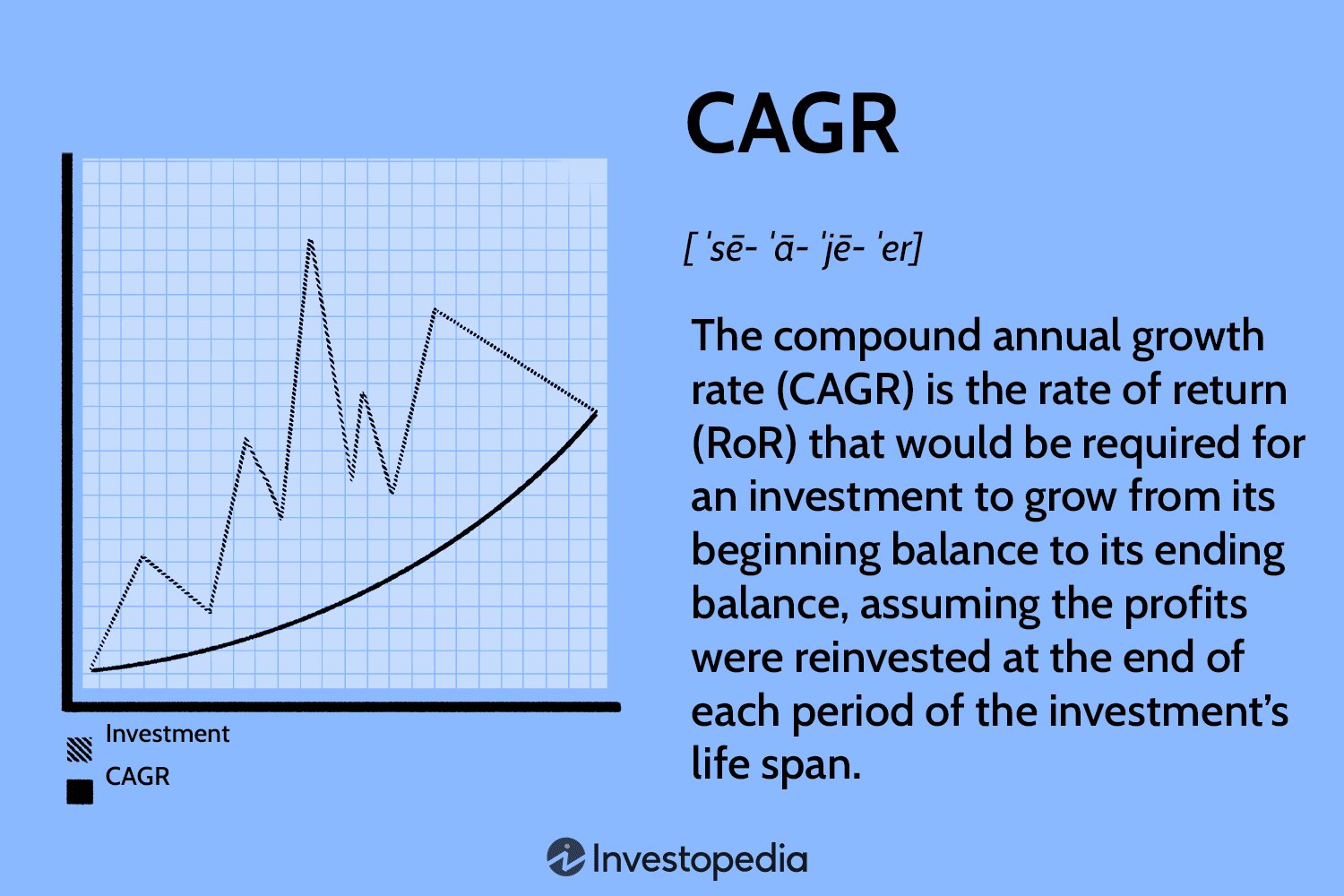

If you’ve ever wondered about compound annual growth rate (CAGR), you’re not alone. CAGR is a widely used financial metric that provides valuable insights into the growth rate of an investment or business over a specific period of time. In simple terms, it measures the average annual growth rate of an investment, taking into account the compounding effect. So, what exactly is compound annual growth rate (CAGR), and how can it benefit you? Let’s dive into the details and uncover the power of this important tool.

What is Compound Annual Growth Rate (CAGR)?

When it comes to investment analysis and financial planning, one term that often comes up is Compound Annual Growth Rate (CAGR). But what exactly does it mean, and why is it important? In this article, we will dive into the details of CAGR, exploring its definition, calculation, and significance in various contexts. By the end, you will have a clear understanding of CAGR and its applications.

The Definition of Compound Annual Growth Rate

Compound Annual Growth Rate (CAGR) is a metric used to measure the annual rate of return of an investment over a specific period of time. It represents the year-over-year growth rate necessary for an investment to reach its ending value from its starting value, assuming that the investment grew at a steady rate over that period.

Unlike simple annual growth rate, which calculates the average growth rate without compounding, CAGR takes into account the compounding effect. This means that CAGR considers all the fluctuations and changes in the investment value over time, providing a more accurate representation of the investment’s performance.

How to Calculate Compound Annual Growth Rate

To calculate CAGR, you need the starting value, ending value, and the number of years or periods. The formula for calculating CAGR is as follows:

CAGR = (Ending Value / Starting Value)^(1 / Number of Years) – 1

Let’s illustrate this with an example:

Suppose you invested $10,000 in a stock, and after 5 years, it has grown to $15,000. To calculate the CAGR, you would plug in the values into the formula:

CAGR = (15,000 / 10,000)^(1 / 5) – 1

CAGR = (1.5)^(0.2) – 1

CAGR ≈ 0.1 or 10%

In this example, the CAGR is approximately 10%, indicating that the investment grew at an average annual rate of 10% over the 5-year period.

The Significance of Compound Annual Growth Rate

CAGR is a valuable tool for investors and financial analysts due to the following reasons:

1. Accurate Representation: CAGR provides a more accurate representation of an investment’s performance because it accounts for compounding. It takes into consideration the volatility and fluctuations in value, offering a meaningful measure of growth.

2. Comparison of Investments: CAGR allows for easy comparison of different investment opportunities. It enables investors to evaluate various options and assess their growth potential over time. By comparing the CAGR of different investments, you can make more informed decisions.

3. Long-Term Planning: CAGR is especially useful for long-term financial planning. It helps individuals and businesses project future growth and estimate the potential returns on their investments. Whether it’s retirement planning, college savings, or business forecasting, CAGR can assist in making realistic and strategic plans.

4. Risk Assessment: CAGR also helps in assessing the risk associated with an investment. By analyzing the historical CAGR of an asset or portfolio, investors can gauge the stability and consistency of returns. A consistently high CAGR indicates a more stable investment, while a volatile CAGR may reflect higher risk.

Limitations of Compound Annual Growth Rate

While CAGR is a powerful metric, it’s important to be aware of its limitations:

1. Smoothed Growth: CAGR assumes a smooth growth rate over the entire period, which might not reflect the actual volatility of an investment’s performance. In reality, investments can experience significant fluctuations, which CAGR may not capture.

2. Short-Term Perspective: Since CAGR is calculated over a specific time frame, it may not provide an accurate representation of short-term performance. It is more suitable for evaluating long-term investments due to its compounding nature.

3. Ignoring Interim Data: CAGR only takes the starting and ending values into account, disregarding any fluctuations that occurred in between. This can lead to an oversimplified view of an investment’s performance, particularly if there were significant ups and downs in between.

Applications of Compound Annual Growth Rate

CAGR finds widespread use in various areas, including:

1. Financial Analysis: CAGR is commonly used in financial analysis to assess the historical performance of investments, such as stocks, mutual funds, and bonds. It helps analysts and investors evaluate the growth potential and volatility of different financial instruments.

2. Business Valuation: CAGR is essential in business valuation processes. It allows investors and potential buyers to estimate the growth rate of a company and project future earnings. CAGR is often used as a basis for determining the value of a business.

3. Market Research: CAGR is a valuable tool in market research, particularly when analyzing industry trends and forecasting future market size. It helps researchers identify growth rates and predict market opportunities.

4. Return on Investment (ROI) Analysis: CAGR helps in calculating the ROI for various investments. It allows investors to assess the profitability and efficiency of different ventures, enabling them to allocate resources effectively.

In conclusion, Compound Annual Growth Rate (CAGR) is a powerful metric used to measure the annual rate of return of an investment over a specific period. It takes into account the compounding effect and provides a more accurate representation of an investment’s performance. By calculating CAGR, investors can compare different investments, plan for the long term, and assess risks. While CAGR has its limitations, it remains a valuable tool in financial analysis, business valuation, market research, and ROI analysis. So, whether you are an investor, analyst, or business owner, understanding CAGR is essential for making informed decisions about investments and growth opportunities.

CAGR explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is compound annual growth rate (CAGR)?

The compound annual growth rate (CAGR) is a measure that calculates the average annual growth rate of an investment over a specific period of time, assuming that the investment has grown at a steady rate. It accounts for the compounding effect on growth, which means that the CAGR takes into consideration the reinvestment of profits or returns over the investment period.

How is CAGR calculated?

CAGR is calculated by dividing the ending value of an investment by the beginning value, raising the result to the power of 1 divided by the number of years, and subtracting 1 from the subsequent result. The formula for CAGR is: CAGR = ((Ending Value / Beginning Value)^(1/Number of Years)) – 1

When is CAGR commonly used?

CAGR is commonly used to measure the performance of investments, especially when comparing different investment options or analyzing the growth of a portfolio over time. It provides a standardized way to assess and compare the annual growth rates of different investments, regardless of their timeframes.

What does a positive CAGR indicate?

A positive CAGR indicates that the investment has experienced growth over the given period. It signifies that the investment has earned a positive return on average each year, implying a successful performance.

Can CAGR be negative?

Yes, CAGR can be negative. A negative CAGR suggests that the investment has experienced a decline in value over the given period. It indicates that the investment has, on average, lost value each year.

Is CAGR a reliable indicator of future performance?

While CAGR provides a historical measure of investment growth, it does not guarantee future performance. CAGR assumes that past trends will continue, which may not always be the case. Other factors such as market conditions and economic changes can significantly impact investment performance.

What are the limitations of using CAGR?

Using CAGR as a sole indicator has limitations as it simplifies the complexity of investment growth. It assumes a steady growth rate over the entire period without considering intermittent fluctuations. Additionally, CAGR does not account for the risk associated with the investment, which is an important consideration for investors.

Can CAGR be used for any duration?

Yes, CAGR can be used for any duration. It is applicable to measure investment growth over short-term periods (e.g., months) or long-term periods (e.g., decades). However, it is important to note that the longer the investment period, the more reliable the CAGR becomes as it smoothens out short-term volatility.

Final Thoughts

Compound Annual Growth Rate (CAGR) is a crucial metric used to analyze the growth rate of an investment over a specific period. By taking into account the yearly growth, CAGR provides a normalized and reliable representation of the investment’s performance. This allows investors to compare different investments on an equal footing. CAGR smooths out the fluctuations and provides a single growth rate that reflects the compounded annual return. Understanding CAGR is essential for making informed investment decisions and assessing the long-term viability of an investment. With CAGR, investors can gain insights into the potential returns and risks associated with their investments, making it an invaluable tool for financial planning and decision-making.