Looking for extra protection that goes beyond your regular insurance policies? Then look no further! What is an umbrella insurance policy, you ask? Well, it’s a comprehensive coverage option that provides an added layer of financial security. Think of it as an umbrella that shields you from unexpected downpours of liability, surpassing the limits of your existing policies. In this article, we will delve into the ins and outs of umbrella insurance, explaining why it’s a smart move for safeguarding your assets. So, let’s dive right in!

What is an Umbrella Insurance Policy?

You’ve probably heard of various types of insurance policies: auto insurance, home insurance, health insurance, and more. But have you ever heard of an umbrella insurance policy? If you’re unfamiliar with this type of coverage, you’re in the right place. In this article, we’ll provide a comprehensive overview of what an umbrella insurance policy is, how it works, and why you might need it.

Understanding Liability Insurance

Before diving into umbrella insurance, it’s crucial to have a solid understanding of liability insurance. Liability insurance provides coverage for financial losses and legal expenses if you’re found responsible for causing bodily injury, property damage, or personal injury to others. This coverage extends beyond the policyholder, protecting their assets and future earnings in case of a lawsuit.

Standard liability insurance policies, such as homeowners or auto insurance, have predetermined limits, often ranging from $100,000 to $500,000. While these limits may seem sufficient, certain accidents can result in significant claims that exceed these limits. This is where umbrella insurance comes into play.

The Basics of Umbrella Insurance

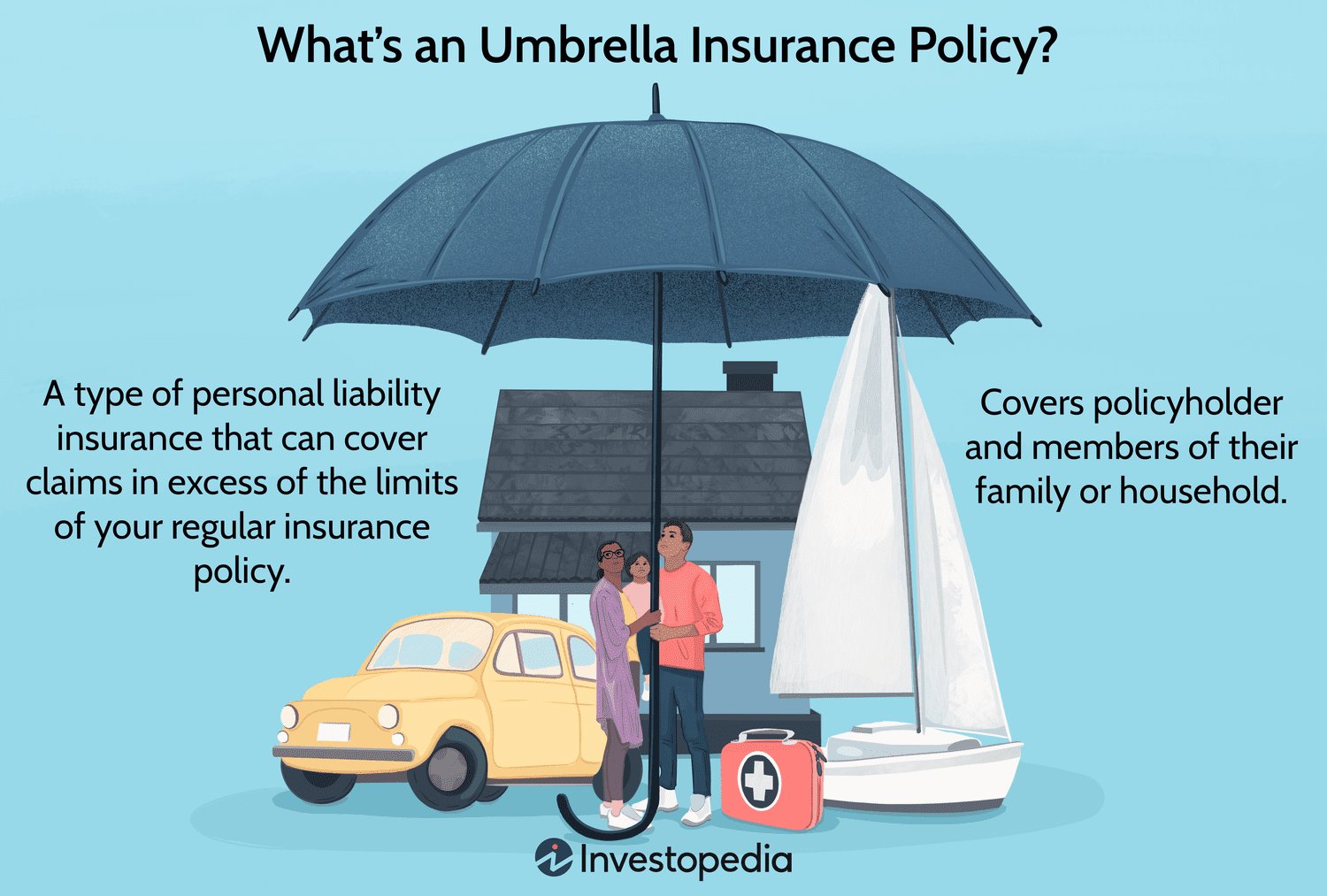

An umbrella insurance policy is a type of liability coverage that extends the limits of your underlying insurance policies. It acts as an additional layer of protection, providing higher coverage limits and filling in the gaps left by your primary policies. Umbrella insurance is designed to safeguard your assets and protect you from potentially devastating financial loss.

How Does Umbrella Insurance Work?

When you purchase an umbrella insurance policy, it typically requires you to have underlying insurance policies in place, such as auto, homeowners, or renters insurance. These primary policies serve as a foundation, and the umbrella policy kicks in when their coverage limits are exhausted.

If you’re involved in an accident or face a lawsuit that exceeds the limits of your underlying policy, the umbrella insurance policy takes effect. It provides additional coverage, often starting at $1 million, depending on the policy’s coverage limits. This ensures that you won’t have to dip into your personal savings, home equity, or retirement funds to pay for damages or legal expenses.

Why Do You Need Umbrella Insurance?

Now that you have a grasp of what an umbrella insurance policy is, let’s explore the reasons why you might need one. Umbrella insurance offers several benefits and can be a valuable addition to your overall insurance portfolio. Here are some scenarios where umbrella insurance can prove to be essential:

1. Protection against Catastrophic Accidents

Accidents happen, and some of them can result in severe injuries or extensive property damage. If you’re at fault for such an accident and the costs exceed your standard liability limits, you could be legally responsible for the remaining amount. Having an umbrella policy in place can protect you from potential financial ruin in these situations.

2. Safeguarding Your Assets

Your assets, such as your home, vehicles, investments, and savings, are valuable and worth protecting. Without adequate liability coverage, these assets could be at risk if you’re sued and held responsible for a significant financial loss. Umbrella insurance provides an added layer of protection, ensuring that your hard-earned assets aren’t vulnerable in the face of a lawsuit.

3. Coverage for Legal Expenses

Legal battles can be lengthy and expensive, even if you’re not at fault. With an umbrella insurance policy, you’ll have coverage for legal expenses, including attorney fees, court costs, and settlements. This coverage can give you peace of mind knowing that you can afford quality legal representation if the need arises.

4. Protection against Personal Liability Claims

Personal liability extends beyond just accidents. It can also involve situations like slander, libel, false arrest, or invasion of privacy. If you’re sued for any of these reasons, an umbrella insurance policy can provide coverage and protect your assets.

What Umbrella Insurance Doesn’t Cover

While umbrella insurance is an essential coverage, it’s important to note that it doesn’t protect against all types of losses. Here are some common exclusions that you won’t find covered under an umbrella policy:

1. Intentional Acts

An umbrella policy won’t cover intentional acts or illegal activities. If you intentionally cause harm or engage in criminal behavior, the policy won’t provide protection.

2. Business Liability

If you run a business, an umbrella policy won’t cover your business-related liability. For business protection, you’ll need a separate commercial liability insurance policy.

3. Professional Liability

Umbrella insurance also doesn’t cover professional liability, also known as errors and omissions (E&O) insurance. If you provide professional services, such as legal advice or medical care, you’ll need a specialized policy tailored to your profession.

How Much Does Umbrella Insurance Cost?

The cost of an umbrella insurance policy varies depending on several factors, including your location, coverage limits, and the underlying policies you have. However, umbrella insurance is generally affordable for the coverage it provides. For around $150 to $300 per year, you can obtain $1 million in additional liability coverage. As you increase the coverage limits, the premium cost will also rise.

It’s worth noting that some insurance companies require you to carry a minimum amount of underlying liability coverage before you can purchase an umbrella policy. This requirement ensures that you have a solid foundation of primary insurance in place.

An umbrella insurance policy offers an extra layer of liability coverage, protecting your assets and future earnings in case of a lawsuit. It fills in the gaps left by your primary insurance policies and provides additional coverage when their limits are exhausted. Umbrella insurance is an affordable way to safeguard your financial well-being and gain peace of mind. Before purchasing an umbrella policy, it’s important to assess your needs and consult with an insurance professional to ensure you have the appropriate coverage.

Do I Need Umbrella Insurance?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is an umbrella insurance policy?

An umbrella insurance policy is a type of liability insurance that provides additional coverage above and beyond the limits of your existing policies, such as auto or homeowner’s insurance. It acts as a safety net to protect you from significant financial losses in case of a lawsuit or a claim that exceeds your primary insurance coverage.

How does an umbrella insurance policy work?

When a claim exhausts the limits of your primary insurance policy, an umbrella policy kicks in to cover the remaining costs, up to the policy’s limit. For example, if you have a liability claim of $1.5 million and your primary insurance covers only up to $1 million, the umbrella policy would cover the additional $500,000.

What does an umbrella insurance policy cover?

Umbrella insurance covers a wide range of liability risks, including personal injury claims, property damage, libel, slander, and even certain lawsuits that may not be covered by your primary insurance. It adds an extra layer of protection to safeguard your assets and future earnings.

Who needs an umbrella insurance policy?

An umbrella policy is beneficial for anyone who wants to protect their assets, maintain financial stability, and mitigate potential risks. It is especially useful for individuals with significant personal assets, high net worth, or those involved in activities that may pose a higher risk of accidents or liability claims.

How much umbrella insurance coverage do I need?

Determining the right amount of coverage depends on various factors, such as your net worth, income, potential risks, and the value of your assets. It is advisable to consult with an insurance professional who can assess your specific situation and recommend an appropriate coverage limit.

Can I add an umbrella policy to my existing insurance?

Yes, in most cases, you can add an umbrella policy to your existing homeowner’s or auto insurance coverage. However, there may be certain requirements or minimum limits for your primary policies before being eligible for an umbrella policy. Consult with your insurance provider for more information.

Is an umbrella insurance policy expensive?

The cost of an umbrella insurance policy varies depending on factors such as coverage limits, your location, your assets, and the insurance company you choose. However, considering the additional protection it offers, umbrella insurance is generally considered affordable, providing a higher level of coverage at a relatively lower cost compared to increasing the limits on your primary policies.

How do I purchase an umbrella insurance policy?

To purchase an umbrella insurance policy, you should reach out to an insurance agent or broker who specializes in liability insurance. They will guide you through the process, assess your needs, and provide you with options from different insurance carriers. It is important to compare coverage and rates to ensure you get the best policy for your requirements.

Final Thoughts

An umbrella insurance policy is a crucial addition to your existing insurance coverage. It offers an extra layer of protection that goes beyond the limits of traditional policies such as auto, home, or renters insurance. With an umbrella policy, you can safeguard yourself against unforeseen circumstances, like a major accident where you are held responsible for substantial damages or a lawsuit brought against you. This policy can provide coverage for legal fees, medical expenses, and property damage that exceed the limits of your primary policies. In short, an umbrella insurance policy provides peace of mind and financial security in situations that exceed the coverage of your existing insurance plans. So, what is an umbrella insurance policy? It’s a smart and comprehensive solution to protect your assets and future.