Financial derivatives trading is a fascinating and complex world that holds immense potential for those who dare to venture into it. Wondering what exactly financial derivatives trading is? Well, it’s a practice that involves the buying and selling of financial contracts whose value is derived from an underlying asset, such as stocks, commodities, currencies, or bonds. Sounds intriguing, right? In this blog article, we will delve into the depths of financial derivatives trading, unraveling its intricacies and shedding light on its numerous possibilities. So, fasten your seatbelts as we embark on this enlightening journey together.

What is Financial Derivatives Trading?

Financial derivatives trading is a complex and dynamic form of investing that involves the trading of financial contracts whose value is derived from an underlying asset. These assets can include commodities, stocks, bonds, currencies, or even market indices. This type of trading allows investors to speculate on the future price movements of these underlying assets, without actually owning them.

Derivatives trading provides investors with opportunities to profit from both upward and downward price movements, allowing for potential returns in any market condition. The derivative contracts themselves can take various forms, including options, futures, swaps, and forwards. Each of these instruments has its own unique characteristics and uses, providing traders with a wide range of strategies to choose from.

Understanding Derivatives Contracts

Derivative contracts are agreements between two parties, the buyer and the seller, to exchange the underlying asset at a predetermined price and date in the future. These contracts are standardized and traded on exchanges, providing liquidity and transparency to the market.

Here are some key components of different types of derivative contracts:

- Options: An option contract gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specific price (strike price) within a specified time period (expiration date).

- Futures: A futures contract obligates the buyer to purchase and the seller to sell the underlying asset at a predetermined price and date in the future. Unlike options, futures contracts are binding for both parties.

- Swaps: Swaps involve the exchange of cash flows or payments between two parties. The most common types of swaps include interest rate swaps, currency swaps, and commodity swaps.

- Forwards: Similar to futures, forward contracts also involve the obligation to buy or sell the underlying asset at a predetermined price and date. However, forwards are customized agreements between two parties and are not traded on exchanges.

The Role of Financial Derivatives Trading

Financial derivatives trading serves several important functions in financial markets. Here are some key roles played by derivatives:

- Hedging: Derivatives allow market participants to manage risks associated with price fluctuations. Hedging involves taking offsetting positions in derivatives to protect against adverse price movements of underlying assets.

- Speculation: Traders can use derivatives to speculate on the potential price movements of an underlying asset. By taking long or short positions, speculators aim to profit from anticipated price changes.

- Arbitrage: Arbitrage opportunities arise when there are price discrepancies between the underlying asset and its corresponding derivative. Traders can exploit these price differences to make risk-free profits.

- Price Discovery: Derivatives trading contributes to price discovery by revealing market expectations and sentiments. The continuous buying and selling of contracts help determine the fair value of the underlying assets.

- Leverage: Derivatives provide traders with leverage, allowing them to control a larger exposure to the underlying asset with a smaller initial investment. This amplifies both potential gains and losses.

Benefits of Financial Derivatives Trading

Financial derivatives trading offers several benefits to investors and market participants:

- Diversification: Derivatives allow investors to access a wide range of asset classes, which helps diversify their portfolios and spread risks.

- Liquidity: Trading in derivatives markets is often highly liquid, allowing investors to enter and exit positions more easily compared to some other investment options.

- Flexibility: Derivatives provide investors with flexibility in terms of the types of strategies they can employ, enabling them to adapt to changing market conditions.

- Enhanced Returns: Due to the leverage and potential for profit in both rising and falling markets, derivatives trading offers the possibility of higher returns compared to traditional investments.

- Hedging Opportunities: Derivatives enable investors to hedge against risks, protecting their portfolios from potential losses resulting from adverse market movements.

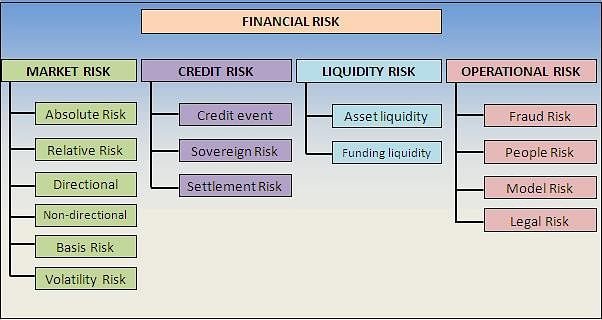

Risks and Considerations

While financial derivatives trading offers opportunities, it’s essential to be aware of the associated risks:

- Market Volatility: Derivatives trading involves price speculation, and market volatility can lead to substantial losses if the price moves against the trader’s position.

- Leverage Risk: The use of leverage amplifies gains but also increases the potential for significant losses. Traders must carefully manage their positions and risk exposure.

- Counterparty Risk: Derivative contracts involve counterparties, and there is a risk of default by one of the parties, leading to financial loss.

- Complexity: Derivatives trading can be complex, requiring a solid understanding of the underlying assets, market conditions, and various strategies. Novice traders should approach derivatives with caution and seek education and guidance.

- Regulatory Considerations: Derivatives are subject to regulations, and traders must comply with relevant laws and requirements. Familiarizing oneself with the regulatory environment is crucial.

Financial derivatives trading provides investors with a diverse range of tools and strategies to manage risks, speculate on price movements, and enhance returns. By understanding derivative contracts, their role in the market, and associated benefits and risks, traders can make informed decisions and navigate the dynamic world of derivatives trading. It is important to approach derivatives with caution, seeking education and guidance, and carefully managing risk to maximize the potential benefits while mitigating potential drawbacks.

Financial Derivatives Explained

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is financial derivatives trading?

Financial derivatives trading refers to the buying and selling of financial contracts whose value is derived from an underlying asset, such as stocks, bonds, commodities, or currencies. These contracts, known as derivatives, include options, futures, swaps, and forward contracts. Traders and investors use derivatives to speculate on price movements, hedge against risks, and manage their portfolio.

How does financial derivatives trading work?

In financial derivatives trading, traders enter into agreements to buy or sell derivative contracts at a future date and at a predetermined price. The value of these contracts is influenced by the underlying asset’s price fluctuations. Traders can take long or short positions on derivatives, depending on whether they expect the price to rise or fall. They can also trade derivatives without owning the actual underlying asset, which increases trading opportunities and liquidity.

What are the advantages of financial derivatives trading?

Financial derivatives trading offers several advantages, including:

– Increased liquidity: Derivatives markets are highly liquid, allowing traders to enter and exit positions easily.

– Risk management: Derivatives enable hedging against potential losses, mitigating risks associated with market volatility.

– Speculative opportunities: Traders can profit from price fluctuations in various asset classes without the need for physical ownership.

– Leverage: Derivatives trading allows traders to control larger positions with a smaller initial investment, potentially amplifying profits.

What are the different types of financial derivatives?

There are several types of financial derivatives, including:

– Options: Contracts that provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period.

– Futures: Agreements to buy or sell an asset at a predetermined price on a future date.

– Swaps: Contracts in which parties exchange cash flows or liabilities based on predetermined terms.

– Forwards: Similar to futures contracts, these are agreements to buy or sell an asset on a specific future date at a predetermined price.

Who participates in financial derivatives trading?

Various participants engage in financial derivatives trading, including:

– Speculators: Traders who aim to profit from short-term price movements by buying or selling derivative contracts.

– Hedgers: Individuals or businesses who use derivatives to mitigate risks associated with potential adverse price movements.

– Arbitrageurs: Traders who exploit price discrepancies between related assets or markets to make risk-free profits.

– Investors: Individuals or institutions who incorporate derivatives into their investment portfolios to diversify and enhance potential returns.

What are the risks associated with financial derivatives trading?

Financial derivatives trading involves certain risks, including:

– Market risk: Derivatives are influenced by the price movements of underlying assets, which can be volatile.

– Counterparty risk: The risk that the other party in a derivative contract may default on their obligations.

– Liquidity risk: Some derivative markets may have less liquidity, making it harder to buy or sell contracts at desired prices.

– Leverage risk: The use of leverage amplifies both potential profits and losses, increasing risk exposure.

Are there regulations for financial derivatives trading?

Yes, financial derivatives trading is subject to regulations and oversight by regulatory bodies in various countries. These regulations aim to ensure fair trading practices, transparency, and stability in the derivatives markets. Traders and market participants are required to comply with rules pertaining to risk management, reporting, and disclosure.

Where can I learn more about financial derivatives trading?

To gain further knowledge about financial derivatives trading, you can explore educational resources provided by reputable financial institutions and regulatory authorities. Websites, books, online courses, and seminars focusing on derivatives trading can provide valuable insights and guidance for beginners and experienced traders alike.

Final Thoughts

Financial derivatives trading is a specialized form of investment that involves the buying and selling of contracts based on underlying assets. These contracts, known as derivatives, derive their value from the performance of assets like stocks, commodities, or currencies. By participating in derivatives trading, investors can speculate on the future price movements of these assets without owning them outright. It provides opportunities for hedging, leveraging, and diversification. Financial derivatives trading allows investors to capitalize on market fluctuations and potential profits, but it also carries risks. Understanding the intricacies of derivative contracts and staying informed about market trends are crucial for successful trading in this dynamic field.