Are you curious about the inner workings of the financial system? You may have come across the term “fractional reserve banking system” and wondered, “What is fractional reserve banking system?” Well, look no further! In this article, we will delve into the world of fractional reserve banking and unravel the mysteries behind it. We’ll explore how banks create money, the impact it has on the economy, and the risks associated with this system. So, let’s embark on this journey of understanding and demystifying the fractional reserve banking system. Strap in, because we’re about to explore a fascinating aspect of the world of finance.

**What is Fractional Reserve Banking System**

Introduction

Fractional reserve banking is a system used by commercial banks to create money and facilitate lending. It is a process where banks hold only a fraction of depositors’ funds in reserve and lend out the rest. This system allows banks to expand the money supply and stimulate economic growth. However, it also carries risks and has been subject to criticism. In this article, we will delve into the details of the fractional reserve banking system, exploring its mechanics, advantages, disadvantages, and its role in the economy.

The Mechanics of Fractional Reserve Banking

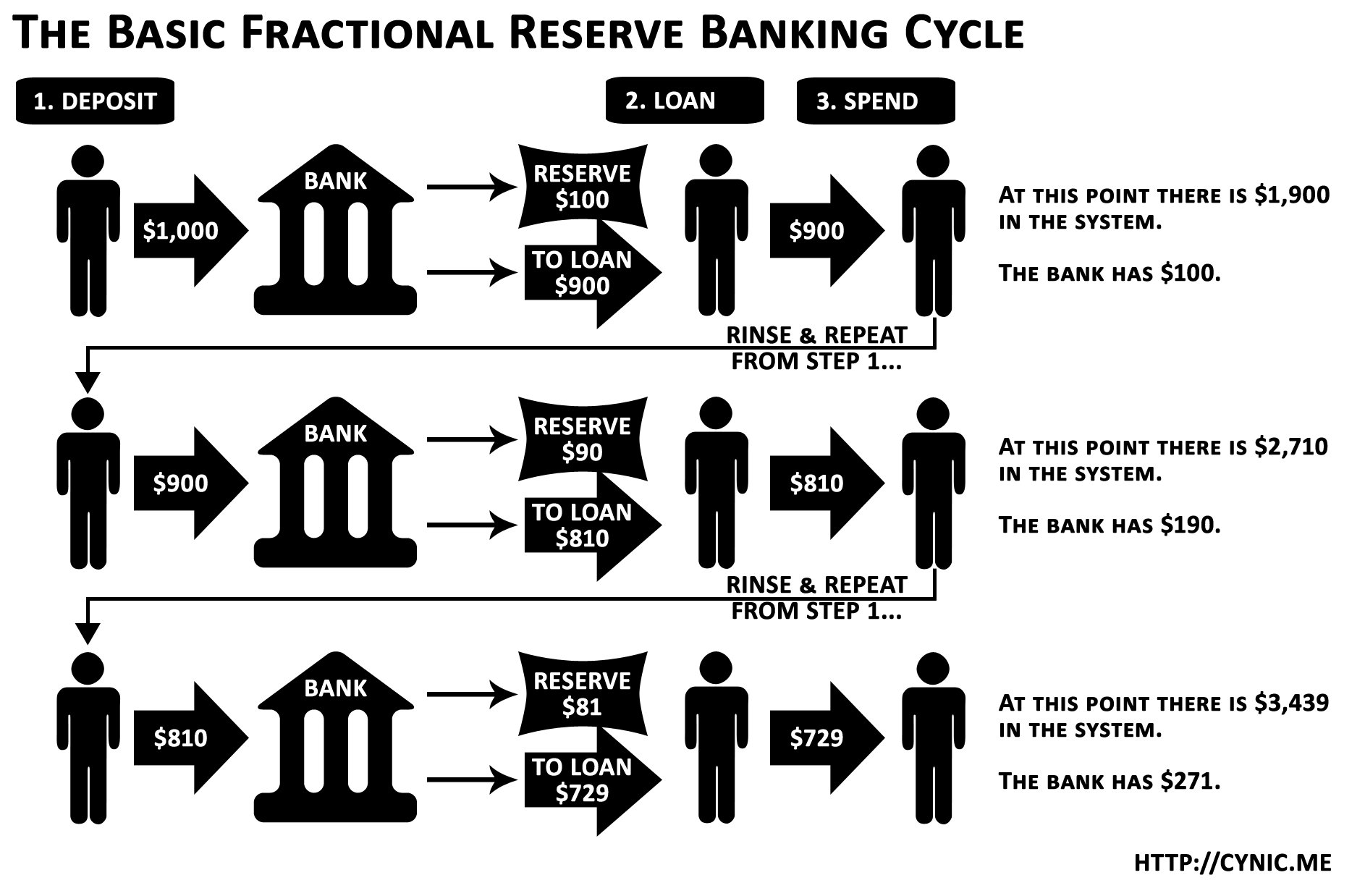

At its core, fractional reserve banking is based on the concept of lending what is essentially other people’s money. Banks take the deposits from customers and hold a fraction of those deposits as reserves. The reserve requirement is set by central banks and varies from country to country. For example, in the United States, banks are required to hold a minimum reserve of 10% of certain types of deposits.

The rest of the deposited funds, known as excess reserves, can be lent out to borrowers, thereby creating new money in the economy. This process is often referred to as the money multiplier effect. When a bank lends out money, the borrower typically uses it to make a purchase or payment, which eventually finds its way back into the banking system. This money is then re-deposited, allowing for further lending and multiplying the initial deposit.

Example:

Let’s consider an example to better understand how the fractional reserve banking system works. Suppose a customer deposits $1,000 into Bank A. The reserve requirement is set at 10%, so the bank must keep $100 (10% of $1,000) as reserves. The remaining $900 is available for lending.

If Bank A lends the $900 to a borrower, the borrower may use the funds to buy a car from another individual. The seller, who receives the $900 as payment, deposits it into Bank B. Bank B, like Bank A, is required to keep 10% of the deposit ($90) as reserves and can lend out the remaining $810. This process continues, with each new deposit allowing for more lending and money creation.

Advantages of Fractional Reserve Banking

Fractional reserve banking has several advantages that contribute to its widespread use:

1. **Money Creation**: The fractional reserve banking system allows banks to create money by lending out excess reserves. This expansion of the money supply can stimulate economic growth, as businesses and individuals have access to additional funds for investment and consumption.

2. **Liquidity and Financial Intermediation**: Banks play a crucial role in intermediating between savers and borrowers. By accepting deposits and providing loans, banks facilitate the flow of funds in the economy, promoting economic activity.

3. **Interest Income**: Banks earn interest income on the loans they make, which contributes to their profitability. This income allows banks to cover operating costs, provide returns to depositors, and support economic growth through lending activities.

4. **Monetary Policy Transmission**: Central banks can influence the economy through fractional reserve banking. By adjusting the reserve requirements or interest rates, central banks can control the money supply, inflation, and economic activity.

Disadvantages and Risks of Fractional Reserve Banking

While fractional reserve banking has its advantages, it also carries inherent risks and disadvantages:

1. **Bank Runs**: One of the primary risks of fractional reserve banking is the potential for bank runs. A bank run occurs when depositors lose confidence in a bank’s ability to return their money. If too many depositors attempt to withdraw their funds simultaneously, a bank may not have enough reserves on hand to meet the demand. This can lead to a liquidity crisis and the collapse of the bank.

2. **Boom and Bust Cycles**: The expansion of credit facilitated by fractional reserve banking can contribute to boom and bust cycles in the economy. When banks increase lending rapidly, it can lead to an unsustainable credit bubble and eventually result in a financial crisis, as seen during the 2008 global financial crisis.

3. **Credit Risk**: Banks face credit risk when lending out funds. If borrowers default on their loans, banks may suffer losses and potentially face insolvency. Proper risk management and lending practices are essential to mitigate credit risk.

4. **Systemic Risk**: The interconnectedness between banks and the broader financial system can amplify the impact of individual bank failures. A significant failure or collapse of a major bank can have systemic implications, affecting other banks and the overall stability of the financial system.

Regulatory Measures for Fractional Reserve Banking

Given the risks associated with fractional reserve banking, regulatory measures are put in place to maintain stability and protect depositors. These measures may vary across jurisdictions but generally include:

1. **Reserve Requirements**: Central banks impose reserve requirements to ensure banks hold a minimum amount of reserves relative to their deposits. These requirements act as a buffer to cover potential withdrawals and enhance the stability of the banking system.

2. **Capital Adequacy Requirements**: Banks are required to maintain a certain level of capital to absorb losses and remain solvent. Capital adequacy requirements help ensure banks can withstand unexpected shocks and protect depositors’ funds.

3. **Supervision and Regulation**: Regulatory bodies oversee banks’ activities and enforce compliance with applicable laws and regulations. This supervision aims to identify potential risks, enforce prudential standards, and promote the safety and soundness of the banking system.

4. **Deposit Insurance**: Many countries have established deposit insurance schemes to protect depositors in the event of bank failures. These schemes provide coverage up to a certain limit, instilling confidence in the banking system and ensuring depositors’ funds are safeguarded.

The Role of Fractional Reserve Banking in the Economy

Fractional reserve banking plays a crucial role in the functioning of the modern economy. Key aspects of its role include:

1. **Credit Intermediation**: Fractional reserve banking facilitates the flow of credit in the economy, allowing individuals and businesses to access funds for investment and consumption. This credit creation supports economic growth and helps finance various sectors such as housing, infrastructure, and entrepreneurship.

2. **Monetary Policy Implementation**: Central banks utilize the fractional reserve banking system to implement monetary policy. By adjusting reserve requirements, interest rates, or conducting open market operations, central banks can influence the money supply and control inflation, fostering economic stability.

3. **Financial Stability and Payment Systems**: Banks provide a secure environment for individuals and businesses to store their funds and make payments. Through the fractional reserve banking system, banks maintain liquidity to fulfill depositors’ demands and facilitate efficient payment systems, contributing to overall financial stability.

4. **Economic Growth and Employment**: Fractional reserve banking, by supporting lending and investment, fuels economic growth and job creation. As businesses expand and individuals have access to credit, economic activity increases, leading to higher employment levels and improved living standards.

Fractional reserve banking is a fundamental system that allows banks to create money and facilitate lending. While it has advantages such as money creation, liquidity provision, and monetary policy transmission, it also carries risks like bank runs, boom and bust cycles, credit risk, and systemic risk. Regulatory measures are necessary to mitigate these risks and ensure the stability and soundness of the banking system. Understanding the mechanics and role of fractional reserve banking is essential for comprehending how money is created and how banks contribute to economic growth.

Overview of fractional reserve banking | The monetary system | Macroeconomics | Khan Academy

Frequently Asked Questions

Frequently Asked Questions (FAQs)

What is the fractional reserve banking system?

The fractional reserve banking system is a banking system in which banks are required to hold only a fraction of the total amount of deposits as reserves. This means that banks can lend out a significant portion of the deposits they receive, creating new money through the process of credit creation.

How does the fractional reserve banking system work?

In a fractional reserve banking system, banks are required to keep a certain percentage of customer deposits as reserves. The remaining portion of the deposits can be used by the bank to extend loans and make investments. This system allows banks to create money by lending out more than what they actually have in reserves.

What is the purpose of the fractional reserve banking system?

The main purpose of the fractional reserve banking system is to facilitate economic growth and provide liquidity to the economy. By allowing banks to create credit and extend loans, the system encourages investment, consumption, and economic activity.

What is the reserve requirement in the fractional reserve banking system?

The reserve requirement is the percentage of customer deposits that banks are required to hold as reserves. It is set by the central bank of a country and can vary depending on monetary policy objectives. The reserve requirement acts as a safeguard to ensure that banks have enough reserves to meet the demand for withdrawals by customers.

What are the advantages of the fractional reserve banking system?

The fractional reserve banking system allows banks to efficiently allocate capital and provide liquidity to the economy. It promotes economic growth by enabling the expansion of credit and investment. Additionally, it allows individuals and businesses to have access to loans and other financial services.

What are the risks associated with the fractional reserve banking system?

One of the main risks of the fractional reserve banking system is the possibility of bank runs or panics, where a large number of depositors simultaneously try to withdraw their funds. If banks do not have enough reserves to meet the demand for withdrawals, it can lead to a financial crisis. Another risk is excessive credit creation, which can contribute to inflation and asset bubbles.

Is the fractional reserve banking system used worldwide?

Yes, the fractional reserve banking system is widely used around the world. Most countries have adopted this system to facilitate banking operations and support economic activities. However, the specific regulations and reserve requirements may vary from country to country.

Can the fractional reserve banking system create money?

Yes, the fractional reserve banking system has the ability to create money. When banks lend out a portion of the deposits they receive, new money is effectively created. This is because both the original depositor and the borrower now have claims on the same funds, effectively increasing the money supply.

What happens if banks fail to meet the reserve requirement?

If banks fail to meet the reserve requirement, they may be subject to penalties and sanctions imposed by the central bank or regulatory authorities. Additionally, banks may need to take corrective actions, such as reducing lending or borrowing additional reserves to meet the requirement. Compliance with reserve requirements is essential to maintain public confidence in the banking system.

Final Thoughts

The fractional reserve banking system is a fundamental aspect of modern banking. It allows banks to hold only a fraction of the total deposits as reserves and lend out the remaining funds. This practice creates new money in the economy and enables banks to facilitate economic growth through lending. However, it also poses risks, as banks must maintain sufficient reserves to meet withdrawal demands. Understanding the fractional reserve banking system is crucial for comprehending how money is created and circulated in the economy. It plays a significant role in shaping the financial landscape and affects individuals and businesses on a daily basis.