Dynamic asset allocation in investing is a strategy that adapts to market conditions, allowing investors to optimize their portfolios for maximum returns. It involves actively monitoring and adjusting the allocation of assets based on factors like market trends, economic indicators, and risk appetite. By constantly reassessing and fine-tuning the mix of stocks, bonds, and other assets, investors can take advantage of opportunities and mitigate potential risks. In this article, we will delve into what dynamic asset allocation in investing truly entails, shedding light on its benefits and how it can help investors achieve their financial goals. So, let’s dive right in!

What is Dynamic Asset Allocation in Investing?

Dynamic asset allocation is a popular investment strategy that involves adjusting the allocation of assets in an investment portfolio based on changing market conditions and economic trends. Unlike static asset allocation, which maintains a fixed allocation over time, dynamic asset allocation aims to take advantage of market opportunities and minimize potential risks by actively managing the portfolio.

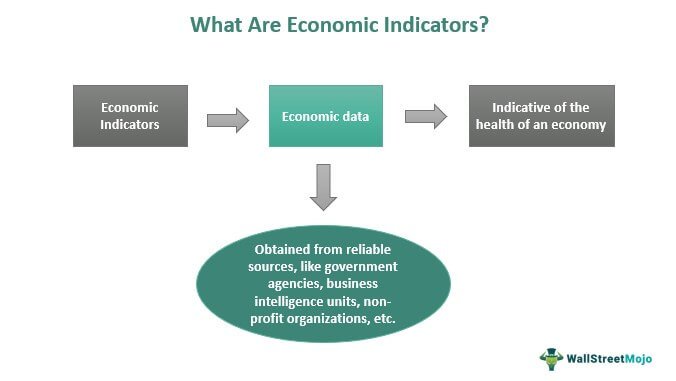

With dynamic asset allocation, investment managers continuously monitor and analyze various factors such as economic indicators, market trends, interest rates, and asset valuations to make informed decisions about the composition of the portfolio. By adapting to changing market conditions, investors can potentially enhance returns and reduce downside risk.

How Does Dynamic Asset Allocation Work?

Dynamic asset allocation involves a systematic process that requires active decision-making based on market analysis and research. Here’s a step-by-step breakdown of how it typically works:

1. Define Investment Goals: Before implementing dynamic asset allocation, investors need to establish clear investment objectives. These goals can vary depending on factors such as risk tolerance, time horizon, and desired returns.

2. Analyze Market Conditions: Investment managers continuously analyze market conditions, economic indicators, and trends to identify potential opportunities and risks. They monitor factors such as GDP growth, inflation, interest rates, corporate earnings, and geopolitical events that could impact investment performance.

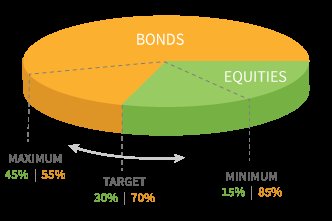

3. Determine Asset Allocation: Based on the analysis of market conditions, investment managers determine the optimal allocation of assets in the portfolio. This allocation can include a mix of stocks, bonds, cash, real estate, and other investment vehicles.

4. Rebalance the Portfolio: As market conditions change, the asset allocation may deviate from the desired targets. Investment managers periodically rebalance the portfolio by buying or selling assets to bring it back in line with the desired allocation. This ensures that the portfolio remains aligned with the investment objectives.

5. Risk Management: Dynamic asset allocation also involves monitoring and managing risk. Investment managers may use various risk management techniques, such as diversification, hedging strategies, and tactical asset allocation, to mitigate potential downside risk and protect the portfolio from market fluctuations.

Benefits of Dynamic Asset Allocation

Dynamic asset allocation offers several potential benefits for investors looking to optimize their investment returns and manage risk effectively. Here are some key advantages of this investment strategy:

1. Flexibility: Dynamic asset allocation allows investors to adapt their portfolios to changing market conditions. By actively adjusting the asset allocation based on market trends and economic indicators, investors can potentially capitalize on opportunities and reduce exposure to potential risks.

2. Enhanced Returns: By actively managing the portfolio and capitalizing on market opportunities, dynamic asset allocation has the potential to generate higher returns compared to static asset allocation strategies. Taking advantage of market upswings and avoiding downturns can lead to improved long-term performance.

3. Risk Management: Dynamic asset allocation enables investors to actively manage risk by adapting the portfolio to changing market conditions. By diversifying across different asset classes and adjusting allocation based on risk appetite, investors can potentially reduce downside risk and protect their investments during market downturns.

4. Market Timing: Dynamic asset allocation allows investors to take advantage of market timing opportunities. By closely monitoring market trends, investment managers can adjust the asset allocation to capture potential gains during market upswings and reduce exposure during periods of market decline.

5. Long-Term Focus: Dynamic asset allocation considers the long-term objectives of the investor and aims to achieve consistent performance over time. By regularly reviewing and adjusting the portfolio, investors can stay on track towards their goals and adapt to changing investment landscapes.

6. Continuous Monitoring and Analysis: Investment managers employing dynamic asset allocation are constantly monitoring market conditions and economic indicators. The ongoing analysis ensures that the portfolio remains aligned with the investment objectives and allows for timely adjustments when necessary.

Challenges and Considerations

While dynamic asset allocation offers potential benefits, it’s important to consider some of the challenges and factors to bear in mind:

1. Expertise Required: Implementing dynamic asset allocation requires knowledge and expertise in market analysis and investment management. Investors may need to rely on professional fund managers or financial advisors with experience in active portfolio management.

2. Increased Transaction Costs: Dynamic asset allocation involves frequent buying and selling of assets, which can lead to higher transaction costs. Investors should carefully consider the impact of these costs on overall investment returns.

3. Market Timing Risks: Timing the market accurately is challenging and risky. Incorrect market timing decisions can result in missing out on potential gains or incurring losses. Investors should carefully evaluate their risk tolerance and consult with professionals to make informed decisions.

4. Active Monitoring: Dynamic asset allocation requires continuous monitoring and analysis of market conditions. The active management approach may not be suitable for investors who prefer a more hands-off or passive investment strategy.

5. Potential Underperformance: While dynamic asset allocation has the potential for higher returns, it also carries the risk of underperforming a static asset allocation strategy during certain market conditions. It’s important to carefully evaluate the investment goals and risk tolerance to determine the most appropriate approach.

Dynamic asset allocation is an investment strategy that aims to optimize portfolio performance by actively adjusting asset allocation based on changing market conditions. By continuously monitoring and analyzing market trends, investment managers can adapt the portfolio to capitalize on opportunities and manage risk effectively. While dynamic asset allocation offers potential benefits, it requires expertise and active management. Investors should carefully consider their investment goals, risk tolerance, and consult with professionals to determine if dynamic asset allocation aligns with their investment objectives.

What are Dynamic Asset Allocation Funds? How to Invest in Dynamic Asset Allocation Funds? (Part 1)

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is dynamic asset allocation in investing?

Dynamic asset allocation in investing refers to the strategy of regularly adjusting the allocation of investments within a portfolio based on changing market conditions, economic outlook, and risk tolerance. It involves shifting the distribution of assets, such as stocks, bonds, and cash, to optimize returns and manage risk in response to market fluctuations.

How does dynamic asset allocation differ from static asset allocation?

Static asset allocation involves setting a fixed allocation of investments and maintaining it over time, regardless of market conditions. Dynamic asset allocation, on the other hand, allows for adjustments to the portfolio’s asset allocation based on the investor’s goals, market trends, and risk appetite. It provides the flexibility to take advantage of potential opportunities and mitigate risks.

What are the benefits of dynamic asset allocation?

Dynamic asset allocation offers several benefits. It helps investors adapt to changing market conditions, potentially generating higher returns by capitalizing on market opportunities. It also enables risk management by reducing exposure to asset classes that may underperform. Additionally, dynamic asset allocation can provide diversification and help investors achieve their long-term financial goals while minimizing potential losses.

How is dynamic asset allocation implemented?

Dynamic asset allocation is implemented through continuous monitoring of market data, economic indicators, and financial news. Investment professionals or portfolio managers use quantitative models and/or subjective analysis to assess market conditions and determine the optimal allocation of assets. The portfolio is then adjusted accordingly, with the aim of improving risk-adjusted returns.

What factors influence dynamic asset allocation decisions?

Several factors influence dynamic asset allocation decisions. These include the investor’s risk tolerance, time horizon, financial goals, and market outlook. Other factors may include interest rates, inflation expectations, geopolitical factors, and sector-specific trends. The specific weightings of asset classes within the portfolio may be adjusted based on these variables to optimize performance.

Is dynamic asset allocation suitable for all investors?

Dynamic asset allocation may not be suitable for all investors. It is more commonly utilized by investors with a longer time horizon and higher risk tolerance. Investors who are comfortable with market fluctuations and understand the potential benefits and risks may find dynamic asset allocation strategies appealing. However, it is important for investors to consult with a financial advisor to ensure alignment with their individual goals and risk appetite.

What are the potential risks of dynamic asset allocation?

Dynamic asset allocation involves risks inherent to investing in the financial markets. The performance of asset classes can be unpredictable, and incorrect predictions or market timing decisions can result in suboptimal returns or losses. Additionally, frequent trades and adjustments may lead to higher transaction costs and tax implications. It is important for investors to carefully evaluate the risks and benefits before implementing a dynamic asset allocation strategy.

Can dynamic asset allocation guarantee higher returns?

Dynamic asset allocation does not guarantee higher returns. While it aims to optimize portfolio performance based on changing market conditions, future market movements and investment outcomes cannot be accurately predicted. The strategy involves a degree of uncertainty and the possibility of losses. However, by actively managing the asset allocation, dynamic strategies seek to improve the risk-return tradeoff over the long term.

Final Thoughts

Dynamic asset allocation in investing refers to the practice of actively adjusting an investment portfolio’s allocation across different asset classes based on changing market conditions. By constantly monitoring and analyzing market trends, investors can make informed decisions to optimize their portfolio’s performance. Dynamic asset allocation aims to capitalize on opportunities and mitigate risks, ensuring a balanced and diversified investment strategy. This proactive approach allows investors to adapt to market fluctuations and potentially enhance returns. Incorporating dynamic asset allocation in investment plans can help investors achieve their financial goals by actively responding to changing market dynamics.