Fiat money. It’s a term that is often thrown around in discussions about finance and the economy. But what exactly is fiat money and its history? In simple terms, fiat money is currency that has value because a government declares it to be legal tender. Unlike money backed by a physical asset like gold or silver, fiat money has value simply because the government says it does. Understanding the history of fiat money is crucial in comprehending the current financial system we live in. So, let’s delve into the fascinating evolution of fiat money and how it has shaped our modern economies.

What is Fiat Money and Its History

Money plays a crucial role in our daily lives, facilitating transactions and serving as a medium of exchange. But have you ever wondered about the different types of money and their history? One significant form of currency is fiat money, which is the focus of this article. In this comprehensive guide, we will explore the concept of fiat money, its history, and its impact on the global economy.

Understanding Fiat Money

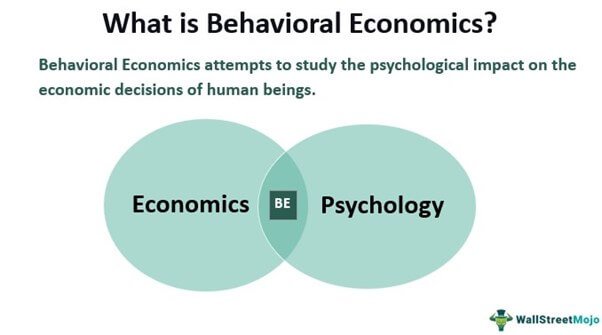

Fiat money is a type of currency that derives its value from government regulation or law, rather than being backed by a physical commodity like gold or silver. The term “fiat” comes from the Latin word meaning “let it be done” or “it shall be.” Essentially, fiat money has value because the government declares it to be legal tender, and individuals must accept it as a form of payment for goods and services.

Unlike commodity money, which has intrinsic value based on the worth of the material it is made from, fiat money is purely representative. Its value is based on the trust and confidence placed in the issuing government. However, this trust can vary depending on various economic factors and the stability of the governing body, making the value of fiat money more susceptible to fluctuations.

A Brief History of Fiat Money

The roots of fiat money can be traced back to ancient China, where the use of paper money began. During the Tang Dynasty in the 7th century, the Chinese government started issuing paper currency known as “jiaozi.” These notes were initially backed by the value of silk, but over time they transitioned into a fully fiat system.

As European civilizations began to explore the New World during the 15th and 16th centuries, precious metals such as gold and silver became the dominant form of currency. However, the influx of wealth from the Americas eventually led to inflation and a shortage of precious metals. This prompted governments to issue fiat money in the form of paper banknotes.

One significant milestone in the history of fiat money occurred in 1661 when the Swedish Riksbank became the world’s first central bank. The Riksbank introduced paper money as legal tender backed by the creditworthiness of the government.

Throughout the 18th and 19th centuries, many countries adopted fiat money systems. However, the convertibility of paper money into precious metals remained a prevalent practice. It wasn’t until the 20th century that most currencies fully transitioned into fiat money, severing the link to gold and silver reserves.

The Advantages and Disadvantages of Fiat Money

Fiat money offers several advantages over other forms of currency. Here are some key benefits:

1. Flexibility and Adaptability:

Fiat money allows governments to adapt to changing economic conditions by adjusting interest rates, implementing monetary policies, and controlling the money supply. This flexibility enables authorities to stimulate or stabilize the economy as needed.

2. Ease of Use:

Being widely accepted as legal tender, fiat money is easily recognizable and convenient for everyday transactions. It eliminates the need for bartering or carrying heavy commodities for exchange.

3. Expansionary Monetary Policy:

Fiat money grants governments the ability to engage in expansionary monetary policies, such as increasing the money supply or implementing quantitative easing. These measures can stimulate economic growth and combat recessions.

However, fiat money also has its drawbacks:

1. Inflation:

Since fiat money lacks intrinsic value, excessive money creation can lead to inflation. If a government prints money excessively without adequate economic growth, it can devalue the currency and erode purchasing power.

2. Currency Manipulation:

Governments and central banks have the authority to manipulate the value of fiat money. Currency devaluation or manipulation can have significant implications for international trade and financial markets.

3. Lack of Trust:

Fiat money relies heavily on public trust in the issuing government. If confidence diminishes due to political instability, economic turmoil, or excessive debt, it can result in a loss of value for the currency.

The Role of Fiat Money in the Global Economy

Fiat money is the dominant form of currency in today’s global economy. Here are some key aspects of its role:

1. Legal Tender:

Fiat money is recognized as legal tender in its respective country, meaning it must be accepted as a form of payment for goods and services. This widespread acceptance is vital for facilitating economic transactions.

2. Monetary Policy Tool:

Central banks utilize fiat money as a tool for implementing monetary policies. They can control interest rates, adjust reserve requirements, and manage the money supply to influence economic growth, inflation, and employment levels.

3. Reserve Currency:

Some fiat currencies, such as the U.S. dollar, hold the status of a global reserve currency. This means that central banks around the world hold significant amounts of these currencies as foreign exchange reserves. Reserve currencies facilitate international trade and serve as a benchmark for commodity pricing.

Overall, fiat money plays a crucial role in the stability and functionality of the global economy. It provides the necessary means for exchange and serves as a tool for economic policy.

Fiat Money, explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is fiat money?

Fiat money is a type of currency that is issued by a government and is not backed by a physical commodity, such as gold or silver. It has value because the government declares it to be legal tender and people accept it as a medium of exchange.

What is the history of fiat money?

Throughout history, various forms of fiat money have been used. The earliest recorded use of fiat money dates back to China in the 9th century. It was also used by the Mongols in the 13th century and by the American colonies in the 18th century. The modern form of fiat money, as we know it today, became prominent during the 20th century.

How does fiat money differ from commodity money?

Commodity money, such as gold or silver coins, has intrinsic value based on the material from which it is made. In contrast, fiat money has value because the government has deemed it to be legal tender, and people have faith in the currency’s ability to be used for transactions and settle debts.

What are the advantages of using fiat money?

Fiat money offers several advantages, including ease of use, portability, and convenience. It can be produced in various denominations and is widely accepted, making it a practical medium of exchange in everyday transactions. Additionally, the supply of fiat money can be controlled by the central bank to manage economic stability.

What are the disadvantages of fiat money?

One of the main disadvantages of fiat money is its susceptibility to inflation. Since it is not backed by a physical commodity, governments can increase the money supply, leading to a decrease in purchasing power. Additionally, the value of fiat money is dependent on public trust and can be impacted by political and economic factors.

Is fiat money used globally?

Yes, fiat money is the most common form of currency used worldwide. Almost every country has its own fiat currency, and most international transactions are conducted using major fiat currencies such as the US dollar, Euro, or Japanese yen.

Can fiat money lose its value?

While fiat money can lose value due to inflation or economic instability, its value is generally maintained through government policies and market confidence. Central banks play a crucial role in managing the value of fiat currencies through monetary policies and interventions in the foreign exchange market.

Can fiat money be converted into other forms of currency?

Generally, fiat money can be converted into other forms of currency, such as exchanging one currency for another when traveling internationally. However, the exchange rate between different fiat currencies can fluctuate based on various factors, including economic conditions and government policies.

Final Thoughts

Fiat money, a form of currency that is not backed by a physical commodity, has a long and complex history. Its origins can be traced back to ancient civilizations, where it emerged as a solution to the challenges of bartering. Throughout history, various forms of fiat money have been used, from paper money to digital currencies. Today, fiat money is the dominant form of currency worldwide, with governments having the authority to issue and regulate it. Understanding what fiat money is and its historical development is crucial for comprehending the modern monetary system.