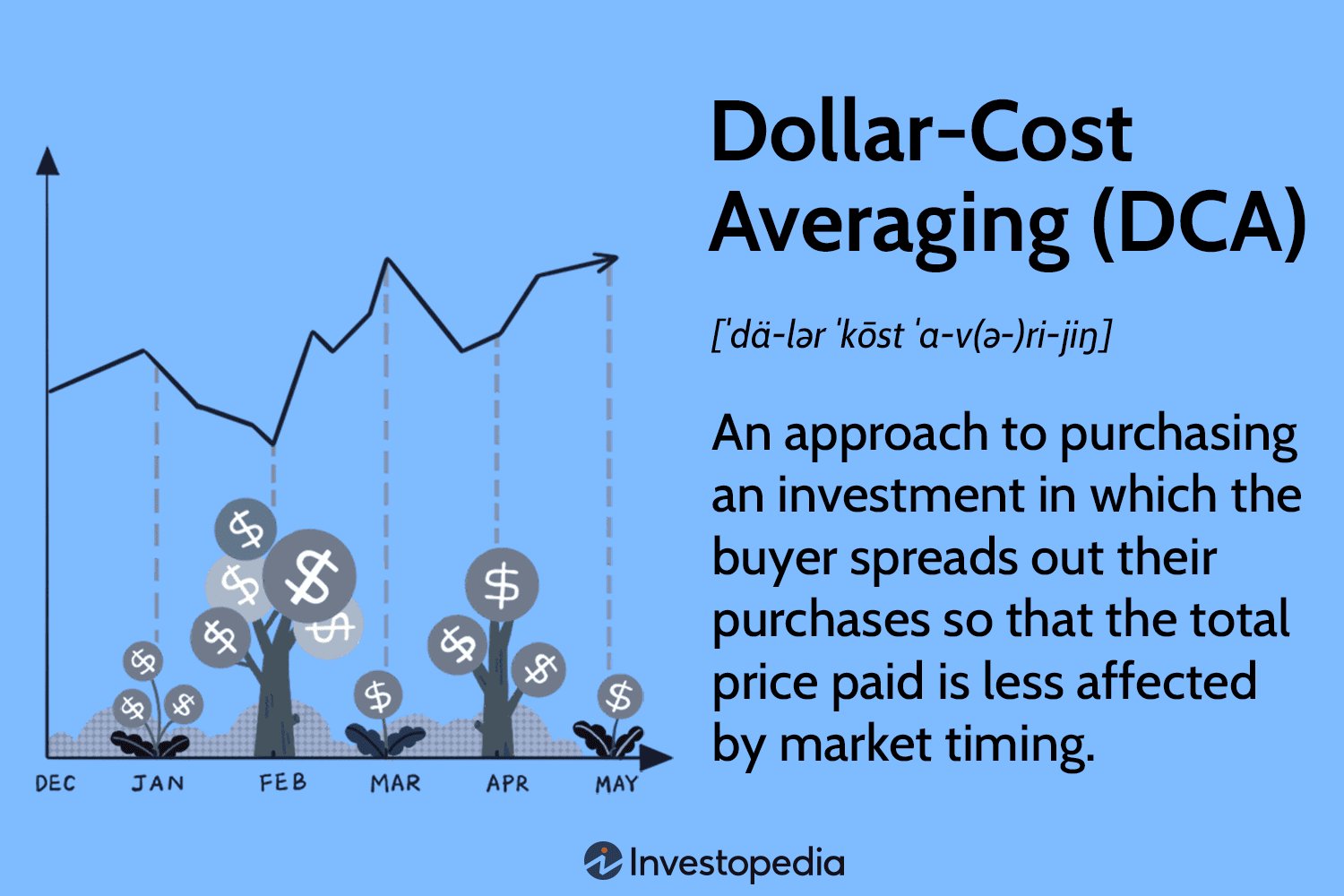

If you’ve ever wondered how to navigate the volatile world of cryptocurrency investing, look no further! Dollar-cost averaging in crypto investing is a strategy that offers a simple yet effective solution. But what exactly is dollar-cost averaging in crypto investing? Well, it’s a method that involves consistently investing a fixed amount of money at regular intervals, regardless of the current price of the cryptocurrency. By doing so, investors can take advantage of market fluctuations, maximizing their returns over time. So, let’s dive into the details and explore the power of dollar-cost averaging in crypto investing.

What is Dollar-Cost Averaging in Crypto Investing?

Dollar-cost averaging (DCA) is a popular investment strategy that involves systematically investing a fixed amount of money at regular intervals, regardless of the asset’s price. This approach is often used in traditional stock market investing, and it can also be applied to cryptocurrency investing.

Cryptocurrencies are known for their volatility, with prices that can fluctuate dramatically in short periods of time. This volatility can make it challenging for investors to determine the best entry points for buying cryptocurrencies. Dollar-cost averaging addresses this issue by spreading out investments over time, reducing the impact of market volatility on the overall investment.

Dollar-cost averaging in crypto investing works as follows:

1. Determine the Investment Amount: First, decide how much money you want to invest in cryptocurrencies. This amount should be based on your financial goals, risk tolerance, and available capital.

2. Set the Investment Interval: Next, determine the frequency at which you will invest. It could be weekly, monthly, or any other interval that works for you. Consistency is key in dollar-cost averaging.

3. Commit to Invest: Once you have determined the investment amount and interval, make a commitment to stick to the plan. This means investing the predetermined amount at the set interval, regardless of the market conditions.

4. Buy Cryptocurrencies: At each investment interval, use the predetermined amount to buy cryptocurrencies. This can be done through exchanges or investment platforms that support recurring purchases.

By following these steps, you will gradually accumulate cryptocurrencies over time, buying more when prices are lower and less when prices are higher. This approach reduces the risk of making large investments at unfavorable price levels and allows you to benefit from the long-term potential of the cryptocurrency market.

Benefits of Dollar-Cost Averaging in Crypto Investing

Dollar-cost averaging offers several advantages for crypto investors, including:

1. Mitigates Timing Risk

One of the main benefits of dollar-cost averaging is that it helps mitigate timing risk. Trying to time the market is notoriously difficult, even for experienced investors. By investing at regular intervals, regardless of the market conditions, you are less dependent on making accurate predictions about short-term price movements.

2. Removes Emotion from Investing

Investing based on emotions can often lead to poor decision-making. Fear and greed can cloud judgment and cause investors to make impulsive decisions that may not align with their long-term investment goals. Dollar-cost averaging helps remove emotion from the equation by sticking to a predetermined investment plan.

3. Averaging Out the Purchase Price

With the volatile nature of cryptocurrencies, prices can experience sharp fluctuations. Dollar-cost averaging allows you to smooth out the impact of these price fluctuations over time. By buying both during periods of high prices and low prices, you average out the purchase price of the cryptocurrencies in your portfolio.

4. Disciplined Investing Approach

Dollar-cost averaging promotes a disciplined approach to investing. It eliminates the temptation to make impulsive investment decisions based on short-term market movements. By committing to a regular investment plan, you develop a consistent and disciplined investing habit that can lead to better long-term results.

5. Reduces Market Timing Stress

Timing the market can be stressful and mentally exhausting. Constantly monitoring price movements and trying to make optimal entry points can take a toll on investors. Dollar-cost averaging alleviates this stress by providing a simple and systematic investment approach that does not rely on timing the market.

Considerations for Dollar-Cost Averaging in Crypto Investing

While dollar-cost averaging offers several benefits, it’s important to consider the following factors when applying this strategy to crypto investing:

1. Market Volatility

Cryptocurrencies are known for their volatility, and this volatility can impact the effectiveness of dollar-cost averaging. While the strategy helps smooth out the impact of price fluctuations, it may not completely eliminate the risk of buying at unfavorable price levels during extreme market swings.

2. Transaction Costs

When implementing dollar-cost averaging in crypto investing, transaction costs can eat into your returns, especially if you’re making frequent purchases. Be mindful of the fees charged by exchanges or investment platforms and consider the impact on your overall investment performance.

3. Research and Due Diligence

Dollar-cost averaging does not exempt you from conducting thorough research and due diligence on the cryptocurrencies you plan to invest in. While the strategy helps reduce timing risk, it’s essential to invest in fundamentally sound projects with long-term potential. Stay informed about the market and make informed investment decisions.

How to Get Started with Dollar-Cost Averaging

If you’re interested in implementing dollar-cost averaging in your crypto investing strategy, here are some steps to help you get started:

1. Set Clear Investment Goals

Define your investment goals, risk tolerance, and time horizon. This will help you determine the appropriate amount to invest and the duration of your dollar-cost averaging plan.

2. Choose the Right Cryptocurrencies

Research and select cryptocurrencies that align with your investment goals. Look for projects with strong fundamentals, active development teams, and real-world use cases. Diversify your portfolio to spread the risk across different crypto assets.

3. Select a Reliable Exchange or Investment Platform

Choose a reputable exchange or investment platform that supports recurring purchases and offers competitive fees. Ensure the platform has sufficient security measures in place to protect your investments.

4. Set Up a Recurring Investment Plan

Set up a recurring investment plan that matches your investment goals and risk tolerance. Determine the investment amount and interval that works for you. Consider automating the process to ensure consistency and avoid the temptation to deviate from the plan.

5. Monitor and Adjust

Regularly monitor your investment performance and review your portfolio. Periodically assess the progress of your dollar-cost averaging strategy and make adjustments as needed. This could involve rebalancing your portfolio or making changes to your investment plan based on market conditions or changes in your financial situation.

By following these steps, you can start implementing dollar-cost averaging in your crypto investing journey and take advantage of this strategy’s potential benefits.

Dollar-cost averaging is a powerful investment strategy that can be applied to crypto investing. By systematically investing a fixed amount at regular intervals, regardless of the cryptocurrency’s price, you reduce timing risk and take advantage of market volatility. While there are considerations to keep in mind, such as market volatility and transaction costs, dollar-cost averaging offers a disciplined and stress-free approach to investing in cryptocurrencies. Start small, set clear goals, and choose the right investments to embark on your dollar-cost averaging journey in the crypto space.

What is Dollar Cost Averaging in Crypto? The SMARTEST Way to Invest

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is dollar-cost averaging in crypto investing?

Dollar-cost averaging is an investment strategy where an investor regularly purchases a fixed amount of a cryptocurrency at regular intervals, regardless of the price. This approach helps to mitigate the impact of market volatility by spreading out the investment over time.

How does dollar-cost averaging work?

With dollar-cost averaging, you invest a fixed amount of money in a cryptocurrency at predetermined intervals, such as weekly or monthly. This consistent investment approach ensures that you buy more of the cryptocurrency when prices are low and less when prices are high.

What are the benefits of dollar-cost averaging in crypto investing?

Dollar-cost averaging reduces the impact of short-term price fluctuations, as you buy both during market dips and peaks. It eliminates the need to time the market, allowing you to stay invested over the long term and potentially benefit from the overall upward trend of the cryptocurrency market.

Does dollar-cost averaging guarantee profits in crypto investing?

Dollar-cost averaging does not guarantee profits in crypto investing. It is important to remember that the cryptocurrency market is highly volatile, and prices can fluctuate significantly. However, this strategy helps to reduce the risk of making large investments at unfavorable prices.

Can I use dollar-cost averaging for any cryptocurrency?

Yes, dollar-cost averaging can be applied to any cryptocurrency of your choice. It is a strategy that is commonly used for Bitcoin, Ethereum, and other popular cryptocurrencies. You can choose the cryptocurrency that aligns with your investment goals and implement dollar-cost averaging accordingly.

How do I get started with dollar-cost averaging in crypto investing?

To get started with dollar-cost averaging, you need to set a fixed investment amount and determine the frequency of your investments. You can then set up automatic purchases on a cryptocurrency exchange or manually execute your investment plan at regular intervals.

Is dollar-cost averaging suitable for short-term or long-term investing in crypto?

Dollar-cost averaging is typically more suitable for long-term investing in crypto, as it aims to capitalize on the overall upward trend of the market over time. It allows you to accumulate cryptocurrency holdings gradually without the need to time the market or make significant lump-sum investments.

Can I adjust my dollar-cost averaging strategy over time?

Yes, you can adjust your dollar-cost averaging strategy over time based on your investment goals and market conditions. You may choose to increase or decrease your investment amount, change the frequency of investments, or even explore different cryptocurrencies depending on your evolving investment strategy.

Are there any risks associated with dollar-cost averaging in crypto investing?

While dollar-cost averaging helps to mitigate the impact of market volatility, it does not eliminate all risks associated with crypto investing. Cryptocurrency prices can still experience significant fluctuations, and it’s essential to conduct thorough research and stay informed about the market before making investment decisions.

Final Thoughts

Dollar-cost averaging is an investment strategy that involves regularly purchasing a fixed amount of a cryptocurrency over a specific period, regardless of its market price. This approach allows investors to mitigate the impact of volatility and take advantage of market fluctuations. By consistently investing, individuals can potentially lower the overall average cost of their cryptocurrency holdings. Dollar-cost averaging in crypto investing helps to reduce the risks associated with trying to time the market and provides a disciplined approach to long-term investment. This strategy offers individuals an opportunity to gradually enter the crypto market and benefit from its potential growth over time.