Are you curious about what exactly an index fund is and what advantages it offers? Look no further! In this article, we will dive into the world of index funds and explore their incredible benefits. Whether you’re new to investing or a seasoned pro, understanding the concept of index funds and their advantages is essential for building a successful investment portfolio. So, let’s get started and unravel the potential of index funds together. Grab a cup of coffee, sit back, and let’s explore what an index fund is and how it can benefit you.

What is an Index Fund and Its Advantages

Before diving into the advantages of index funds, let’s first understand what they are and how they function. Index funds are a type of mutual fund or exchange-traded fund (ETF) that aim to replicate the performance of a particular market index, such as the S&P 500 or the Dow Jones Industrial Average. Instead of actively choosing individual stocks to invest in, index funds use a passive investment strategy by holding a diversified portfolio of securities that mirror the composition of the chosen index.

Passive vs. Active Investing

Active investing involves frequent buying and selling of stocks in an attempt to outperform the market. This approach relies heavily on the skills and expertise of fund managers or individual investors who analyze companies, assess market trends, and make investment decisions based on their research and insights.

In contrast, passive investing, which index funds are a prime example of, takes a more hands-off approach. Instead of trying to beat the market, investors in index funds seek to match its performance. Rather than relying on active decision-making, the goal of passive investing is to achieve broad market exposure, diversification, and low-cost investing.

Advantages of Index Funds

Index funds have gained popularity among investors for several reasons. Let’s explore the advantages they offer:

Broad Market Exposure

By investing in an index fund, you gain exposure to a broad range of securities within the chosen market index. This diversification helps reduce the risk associated with investing in individual stocks. Instead of relying on the performance of a single company, your investment is spread across multiple companies, industries, and sectors. This broad market exposure can provide more stable returns over the long term.

Lower Costs

Compared to actively managed funds, index funds generally have lower expense ratios. Since the investment strategy of index funds is passive, there is no need for expensive research, analysis, or frequent trading. As a result, index funds tend to have lower management fees and transaction costs. These lower costs can significantly impact your overall investment returns over time.

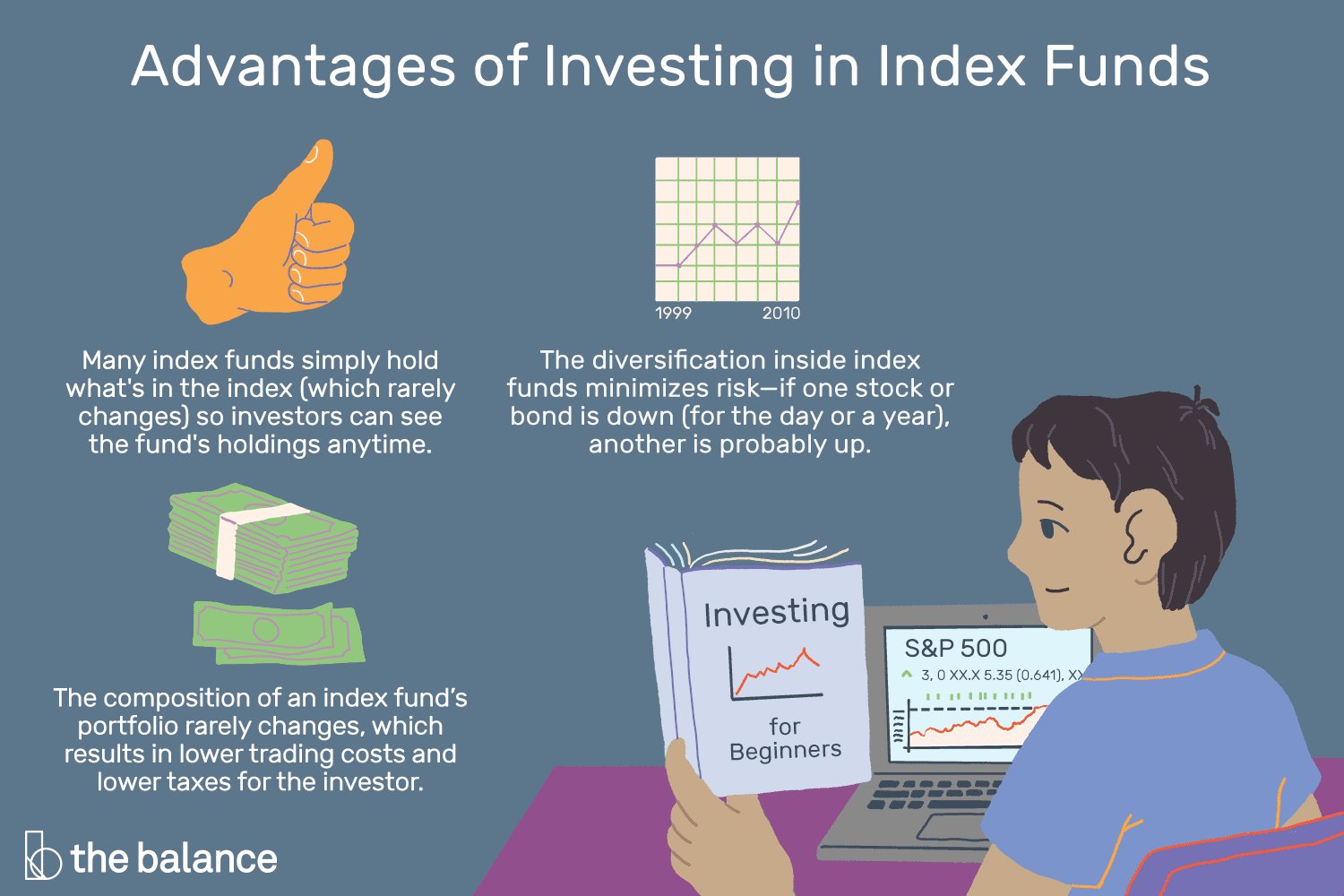

Transparency

One of the key advantages of index funds is their transparency. The holdings of an index fund are based on a predefined index, and the weights of each holding are publicly disclosed. This transparency allows investors to know exactly what securities are included in the fund and in what proportions. As a result, investors can make informed decisions and have a clear understanding of the composition of their investment.

Consistent Performance

Index funds aim to replicate the performance of their underlying index. While they may not outperform the market, they also tend to avoid significant underperformance. By investing in an index fund, you can expect consistent performance that closely aligns with the overall market. This stability can be beneficial for long-term investors who prioritize steady and reliable returns over short-term volatility.

Reduced Risk

As mentioned earlier, index funds offer diversification by investing in a wide range of securities across different industries and sectors. This diversification helps mitigate the risk associated with holding a concentrated portfolio of individual stocks. Even if one or a few stocks in the index perform poorly, the impact on the overall fund’s performance is often minimized by the presence of other well-performing stocks. Thus, index funds can provide a more stable investment option for risk-averse investors.

Tax Efficiency

Due to their passive investment strategy, index funds generally have lower portfolio turnover compared to actively managed funds. This lower turnover can result in fewer capital gains distributions, reducing the tax liabilities for investors. Additionally, index funds are less likely to trigger taxable events through frequent buying and selling of securities, making them a tax-efficient investment option.

Accessibility

Index funds are widely available and accessible to investors of all levels. They can be purchased through brokerage accounts, retirement plans, and online investment platforms. With low minimum investment requirements, index funds provide an opportunity for individual investors to participate in the stock market without the need for significant capital. This accessibility makes index funds an appealing choice for beginners and seasoned investors alike.

In conclusion, index funds offer several advantages, including broad market exposure, lower costs, transparency, consistent performance, reduced risk, tax efficiency, and accessibility. These benefits make index funds a compelling investment option for those seeking a simple yet effective way to diversify their portfolio and achieve long-term financial goals. Whether you’re a beginner or an experienced investor, index funds can be a valuable addition to your investment strategy. Consider exploring the diverse range of index funds available and consult with a financial advisor to determine the best fit for your investment objectives and risk tolerance.

Index Funds For Beginners: Your Guide For Passive Investing

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an index fund?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific financial market index, such as the S&P 500. It is designed to replicate the holdings and returns of the underlying index it tracks.

What are the advantages of investing in index funds?

Investing in index funds offers several advantages, including:

– Broad market exposure: Index funds provide exposure to a wide range of securities within a specific index, allowing investors to diversify their portfolios easily.

– Lower fees: Due to their passive management approach, index funds tend to have lower expense ratios compared to actively managed funds, making them more cost-effective for long-term investors.

– Consistent returns: Index funds aim to match the performance of their underlying indexes, providing investors with consistent returns over time.

– Reduced risk: By investing in a diversified portfolio of securities, index funds help to minimize the risks associated with individual stocks or sectors.

– Simplicity: Index funds are straightforward investment vehicles, making them suitable for both beginner and experienced investors.

Can index funds outperform actively managed funds?

While index funds are not designed to outperform the market, they have historically shown to outperform the majority of actively managed funds over the long term. This is primarily due to their low fees and ability to capture the overall market performance.

Are index funds suitable for all investors?

Index funds are generally considered suitable for a wide range of investors, including those who are looking for long-term investment strategies, prefer a passive approach to investing, or want an easily diversified portfolio. However, individual investors should consider their specific financial goals, risk tolerance, and investment time horizon before investing in index funds.

How do index funds differ from actively managed funds?

The main difference between index funds and actively managed funds lies in their investment approach. While index funds aim to replicate the performance of a specific index, actively managed funds rely on the expertise of portfolio managers to select investments and attempt to outperform the market. Additionally, index funds generally have lower fees compared to actively managed funds.

Can index funds provide dividend income?

Yes, index funds can provide dividend income to investors. Many index funds reinvest the dividends received from the underlying securities back into the fund, which can lead to additional long-term growth. However, the dividend yield of an index fund may vary depending on the composition of the underlying index.

What types of indexes do index funds track?

Index funds can track a wide range of indexes, including broad market indexes like the S&P 500, international indexes such as the MSCI EAFE, sector-specific indexes like the Dow Jones U.S. Technology Sector Index, or bond indexes such as the Bloomberg Barclays U.S. Aggregate Bond Index.

Are index funds a good option for retirement savings?

Index funds are often considered a suitable option for retirement savings due to their long-term performance, diversification benefits, and lower fees. By investing in a mix of equity and bond index funds, individuals can build a well-diversified retirement portfolio that aims to generate consistent returns over time. However, it is essential to consult with a financial advisor or do thorough research based on your specific retirement goals and risk tolerance.

Final Thoughts

An index fund is a type of investment fund that aims to replicate the performance of a specific market index such as the S&P 500. It offers several advantages to investors. Firstly, index funds typically have lower management fees compared to actively managed funds. Secondly, they provide diversification by holding a broad range of securities in the index, reducing the risk associated with individual stocks. Lastly, index funds offer transparency as they disclose their holdings regularly. Overall, investing in index funds is an efficient and cost-effective way for individuals to gain exposure to the overall market and potentially achieve long-term financial goals.