Looking to increase your discretionary income? You’re in the right place! Discretionary income refers to the money left over after paying for essential expenses like rent, groceries, and bills. It’s the extra cash that you have control over, which means you can use it to indulge in hobbies, save for the future, or even splurge on something special. In this article, we’ll explore what discretionary income is all about and share practical tips on how you can boost it. So, if you’re eager to find ways to maximize your spending power, keep reading!

What is Discretionary Income and How to Increase It

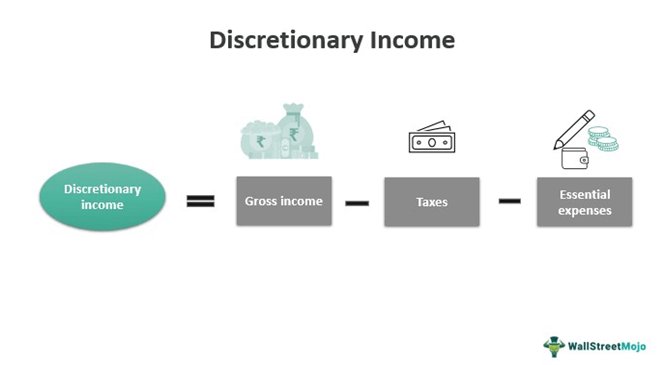

In today’s fast-paced world, managing your finances wisely is crucial. One important aspect of personal finance to understand is discretionary income. Discretionary income refers to the money you have left over after deducting your essential expenses from your total income. It is the amount that you can choose how to spend or save. Increasing your discretionary income can give you more financial freedom, allowing you to pursue your goals and dreams. In this article, we will delve into what discretionary income is, its importance, and explore effective strategies to increase it.

The Definition and Importance of Discretionary Income

Discretionary income is the portion of your income that is available for discretionary spending, meaning it is not allocated for essential needs such as housing, food, utilities, and transportation. It represents the money you have control over, enabling you to make choices on how to use it based on personal preferences and priorities.

The importance of discretionary income lies in its potential to impact various aspects of your life. Here are a few key reasons why understanding and increasing your discretionary income is crucial:

1. Financial Flexibility: Having a higher discretionary income provides you with greater flexibility in managing unexpected expenses or emergencies. It allows you to build a safety net, ensuring you are better equipped to handle financial setbacks.

2. Pursuing Goals and Dreams: Increasing discretionary income opens up opportunities to pursue your passions and long-term goals. Whether it’s traveling, starting a business, or investing in education, having more money at your disposal can make your aspirations a reality.

3. Quality of Life: With more discretionary income, you can enhance your quality of life by enjoying leisure activities, dining out, engaging in hobbies, or upgrading your living environment. Increasing discretionary income can contribute to a higher level of personal satisfaction and happiness.

Factors Affecting Discretionary Income

To effectively increase your discretionary income, it’s essential to understand the factors that influence it. Several key elements can impact the amount of money available for discretionary spending:

1. Income Level: Your total income is a significant determinant of your discretionary income. Generally, the higher your income, the more money you will have left over after covering essential expenses.

2. Debt and Loan Payments: Debt obligations, such as student loans, credit card debt, or personal loans, directly influence your discretionary income. The higher your debt payments, the less money you have available for discretionary spending.

3. Cost of Living: The cost of living in your area affects the amount you spend on essential expenses. Higher costs for housing, utilities, groceries, and transportation can reduce your discretionary income.

4. Lifestyle Choices: Your spending habits and lifestyle choices can significantly impact your discretionary income. If you regularly indulge in non-essential purchases or have expensive hobbies, it can limit the money left for discretionary spending.

Effective Strategies to Increase Discretionary Income

Now that we understand what discretionary income is and its importance, let’s explore some actionable strategies to increase it:

1. Budgeting and Expense Tracking

Creating and sticking to a comprehensive budget is the foundation of managing your finances effectively. By tracking your income and expenses, you gain a clear picture of where your money is going and identify areas where you can reduce spending. Here are a few tips for budgeting and expense tracking:

– Categorize Your Expenses: Divide your expenses into categories like housing, transportation, groceries, entertainment, and discretionary spending. This allows you to analyze each category and identify potential areas for cost-cutting.

– Set Spending Limits: Establish spending limits for discretionary categories to ensure you allocate a specific amount of money for non-essential expenses each month.

– Utilize Budgeting Tools: Take advantage of budgeting apps or spreadsheets to simplify expense tracking and gain insights into your spending patterns.

– Review and Adjust Regularly: Regularly review your budget to identify any deviations or areas where you can further optimize your spending.

2. Reduce and Eliminate Debt

Debt payments can significantly eat into your discretionary income. Taking steps to reduce and eliminate debt can free up more money for discretionary spending. Consider the following approaches:

– Prioritize High-Interest Debt: Focus on paying off debts with high interest rates first, such as credit card debt or loans with high APRs. This will save you money in interest payments over the long term.

– Consolidate Debt: Explore options for consolidating your debts, such as transferring credit card balances to a low-interest rate card or obtaining a debt consolidation loan. Consolidating debt can streamline payments and potentially reduce interest rates.

– Negotiate Lower Interest Rates: Contact your creditors and negotiate lower interest rates, especially if you have a good payment history. Lower interest rates mean less money going towards interest and more towards discretionary spending.

3. Increase Income

Increasing your income directly impacts your discretionary income. Here are some ways to boost your earning potential:

– Explore New Job Opportunities: Consider seeking better-paying job opportunities or advancing your career through additional education or certifications.

– Side Hustles and Freelancing: Take advantage of the gig economy by starting a side business, freelancing, or utilizing your skills for part-time work. The extra income can significantly contribute to your discretionary funds.

– Passive Income Streams: Investigate options to generate passive income, such as investing in rental properties, creating and selling digital products, or engaging in affiliate marketing.

4. Minimize Unnecessary Expenses

Reducing unnecessary expenses is a powerful strategy to increase your discretionary income. By making conscious choices and eliminating non-essential costs, you can allocate more money towards discretionary spending. Consider implementing the following:

– Evaluate Subscriptions and Memberships: Review your recurring subscriptions and memberships. Cancel those you no longer use or find alternatives at lower costs.

– Cook at Home: Eating out can quickly deplete your discretionary funds. Opt for cooking at home more often, as it is usually more cost-effective and healthier.

– Shop Smart: Take advantage of sales, discounts, and coupons to save money on your essential expenses. This allows you to allocate more money towards discretionary spending.

– Delay Gratification: Practice delayed gratification by avoiding impulse purchases. Give yourself time to evaluate whether a non-essential item is truly worth the expense.

5. Invest and Save Wisely

Investing and saving can help grow your discretionary income over time. By making smart choices with your money, you can generate additional funds for future discretionary spending. Consider these options:

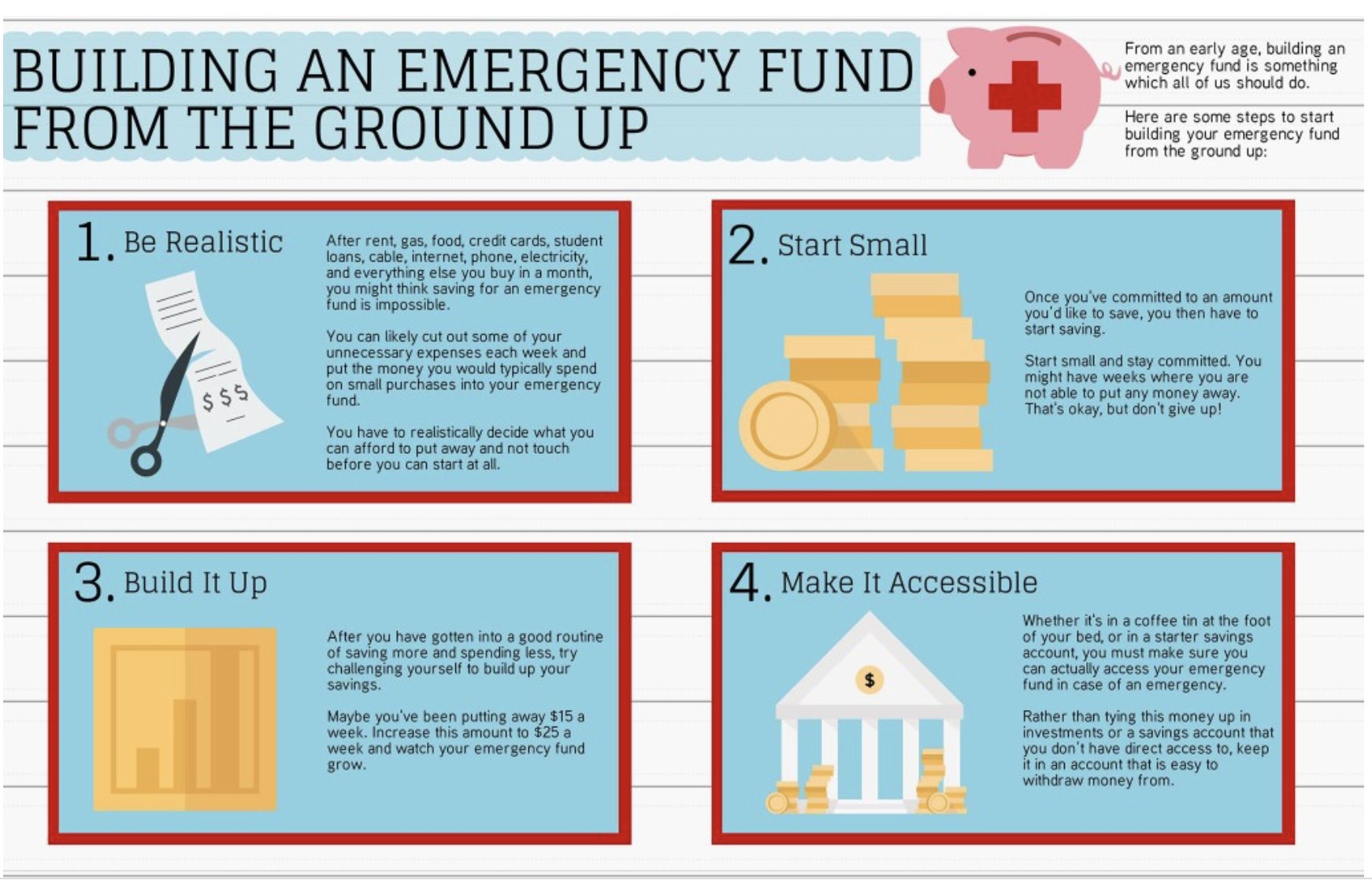

– Emergency Fund: Build an emergency fund to cover unexpected expenses, reducing the impact on your discretionary income.

– Retirement Savings: Contribute regularly to retirement accounts or pension plans. Doing so ensures you have a secure financial future and potentially provides tax benefits.

– Long-Term Investments: Explore investment opportunities that align with your risk tolerance and long-term goals. Consult with a financial advisor to create a diversified investment portfolio.

Understanding discretionary income and employing strategies to increase it can greatly enhance your financial well-being. By budgeting, reducing debt, increasing income, minimizing unnecessary expenses, and investing wisely, you can unleash the full potential of your discretionary funds. Remember, every small step you take to increase your discretionary income brings you closer to achieving your financial goals and enjoying the freedom and flexibility it offers. Start adopting these strategies today and take control of your financial future.

What is discretionary income and how does it apply to student loans?

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is discretionary income?

Discretionary income refers to the amount of money an individual or household has left after paying for essential expenses like rent, bills, and groceries. It is the income that can be spent or saved as desired.

How can I increase my discretionary income?

Increasing your discretionary income requires a combination of reducing expenses and finding ways to increase your overall income. Here are some strategies you can consider:

1. How can I reduce my expenses?

– Analyze your monthly budget and identify areas where you can cut back, such as dining out, entertainment, or subscription services.

– Negotiate lower interest rates on credit cards or loans.

– Look for cheaper alternatives or discounts when purchasing goods or services.

2. How can I increase my income?

– Seek opportunities for career advancement and professional development to qualify for higher-paying positions.

– Consider taking on a side gig or freelance work to supplement your primary income.

– Invest in personal growth and acquire new skills that are in demand in the job market.

3. Are there any tax strategies to increase discretionary income?

– Take advantage of tax deductions and credits available to you.

– Consider contributing to retirement accounts, such as IRAs or 401(k)s, to reduce your taxable income.

– Consult a tax professional to ensure you are maximizing your tax benefits.

4. How can I save money on everyday expenses?

– Shop smart by comparing prices and looking for discounts or coupons.

– Opt for generic brands instead of expensive branded products.

– Use energy-efficient appliances and conserve electricity to reduce utility bills.

5. Is investing a good way to increase discretionary income?

– Investing can potentially increase your income over time, but it involves certain risks.

– Research and consider different investment options based on your risk tolerance and financial goals.

– Seek advice from a financial advisor to make informed investment decisions.

6. Can budgeting help increase discretionary income?

– Yes, creating a budget and sticking to it can help you manage your expenses effectively.

– Allocate a specific amount for discretionary spending and track your expenses to stay within the budget.

– Identify areas where you can reduce unnecessary spending and redirect that money towards savings or debt repayment.

7. How can I negotiate for a higher salary?

– Research the market value of your position and gather evidence of your accomplishments and skills.

– Prepare a compelling case to present to your employer, emphasizing your value to the company.

– Be confident and assertive during salary negotiations, focusing on the value you bring to the organization.

8. Are there any government programs or assistance to increase discretionary income?

– Explore potential benefits or programs available in your country or region, such as tax credits for low-income individuals or government assistance for specific needs.

– Check with local community organizations or social services agencies for resources that can help improve your financial situation.

Final Thoughts

Increasing discretionary income is essential for achieving financial freedom and a more enjoyable lifestyle. By understanding what discretionary income is and implementing strategies to increase it, individuals can have more freedom and flexibility with their money.

Discretionary income refers to the money left over after essential expenses, such as rent, bills, and groceries, are paid. It is the discretionary income that allows individuals to indulge in non-essential purchases and experiences, like dining out, traveling, or pursuing hobbies.

To increase discretionary income, it is crucial to first analyze and evaluate current spending habits. By tracking expenses and identifying areas where money is unnecessarily being spent, individuals can cut back on non-essential expenses and redirect that money towards savings or investments.

Additionally, finding ways to increase income can significantly impact discretionary funds. This can include negotiating a higher salary, taking on a side gig, or investing in personal development to enhance skills and increase earning potential.

Saving money on everyday expenses, such as finding discounts, using coupons, or opting for generic brands, can also contribute to increasing discretionary income. Cutting back on luxury items or unnecessary subscriptions can create more financial breathing room.

Moreover, prioritizing debt repayment can free up more discretionary income in the long run. By paying off high-interest debts and avoiding unnecessary borrowing, individuals can reduce the amount of money spent on interest and redirect it towards savings or leisure activities.

Overall, increasing discretionary income requires a combination of budgeting, saving, increasing income, and making conscious spending choices. By being intentional with money and making strategic decisions, individuals can enjoy the benefits of a higher discretionary income, enabling them to live a more fulfilling and financially secure life.