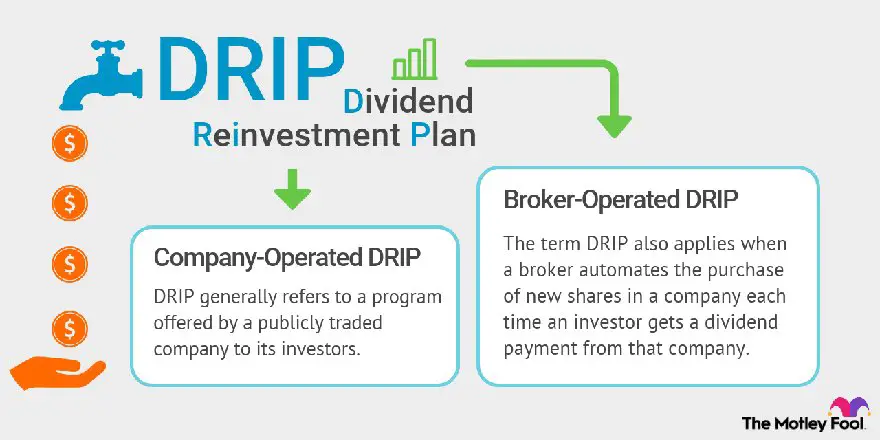

Are you looking for a way to grow your investments? Well, look no further! The solution you’ve been seeking is right here: the dividend reinvestment plan, often abbreviated as DRIP. So, what is a dividend reinvestment plan? It’s a smart and efficient method that allows you to reinvest your dividends back into the company that issued them. This means that instead of receiving cash payments, you’ll receive additional shares of the company’s stock. In other words, you’re letting your investments work for you, compounding your returns over time. With a dividend reinvestment plan, you can take control of your financial future and watch your investments flourish.

What is Dividend Reinvestment Plan?

A dividend reinvestment plan (DRIP) is an investment strategy that allows shareholders to automatically reinvest their cash dividends into additional shares of the underlying company’s stock. Rather than receiving a cash payout, shareholders can choose to have their dividends used to purchase more shares, increasing their ownership in the company.

DRIPs are offered by many publicly traded companies and are often facilitated through a transfer agent or a brokerage firm. This strategy provides investors with a convenient way to compound their investment returns over time.

How Dividend Reinvestment Plans Work

When investors enroll in a dividend reinvestment plan, any cash dividends earned from their holdings are automatically reinvested into additional shares of the company’s stock. This reinvestment can occur at regular intervals, typically on a quarterly basis.

To participate in a DRIP, investors need to meet certain eligibility criteria, which may vary between companies. Some common requirements include:

- Being a registered shareholder of the company

- Owning a minimum number of shares

- Residing in a specific country or region

Once enrolled, shareholders no longer receive cash dividends. Instead, the dividends are used to purchase additional shares of the company’s stock at the prevailing market price. The number of shares acquired depends on the amount of the dividend and the stock’s trading price at the time of reinvestment.

DRIPs may also offer the option to make additional cash contributions to purchase more shares beyond the reinvestment of dividends. This allows investors to accelerate the growth of their investment by adding more funds to their holdings.

Benefits of Dividend Reinvestment Plans

Dividend reinvestment plans offer several advantages for investors:

1. Compounding Returns

By reinvesting dividends, investors can take advantage of compounding returns. Instead of receiving a fixed cash payout, which may be subject to taxes, shareholders can use their dividends to acquire more shares. Over time, these additional shares can generate even more dividends, leading to exponential growth in the investment.

2. Cost Averaging

DRIPs typically allow investors to purchase additional shares at the prevailing market price. This means that during periods of market volatility, investors may be able to acquire more shares when prices are low. This strategy, known as dollar-cost averaging, can help mitigate the impact of market fluctuations and potentially increase investment returns over the long term.

3. No Commissions

Many dividend reinvestment plans waive or reduce transaction fees and commissions for participants. This can be particularly beneficial for small investors who may not have substantial funds to allocate to their investment account.

4. Long-Term Focus

DRIPs are well-suited for investors with a long-term investment horizon. By automatically reinvesting dividends, investors can avoid the temptation to spend the cash and instead stay invested in the company’s stock. This aligns with the principle of long-term investing, where holding investments for extended periods can lead to greater potential for capital appreciation.

Considerations for Dividend Reinvestment Plans

While dividend reinvestment plans offer numerous benefits, there are some factors to consider before participating:

1. Dilution of Ownership

As additional shares are issued through the dividend reinvestment plan, existing shareholders may experience dilution of their ownership. This is because the company’s total number of outstanding shares increases, potentially reducing each shareholder’s proportional ownership in the company.

2. Tax Implications

Although shareholders do not receive cash dividends, the reinvested dividends are still subject to taxation. Depending on the tax laws in the investor’s jurisdiction, the reinvested dividends may be treated as taxable income in the year they are received. It is important for investors to consult with a tax advisor to understand the tax implications of participating in a DRIP.

3. Lack of Flexibility

By enrolling in a DRIP, investors give up the option to receive cash dividends. This lack of flexibility means that investors may not have immediate access to the cash for other uses, such as covering expenses or diversifying their investment portfolio. It is important for investors to assess their financial needs and goals before deciding to participate in a dividend reinvestment plan.

Dividend reinvestment plans are a powerful tool for long-term investors looking to compound their investment returns. By automatically reinvesting cash dividends into additional shares, investors can harness the power of compounding and potentially accelerate the growth of their investment over time. However, it is essential to carefully evaluate the features and considerations of each specific dividend reinvestment plan and consult with a financial advisor or tax professional before making investment decisions.

Dividend Reinvestment Plan | Simple Steps for a Retirement Portfolio Course

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is a dividend reinvestment plan?

A dividend reinvestment plan, commonly known as DRIP, is a program offered by some companies that allows shareholders to automatically reinvest their cash dividends in additional shares of the company’s stock instead of receiving the dividends in cash.

How does a dividend reinvestment plan work?

When you participate in a dividend reinvestment plan, any dividends you earn from your shares will be used to purchase additional shares in the same company. These additional shares are usually bought directly from the company, often at a discount from the market price.

What are the benefits of a dividend reinvestment plan?

There are several benefits to participating in a dividend reinvestment plan. Firstly, it allows you to compound your investment by reinvesting dividends and acquiring more shares. It also provides a convenient way to automatically reinvest your dividends without incurring transaction fees. Additionally, some companies may offer discounts or bonus shares to participants in their DRIPs.

Are dividend reinvestment plans available for all stocks?

Dividend reinvestment plans are not available for all stocks. Companies must choose to offer a DRIP to their shareholders, and participation is entirely voluntary. It’s important to check whether the stocks you own have a dividend reinvestment plan available.

Can I choose partial dividend reinvestment?

In most cases, dividend reinvestment plans allow shareholders to reinvest only a portion of their dividends. You can typically choose to reinvest a specific percentage of your dividends while receiving the remaining amount in cash.

Can I sell my shares in a dividend reinvestment plan?

Yes, you can sell the shares you acquire through a dividend reinvestment plan at any time, just like any other shares you own. However, there may be fees and restrictions associated with selling the shares acquired through the DRIP, so it’s important to review the terms of the plan.

Are dividends reinvested at market price?

Dividends are typically reinvested at the market price prevailing on the dividend payment date. Some companies may offer a discount on the market price to encourage participation in their DRIPs. The exact mechanism for determining the reinvestment price may vary by company.

Can I enroll in a dividend reinvestment plan if I don’t own any shares?

In most cases, you need to be a current shareholder to enroll in a dividend reinvestment plan. However, some companies may offer a direct stock purchase plan (DSPP) that allows you to buy the company’s shares directly from them, which would then make you eligible to participate in the DRIP.

Please note that specific terms and conditions of dividend reinvestment plans may vary depending on the company. It’s always recommended to review the company’s official materials or contact their investor relations department for detailed information.

Final Thoughts

A dividend reinvestment plan, also known as a DRIP, allows investors to automatically reinvest their cash dividends into additional shares of the same stock. By participating in a DRIP, investors can maximize their returns by harnessing the power of compounding. This means that instead of receiving a cash payout, the dividends are used to purchase more shares, increasing the potential for future earnings. Dividend reinvestment plans provide a convenient and efficient way to grow your investments over time, without the need for active involvement or timing the market. With a DRIP, you can potentially benefit from the power of compounding and build wealth gradually. So, if you are looking to enhance your investment strategy and generate long-term growth, a dividend reinvestment plan could be a valuable tool to consider.