Capital gains tax can be a significant concern for many individuals and businesses. But fear not! In this article, we will delve into the ins and outs of what capital gains tax is and how you can effectively minimize it. Whether you’re a seasoned investor or just starting out, understanding this tax and its implications is crucial for optimizing your financial strategies. So, let’s explore the world of capital gains tax and uncover smart tactics to reduce its impact on your investments and overall financial well-being. Ready to gain insights into what is capital gains tax and how to minimize it? Let’s jump right in!

What is Capital Gains Tax and How to Minimize It

Capital gains tax is a tax imposed on the profits earned from the sale of certain assets, known as capital assets. These assets can include real estate, stocks, bonds, and even valuable collectibles. When you sell a capital asset for more than its original purchase price, the difference between the sale price and the initial cost basis is considered a capital gain. This gain is subject to taxation, and understanding the intricacies of capital gains tax can help you make informed decisions to minimize your tax liability.

Types of Capital Gains Tax

Before diving into strategies for minimizing capital gains tax, let’s first explore the different types of capital gains tax that exist:

- Short-Term Capital Gains Tax: Short-term capital gains tax applies to profits made from the sale of capital assets owned for one year or less. These gains are taxed at your ordinary income tax rate, which means they can be significantly higher than long-term capital gains tax rates.

- Long-Term Capital Gains Tax: Long-term capital gains tax applies to profits made from the sale of capital assets owned for more than one year. The tax rates for long-term capital gains are typically lower than ordinary income tax rates, providing taxpayers with potential tax advantages.

Strategies to Minimize Capital Gains Tax

While capital gains tax is an inevitable part of investing and selling assets, there are several strategies you can employ to minimize your tax liability and keep more of your hard-earned profits:

1. Utilize Tax-Advantaged Accounts

One effective way to minimize capital gains tax is to invest in tax-advantaged accounts such as Individual Retirement Accounts (IRAs) or 401(k) plans. Contributions to these accounts are made with pre-tax dollars, allowing your investments to grow tax-free until withdrawal. By strategically selling assets within these accounts, you may be able to avoid or postpone capital gains tax altogether.

2. Hold Investments for the Long Term

As mentioned earlier, long-term capital gains tax rates are typically lower than short-term rates. If possible, consider holding onto your investments for more than one year to take advantage of the lower tax rates. This strategy is especially beneficial if you anticipate significant gains from the sale of an asset.

3. Offset Gains with Losses

If you have a mix of both capital gains and losses within a given tax year, you can offset your gains by selling assets that have declined in value. By selling these assets at a loss, you can deduct the losses from your gains, reducing your overall tax liability. This technique is known as tax-loss harvesting.

4. Take Advantage of Exemptions and Deductions

Sometimes, certain assets may be eligible for exemptions or deductions, allowing you to exclude or reduce the amount subject to capital gains tax. For example, if you sell your primary residence and meet specific criteria, you may be able to exclude a portion or the entire gain from taxation. Additionally, if you make capital improvements to an asset, such as renovating a property, the cost of those improvements can be added to the asset’s cost basis, reducing the overall gain.

5. Gift Assets Instead of Selling

When you gift an appreciated asset to someone else, they inherit your cost basis. This means that when they eventually sell the asset, they will only be liable for capital gains tax on the appreciation that occurs after they received the gift. By gifting assets instead of selling them, you can potentially avoid or minimize capital gains tax altogether.

6. Consider Charitable Donations

Donating appreciated assets to charitable organizations can be a tax-efficient way to minimize your capital gains tax liability. When you donate qualifying assets, you can deduct the fair market value of the asset from your taxable income, effectively reducing your overall tax liability. Additionally, you can avoid capital gains tax on the appreciation of the asset.

Capital gains tax can significantly impact the profits you earn from selling assets. By understanding the different types of capital gains tax and implementing strategic approaches to minimize your tax liability, you can retain more of your investment gains. Utilizing tax-advantaged accounts, holding investments for the long term, offsetting gains with losses, taking advantage of exemptions and deductions, gifting assets, and considering charitable donations are all effective strategies to explore. By being proactive and well-informed, you can navigate the world of capital gains tax and make decisions that align with your financial goals.

How to PAY ZERO Taxes on Capital Gains (Yes, It's Legal!)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is capital gains tax?

Capital gains tax is a tax imposed on the profit that an individual or business makes from selling an asset, such as real estate, stocks, or bonds. It is based on the difference between the purchase price and the selling price of the asset.

How is capital gains tax calculated?

Capital gains tax is calculated by subtracting the cost basis (purchase price) from the selling price of the asset. The resulting profit is then subject to the applicable tax rate, which depends on factors such as the holding period and the taxpayer’s income bracket.

What are short-term and long-term capital gains?

Short-term capital gains refer to profits made from selling assets held for one year or less. They are generally taxed at the individual’s ordinary income tax rate. Long-term capital gains, on the other hand, are derived from assets held for more than one year, and they are subject to lower tax rates.

Are there any exemptions or deductions available to minimize capital gains tax?

Yes, there are several strategies to minimize capital gains tax. Some common methods include utilizing tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k) plans, conducting tax-loss harvesting, making charitable donations, and using the “step-up in basis” rule for inherited assets.

Can I defer paying capital gains tax?

Yes, it is possible to defer paying capital gains tax by utilizing tax-deferred investment vehicles, like 1031 exchanges for real estate or certain retirement accounts, such as a Roth IRA. These options allow individuals to reinvest their profits into similar investments without triggering an immediate tax liability.

What is the difference between capital gains tax and ordinary income tax?

Capital gains tax is specifically applied to the profit made from selling assets, while ordinary income tax is levied on an individual’s regular earnings, such as wages or salaries. The tax rates and rules may also differ for capital gains when compared to ordinary income.

Are capital gains taxed at the same rate for everyone?

No, capital gains tax rates vary depending on the individual’s income level and the duration of time the asset was held. Generally, individuals in higher income brackets may be subject to higher capital gains tax rates compared to those in lower income brackets.

Are there any tax benefits for investments in certain sectors or asset classes?

Yes, some governments offer tax incentives for investments in certain sectors or asset classes to encourage economic growth. For example, investing in qualified opportunity zones or renewable energy projects may provide tax benefits, such as capital gains tax exemptions or credits.

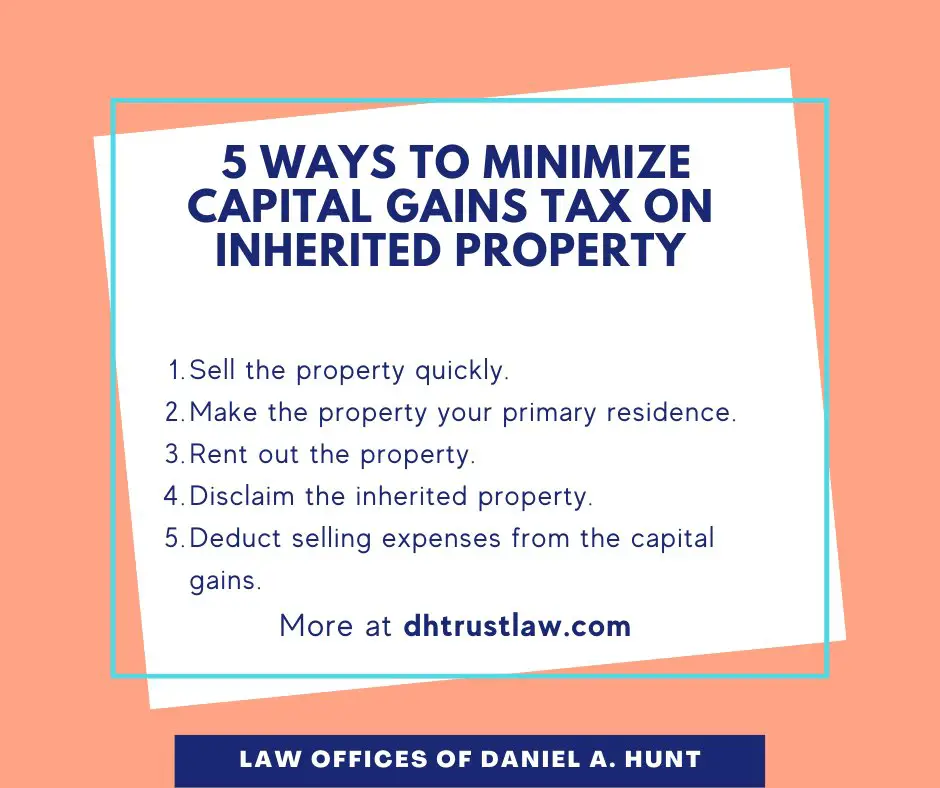

Do I need to pay capital gains tax on inherited assets?

In general, inherited assets receive a “step-up” in basis, meaning the value of the asset at the time of inheritance becomes its new cost basis for tax purposes. This can potentially minimize or eliminate capital gains tax if the asset is sold shortly after inheriting it. However, tax rules can vary, so it’s advisable to consult with a tax professional.

Final Thoughts

Understanding capital gains tax and finding ways to minimize it is crucial for individuals and businesses alike. Capital gains tax refers to the tax levied on the profit gained from the sale of an asset, such as stocks, bonds, or property. By employing certain strategies, taxpayers can reduce their capital gains tax liability. One effective approach is to hold onto assets for more than a year, as this may qualify for long-term capital gains rates, which are often lower. Additionally, utilizing tax-efficient investment accounts and offsetting capital gains with capital losses can further minimize the tax burden. By being aware of these strategies, individuals and businesses can navigate the complexities of capital gains tax and potentially save money.