Looking for a flexible financial solution that can help you tackle expenses without putting a strain on your budget? Well, look no further! An installment loan might just be the answer you’ve been searching for. So, what is an installment loan and its uses? Simply put, it’s a type of loan that allows you to borrow a fixed amount of money and repay it in regular installments over a predetermined period of time. Whether you need to pay for unexpected medical bills, make home improvements, or consolidate high-interest debts, an installment loan can provide the financial assistance you need. Let’s delve deeper into the world of installment loans and explore their various uses.

What is an Installment Loan and Its Uses

An installment loan is a type of borrowing that allows you to receive a lump sum of money from a lender and repay it over a set period of time in regular installments. These loans are commonly used for various purposes, such as making big purchases, consolidating debt, or covering unexpected expenses. This article will delve into the details of installment loans, exploring their features, benefits, and popular use cases.

Understanding Installment Loans

Installment loans are a popular form of consumer credit where borrowers can obtain a specific amount of money from a lender. Unlike revolving credit, such as credit cards, installment loans have a fixed repayment schedule and a predetermined interest rate. The borrower agrees to repay the loan in equal installments over a set period, typically ranging from a few months to several years.

How Do Installment Loans Work?

When you apply for an installment loan, lenders assess your creditworthiness based on factors like your credit score, income, and debt-to-income ratio. If approved, you receive the loan amount in a lump sum. The repayment terms, including interest rates and the duration of the loan, are agreed upon beforehand.

Each monthly installment consists of a portion of the principal amount borrowed and the accrued interest. As you make regular payments, the balance is gradually reduced until the loan is fully repaid. The monthly installments are typically fixed, making it easier to budget and plan for repayment.

The Benefits of Installment Loans

Installment loans offer several benefits compared to other types of loans, which is why they are a popular choice for many consumers. Some key advantages include:

- Predictable Repayment: With fixed monthly payments, you know exactly how much to budget for each month, making it easier to manage your finances.

- Flexible Loan Amounts: Depending on your financial needs, installment loans can be tailored to suit various borrowing requirements, allowing you to access the right amount of funds.

- Build Credit: Consistently making on-time payments towards your installment loan can help improve your credit score over time, demonstrating responsible financial behavior to lenders.

- Potential Lower Interest Rates: Installment loans often come with lower interest rates compared to other forms of credit, such as credit cards or payday loans, leading to potential savings in interest payments.

Popular Uses of Installment Loans

Installment loans are versatile and can be used for various purposes. Here are some common scenarios where people utilize installment loans:

1. Debt Consolidation

Debt consolidation is a popular use for installment loans. If you have multiple high-interest debts, such as credit card balances or personal loans, consolidating them into a single installment loan can simplify your repayment strategy. By combining your debts, you can potentially secure a lower interest rate, lower your monthly payments, and streamline your debt management.

2. Major Purchases

Whether it’s buying a car, renovating your home, or funding a wedding, installment loans are often used to finance significant purchases. Instead of using high-interest credit cards or depleting your savings, installment loans offer a structured repayment plan that allows you to spread the cost over time while keeping your savings intact.

3. Medical Expenses

Unforeseen medical costs can put a strain on your finances. Installment loans can be a lifeline for covering medical bills, surgeries, or other healthcare expenses. They provide a way to access the funds you need promptly, allowing you to focus on your health without the added financial stress.

4. Educational Expenses

Education is an investment in yourself or your loved ones. Whether it’s financing tuition fees, purchasing textbooks, or covering other educational expenses, installment loans can help bridge the gap between available funds and your educational aspirations.

5. Emergency Situations

Life is unpredictable, and emergencies can strike at any moment. Installment loans can be a valuable resource when faced with unexpected costs, such as home repairs, car accidents, or legal fees. Having access to quick funds allows you to navigate these situations without disrupting your financial stability.

6. Business Financing

Entrepreneurs and small business owners often turn to installment loans to finance business operations, purchase inventory, or invest in growth opportunities. These loans provide a reliable source of capital to support business ventures and cash flow management.

7. Special Occasions and Events

From dream vacations to milestone celebrations, installment loans can be used to make special occasions memorable. By spreading out the cost over several months, you can enjoy these experiences without compromising your budget or incurring high-interest debts.

In conclusion, installment loans offer borrowers the flexibility and convenience of repaying borrowed funds over time through equal monthly installments. The numerous benefits, such as predictable repayment, flexibility in loan amounts, and the potential to improve credit scores, make installment loans an attractive choice for various financial needs. Whether it’s consolidating debt, financing major purchases, or covering unexpected expenses, installment loans provide a valuable solution to help individuals and businesses achieve their goals.

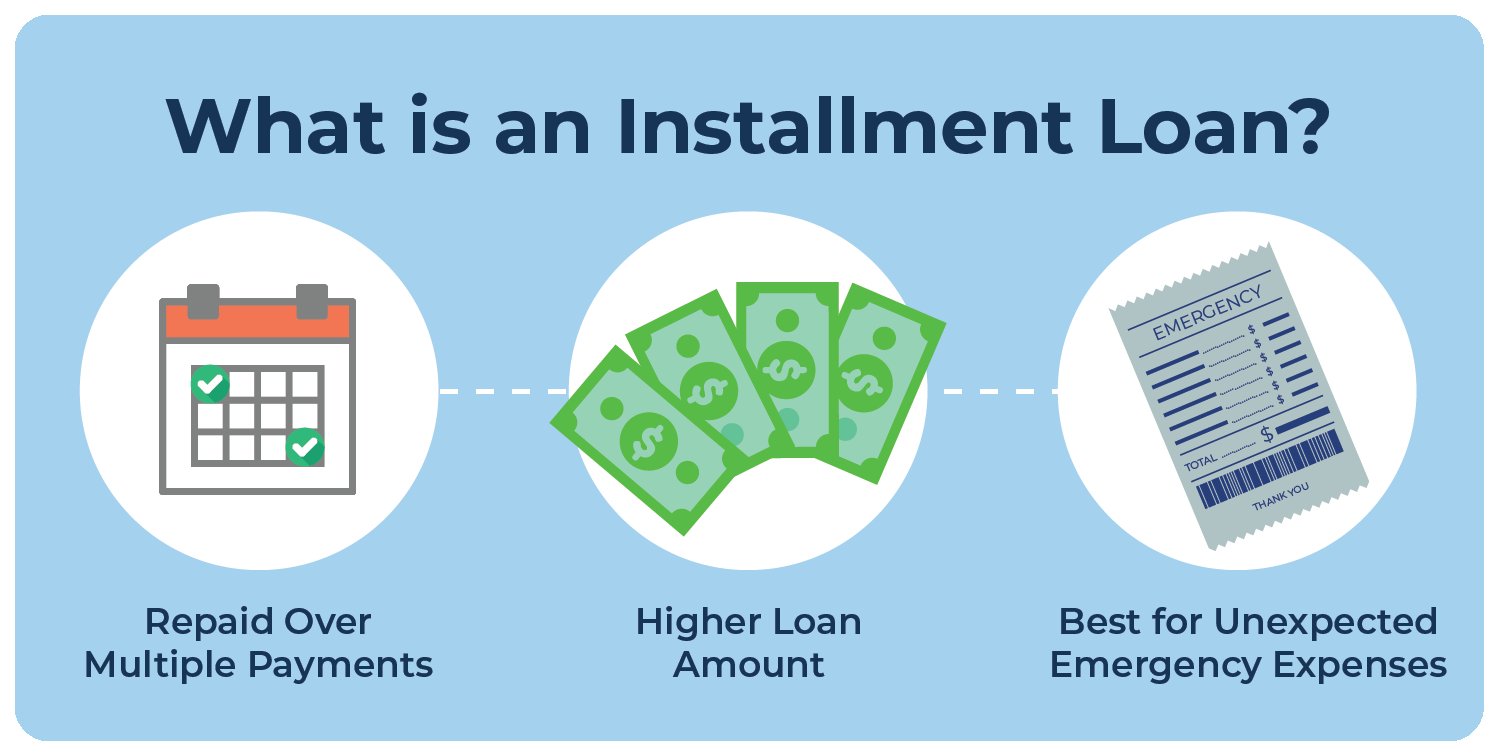

What Is an Installment Loan?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an installment loan and how can it be used?

An installment loan is a type of loan that is repaid in fixed, regular installments over a predetermined period of time. It is commonly used for various purposes such as funding large purchases, consolidating debt, or covering unexpected expenses.

How does an installment loan work?

When you take out an installment loan, you borrow a specific amount of money from a lender. You then agree to repay that loan, plus interest, in regular installments over a set period of time. The installments typically remain the same throughout the repayment period.

What are the advantages of using an installment loan?

Using an installment loan can provide several advantages. First, it allows you to make large purchases or cover expenses without having to pay the full amount upfront. Additionally, since the payments are spread out over time, it can be easier to fit into your monthly budget.

Are there different types of installment loans?

Yes, there are different types of installment loans available. Some common types include personal loans, auto loans, mortgages, and student loans. Each type has its own specific terms, interest rates, and repayment periods.

How is an installment loan different from a revolving line of credit?

An installment loan is repaid over a fixed period of time with set payments, while a revolving line of credit, such as a credit card, allows you to borrow and repay funds on an ongoing basis. With an installment loan, you know exactly when the loan will be paid off.

What factors determine the interest rate on an installment loan?

The interest rate on an installment loan depends on several factors, including your credit score, the loan amount, the length of the loan, and current market conditions. Lenders use these factors to assess the level of risk involved in lending to you.

Can I pay off an installment loan early?

Yes, most installment loans allow you to pay off the loan early without any prepayment penalties. By paying off the loan early, you can potentially save on interest charges.

What happens if I miss an installment loan payment?

If you miss an installment loan payment, it can have negative consequences. Late payments may result in fees, increased interest rates, and damage to your credit score. It is important to communicate with your lender if you’re unable to make a payment to explore possible alternatives or arrangements.

Note: The information provided above is intended for general informational purposes only and should not be considered as financial advice. It is recommended to consult with a financial professional for personalized guidance based on your specific circumstances.

Final Thoughts

An installment loan is a type of loan that allows borrowers to repay the amount borrowed in regular, fixed payments over a set period of time. These loans are commonly used for large purchases such as homes, cars, or education expenses. With the flexibility of installment loans, borrowers can budget and plan their finances accordingly. By making timely payments, borrowers can also build a positive credit history. Overall, installment loans provide individuals with a practical and manageable way to finance their needs while maintaining financial stability. So, if you’re looking for a reliable loan option, consider an installment loan and explore its various uses.