Have you ever wondered how to navigate the volatile world of cryptocurrency investing? Look no further! In this article, we’ll dive into the concept of dollar-cost averaging in crypto – a strategy that can help you navigate the ups and downs of the market and potentially maximize your gains. So, what is dollar-cost averaging in crypto exactly? Simply put, it’s a strategy where you consistently invest a fixed amount of money at regular intervals, regardless of the price of the cryptocurrency. By doing so, you take advantage of both high and low prices, ultimately aiming to reduce the risk of making poor investment decisions based on short-term market fluctuations. Let’s explore this strategy further to see how it works and why it can be a valuable tool for crypto investors.

What is Dollar-Cost Averaging in Crypto?

Cryptocurrency markets can be highly volatile, with prices experiencing significant fluctuations on a daily basis. This volatility can make investing in cryptocurrencies a risky endeavor, especially for those who are new to the space. However, there are strategies that can be employed to mitigate some of the risks and potentially increase the chances of long-term success. One such strategy is dollar-cost averaging (DCA). In this article, we will explore what dollar-cost averaging is in the context of cryptocurrencies and how it can be used as an investment approach.

Understanding Dollar-Cost Averaging

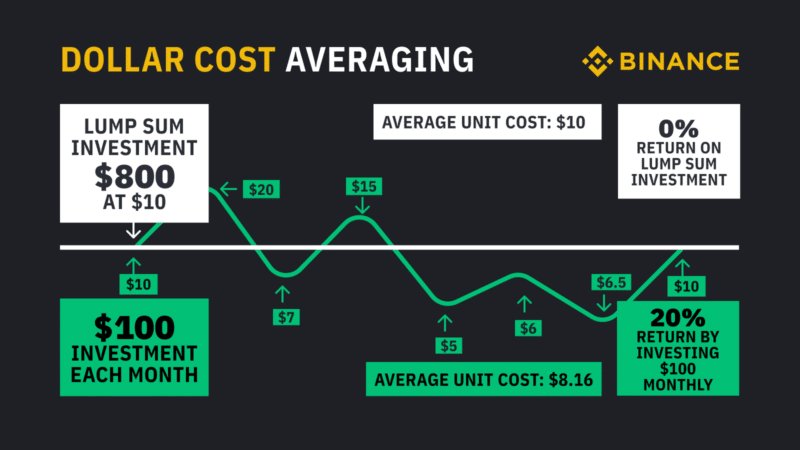

Dollar-cost averaging is an investment strategy that involves regularly investing a fixed amount of money into a specific asset over a period of time. Instead of trying to time the market and make large lump sum investments, investors using DCA approach the market with a gradual and disciplined approach. This strategy is based on the concept of buying more units of an asset when prices are low and fewer units when prices are high. By consistently investing over time, investors aim to reduce the impact of short-term market fluctuations on their overall investment.

In the context of cryptocurrencies, dollar-cost averaging can be particularly useful due to the market’s volatility. Instead of trying to predict the best time to enter the market, DCA allows investors to spread their investment over time, potentially minimizing the risk of entering at the peak of a price bubble.

How Dollar-Cost Averaging Works

To understand how dollar-cost averaging works, let’s consider an example. Suppose an investor wants to invest $500 in Bitcoin using the DCA strategy. Instead of investing the entire amount at once, the investor decides to spread the investment over a period of six months, investing $83.33 each month.

Month 1: The price of Bitcoin is $10,000, so the investor buys 0.00833 BTC (83.33 / 10,000).

Month 2: The price of Bitcoin drops to $8,000, so the investor buys 0.01042 BTC (83.33 / 8,000).

Month 3: The price of Bitcoin increases to $12,000, so the investor buys 0.00694 BTC (83.33 / 12,000).

Month 4: The price of Bitcoin falls to $9,000, so the investor buys 0.00926 BTC (83.33 / 9,000).

Month 5: The price of Bitcoin rises to $11,000, so the investor buys 0.00757 BTC (83.33 / 11,000).

Month 6: The price of Bitcoin drops to $7,000, so the investor buys 0.01190 BTC (83.33 / 7,000).

At the end of the six-month period, the investor has accumulated a total of 0.05442 BTC. By consistently investing a fixed amount over time, the investor has managed to spread the investment at different price points, taking advantage of both the lows and highs of the market. This approach helps smooth out the overall cost basis and reduce the impact of short-term market volatility.

The Advantages of Dollar-Cost Averaging in Crypto

Dollar-cost averaging in cryptocurrencies offers several advantages:

1. Reducing the risk of market timing: Crypto markets are notoriously volatile, with prices fluctuating dramatically. Attempting to time the market by buying at the lowest price and selling at the highest is extremely challenging, even for experienced investors. DCA reduces the risk associated with timing the market by averaging the overall purchase price over time.

2. Disciplined approach: Using DCA requires investors to stick to a disciplined investment plan. By investing a fixed amount regularly, investors build a habit of investing regardless of short-term market movements. This approach can help prevent impulsive and emotionally driven investment decisions.

3. Mitigating the impact of price volatility: Cryptocurrencies are known for their wild price swings. DCA helps reduce the risk of making large investments at the peak of a price bubble by spreading the investment over time. By buying at different price points, investors lower the overall average cost of their investment.

4. Psychological benefits: Investing in cryptocurrencies can be emotionally challenging, especially during periods of extreme market volatility. DCA can help alleviate some of the stress and anxiety associated with investing by removing the pressure to make the perfect investment decision at a specific time.

Factors to Consider When Implementing Dollar-Cost Averaging

While dollar-cost averaging can be an effective strategy, there are a few factors investors should consider when implementing it in the cryptocurrency market:

1. Investment horizon: DCA is a long-term investment strategy. It works best when investors have a long-term outlook and are willing to hold their investments for an extended period. Short-term traders may find other strategies more suitable for their investment goals.

2. Investment amount: The amount of money invested regularly should be predetermined based on an investor’s financial goals and risk tolerance. It’s important to choose an amount that does not put undue financial strain on an individual’s overall financial situation.

3. Asset selection: Cryptocurrencies are highly diverse, with thousands of different coins available for investment. It’s important to conduct thorough research and due diligence before selecting the specific cryptocurrencies to invest in using the DCA strategy. Factors such as project fundamentals, market trends, and overall market sentiment should be considered.

4. Regular review: While the DCA strategy is designed to be consistently implemented over time, it’s essential to periodically review the investment performance and adjust the approach if needed. Market conditions and individual goals may change, and it’s crucial to reassess the strategy accordingly.

Dollar-cost averaging provides a disciplined and systematic approach to investing in cryptocurrencies. By regularly investing a fixed amount over time, investors can mitigate the risk associated with market timing and smooth out the overall cost basis of their investment. This approach is particularly relevant in the highly volatile crypto market, where prices can fluctuate dramatically within short periods.

While dollar-cost averaging does not guarantee profits, it offers advantages such as reducing the impact of price volatility and providing a psychologically sound investment strategy. By carefully considering factors such as investment horizon, investment amount, asset selection, and regular review, investors can effectively implement dollar-cost averaging and increase their chances of success in the crypto space.

What is Dollar Cost Averaging in Crypto? The SMARTEST Way to Invest

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is dollar-cost averaging in crypto?

Dollar-cost averaging (DCA) is an investment strategy where an investor buys a fixed dollar amount of a particular cryptocurrency at regular intervals, regardless of the price. This approach helps to mitigate the impact of market volatility and eliminates the need for perfectly timing the market.

How does dollar-cost averaging work?

With dollar-cost averaging, you invest the same amount of money periodically, such as monthly or weekly, into a cryptocurrency regardless of its price. When prices are low, you can purchase more units, and when prices are high, you will buy fewer units. Over time, this strategy aims to reduce the impact of short-term market fluctuations and potentially lower the average purchase price.

What are the benefits of utilizing dollar-cost averaging?

Dollar-cost averaging in crypto offers several benefits. Firstly, it removes the temptation to time the market, which can be challenging even for experienced investors. Secondly, it helps to reduce the impact of short-term price fluctuations on your investment. Lastly, it promotes a disciplined approach to investing by automatically buying more when prices are low and fewer when prices are high.

Is dollar-cost averaging a suitable strategy for crypto investments?

Yes, dollar-cost averaging is considered a suitable strategy for crypto investments. Cryptocurrencies are known for their volatility, and attempting to time the market can be extremely challenging. By using dollar-cost averaging, investors can mitigate the risk of making poor investment decisions based on short-term price fluctuations.

What are the potential drawbacks of dollar-cost averaging in crypto?

While dollar-cost averaging is generally a sound strategy, it does have certain limitations. One drawback is that it does not guarantee profits or prevent losses. Additionally, during periods of strong upward price trends, consistently investing at fixed intervals may result in missing out on potential gains that could have been made by investing a larger sum upfront.

What are the recommended time intervals for dollar-cost averaging in crypto?

The choice of time intervals for dollar-cost averaging in crypto depends on individual preferences and investment goals. Common intervals include weekly, bi-weekly, or monthly investments. It is important to select a frequency that aligns with your financial capabilities and risk tolerance.

Which cryptocurrencies are suitable for dollar-cost averaging?

Dollar-cost averaging can be applied to any cryptocurrency that is traded on a regular basis and has sufficient liquidity. Popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), or Litecoin (LTC) are commonly used for this investment strategy.

Can dollar-cost averaging be used for short-term trading?

Dollar-cost averaging is primarily a long-term investment strategy aimed at reducing the impact of market volatility. It may not be as effective for short-term trading, where timing the market becomes more important. Short-term traders often rely on technical analysis and other strategies specifically tailored for their trading objectives.

Final Thoughts

Dollar-cost averaging in crypto is a strategy that involves regularly investing a fixed amount of money into a cryptocurrency, regardless of its price fluctuations. This approach helps mitigate the risks associated with volatile markets and reduces the impact of short-term price movements on an investment. By spreading out purchases over time, investors can take advantage of market dips and effectively lower their average cost per coin. Dollar-cost averaging in crypto allows individuals to build a position in a cryptocurrency gradually, ensuring a more balanced and disciplined investment approach.