initial period, typically lasting 3, 5, 7, or 10 years, where the interest rate remains fixed. During this time, borrowers enjoy a stable monthly payment, making it easier to budget for their mortgage.

2. Adjustment Period

After the initial fixed-rate period, the interest rate will adjust periodically. This adjustment period refers to how often the interest rate will change. For example, a 5/1 ARM has an initial fixed-rate period of 5 years and adjusts annually afterward.

3. Index

The index is the benchmark used to determine the interest rate adjustment. Common indexes include the U.S. Treasury bill rate, LIBOR, or the Cost of Funds Index (COFI). Lenders look at the current value of the index and add a margin to determine the new interest rate. The margin is a fixed percentage that does not change throughout the life of the loan.

4. Interest Rate Caps

To protect borrowers from dramatic rate fluctuations, adjustable-rate mortgages often have interest rate caps. These caps limit how much the interest rate can increase or decrease during adjustment periods. There are typically two types of caps:

a. Periodic Adjustment Caps: This cap limits how much the interest rate can change during each adjustment period, regardless of market conditions.

b. Lifetime Cap: This cap sets the maximum interest rate over the loan’s lifetime, preventing excessively high rates.

Types of Adjustable-Rate Mortgages

Adjustable-rate mortgages come in various forms, each catering to different financial needs and circumstances. Let’s explore the most common types:

1. Hybrid ARMs

Hybrid ARMs combine features of both fixed-rate and adjustable-rate mortgages. They begin with an initial fixed-rate period, often 3, 5, 7, or 10 years, offering stability and predictable payments. After this period, the interest rate adjusts periodically based on the chosen index. Hybrid ARMs are ideal for those who plan to stay in their homes for a few years but want to take advantage of the lower initial interest rates.

2. Interest-Only ARMs

With interest-only ARMs, borrowers pay only the interest for a specified period, typically 5, 7, or 10 years, without reducing the loan’s principal balance. After the interest-only period ends, the mortgage payments increase to include both principal and interest. Interest-only ARMs are suitable for borrowers who expect their income to rise in the future or have other short-term financial obligations.

3. Option ARMs

Option ARMs offer borrowers flexibility in choosing how much they pay each month. These mortgages typically provide various payment options, including an interest-only payment, a minimum payment that doesn’t cover the interest, and a fully amortized payment. However, making the minimum payment could lead to negative amortization, causing the loan balance to increase over time. Option ARMs are suitable for financially savvy borrowers who want more control over their monthly payments.

Pros and Cons of Adjustable-Rate Mortgages

Like any financial decision, adjustable-rate mortgages have advantages and disadvantages. Let’s explore both sides to help you make an informed decision:

Pros:

1. Lower Initial Rates: One of the main advantages of ARMs is the lower initial interest rates compared to fixed-rate mortgages. This can lead to lower mortgage payments and increased buying power.

2. Potential for Lower Costs: If interest rates decrease or remain stable over time, borrowers with ARMs can benefit from lower overall costs compared to those with fixed-rate mortgages.

3. Flexibility: Adjustable-rate mortgages offer flexibility, especially for those who plan to sell or refinance their homes before the adjustment period begins. This can be advantageous for individuals who do not plan to stay in their homes for an extended period.

Cons:

1. Uncertainty in Future Payments: The adjustable nature of ARM interest rates introduces uncertainty, as it is challenging to predict how rates will change in the future. This uncertainty can make budgeting more difficult.

2. Rate Increase Risk: Interest rates can rise significantly during the adjustment period, leading to higher monthly mortgage payments. This risk is particularly significant if the adjustment period begins near historically low interest rates.

3. Refinancing Costs: If homeowners do not sell or refinance before the adjustment period, they may face higher mortgage payments. Refinancing to a fixed-rate mortgage at that point can involve closing costs, potentially offsetting any savings from the initial lower rates.

In conclusion, adjustable-rate mortgages can offer flexibility and potentially lower initial rates to borrowers. However, they also carry some degree of uncertainty, as the interest rates can increase over time. Consider your financial goals, risk tolerance, and future plans before deciding if an ARM is the right choice for you. Always consult with a mortgage professional to fully understand the terms and conditions of any loan option.

Adjustable rate mortgages ARMs | Housing | Finance & Capital Markets | Khan Academy

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an adjustable-rate mortgage?

An adjustable-rate mortgage (ARM) is a type of home loan where the interest rate can change periodically. Unlike a fixed-rate mortgage, which has a constant interest rate over the life of the loan, an ARM offers an initial fixed-rate period followed by adjustable rates based on specific factors.

How does an adjustable-rate mortgage work?

With an adjustable-rate mortgage, the interest rate is typically fixed for an initial period, usually 3, 5, 7, or 10 years. After this initial period, the rate will adjust periodically based on changes in a specified index, such as the U.S. Prime Rate or the London Interbank Offered Rate (LIBOR). The adjustment frequency and rate cap details are agreed upon during the loan application process.

What are the benefits of an adjustable-rate mortgage?

Some potential benefits of an adjustable-rate mortgage include lower initial interest rates compared to fixed-rate mortgages, which can lead to lower monthly payments during the initial fixed-rate period. It can be advantageous if you plan to sell the property before the rate adjusts or if you expect your income to increase in the future.

What are the drawbacks of an adjustable-rate mortgage?

One potential drawback of an adjustable-rate mortgage is the uncertainty in future interest rate adjustments. If interest rates rise significantly, your monthly payments could increase, potentially causing financial strain. Additionally, if you plan to stay in your home beyond the initial rate period, there is a risk of higher payments in the future.

What factors determine the adjustment of an ARM?

The adjustment of an adjustable-rate mortgage depends on several factors, including the index used, the margin (percentage) added to the index rate, the adjustment frequency (e.g., annually or monthly), and any rate caps that limit how much the rate can change in a given adjustment period or over the life of the loan.

Can I refinance my adjustable-rate mortgage into a fixed-rate mortgage?

Yes, it is possible to refinance an adjustable-rate mortgage into a fixed-rate mortgage. By refinancing, you can secure a stable interest rate for the remainder of your loan term, eliminating the uncertainty associated with future rate adjustments. However, it’s essential to evaluate the costs and benefits of refinancing based on your financial situation and long-term goals.

Are there any risks in choosing an adjustable-rate mortgage?

While an adjustable-rate mortgage can be beneficial in certain situations, it is essential to consider the risks involved. If interest rates increase significantly, your monthly payments can rise, potentially causing financial strain. Moreover, if you plan to stay in your home beyond the initial fixed-rate period, there is uncertainty regarding future payment amounts.

What should I consider when deciding between an adjustable-rate mortgage and a fixed-rate mortgage?

When deciding between an adjustable-rate mortgage and a fixed-rate mortgage, consider factors such as your financial stability, long-term plans for the property, and your risk tolerance. If you expect to move or refinance within a few years, an ARM with its initial fixed-rate period may be a suitable choice. However, if you prefer stability and predictability in your monthly payments, a fixed-rate mortgage offers more peace of mind.

Note: The information provided here is general in nature and not specific financial advice. It is recommended to consult with a qualified mortgage professional before making any decisions regarding home financing options.

Final Thoughts

An adjustable-rate mortgage, commonly referred to as an ARM, is a type of home loan where the interest rate fluctuates over time. This differs from a fixed-rate mortgage, where the interest rate remains constant throughout the life of the loan. With an ARM, the initial interest rate is typically lower than that of a fixed-rate mortgage, making it an attractive option for some borrowers. However, the interest rate may adjust periodically, based on market conditions, potentially resulting in higher monthly payments. It is important for borrowers to carefully consider the risks and benefits of an adjustable-rate mortgage before making a decision. In summary, an adjustable-rate mortgage is a home loan that offers an initial lower interest rate but can fluctuate over time.