Commercial paper in finance refers to short-term debt instruments issued by corporations, financial institutions, and governments to meet their immediate funding requirements. It serves as a promissory note, a promise to repay the borrowed amount on a specified future date. What distinguishes commercial paper from other forms of debt is its maturity period, which typically ranges from a few days to a year. With its ease of issuance and relatively low-risk nature, commercial paper has become a popular choice for businesses to raise funds quickly and efficiently. Let’s delve deeper into this essential aspect of the financial world and understand how commercial paper works.

What is Commercial Paper in Finance?

Commercial paper is a widely used financial instrument in the business world. It plays a crucial role in providing short-term funding to corporations, financial institutions, and governments. In simple terms, commercial paper is a type of unsecured promissory note that a company issues to raise funds for its immediate working capital needs. Investors purchase these notes, providing the company with the necessary funds, and in return, they receive interest payments.

Commercial paper is considered an essential part of the money market. It offers an attractive investment option for investors seeking short-term, low-risk opportunities. Let’s explore the key aspects of commercial paper, including its characteristics, types, benefits, and risks.

Characteristics of Commercial Paper

Commercial paper possesses several distinct characteristics that make it an attractive investment vehicle for both issuers and investors:

1. Maturity: Commercial paper has a short-term maturity, usually ranging from one to 270 days. This makes it a valuable tool for companies seeking quick funding to meet their liquidity needs.

2. Unsecured: Unlike bonds or debentures, commercial paper is typically unsecured. This means the issuer does not pledge any specific collateral as a guarantee. Instead, investors rely on the creditworthiness and reputation of the issuing company.

3. Issued at a Discount: Commercial paper is often sold at a discount to its face value, allowing investors to earn interest upon maturity. The discount rate reflects the perceived credit risk associated with the issuing company.

4. Liquidity: Commercial paper can be liquidated before its maturity either through secondary markets or direct sales to other investors. This flexibility provides investors with an exit option if the need arises.

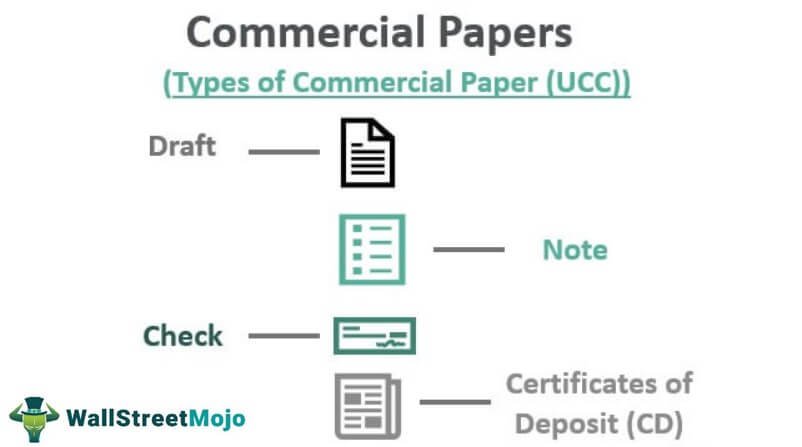

Types of Commercial Paper

Commercial paper can be classified into two main types: financial and non-financial. Let’s take a closer look at each:

1. Financial Commercial Paper: Financial commercial paper is issued by financial institutions such as banks, insurance companies, and other non-bank financial intermediaries. These financial institutions have a strong creditworthiness, making their commercial paper highly sought after in the market.

2. Non-Financial Commercial Paper: Non-financial commercial paper is issued by non-financial corporations and government agencies. The creditworthiness of these issuers may vary, depending on factors such as their financial stability, industry reputation, and market conditions.

Benefits of Commercial Paper

Commercial paper offers several advantages for both the issuer and the investor. Let’s delve into the benefits:

1. Low-cost Funding: For issuers, commercial paper provides a cost-effective way to raise short-term funds compared to traditional bank loans. The interest rates on commercial paper are typically lower than those offered by banks, resulting in potential cost savings.

2. Diversification: Investors can diversify their investment portfolios by including commercial paper. Its short-term nature and variety of issuers allow investors to spread their risk across different industries and sectors.

3. Liquidity: As mentioned earlier, commercial paper offers liquidity, allowing investors to sell their holdings before maturity. This provides flexibility and the ability to access funds quickly if needed.

4. Higher Returns: Although commercial paper is considered a low-risk investment, it offers higher returns compared to traditional bank deposits or Treasury bills. This makes it an attractive option for investors seeking moderate growth with minimal risk.

Risks Associated with Commercial Paper

While commercial paper is generally considered a safe investment, it is important to be aware of certain risks:

1. Credit Risk: The primary risk associated with commercial paper is the creditworthiness of the issuer. If the issuing company or institution experiences financial distress or defaults on its obligations, investors may suffer losses.

2. Market Risk: The value of commercial paper can be influenced by market conditions, such as changes in interest rates. Fluctuations in interest rates can impact the demand and pricing of commercial paper in the secondary market.

3. Roll-Over Risk: Commercial paper issuers may face challenges in rolling over their existing paper when it matures. If the company is unable to find new investors to purchase its paper, it may need to rely on alternative funding sources, potentially at higher interest rates.

Commercial paper is a vital tool in the world of finance, enabling companies to meet their short-term funding requirements and investors to earn income on their surplus funds. Its short-term maturity, flexibility, and relatively low-risk profile make it an appealing option for issuers and investors alike. However, as with any investment, it is crucial to carefully assess the creditworthiness of the issuing company and consider the associated risks. By understanding the nature and benefits of commercial paper, businesses and investors can make informed decisions to enhance their financial strategies.

What is a Commercial Paper?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is commercial paper in finance?

Commercial paper in finance refers to a short-term debt instrument issued by corporations, financial institutions, and other eligible entities to meet their short-term funding needs. It represents an unsecured promissory note that promises to repay the holder the face value of the instrument upon maturity, typically within 270 days.

Why do companies issue commercial paper?

Companies issue commercial paper as a way to raise funds quickly and at relatively low costs. It allows them to meet their short-term obligations, such as financing working capital, funding accounts receivable, or covering inventory costs. Commercial paper is an attractive option for companies with excellent credit ratings, as it provides liquidity and flexibility.

Who can invest in commercial paper?

Eligible investors for commercial paper include institutional investors, such as banks, mutual funds, insurance companies, and corporations. Individual investors can also access commercial paper through money market funds or brokerage accounts. However, it is important to note that commercial paper is typically restricted to sophisticated investors due to its short-term nature and higher risk compared to longer-term bonds.

What is the maturity period of commercial paper?

The maturity period of commercial paper typically ranges from a few days to a maximum of 270 days. Most commercial paper issuances have maturities between 30 and 90 days, allowing companies to borrow on a short-term basis while minimizing interest costs.

How is commercial paper different from bonds?

Commercial paper and bonds are both debt instruments, but they differ in several ways. Commercial paper has a shorter maturity period, typically less than a year, whereas bonds have longer-term maturity periods, often ranging from a few years to several decades. Additionally, commercial paper is typically unsecured, while bonds may be secured by collateral or assets.

What are the advantages of investing in commercial paper?

Investing in commercial paper offers several advantages. It provides an opportunity for investors to earn higher yields compared to traditional savings accounts or certificates of deposit. Additionally, commercial paper issuers often have strong credit ratings, reducing the risk of default. Furthermore, commercial paper is generally highly liquid, allowing investors to easily buy or sell their holdings in the secondary market.

What are the risks associated with investing in commercial paper?

While commercial paper is considered relatively safe, there are some risks to be aware of. The main risk is the potential for default by the issuer, especially if the company’s creditworthiness deteriorates. Moreover, in times of financial stress or market disruptions, the secondary market for commercial paper can become illiquid, making it challenging to sell the investment before maturity.

How does the secondary market for commercial paper work?

The secondary market for commercial paper allows investors to buy and sell previously issued commercial paper before its maturity date. This market provides liquidity and flexibility for investors who wish to exit their investments early or purchase commercial paper from other market participants. Transactions in the secondary market are typically facilitated through dealers or brokers.

Final Thoughts

Commercial paper is a widely used financial instrument in the world of finance. It serves as a short-term borrowing option for corporations, allowing them to raise capital quickly and efficiently. This unsecured debt instrument is typically issued by large, creditworthy companies and carries a fixed maturity period, usually ranging from a few days to a year. In essence, commercial paper acts as a promissory note, wherein the issuer promises to repay the principal amount along with interest to the investor upon maturity. By offering an attractive alternative to traditional bank loans, commercial paper plays a crucial role in meeting short-term funding requirements for businesses. Understanding what commercial paper is in finance is essential for investors and corporations alike, as it offers a valuable tool for managing liquidity and financing needs efficiently.