An annuity: you might have heard the term before, but what exactly is it and what are its pros and cons? In simple terms, an annuity is a financial product that provides a steady income stream in exchange for a lump sum or periodic payments. It can offer security, especially during retirement, but it also comes with its own set of advantages and disadvantages. Let’s delve into what is an annuity and its pros and cons, so you can make an informed decision about whether it’s the right option for you.

What is an Annuity and its Pros and Cons

Understanding Annuities

An annuity is a financial product that provides a guaranteed income stream over a specific period of time, typically during retirement. It is essentially a contract between an individual and an insurance company, where the individual makes premium payments to the insurer, who then invests and manages the funds. In return, the insurer promises to provide regular payments to the individual, either for a fixed number of years or for the rest of their life.

There are several types of annuities, including fixed, variable, indexed, and immediate annuities. Each type has its own unique features and benefits, which we will explore in detail in the following sections.

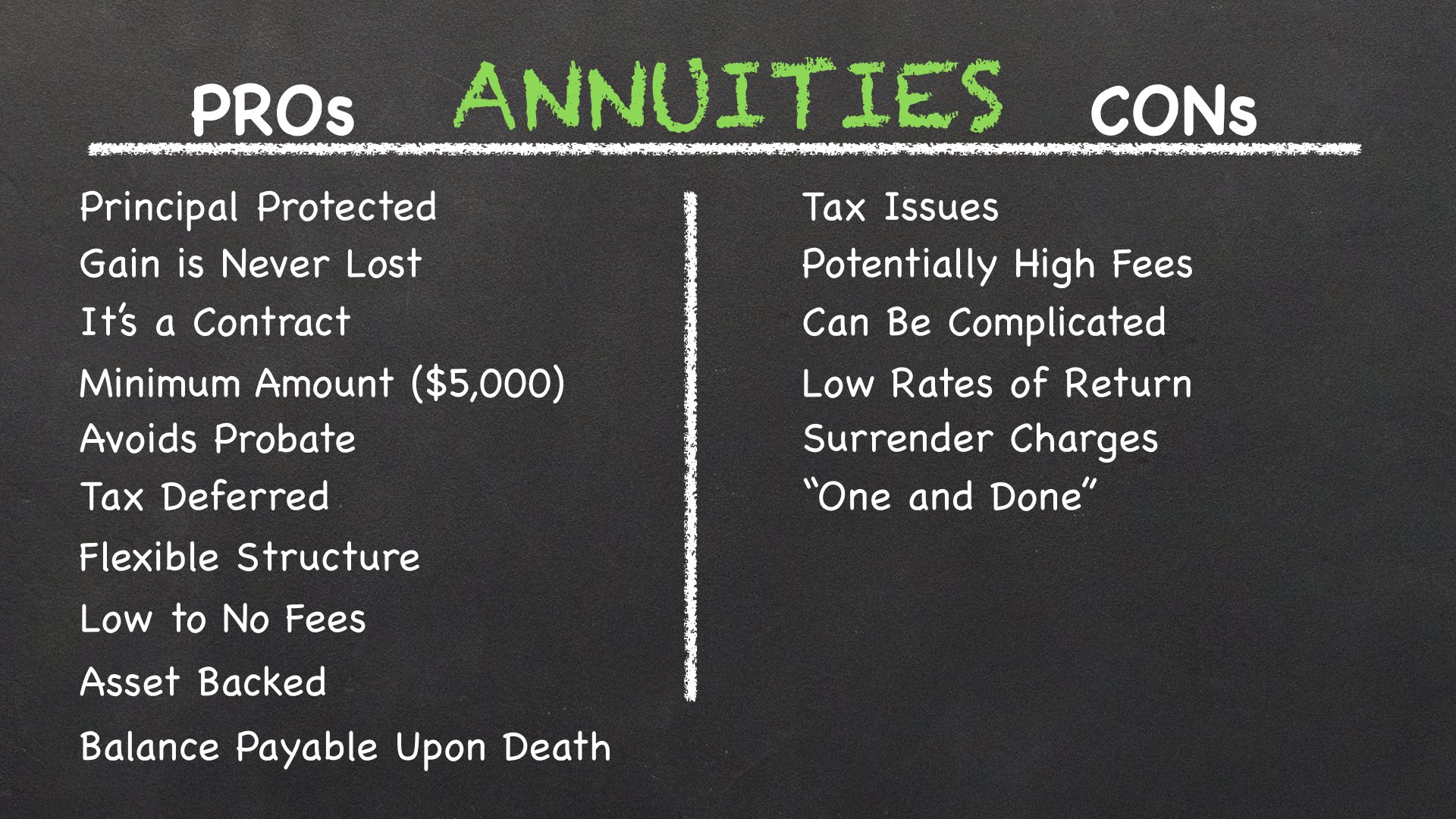

The Pros of Annuities

Annuities offer several advantages that can make them an appealing option for individuals planning for retirement. Here are some of the key benefits:

- Guaranteed Income: One of the biggest advantages of annuities is the ability to receive a guaranteed income stream for a specified period or even for life. This can provide peace of mind and financial security, especially for those concerned about outliving their savings.

- Tax-Deferred Growth: Annuities offer tax-deferred growth, meaning you won’t have to pay taxes on the earnings until you start receiving payments. This can be advantageous for individuals looking to maximize their retirement savings and potentially lower their tax liability during their working years.

- Investment Options: Depending on the type of annuity, you may have the opportunity to choose from various investment options. Fixed annuities offer a guaranteed interest rate, while variable and indexed annuities allow you to invest in a range of underlying assets such as stocks, bonds, or mutual funds. This flexibility can help you tailor your annuity to your specific investment goals and risk tolerance.

- Estate Planning: Annuities can also be useful for estate planning purposes. By naming beneficiaries, you can ensure that any remaining funds from your annuity will be passed on to your loved ones after your death, without going through probate.

The Cons of Annuities

While annuities offer several benefits, it’s important to consider the potential drawbacks before making a decision. Here are some of the key disadvantages:

- High Fees and Expenses: Annuities can come with high fees and expenses, which can eat into your overall returns. These fees may include administrative fees, mortality risk charges, and investment management fees. It’s important to carefully review the fee structure of any annuity before committing.

- Limited Liquidity: Annuities are designed to be long-term investments, and as such, they often come with limited liquidity. Withdrawing funds from an annuity before a certain age, typically 59½, may result in penalties and surrender charges. It’s important to consider your financial needs and potential emergencies before tying up a significant portion of your savings in an annuity.

- Loss of control: When you purchase an annuity, you essentially transfer control of your funds to the insurance company. This means you may have limited investment choices and less control over how your money is managed. If having control over your investments is important to you, an annuity may not be the best option.

- Complexity: Annuities can be complex financial products with intricate features and terms. Understanding the fine print and the various options available can be challenging. It’s essential to carefully read the contract and seek professional advice to ensure you fully comprehend the terms and conditions.

Choosing the Right Annuity for You

When deciding whether an annuity is right for you, it’s crucial to consider your individual financial goals, risk tolerance, and retirement needs. Here are some factors to consider:

- Financial Goals: Determine your financial goals and how an annuity aligns with them. Are you looking for a guaranteed income stream? Do you want the potential for higher returns through market investments? Understanding your objectives will help you choose the right type of annuity.

- Risk Tolerance: Consider your risk tolerance. Fixed annuities offer predictable returns but are more conservative, while variable or indexed annuities are tied to market performance and may be subject to greater fluctuations. Assess your comfort level with market volatility to choose an annuity that matches your risk tolerance.

- Time Horizon: Determine the time horizon for which you require income. If you’re looking for income for life or a set number of years, an immediate or fixed annuity may be appropriate. However, if you have a longer time horizon and want to potentially benefit from market growth, a variable or indexed annuity may be more suitable.

- Company Reputation: Research the reputation and financial stability of the insurance company offering the annuity. Ensure that the company has a strong track record and is capable of fulfilling its financial obligations over the long term.

- Professional Guidance: Seek advice from a qualified financial professional who can help you navigate the complexities of annuities and guide you in making an informed decision based on your individual circumstances.

In conclusion, annuities can be a valuable tool for retirement planning, offering a guaranteed income stream, tax advantages, and investment options. However, it’s crucial to carefully consider the pros and cons, understand the various types of annuities, and evaluate your individual needs before committing to a specific product. With proper research and professional guidance, you can determine whether an annuity is the right choice to help you achieve your financial goals and secure a comfortable retirement.

Understanding the Pros and Cons of Annuities

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an annuity?

An annuity is a financial product that provides a regular stream of income in exchange for a lump sum payment or a series of payments. It is typically offered by insurance companies and can be used as a retirement savings vehicle.

What are the pros of an annuity?

Annuities offer several advantages, including:

– Guaranteed income: Annuities provide a predictable stream of income that can last for a specific period or even for life.

– Tax-deferred growth: Earnings on annuities are tax-deferred until withdrawal, allowing your investment to potentially grow faster.

– Death benefit: Many annuities offer a death benefit that ensures your beneficiaries receive a payout upon your death.

– Diversification: Annuities can be an effective tool for diversifying your investment portfolio and reducing risk.

What are the cons of an annuity?

While annuities have their benefits, there are also some drawbacks to consider:

– Fees: Annuities often come with fees, such as contract fees, administrative fees, and investment management fees, which can eat into your returns.

– Lack of liquidity: Annuities are designed for long-term retirement planning and usually have restrictions on withdrawals, which can limit your access to funds.

– Inflation risk: If the annuity’s income does not keep up with inflation, your purchasing power could decrease over time.

– Surrender charges: Some annuities impose surrender charges if you withdraw your money before a specified period, which can result in significant penalties.

How does an annuity work?

An annuity works by allowing you to invest a lump sum or make regular payments to an insurance company. The funds are then invested and grow over time. At a selected date or age, the annuity starts paying out a regular income, which can be fixed or variable depending on the type of annuity you choose.

What are the different types of annuities?

There are several types of annuities, including:

– Fixed annuities: These offer a guaranteed interest rate and a fixed income stream for a specific period.

– Variable annuities: These allow you to invest in underlying investment options such as mutual funds, offering the potential for higher returns but with more risk.

– Indexed annuities: These annuities provide returns based on the performance of a specific index, such as the S&P 500, offering a balance between fixed and variable annuities.

Can I access my money in an annuity?

Yes, you can access your money in an annuity, but it may be subject to withdrawal restrictions and surrender charges. Some annuities also offer penalty-free withdrawals for specific circumstances such as illness or long-term care needs.

Are annuities suitable for everyone?

Annuities may not be suitable for everyone. They are often recommended for individuals looking for a steady stream of income in retirement and are willing to sacrifice liquidity for guaranteed payments. It’s essential to evaluate your financial goals and consult with a financial advisor to determine if an annuity aligns with your needs.

Can I switch or transfer my annuity?

Yes, it is possible to switch or transfer an annuity to a different contract or insurance company. However, it is crucial to consider any surrender charges, fees, and potential tax implications before making such a decision. Consulting with a financial advisor can help you understand the implications of switching or transferring your annuity.

How are annuities taxed?

Annuities are taxed differently depending on whether they are qualified or non-qualified. Qualified annuities are funded with pre-tax dollars, such as those held in an employer-sponsored retirement plan like a 401(k). Withdrawals from qualified annuities are taxed as ordinary income. Non-qualified annuities are funded with after-tax dollars, and only the earnings portion is taxable upon withdrawal. It’s advisable to consult with a tax professional to understand the specific tax implications of your annuity.

Final Thoughts

An annuity is a financial product that provides a stream of income over a specified period or for the rest of your life. It can be a reliable source of retirement income, offering stability and peace of mind. However, annuities also have their drawbacks. On the positive side, annuities offer tax-deferred growth, guaranteed income, and the option for customization. On the downside, they can be complex, come with high fees, and limit access to your money. Understanding the pros and cons of annuities is crucial when considering them as part of your financial plan. Whether an annuity is a suitable investment for you depends on your individual circumstances and goals. So, when exploring financial options, it’s essential to weigh the pros and cons of annuities carefully.