Looking to understand what an expense ratio in mutual funds is all about? You’ve come to the right place! An expense ratio is a crucial factor to consider when investing in mutual funds. In simple terms, it represents the percentage of an investment’s assets that go toward covering the fund’s operating expenses. These expenses can include administrative fees, management fees, advertising costs, and more. By understanding the expense ratio, investors can gauge the impact of fees on their overall returns. So, let’s dive deeper into the world of expense ratios in mutual funds and gain a better understanding of how they can affect your investment journey.

What is an Expense Ratio in Mutual Funds?

The expense ratio is a crucial concept to understand when investing in mutual funds. It refers to the annual fees and expenses charged by a mutual fund company to manage and operate the fund. This ratio is expressed as a percentage of the fund’s average net assets and is deducted from the investor’s returns.

The expense ratio covers various costs, including administrative expenses, management fees, distribution and marketing expenses, custodial fees, accounting fees, legal expenses, and other operating costs related to running the mutual fund. It is important to note that the expense ratio is not charged directly to the investor but rather deducted from the fund’s assets.

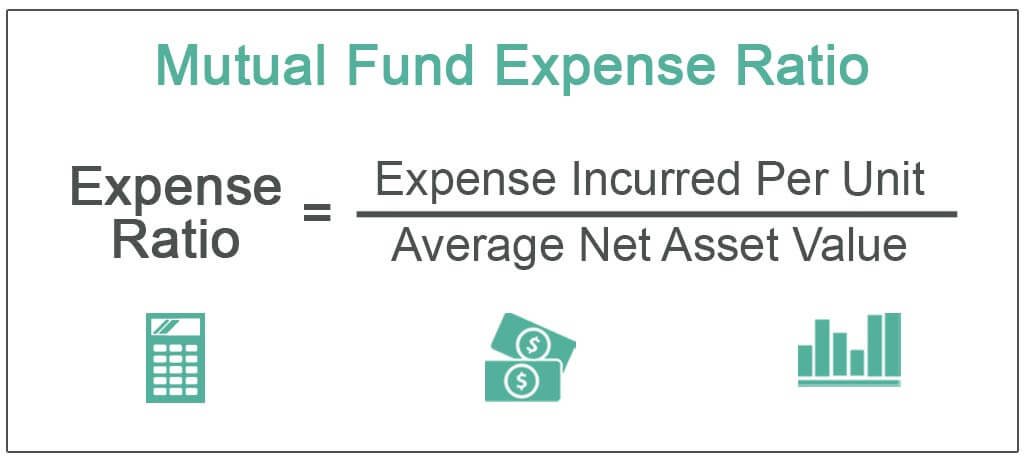

Calculation of an Expense Ratio

To calculate the expense ratio, the total expenses of the mutual fund are divided by the average net assets. The result is then multiplied by 100 to obtain the percentage representation. For example, if a mutual fund has total expenses of $100,000 and average net assets of $5,000,000, the expense ratio would be calculated as follows:

Expense Ratio = (Total Expenses / Average Net Assets) * 100

= ($100,000 / $5,000,000) * 100

= 2%

In this example, the expense ratio of the mutual fund would be 2%. This means that for every $1,000 invested in the fund, $20 would go towards covering the expenses associated with managing the fund.

Understanding the Impact of Expense Ratios

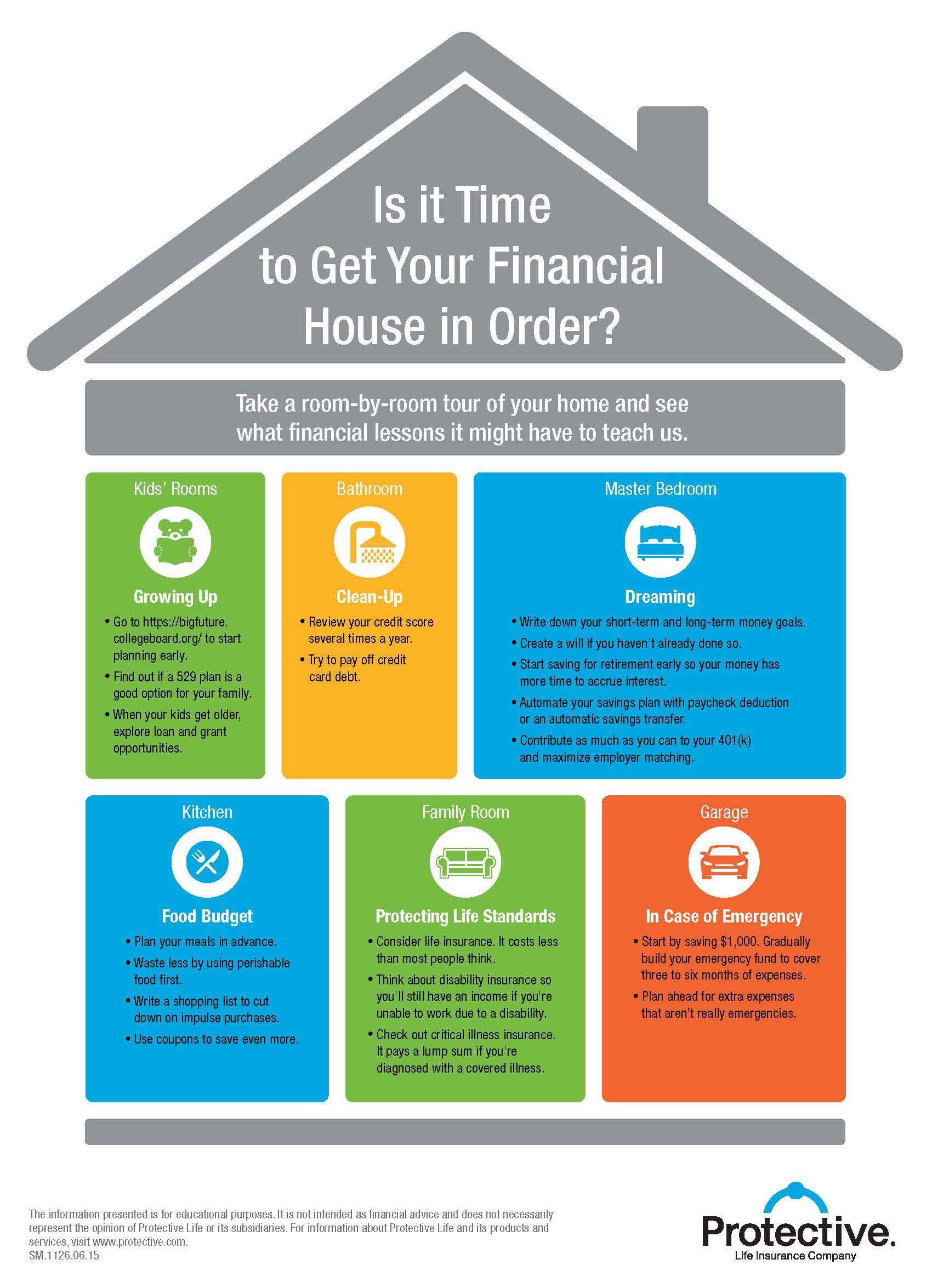

Expense ratios are an important factor to consider when choosing a mutual fund because they directly impact an investor’s returns. Here are some key points to understand about the impact of expense ratios:

1. Reduction in Investment Returns: The expense ratio is deducted from the fund’s assets, which means that investors’ returns are reduced by the percentage of the expense ratio. For example, if a mutual fund generates a 10% return but has a 2% expense ratio, the investor’s net return would be 8%.

2. Compounding Effect: Over time, the impact of expense ratios can be significant due to their compounding effect. Even a seemingly small difference in expense ratios can result in substantial differences in long-term returns. Therefore, it’s important to choose funds with lower expense ratios to maximize investment growth.

3. Comparing Expense Ratios: When comparing mutual funds, it is essential to consider expense ratios within the same asset class. Lower expense ratios are generally more favorable as they allow investors to keep a larger portion of their returns. However, it’s important to consider other factors such as fund performance and investment strategy alongside the expense ratio.

4. Active vs. Passive Funds: Active mutual funds tend to have higher expense ratios compared to passively managed index funds. This is due to the higher costs associated with research, analysis, and active portfolio management. Passive funds, on the other hand, aim to replicate the performance of a specific index and have lower expense ratios.

Factors Affecting Expense Ratios

Several factors can influence the expense ratios of mutual funds. Understanding these factors can help investors make informed decisions. Here are some common factors that affect expense ratios:

1. Fund Size: The size of a mutual fund can impact the expense ratio. Larger funds often benefit from economies of scale, as the fixed costs associated with running the fund can be spread across a larger asset base. This allows them to have lower expense ratios compared to smaller funds.

2. Investment Strategy: The investment strategy employed by a fund can impact its expense ratio. Funds that require extensive research, active management, or specialized strategies often have higher expense ratios compared to passively managed index funds.

3. Asset Class: Different asset classes may have varying expense ratios. For example, equity funds may have higher expense ratios compared to bond funds due to the additional costs associated with researching and analyzing individual stocks.

4. Share Class: Mutual funds may offer different share classes, each with its own expense ratio. Common share classes include A, B, C, and institutional shares. Each class may have different fee structures, loads, and expense ratios.

5. Investment Company: Different mutual fund companies may have different expense structures. It is important to compare expense ratios within the same asset class and investment style to ensure an accurate comparison.

Expense Ratios and Performance

Expense ratios should be considered in conjunction with a fund’s performance. While low expense ratios are generally desirable, solely focusing on expense ratios without considering other factors such as historical performance, investment strategy, and risk may lead to suboptimal investment decisions.

It is important to remember that higher expense ratios do not guarantee better performance, and lower expense ratios do not necessarily indicate superior returns. Investors should evaluate expense ratios as part of a comprehensive analysis of a mutual fund’s overall potential for success.

Understanding expense ratios is crucial for investors seeking to make informed decisions when investing in mutual funds. The expense ratio represents the annual fees and expenses charged by a mutual fund company and directly impacts an investor’s returns. By considering expense ratios alongside other factors such as fund performance, investment strategy, and risk, investors can make more informed decisions that align with their investment objectives.

How Does Expense Ratio 'Get Charged?'

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an expense ratio in mutual funds?

An expense ratio in mutual funds represents the annual fees and expenses charged by the fund to investors. It includes management fees, administrative costs, and operational expenses, which are deducted from the fund’s assets. The expense ratio is expressed as a percentage of the fund’s average net assets.

How does the expense ratio affect my investment?

The expense ratio directly impacts your investment returns. A higher expense ratio means more of your investment earnings will be used to cover fees and expenses, resulting in lower returns. Conversely, a lower expense ratio allows a higher proportion of investment returns to be retained by investors.

Why is it important to consider the expense ratio?

Considering the expense ratio is crucial as it directly affects your investment’s profitability. Lower expense ratios can significantly enhance your long-term returns, especially when considering the effects of compounding over time. Therefore, it is wise to choose mutual funds with lower expense ratios to maximize your investment potential.

What does a typical expense ratio range from?

Expense ratios can vary depending on the type of mutual fund. Generally, actively managed funds tend to have higher expense ratios, ranging from 0.5% to 2%. Meanwhile, index funds and exchange-traded funds (ETFs) typically have lower expense ratios, often below 0.5%.

How can I find the expense ratio of a mutual fund?

You can find the expense ratio of a mutual fund in its prospectus or fund fact sheet. Additionally, many financial websites and online brokerages provide information on the expense ratios of various mutual funds. It is important to review this information before making an investment decision.

Do expense ratios vary within the same mutual fund?

Expense ratios typically remain consistent within the same mutual fund. However, certain share classes of the fund may have different expense ratios. For example, institutional share classes may have lower expense ratios than retail share classes. It is essential to verify the expense ratio associated with your specific share class before investing.

What are the factors that impact expense ratios?

Several factors can influence expense ratios. The primary factors include the fund’s investment strategy, the level of active management involved, the fund’s asset size, and the fund’s operating costs. Funds with complex strategies or smaller asset sizes often have higher expense ratios due to increased operational costs.

Can high expense ratios indicate poor fund performance?

While high expense ratios can eat into investment returns, they do not necessarily indicate poor fund performance. It is important to evaluate a fund’s performance based on its overall returns, risk-adjusted performance, and consistency over time. Expense ratios should be considered alongside other performance metrics when assessing a mutual fund.

Final Thoughts

An expense ratio in mutual funds is a crucial metric that investors should consider. It represents the percentage of a fund’s assets that are used to cover its operating expenses. By analyzing the expense ratio, investors can understand the costs associated with owning a particular mutual fund. A lower expense ratio is generally favorable as it means less money is being deducted from your investment returns. It is essential to compare expense ratios across different funds to make informed investment decisions. Understanding what an expense ratio entails is vital for investors looking to maximize their returns.