Curious about what diversification in investment means? Look no further! Diversification is a strategy that savvy investors utilize to spread their risk across different assets. By incorporating a variety of investments into their portfolio, they aim to minimize the impact of any single investment’s performance. This approach helps to cushion against potential losses while potentially increasing overall returns. Now, let’s delve into the world of diversification and uncover the key benefits it holds for investors like you.

What is Diversification in Investment?

Diversification in investment refers to the strategy of spreading your investment portfolio across different assets, industries, or geographical regions. The goal of diversification is to reduce risk by not putting all your eggs in one basket. By investing in a variety of assets, you can potentially minimize the impact of a single investment’s poor performance on your overall portfolio.

When you diversify your investments, you spread your risks and increase the likelihood of achieving better long-term returns. This strategy is based on the principle that different investments perform differently under various market conditions. By combining assets that have low or negative correlations, you can potentially mitigate losses in one investment with gains from another.

Diversification is not limited to securities like stocks and bonds. It can also be applied to other asset classes such as real estate, commodities, and alternative investments. Additionally, diversification can be implemented within each asset class, further reducing risk by investing in different companies or properties.

Why is Diversification Important?

Diversification is crucial for several reasons:

1. Risk Reduction: Diversifying your investments helps mitigate the impact of market volatility. Different assets perform differently under various economic conditions, so a diversified portfolio is better positioned to weather market downturns.

2. Preserving Capital: By spreading your investments across different assets, you reduce the risk of losing a significant portion of your capital if one investment performs poorly. A diversified portfolio can help preserve your wealth over the long term.

3. Potential for Higher Returns: While diversification aims to reduce risk, it also opens up opportunities for higher returns. By investing in different assets, you increase the chances of benefiting from positive performance in one or more areas of your portfolio.

4. Adaptability to Changing Market Conditions: Diversification allows you to adapt to changes in the market. By investing in various sectors or regions, you can take advantage of growth opportunities in different areas while minimizing the impact of any single event.

5. Emotional Stability: Diversification helps investors avoid the emotional roller coaster that can come with concentrating all investments in a single asset. Spreading investments across various assets helps maintain a more stable investment experience.

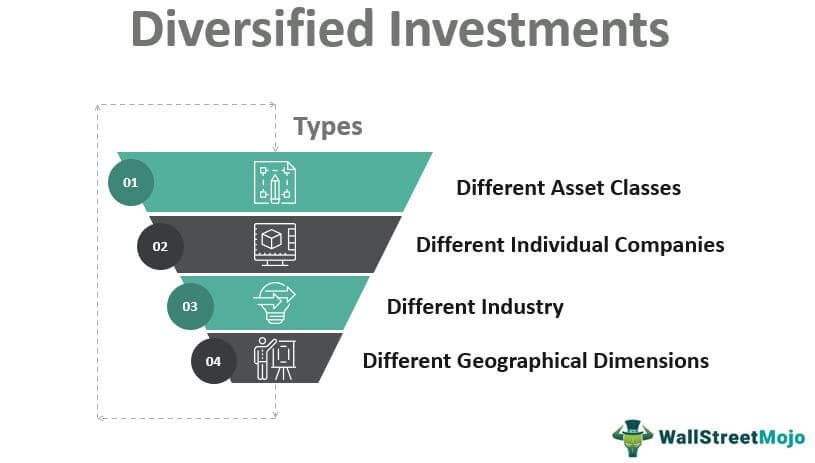

Types of Diversification

Diversification can be achieved in different ways, depending on your investment goals and risk tolerance. Here are some common types of diversification:

1. Asset Class Diversification: This involves investing in different types of assets, such as stocks, bonds, real estate, and commodities. Asset class diversification helps spread risk across various investment categories.

2. Geographic Diversification: Investing in different countries or regions can help mitigate the impact of local economic and political factors. Global diversification allows you to tap into opportunities in different markets and reduce exposure to any single jurisdiction.

3. Industry Diversification: Spreading investments across different sectors, such as technology, healthcare, or consumer goods, helps reduce the impact of sector-specific risks. Industries perform differently based on market cycles, so broad sector exposure can potentially improve returns.

4. Company Diversification: Investing in a range of companies within a sector helps reduce the risk associated with individual company performance. By diversifying across companies of different sizes, financial strengths, and business models, you can mitigate the impact of any single company’s poor performance.

5. Time Diversification: This strategy involves investing in a staggered manner over time. By spreading out your investments over a period, you reduce the risk of investing a significant amount at the peak of a market cycle. This approach takes advantage of dollar-cost averaging and reduces the impact of short-term market fluctuations.

Benefits of Diversification

Diversification offers several benefits for investors:

1. Risk Management: By spreading investments across different assets, investors can reduce the overall risk of their portfolio. Diversification helps protect against significant losses from a single investment, which can occur due to market volatility, economic downturns, or company-specific issues.

2. Potential for Higher Returns: Diversification not only reduces risk but also opens up opportunities for higher returns. By investing in multiple assets, investors increase the likelihood of benefiting from positive performance in at least one area of their portfolio.

3. Stability: A diversified portfolio tends to be more stable and less susceptible to extreme fluctuations. By combining assets with low correlations, the impact of adverse events on the portfolio can be minimized.

4. Flexibility: Diversification provides investors with the flexibility to adapt to changing market conditions. By having exposure to different sectors, regions, and asset classes, investors can take advantage of emerging opportunities while mitigating risks associated with specific events or sectors.

5. Emotional Discipline: Diversification helps investors maintain emotional discipline during market fluctuations. By having a well-diversified portfolio, investors are less likely to panic-sell or make impulsive decisions based on short-term market movements.

6. Long-Term Wealth Preservation: Diversification is a key component of long-term wealth preservation. By reducing the risk of significant losses, investors can more effectively grow and protect their wealth over time.

Challenges and Considerations

While diversification can be an effective strategy, it is important to consider the following challenges and factors:

1. Risk of Over-Diversification: While diversification is beneficial, excessively spreading investments across too many assets can lead to watered-down returns. It is essential to strike a balance between diversification and maintaining concentrated positions where appropriate.

2. Evaluating Correlations: It is crucial to understand the correlations between different assets within a portfolio. If assets have high positive correlations, diversification might not provide the desired risk reduction. Analyzing correlations can help ensure effective diversification.

3. Research and Due Diligence: Diversification requires careful research and due diligence. Investors need to thoroughly analyze each asset class, sector, or company they plan to include in their portfolio. Adequate research can help identify the most suitable investments for diversification.

4. Monitoring and Rebalancing: Diversified portfolios require regular monitoring and rebalancing to maintain the desired asset allocation. Asset values can change over time, affecting the portfolio’s diversification. Regular reviews and adjustments are essential for optimal diversification.

5. Costs and Fees: Diversification may involve transaction costs, management fees, or other expenses. It is important to consider these costs and ensure they align with the potential benefits of diversification.

6. Risk Tolerance and Investment Goals: Diversification strategies should align with an investor’s risk tolerance and investment goals. Some individuals may prefer a more concentrated portfolio focused on specific assets, while others may opt for broader diversification to reduce risk.

Diversification is a fundamental strategy in investment management. By spreading investments across different assets, industries, and regions, investors can potentially reduce risk, improve long-term returns, and maintain stability. However, effective diversification requires careful consideration, research, and monitoring. It is essential to strike a balance between risk reduction and maintaining concentrated positions to achieve optimal portfolio performance. Whether you are a novice investor or an experienced professional, diversification should be a key component of your investment strategy.

Investing: Why You Should Diversify

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is diversification in investment?

Diversification in investment refers to the strategy of spreading your investment portfolio across different asset classes, industries, and geographic regions. This approach aims to reduce risk by minimizing the impact of any single investment on the overall portfolio.

Why is diversification important in investment?

Diversification is important in investment because it helps to lower the risk associated with investing. By spreading your investments across different assets, you can minimize the potential negative impact of any single investment on your overall portfolio. Diversification helps to balance the risk and return potential and can enhance long-term portfolio performance.

How does diversification work?

Diversification works by distributing investments across various assets that have different risk and return characteristics. If one investment performs poorly, the impact on the overall portfolio is reduced as other investments may offset the losses. It allows investors to potentially achieve more stable returns over time.

What are the benefits of diversification?

Diversification offers several benefits to investors, including:

1. Risk reduction: By spreading investments across different assets, the risk of loss due to adverse events impacting a particular investment is minimized.

2. Potential for higher returns: Diversification allows investors to access different investment opportunities, increasing the potential for higher overall returns.

3. Smoother ride: A diversified portfolio tends to experience fewer and smaller fluctuations, leading to a more stable investment journey.

Are there any downsides to diversification?

While diversification is generally viewed as a beneficial strategy, it is essential to consider certain downsides:

1. Potential underperformance: Diversification could limit the potential for exceptional returns if a highly concentrated investment performs exceptionally well.

2. Over-diversification: Spreading investments too thin across numerous assets may dilute potential returns and make it challenging to monitor the portfolio effectively.

3. Correlation risk: If investments within a portfolio are highly correlated, diversification may not effectively reduce risk as anticipated.

Can diversification completely eliminate investment risk?

No, diversification cannot completely eliminate investment risk. While it can reduce the impact of individual investment losses, it cannot protect against systematic risks that affect the entire market or specific asset classes. It is important to note that all investments carry a degree of risk, and diversification is a risk management strategy rather than a risk elimination strategy.

What are the different types of diversification?

There are various types of diversification when it comes to investments, including:

1. Asset diversification: Spreading investments across different asset classes like stocks, bonds, real estate, commodities, etc.

2. Industry diversification: Investing in companies from different industries to reduce the impact of industry-specific risks.

3. Geographic diversification: Investing in various regions and countries to minimize the impact of country-specific risks.

How can I achieve diversification in my investment portfolio?

To achieve diversification in your investment portfolio, you can:

1. Invest in a mix of different asset classes, such as stocks, bonds, and real estate.

2. Allocate your investments across various industries, including healthcare, technology, finance, etc.

3. Consider investing in different geographic regions, both domestically and internationally.

4. Utilize investment vehicles such as mutual funds or exchange-traded funds (ETFs) that offer broad exposure to multiple assets or indices.

Remember that the specific diversification strategy should align with your financial goals, risk tolerance, and investment time horizon.

Final Thoughts

Diversification in investment is an essential strategy for managing risk and maximizing potential returns. By spreading investments across different asset classes, sectors, and geographical regions, investors can reduce their exposure to any single investment and increase the likelihood of overall portfolio growth. Diversification helps to protect against market volatility and unforeseen events that can affect specific industries or regions. Through diversification, investors can balance their portfolio and potentially achieve a more stable and consistent return on investment. It is crucial to understand the benefits of diversification and incorporate it into your investment approach to improve long-term outcomes and mitigate risk.